Altcoins are cryptocurrencies that popped up in the aftermath of Bitcoin’s popularity. As a result, they often position themselves as superior alternatives to Bitcoin. Because altcoins make up such a large portion of the market, every crypto investor should be familiar with how they operate.

Certain altcoins to validate transactions employ a different consensus process. Alternatively, they differentiate themselves from Bitcoin by offering new or enhanced features, such as smart contracts or minimal price volatility.

Best altcoin crypto projects to watch right now

Finding the finest altcoins might be difficult because there are so many to select from, but it’s unquestionably worthwhile because these currencies can frequently yield triple-digit returns.

Here’s a quick recap of the best altcoin projects to watch right now. We’ll explain their growth potential later.

Stellar (XLM)

Stellar is a distributed payment network that uses Stellar Lumens (XLM), the network’s native cryptocurrency. As a result, the network enables fast payments to be sent globally for low fees regardless of currency. Finally, this considerably enhances the traditional banking system, making Stellar one of the finest cryptocurrencies.

Polkadot (DOT)

Polkadot features a blockchain-based core network on which transactions are permanently recorded. However, the technology’s distinguishing feature is its parachains, which are user-created blockchains that may be modified while maintaining the same security precautions as the main Polkadot chain.

DogeCoin (DOGE)

DogeCoin is an open-source cryptocurrency that allows users to send and receive encrypted money. Although it was made as a joke, it is still worth the blockchain as it has now emerged as a formidable competitor to Bitcoin and Ethereum.

DogeCoin has a market cap of $93.38 billion. Dogecoin uses a proof of work consensus technique, which requires miners to use computers to solve complex formulas to manage and verify transactions on the blockchain.

How much would you have made a year ago if you had invested in such projects?

This section will look at one of the most significant cryptocurrencies to see how much you’d have if you had invested in it a year ago. First, we’ll take the example of Solana. On January 1, the price of Solana was $1.53. On December 31, the price was $166. If you had invested in the Solana blockchain’s native cryptocurrency SOL at the start of 2021, when one coin cost $1.53, your investment would have risen to 10798.7%.

Let’s discuss some of the best altcoins for 2022.

Stellar (XLM)

Lumens (XLM), the Stellar network’s native coin, is what drives it. It employs the Stellar Consensus Protocol, a Proof-of-Stake consensus technique (SCP). If you wish to convert your money to another currency, the fund you upload is first converted to XLM coins and then to your chosen currency.

Why will XLM be bigger than Bitcoin?

Deloitte, Stripe, IBM, and other European and Asian financial institutions have worked with Stellar. Exploiting the unexplored market will, of course, increase the value of XLM.

Why does it have the potential to grow?

Stellar Lumens has introduced a new remittance corridor in the Philippines, which has resulted in a price increase of more than $0.23. In addition, the Starbridge project is almost ready to debut, allowing users to move assets across the XLM and ETH networks. Stellar Lumens is one of the cryptocurrencies to watch because of its unique properties.

