Losing is normally part of the learning process when trading currencies. After burning an account or two, traders start to embark on a learning journey. However, some traders do not learn their lessons and keep repeating the same mistakes. It would help if you did not belong to this camp.

In this article, you will understand why 90 percent of traders are losers. You will get to know the common mistakes traders make, so you do not do them yourself. We hope that this knowledge will bring about a change in your approach to trading. Then you can be part of the 10 percent who constantly make money in this business.

Leading causes of failure and how to address them

Most traders understand that there are three aspects of trading that one must get a handle on. These are the trading methods, psychology, and risk management. Among the three, risk management is arguably the most important.

Traders fail for several reasons. Not everyone is cut out to be traders in the first place. Your success in your field will not translate to trading success straight away. Regardless of background, traders seem to commit similar mistakes time and again. This article will present three causes of failure and try to get down to these issues.

Cause 1. Not using proper risk management

Regardless of your account leverage, when you open positions, the most critical consideration is your account exposure. If you always take more risk than your account can handle, it will erode your account little by little. It is only a matter of time before you lose everything. Therefore, you must understand how much risk each trade takes and what is the real danger to your account at any point.

- While it is possible to trade without a stop loss, it is a risky method not suitable for beginners.

- If you are starting, steer clear from this approach.

- Make sure that you put a stop loss to each trade.

- So this is how you define the risk on each trade.

- Then if you open multiple trades at any given time, compute the total exposure by adding up the trade risks.

- To avoid overtrading, decide how much you can afford to lose each day and each week.

- If you reach your limit, you have to stop, take a break, and then get back to the drawing board after a while.

- If you want to spread your risk across multiple pairs, keep the overall risk percentage in mind.

For example, if your risk per trade is two percent, determine what this value is in terms of the dollar amount. Then you can divide the amount into equal parts and allocate the same portion to each symbol being traded. This way, the overall risk is still two percent for all open positions.

