The advance/decline is a technical indicator. As the name suggests, it tracks advances and declines in the crypto market. It helps give traders an idea about the ongoing trends in the crypto market, their intensity, and their direction.

The article will elaborate on the advance-decline line and discuss the top five tips for crypto trading.

What is the advance/decline line?

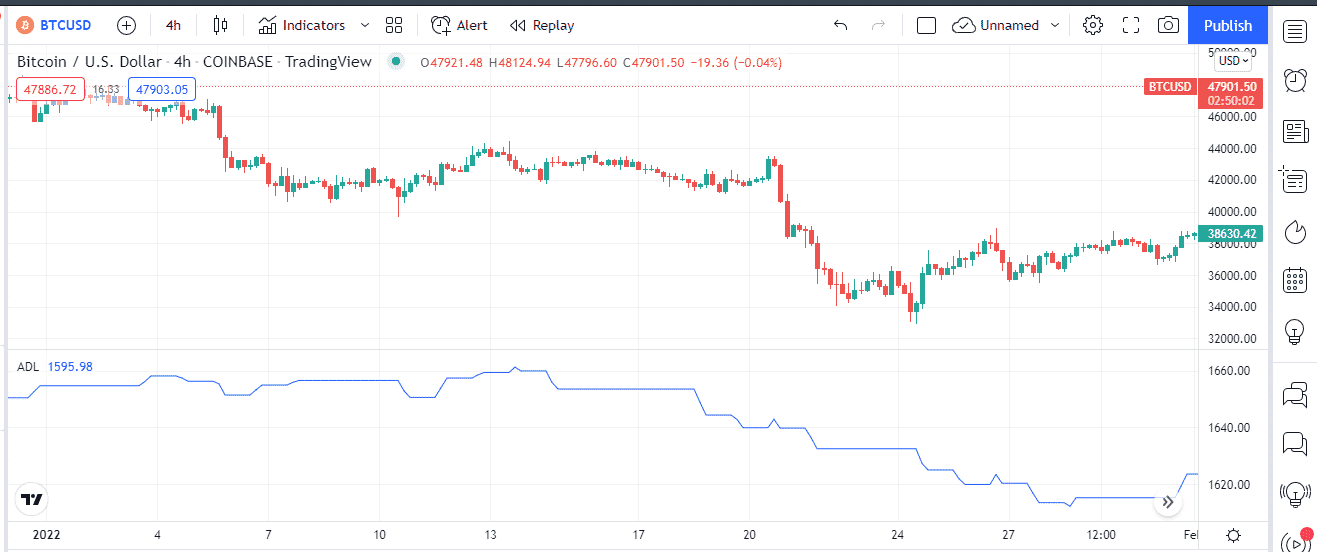

It is essentially a momentum indicator. It is based on volume and divergence. The AD line cumulates and depicts the performance of the entire market. It tracks and shows the differences between advances and declines in the crypto market over a given period.

The AD line indicator depends on the average number of green or red closes. The advance-decline line helps traders identify if the market is bullish or bearish.

Usually, the AD line fluctuates between 0 and 10. If the line indicator is between 0 and 2, the market is bearish. Therefore, the best time to make purchases would be if the AD line goes above the value of 2.

Top 5 tips for trading with an advance/decline line

The AD line is calculated using a specific formula. The simplest version is dividing advancing shares with declining shares.

After doing the math, it is time to use the AD line strategy to our benefit. Below are the five tips traders can use when using the strategy during crypto trading.

