The crypto industry has become an attractive sector as it enables various ways to generate incomes for individuals. So no wonder recently, stablecoins have become more popular to companies and individual investors interested in the crypto industry. The volatile marketplace of the crypto was a challenging factor to accept as a payment gateway, and the stablecoins come with the solutions.

However, when you are interested in entering the realm of cryptocurrencies and seeking fix-valued assets like stablecoins, knowing the best coins in the crypto industry is mandatory. This article will introduce you to the top five stablecoins that allow investing and staking.

What are stablecoins?

You can consider stablecoins as the bridge between crypto-assets and fiat currencies as these crypto coins are pegged to reserve assets like gold or the USD. The purpose of these coins is to provide stability as it protects against volatility. This feature makes the crypto market more attractive to investors who may avoid this marketplace due to enormous fluctuations. This idea of combining digital-asset flexibility and traditional-asset stability is remarkable as these coins already exceed Billions of dollars investments.

There are several types of stablecoins, such as:

- Fiat-backed stablecoins

This type of stablecoins keeps a reserve of traditional currencies as collateral.

- Commodity-backed stablecoins

These stablecoins are usually stabilized with hard assets like real estate, gold, or other precious metals.

- Seigniorage-style stablecoins

Usually, an algorithm backs and governs these stablecoins rather than real-world currencies or assets.

- Crypto-backed stablecoins

These stablecoins are pegged with other crypto coins.

The best five stablecoins

Stablecoins allow individual users to transfer money internationally, have low transaction fees, trade or store money, earn interest, etc.

The best five among them are:

- Tether (USDT)

- Binance USD (BUSD)

- USD Coin (USDC)

- TerraUSD (UST)

- Dai (DAI)

Tether (USDT)

What is USDT about?

USDT is the largest stable-value cryptocurrency that mirrors the performance of the United States Dollar. The launching period of this crypto coin is Jul 2014, and the issuer of this crypto coin is Tether, a Hong Kong-based company. Reeve Collins, Craig Sellars, and Brock Pierce are the founders of this crypto asset.

Most special aspects

The price of USDT is currently floating near $1.0004 today with a 24-H trading volume of $66,780,616,236.

- Fully diluted market cap: $82,201,547,096

- Live market cap: $79,620,822,549

- Circulating supply: 79.58B USDT

- Total supply: 82,164,697,049 USDT

- Max supply: not available

- Volume / market cap: 0.8365

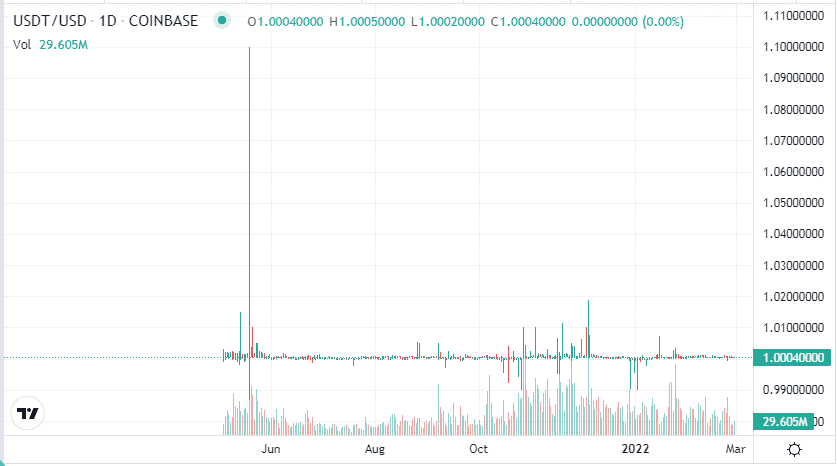

USDT price performance

USDT made the highest peak near $1.099 in May 2021.

USDT price prediction 2022

Many crypto analysts anticipate an average price of USDT may hit near $1.29 by Dec 2022.

Binance USD (BUSD)

What is BUSD about?

Binance USD is a stable crypto coin that is 1:1 USD backed, and the issuer of this coin is Binance. The New York State Department of Financial Services (NYDFS) regulates and approves this crypto asset, and the launching period of BUSD is Sep 2019. Many top crypto wallets, including Zapper, Trust Wallet, Metamask, Trezor etc., allow holding this coin.