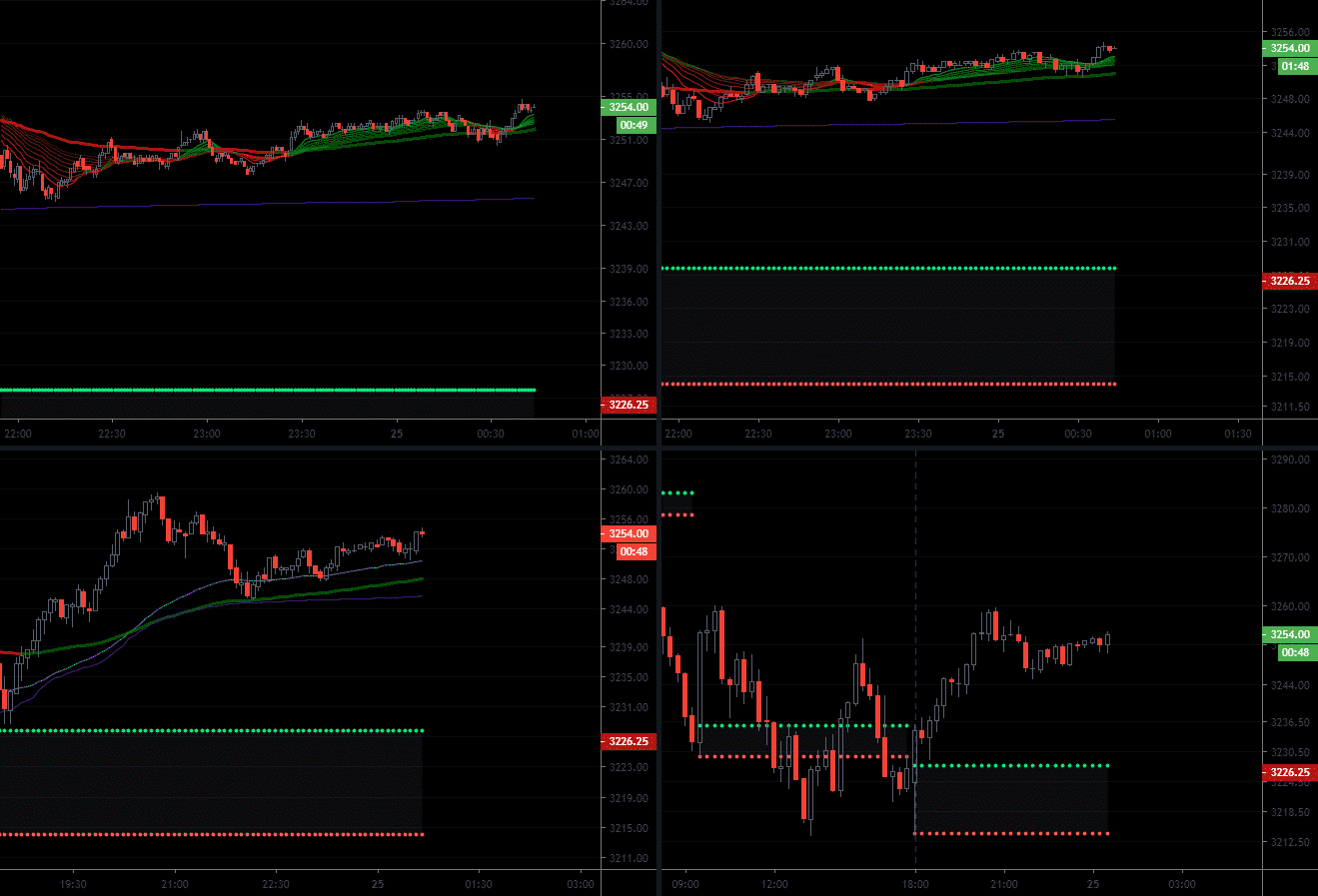

Here is a sample of this money management strategy:

- Capital = $10,000

- Risk per trade = 2%

- Risk per trade-in dollars = 0.02 x 10,000 = $200

- Number of positions = 4

- Risk per position = 200 / 4 = $50

Now instead of risking $200 in one trade only, you are opening four trades in four different pairs. Each deal has a risk of $50. To reduce the risk further, see that the four pairs are not correlated. The chance of losing one trade with a risk of $200 is 50 percent. However, the possibility of losing all four trades with a risk of $50 each is significantly lower than 50 percent. That is the advantage of diversification.

Cause 2. Not having a trading plan

This is a common beginner mistake. Due to your fascination with trading, you come to the charts without a trading plan and take whatever it is that looks enticing. So this is not the right way to approach trading. You will lose your grubstake in no time if you take this approach.

Trading the currency market is like going to war with a formidable enemy. Your winning chances are slim because the enemy is much bigger than you. If you go to the battlefield without a game plan, there is a good chance you will not be getting out alive. The same holds for trading.

There are many things you should consider before entering a position. Spend 80 percent of your time selecting markets, finding setups, and qualifying opportunities. Allot the remaining 20 percent in monitoring the trade and understanding market action. Once you enter the trade, you cannot do much more than see how it goes.

