When you first learn how to trade, you might have come across the idea to cut your losses short and let your profits run. Stated another way means you have to define a fixed stop loss, but no “take profit” at all. This type of trade management is common but maybe not suitable for everyone.

What if you do the opposite? What if you trade with a take-profit target but without stop loss? Of course, most traders would not support the idea. However, there is a small number of traders who do trade without a stop loss.

This approach is not suitable for beginners. However, seasoned traders have a handle on the forex market. Therefore, they can take riskier but carefully analyzed trades.

If you do attempt to trade this strategy, you need to have a trading plan in place. To manage the risk, you must open more minor positions concerning your trading account. You must set small profit targets as well.

How to trade successfully without a stop loss?

As discussed in the previous section, you can make money trading without stop loss. But there is a related question that is hard to answer. If you trade without stop loss and make a profit, can you keep the profit for long?

The thing is, traders can make money trading without stop loss and even without a trading plan. This is the case for some novice traders. They enter positions through gut feeling or using purely market sentiment.

Traders employing market sentiment as entry criteria look at the number of buyers and the number of sellers at any given point. Of course, this is assuming that information is readily available. Anyway, some brokers provide this information. If there are more buyers than sellers, sentiment traders take long positions.

More often, these entries do not have stop losses. At times, traders got lucky. They can exit trades quickly if the chosen trade direction turns out correct. At other times, though, they are forced to hold on to losing trades after making a wrong call.

They believe the price will eventually return to the mean, which holds water anyhow. However, they might have lost their capital when that happens. In the end, these traders give up and shun trading as a result.

Successful trading strategy without a stop loss

This article will present a strategy that will allow you to take trades without stop loss. Since this trading approach is risky, you have to do it right at the get-go. Else, you will learn after losing your stake. This is a complicated way of learning a lesson, so avoid it at all costs.

To implement this strategy successfully, follow the steps below:

- Use cost averaging in building a position

- Trade with the concept of mean reversion

- Trade divergence signals

Step №1. Determine the trade size using cost averaging

Cost averaging means dividing your position into multiple trades, each having the same lot size. An example will clearly illustrate the concept. If you have a standard account and typically trade with a lot size of 1.0, divide this lot size by any number, say, 5. Now instead of entering one 1.0 lot trade, you open five trades, each at 0.02 lot. The table below clearly explains this point.

| Approach | Number of trades | Lot size per trade | Total Position |

| Without cost averaging | 1 | 1.0 | 1.0 lot |

| With cost averaging | 5 | 0.02 | 1.0 lot |

The importance of setting the correct trade size for each position cannot be stressed enough. This can make or break you as a trader. If there is one thing you should learn as a trader, that is this concept. All other trading ideas are secondary in importance to this concept.

Continuing with the previous example, you will open a total of five trades with 0.02 lots each. However, it is not necessary to open all five orders each time. Depending on your entry strategy, you might have one or two open trades in a trade cycle. If your initial entries did not work out, you could take up to five entries until the market moves in your intended direction. Note that with this type of entry, a stop loss is not practical.

Step №2. Apply the concept of mean reversion

The next part of the strategy is to know which location you would enter trades. This is where trading with mean reversion comes into the picture. You can use any mean reversion tool of your choice.

Your options include:

Here we will use the moving average as a mean reversion tool. The best moving averages for mean reversion are long-term periods, such as 100 EMA and 200 EMA. Any type of moving average will do, such as simple, smoothed, linear weighted, etc. The best type seems to be the exponential average because it reacts quickly to price action. Let us use the 100 EMA for this exercise.