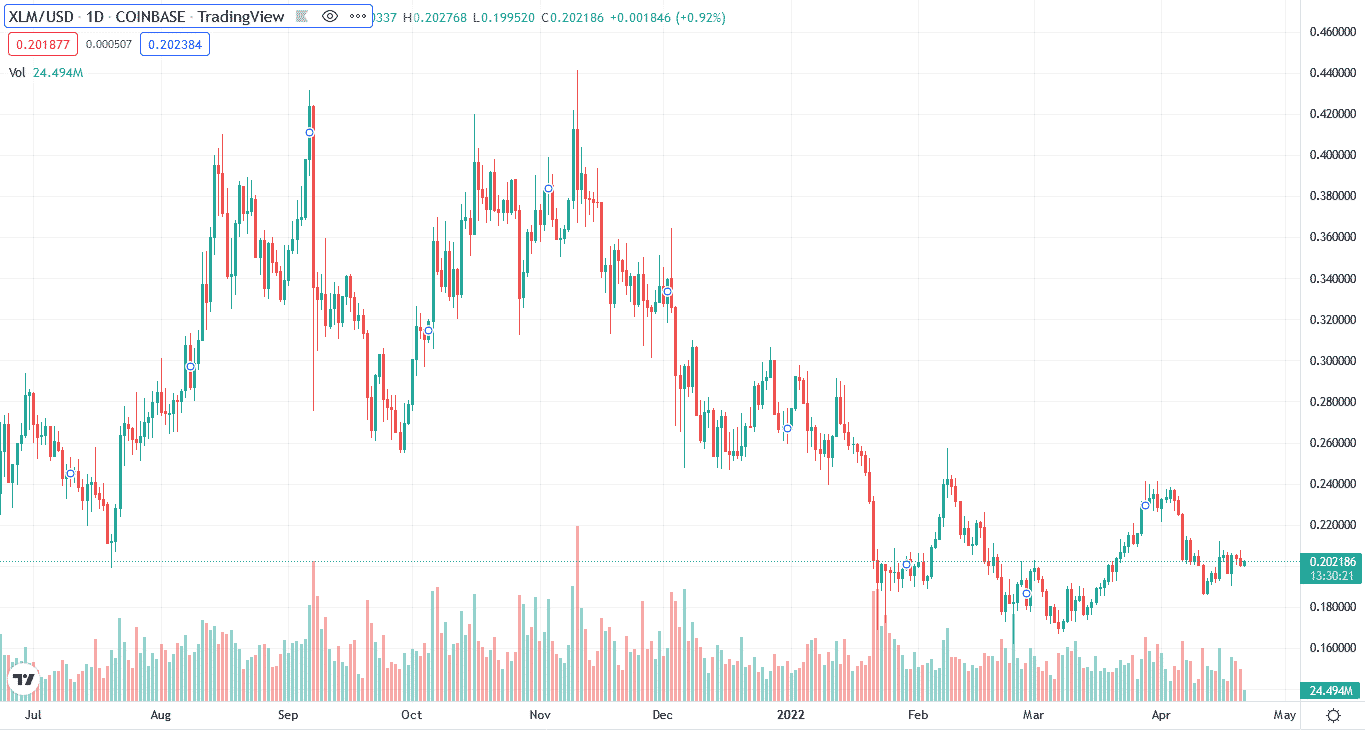

How much would you earn if you invested 1 year ago?

The price of XLM in April 2021 was 0.48. At the time of writing, the price is traveling around 0.26. As you can see, you wouldn’t have earned anything if you invested in XLM a year ago; rather, you would be on the opposite end.

Solana (SOL)

Despite only being launched in 2020, Solana has grown by more than 13,800 percent in the last year and is now the No. 5 largest cryptocurrency, with a market worth of more than $35 billion.

Why will SOL be bigger than Bitcoin?

The Solana blockchain’s strength is its scalability. While other networks, like Ethereum, struggle with poor speeds and hefty gas prices, Solana has jumped in to provide both speed and simplicity to the network’s creators.

The network claims to execute over 60,000 transactions per second, which is an impressive feature for developers looking to capitalize on such potential.

Why does it have the potential to grow?

Solana has acquired popularity among DeFi developers. In terms of TVL, it is presently one of the largest blockchains. Moreover, its rapid acceptance rate has made it a possible Ethereum killer, with many anticipating that it could eventually overtake Ethereum’s market valuation.