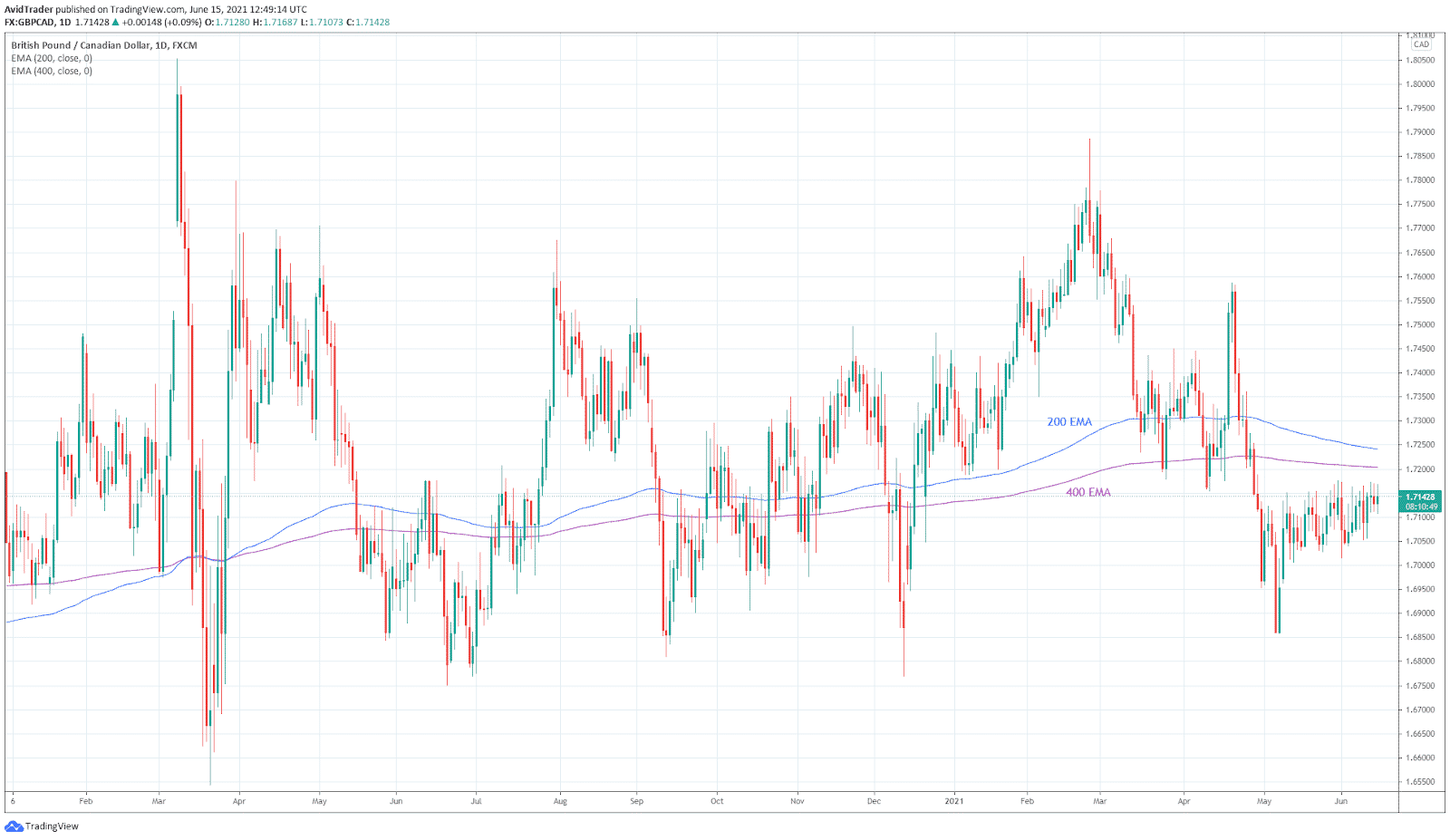

Consider the above GBP/CAD daily chart. Is this the kind of chart you would like to trade-in? The answer to this question is a simple yes or no. If you do not have a trading plan, your answer might not be a resounding yes. The market environment is only one item that your trading plan should take into account.

These are some of the elements that should go into your trading plan:

- Currency pairs to monitor and trade

- Time frames for trend analysis, setup, and entry

- Trading sessions to look for entrances and exits

- Indicators to be used for entry

- Entry rules

- Exit rules for every scenario

- Accepted risk-reward ratio

- Risk percent per trade

Your specific trade plan may not look like the above list. It might contain different items. However, you must have at least a list of some of these items before you start looking for trades.

Your trade plan should include every action you should do in every situation you fall into. This is to prevent emotions from taking over once a deal goes live. If you do not have such a trade plan, you should not be trading at all. Doing so is closer to gambling than trading.

Cause 3. Not following the trade plan

Another problem with many traders is discipline. It is way too easy to forget the trade plan when one gets bored and feels the need to trade. Unfortunately, many traders do this over and over again. That is why most cannot maintain their profitability. They make a lot of money at some point and then lose it all at another point. That is the danger of discretionary trading, which is reserved for experienced traders.

If you have a trading plan but do not follow it, you are no better than a trader without having one. Your trading will have no direction, and you will not know which part needs improvement. This is akin to a sailor not using a compass to steer the ship. As a result, you might not be able to reach your destination, that is, profitability and freedom.

Final thoughts

- As a beginner, you should focus on the trading process. Do not think about profits in the meantime.

- Do not be like traders who learn the hard way by losing at first.

- Embrace the learning process.

- Stick to your plan. You will not know what works and what does not work if you move from one trading plan to another.

- Start with a step-by-step strategy and improve it as you gain more experience.