Most special aspects

The price of BUSD is currently floating near $1.000 today with a 24-H trading volume of $5,698,364,746.

- Fully diluted market cap: $18,354,547,740

- Live market cap: $18,324,082,365

- Circulating supply: 18.34B BUSD

- Total supply: 18,341,651,33 BUSD

- Max supply: not available

- Volume / market cap: 0.31

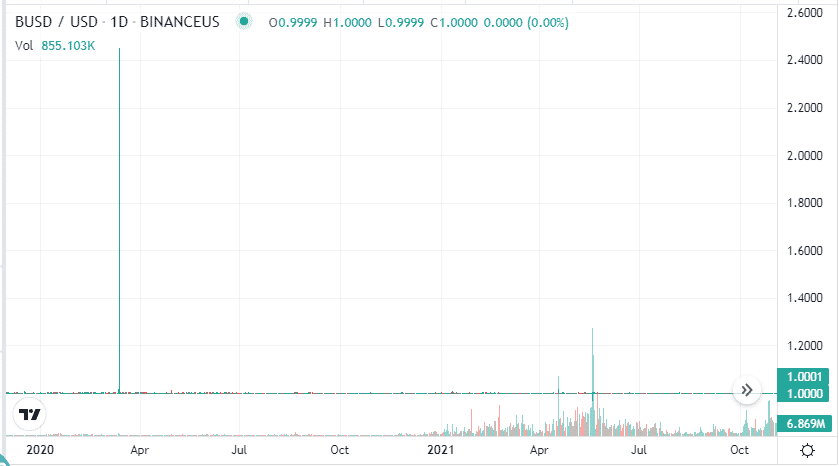

BUSD price performance

BUSD made the highest peak near $2.45 in Mar 2020.

BUSD price prediction 2022

Many crypto experts anticipate the price of BUSD might hit nearby Dec 2022.

USD Coin (USDC)

What is USDC about?

USD coin is a stablecoin that is 1:1 basis pegged to the United States Dollar. A $1 reserve as collateral backs up every unit of this coin circulating. The launching period of this crypto coin is Sep 2018. Sean Neville and Jeremy Allaire are the founders of this stablecoin.

Most special aspects

The price of USDC is currently floating near $1.000 today with a 24-H trading volume of $5,303,301,404.

- Fully diluted market cap: $53,528,588,207

- Live market cap: $53,529,495,457

- Circulating supply: 53.53B USDC

- Total supply: 53,530,696,147 USDC

- Max supply: not available

- Volume / market cap: 0.09948

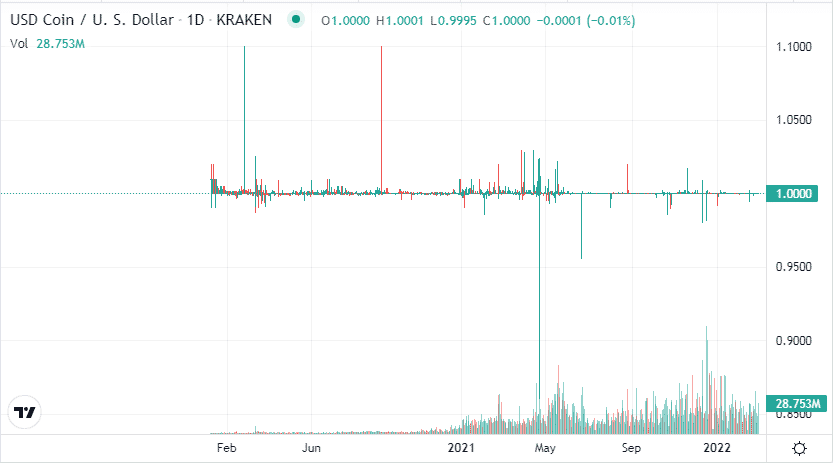

USDC price performance

The highest peak of USDC is near $1.10 (Sep 2020), and the low is near $0.86 in Apr 2021.

USDC price prediction 2022

Many crypto experts predict the price of USDC might hit near $1.28 by Dec 2022.

TerraUSD (UST)

What is UST about?