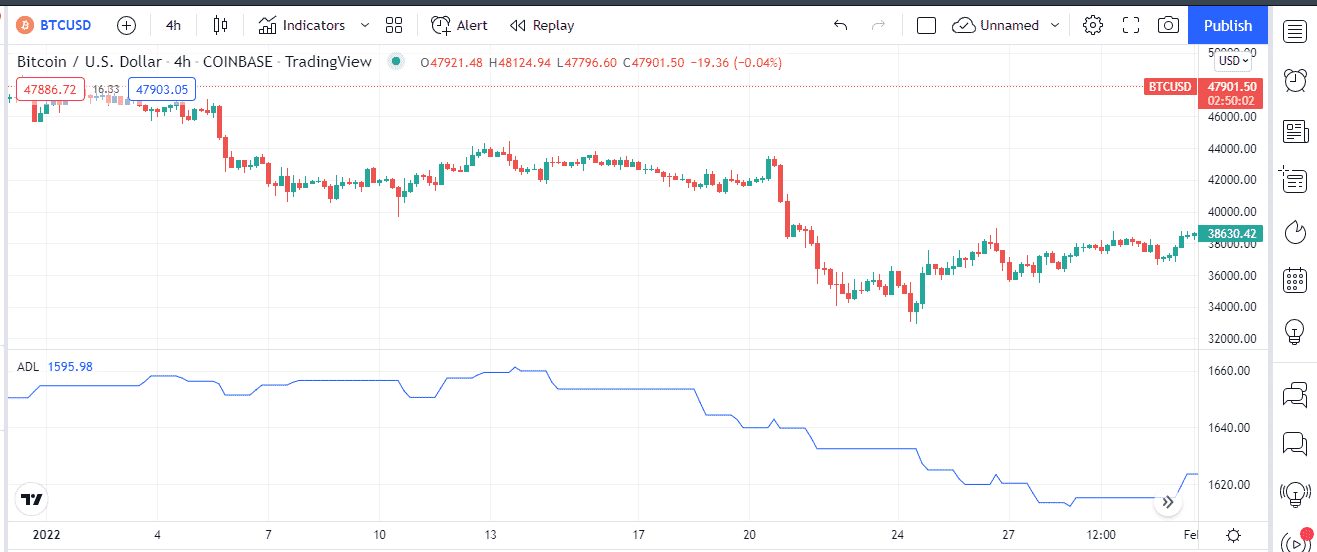

Tip 1. Open a long trade

When the AD line begins to rise and, more crucially, reaches an extreme high, it indicates that the general market is bullish and that the price advance will continue.

Why does it happen?

When the AD line indicator is above 2 for at least five-period trade closes, it is the right time to opt for a long trade. Open a long trade when the indicator has been above the average for three periods. The usual average for most long days is five green closes.

How to avoid a mistake?

The best thing to do would be to open the trade before the AD line indicator reaches 10. This bubble territory should be avoided as it is possible to get a pullback.

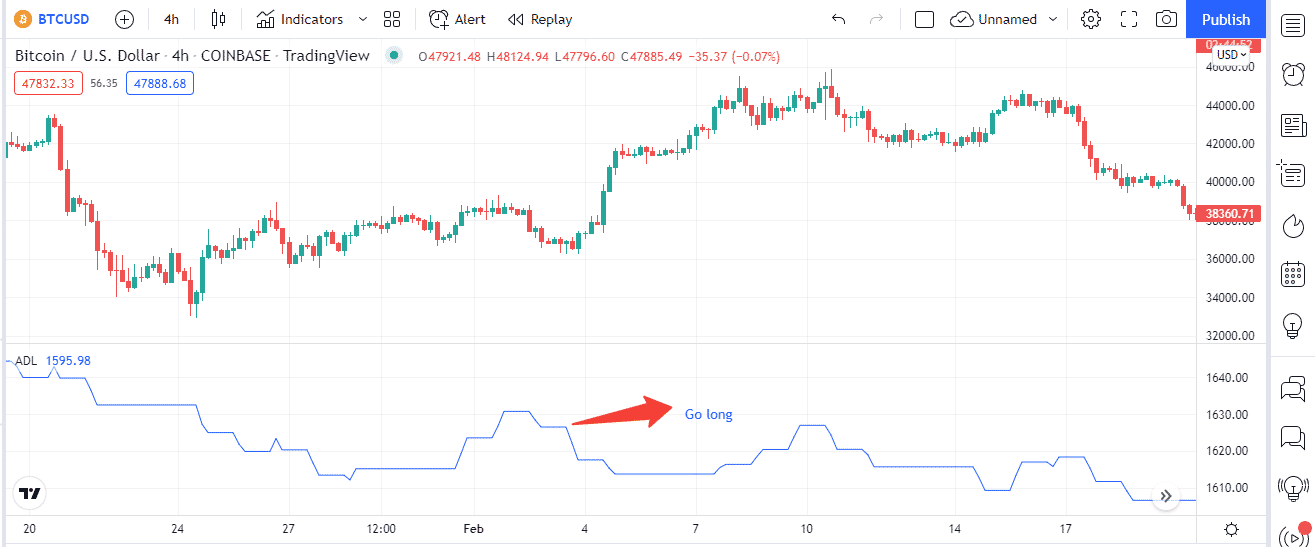

Tip 2. Open a short trade

When the advance-decline line begins to make new lows, it indicates that general activity is bearish.

Why does it happen?

Open short trades when the indicator breaks the average downwards and remains under the average for a minimum of 10 periods. In other words, wait for it to go below the value of 1 for at least five daily closes.

How to avoid a mistake?

Short trades are typically a lot riskier as compared to long trades. Remember when bearish and bullish trends will occur and enter a short trade accordingly.