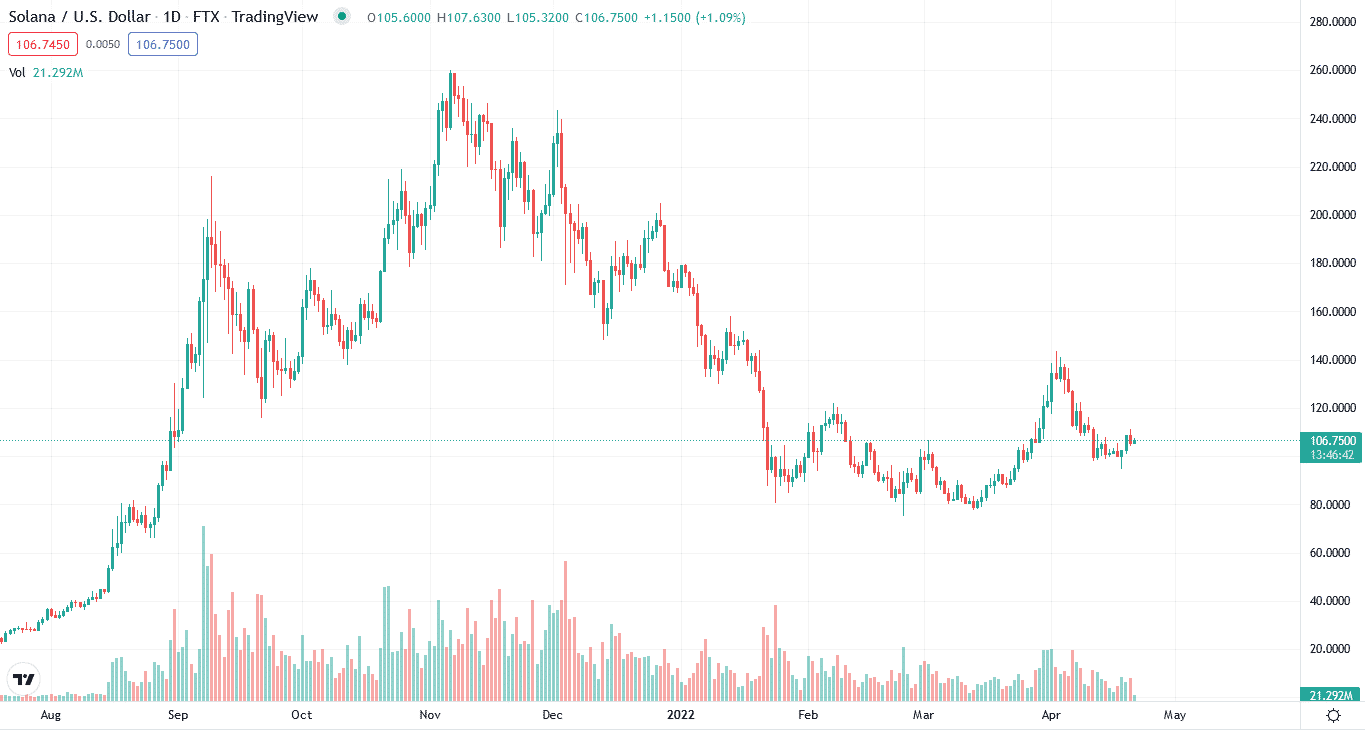

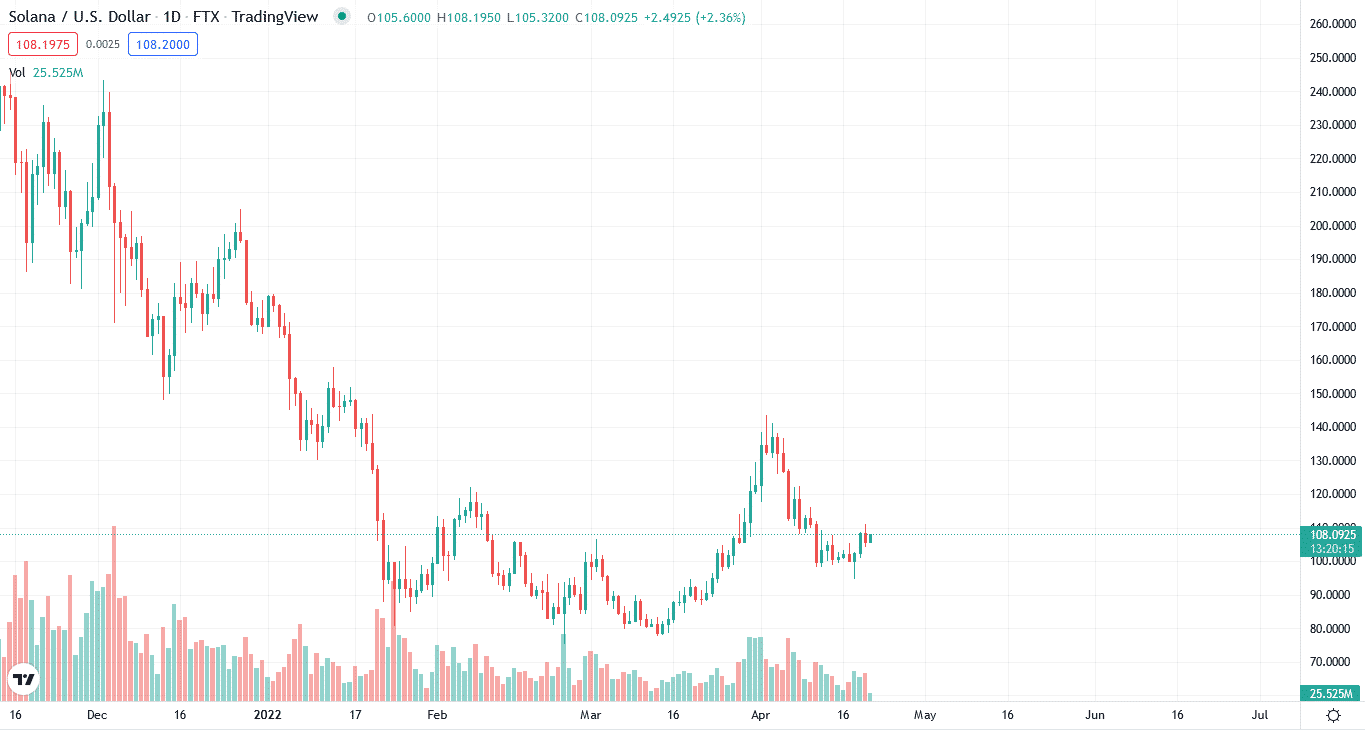

How much would you earn if you invested 1 year ago?

The price of SOL in April 2021 was 26. At the time of writing, the price is traveling around 107. So it means there’s an increase of a staggering 296%.

Ethereum (ETH)

Ethereum is the world’s second-largest cryptocurrency behind bitcoin. It has become one of the household names in the crypto world, and with several technological projects u der way, ETH will explode soon.

Why will ETH be bigger than Bitcoin?