TerraUSD is an algorithmic and decentralized stablecoin on the Terra blockchain. The launching period of this coin is Sep 2020.

Most special aspects

The price of UST is currently floating near $1.0008 today with a 24-H trading volume of $576,323,750.

- Fully diluted market cap: $12,939,623,192

- Live market cap: $12,940,039,711

- Circulating supply: 12.92B UST

- Total supply: 12,915,893,020 UST

- Max supply: not available

- Volume / market cap: 0.04487

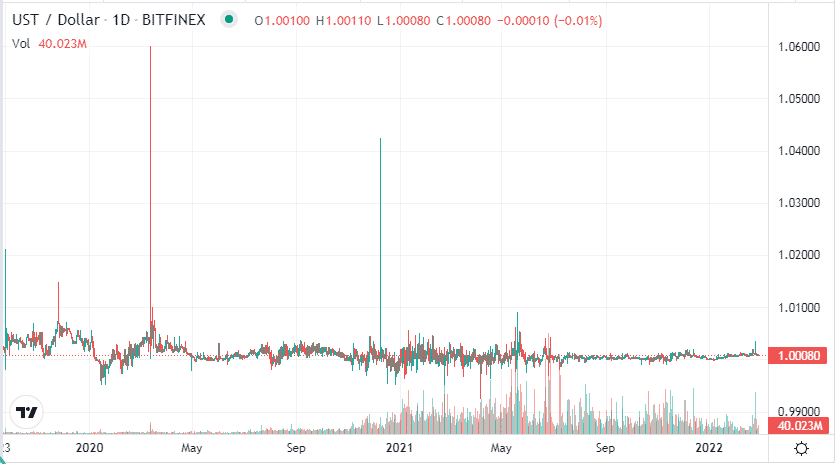

UST price performance

UST made the highest peak near $1.06 in Mar 2020.

UST price prediction 2022

Many crypto experts anticipate UST might hit near $1.286 by Dec 2022.

Dai (DAI)

What is DAI about?

DAI is an Ethereum-based stable-price crypto coin. The MakerDAO decentralized autonomous organization and Maker protocol manage the development and issuance of this stablecoin. The launching period of this crypto asset is Nov 2019.

Most special aspects

The price of DAI is currently floating near $1.0007 today with a 24-H trading volume of $295,959,363.

- Fully diluted market cap: $9,687,799,725

- Live market cap: $9,687,883,149

- Circulating supply: 9.68B DAI

- Total supply: 9,684,248,426 DAI

- Max supply: not available

- Volume / market cap: 0.03102

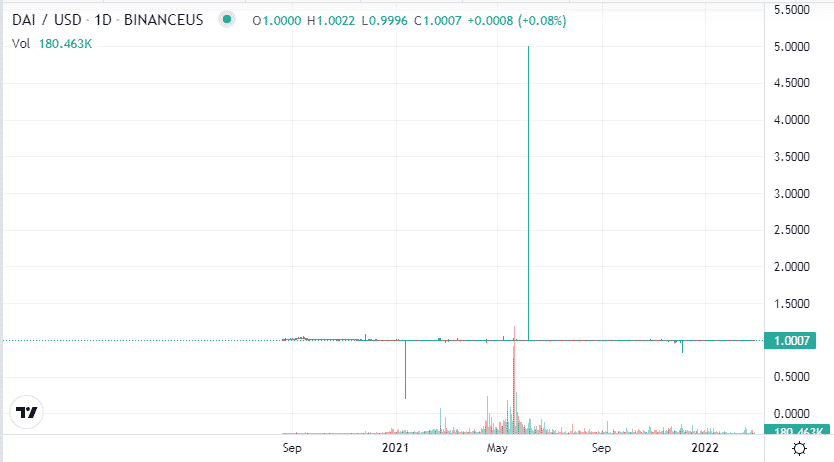

DAI price performance

DAI made the highest peak near $5.00 in Jun 2021.

DAI price prediction 2022

Many crypto analysts expect the price of DAI might hit near $1.283 by Dec 2022.

Final thought

Finally, these stablecoins can be a potential investment in 2022 as you can make money from staking alongside holding these assets. Note that entities that issue these stablecoins are similar to the banks without any audit requirements or licenses.