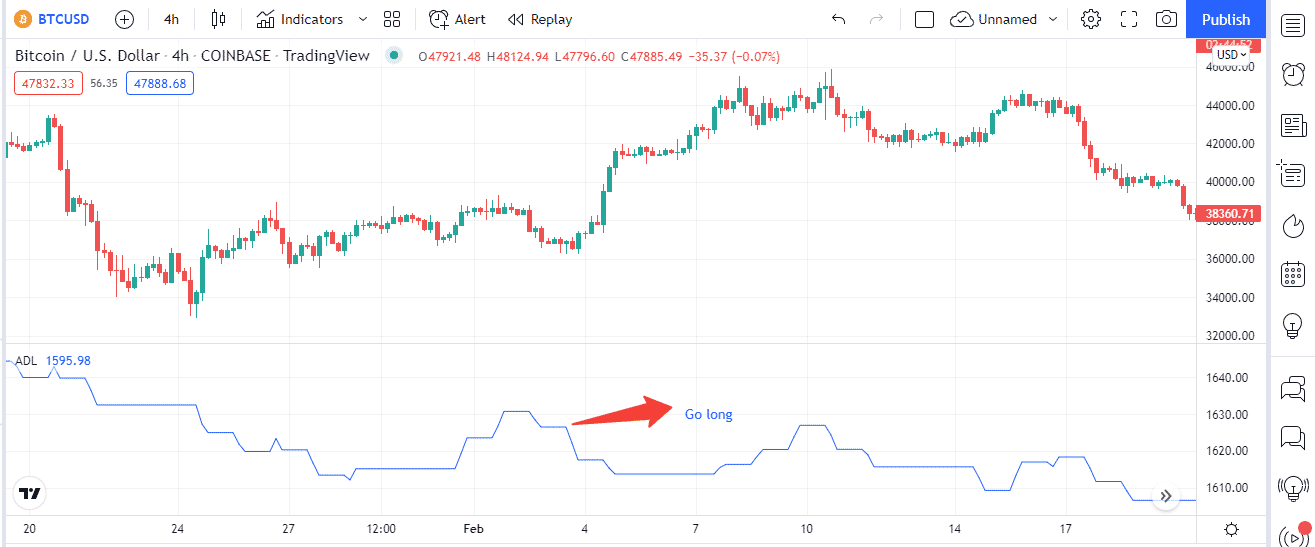

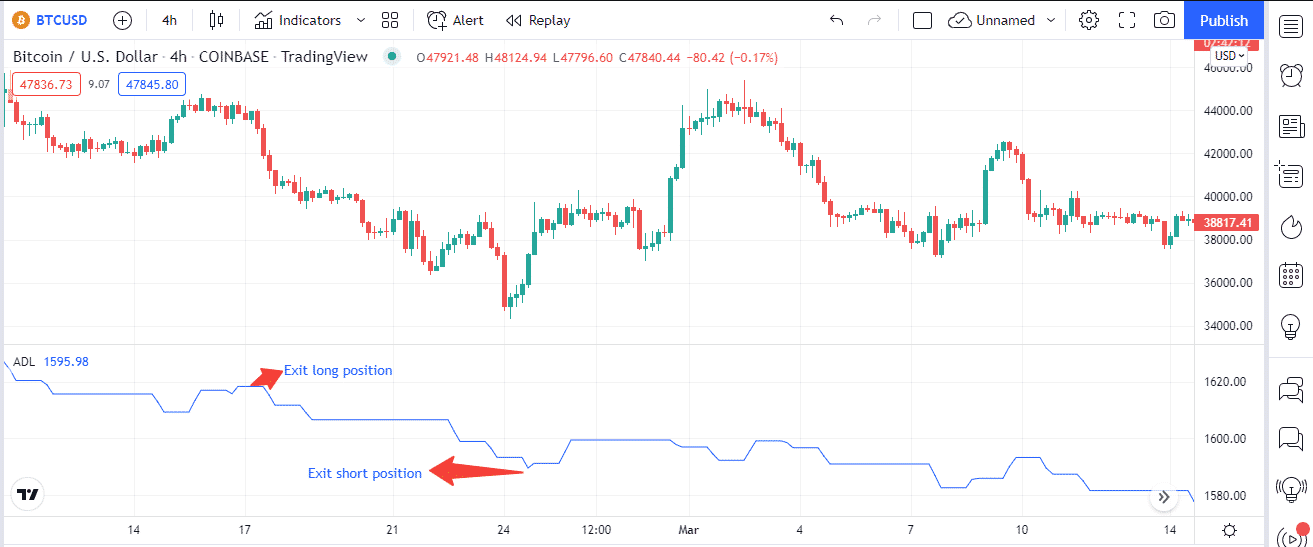

Tip 3. Close long and short trades

We mentioned the above tips when the AD line gives an entry signal. Now we’ll find out how to exit positions.