Ethereum has become a popular cryptocurrency investment among both retail and institutional investors. Because of the expanding use case of its blockchain network, many feel that the token can act as a store of value.

Why does it have the potential to grow?

The Ethereum blockchain network supports smart contracts. It is now the largest decentralized money network (DeFi). The rising use of the network for DeFi is improving ETH’s usefulness.

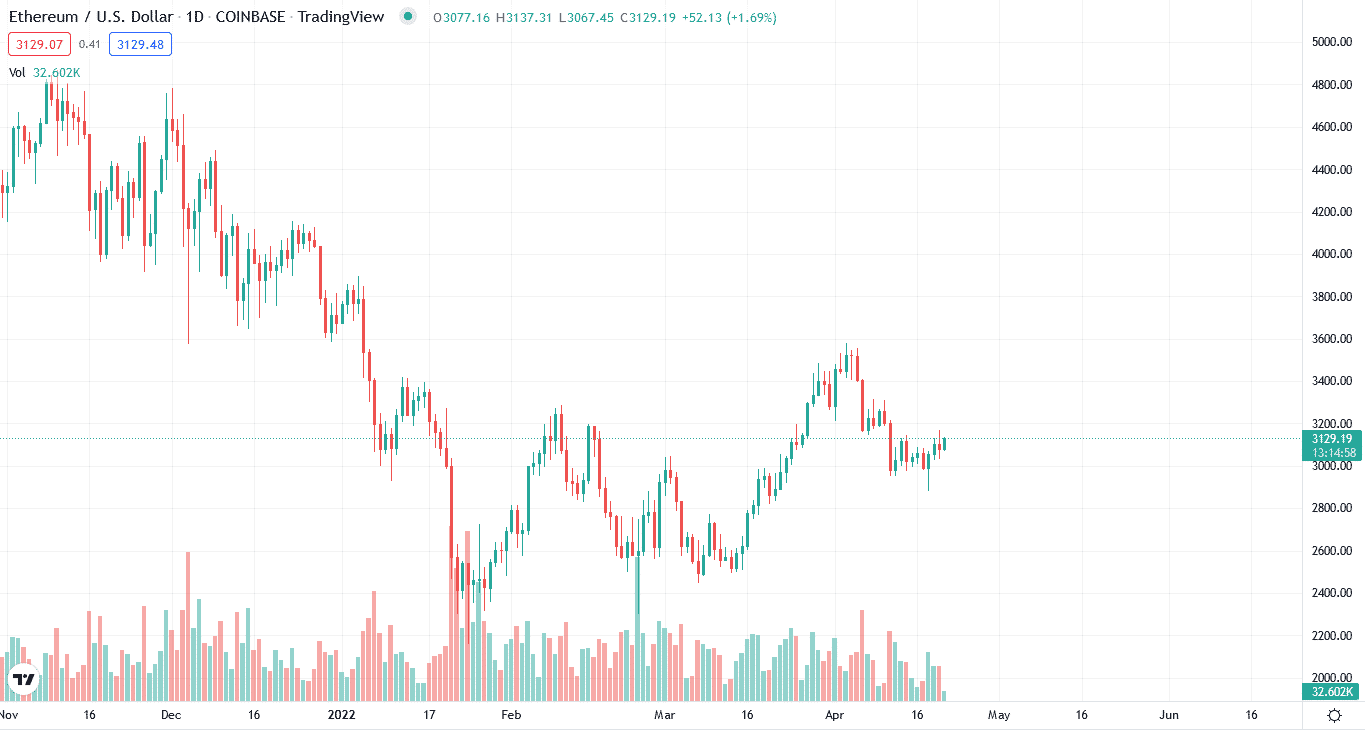

How much would you earn if you invested 1 year ago?