Why does it happen?

Close a long trade when the AD line goes below the average level and stays for at least ten periods. After this point, it is advised to collect the profit. Close a short trade when the AD line goes above the average for at least three periods.

How to avoid a mistake?

Open and close trades are mutually reinforcing. Therefore, an AD indicator can help you conclude the right move for your trade. Place a stop-loss for both short and long trades to avoid losses. This safety precaution signals you to close a trade when it drops below a specific loss percentage.

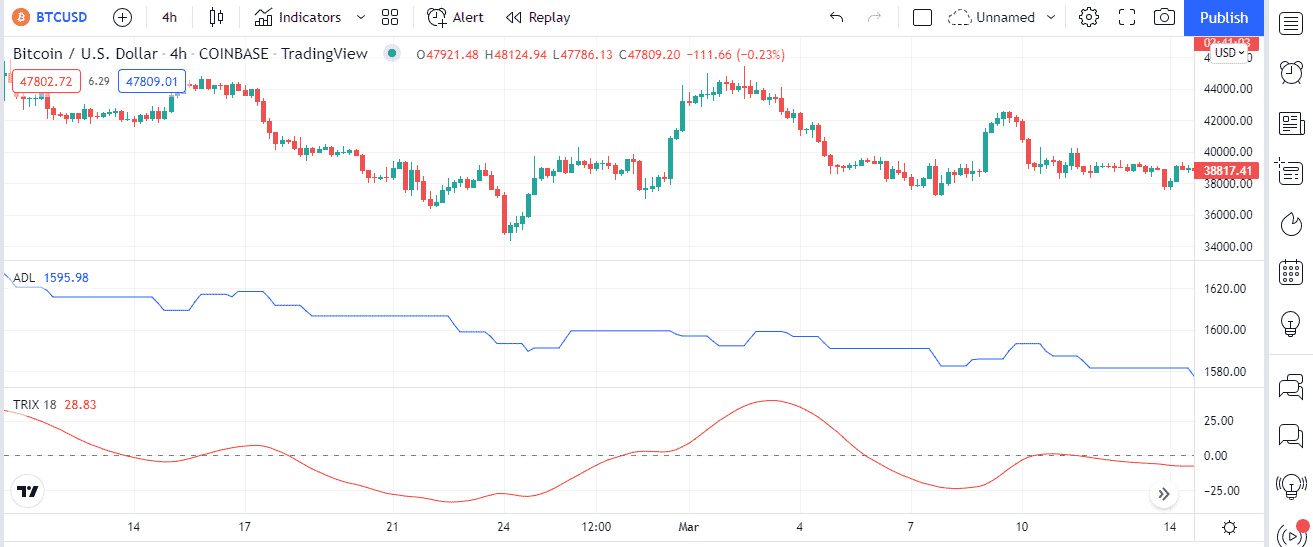

Tip 4. Use the AD line indicator + TRIX

Combining of AD line indicator with TRIX reduces market noise and presents favorable opportunities, especially in the range-bound markets.

Why does it happen?

Common strategy traders use in the crypto market is to use the AD line indicator with TRIX, another momentum indicator. It stands for Triple exponential average and consists of one line oscillating above and below a zero level.

It is a validation signal, simply confirming entry signals coming from the AD line indicator.

How to avoid a mistake?

Once you get the appropriate signals from the AD indicator, go for a long trade but only if the TRIX indicator is above zero.

The indicator is used to validate entry signals, as mentioned before. So, only use the AD indicator for closing signals; otherwise, rely on TRIX to confirm signals. Consider opting for a short trade when appropriate signals from the AD line indicator are received, but only if the TRIX is below zero.

Tip 5. AD line indicator: a strength and a weakness

Every indicator has strengths and weaknesses. Finding the AD line’s pros and cons is helpful if you want to base your strategy around it.

Why does it happen?

The fact that an AD indicator gives a complete picture of the crypto market is also its weakness. This is because a trader can wrongly decide about entering or not entering a market. For example, they may think that the market is not bullish enough and missing opportunities.

How to avoid a mistake?

The AD indicator should not be overused as if everything it shows is set in stone. Instead, only use it as what it is: a measurement tool. Use the AD to gauge the state of the market and get an eagle’s view of the performance in the market. But, of course, it would be even better if other indicators were used with it as confirmation.

Final thoughts

The advance/decline indicator is a popular momentum indicator that helps traders determine price movements in a crypto market. The individual prices do not affect the AD line, but the market does. Therefore, use the AD indicator with a grain of salt as it may not accurately show everything.

Knowing such strategies can help traders understand the crypto market to manage their trades accordingly.