The price of ETH in April 2021 was 26. At the time of writing, the price is trading around 3133. It means there’s an increase of more than 51%.

Polkadot (DOT)

The Polkadot network utilizes three forms of blockchain: relay chains, bridge chains, and parachains. Cross-chain compatibility lets diverse systems function in tandems, such as oracles, permissionless blockchains, and permitted blockchains, which may all be connected via Polkadot’s protocol.

Why will DOT be bigger than Bitcoin?

Polkadot has reported the March 30 launch of its Wormhole bridge to Ethereum and Solana. Additionally, DOT has been on a bullish streak since March 2022.

Why does it have the potential to grow?

Polkadot has prioritized compatibility in addition to scalability. This enables communication among blockchain networks. Accessibility is an important feature since it allows developers developing on Polkadot to use other blockchains’ possibilities.

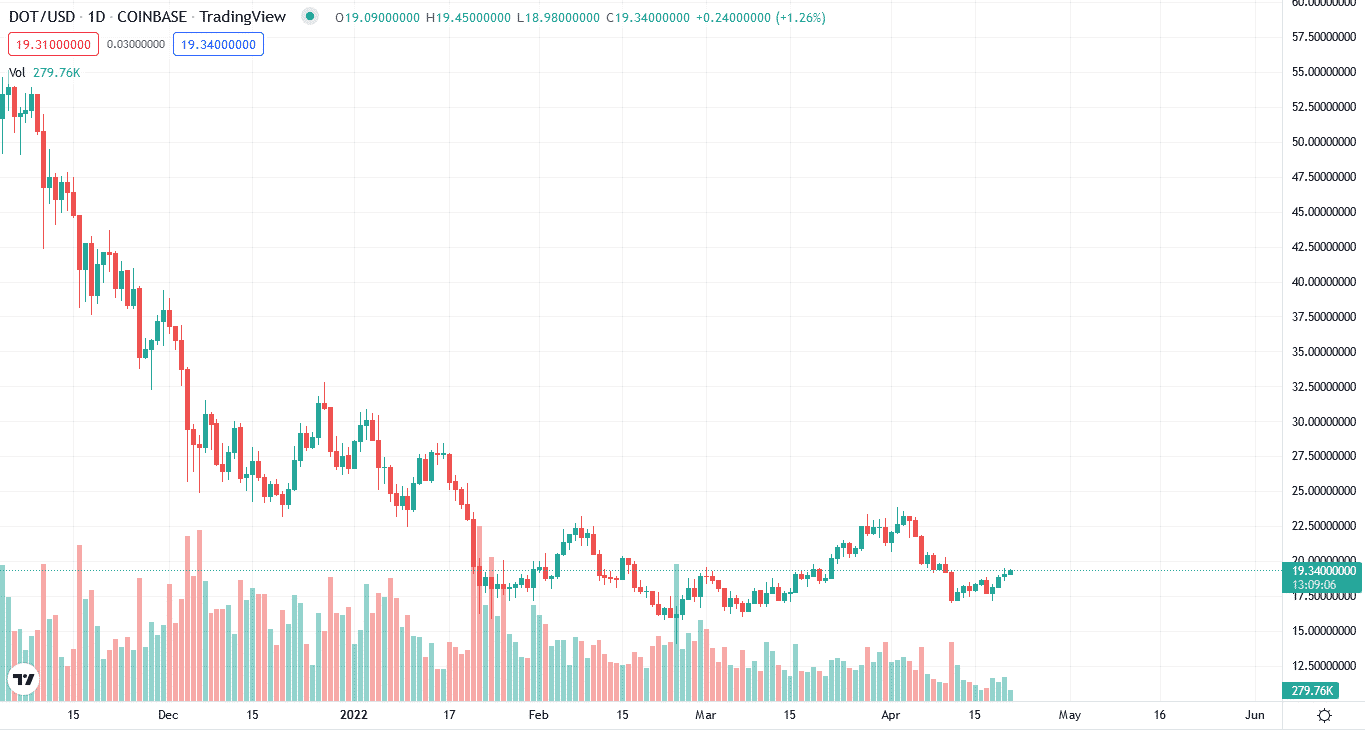

How much would you earn if you invested 1 year ago?

The price of DOT at its launch in June 2021 was 22. At the time of writing, the price is trading around 19. It suggests there’s a decrease of 13%.

Avalanche (AVAX)

Avalanche is at the top of the list regarding underestimated Altcoins. Avalanche is a blockchain and smart contract platform based on proof-of-stake (PoS).

Why will AVAX be bigger than Bitcoin?

Avalanche, as a scalable network, has also been lauded for its ability to change Ethereum in the cryptocurrency industry. In terms of TVL, Avalanche is one of the biggest blockchain networks.

Why does it have the potential to grow?

Avalanche would be a great investment given the boom in dApp projects that meet developers’ requirements for a low-cost, accessible blockchain.

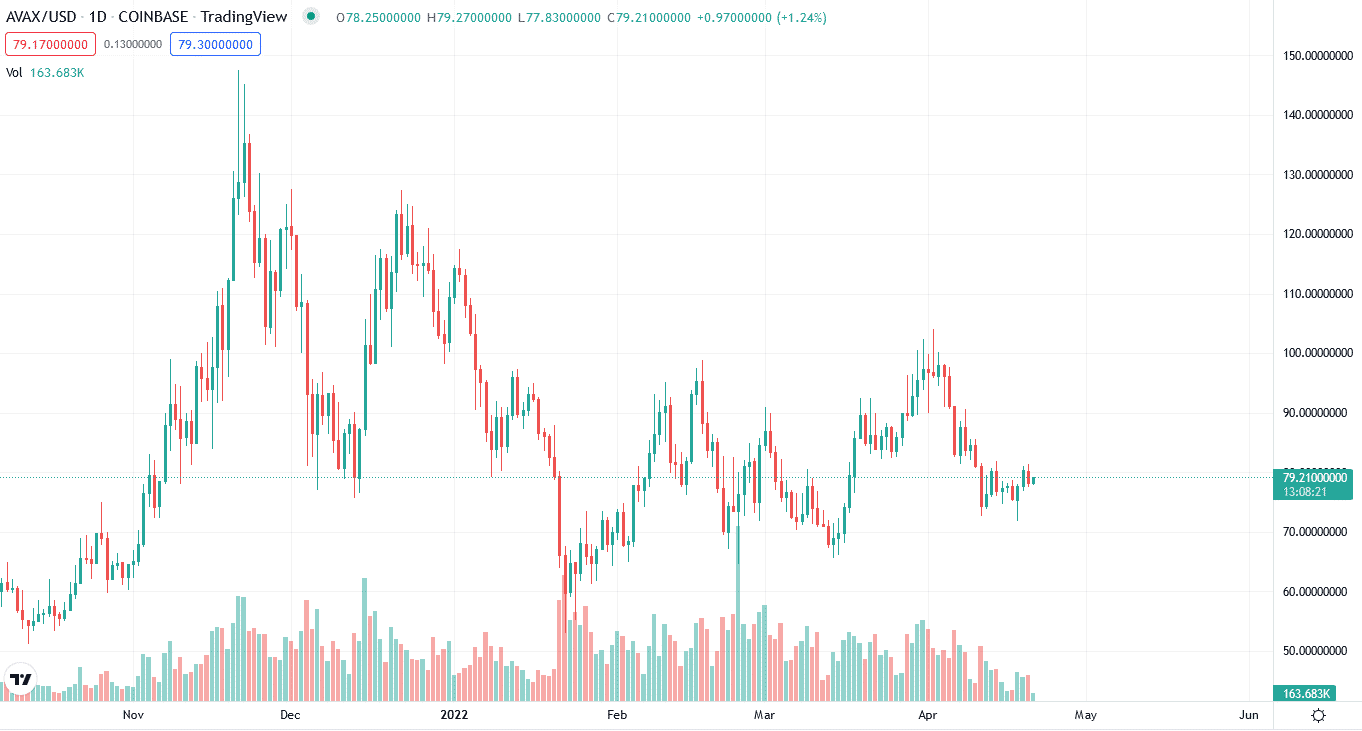

How much would you earn if you invested 1 year ago?

The price of AVAX at its launch in September 2021 was 64. At the time of writing, the price is trading around 81. It suggests there’s an increase of a massive 26%.

Final thoughts

Altcoins provide great diversification opportunities. Consider aspects like acceptance, performance, and market cap when investing in altcoins.