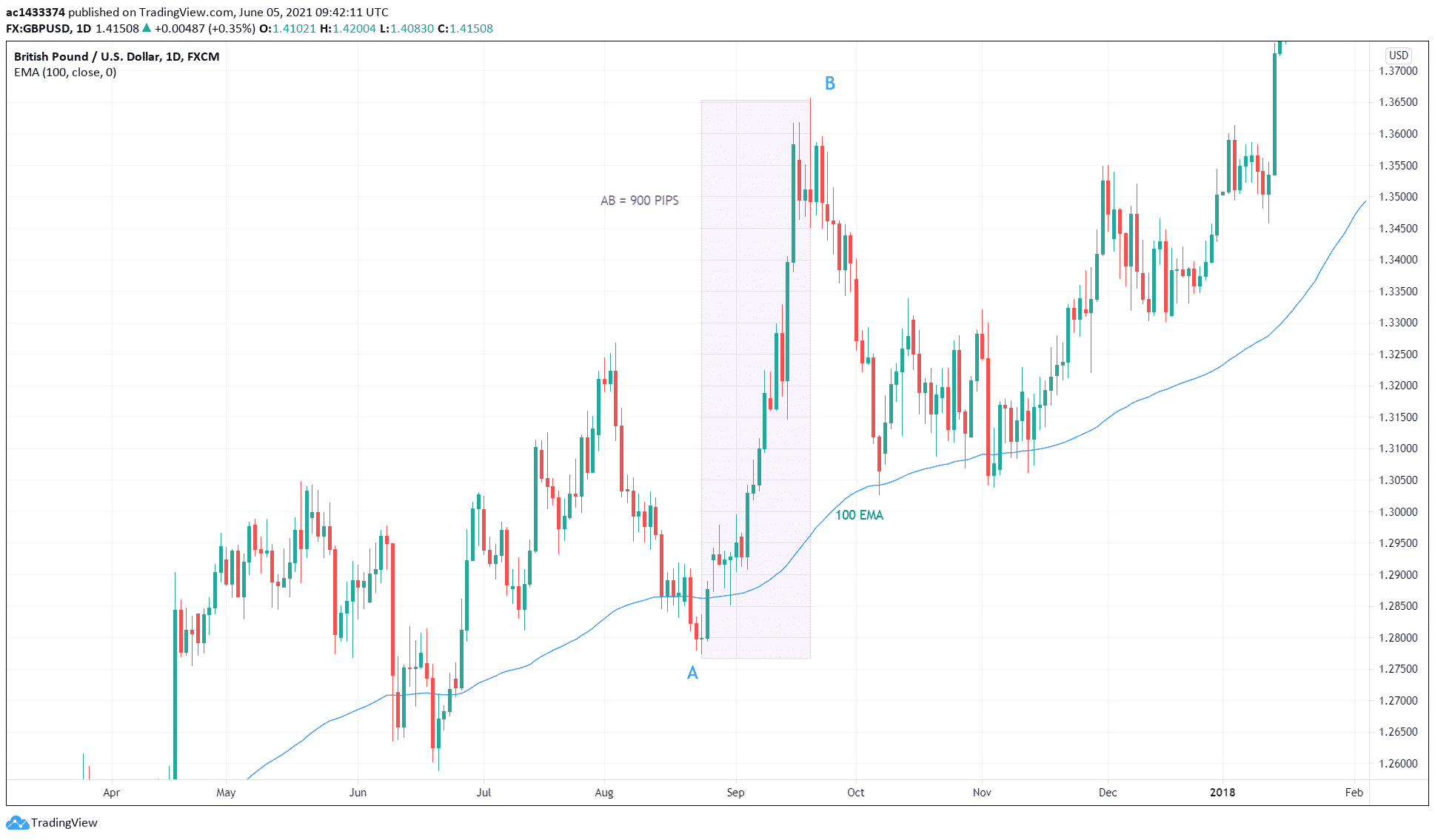

You can use any time frame for an entry chart. The best time frames are hourly, four-hour, and daily. The next thing to do is go through each chart in your trading platform. Then find a chart whose price has gone too far from the 100 EMA. At this condition, a reversal or correction is likely to happen.

Take the GBP/USD daily chart above, for example. The trend is bullish because the 100 EMA is sloping upward. At some point, the price made an upswing that drifted too far from the 100 EMA. This swing started at point A and ended at point B. The move covered 900 pips. We can make the case that price is overbought at point B, so it is a good location for sell entries.

Step №3. Trade divergence setups

The last step in this strategy is to open a position every time you see a divergence. You can use any divergence indicator you prefer, including:

- Relative strength index

- Stochastic

- Traders dynamic index

- MACD

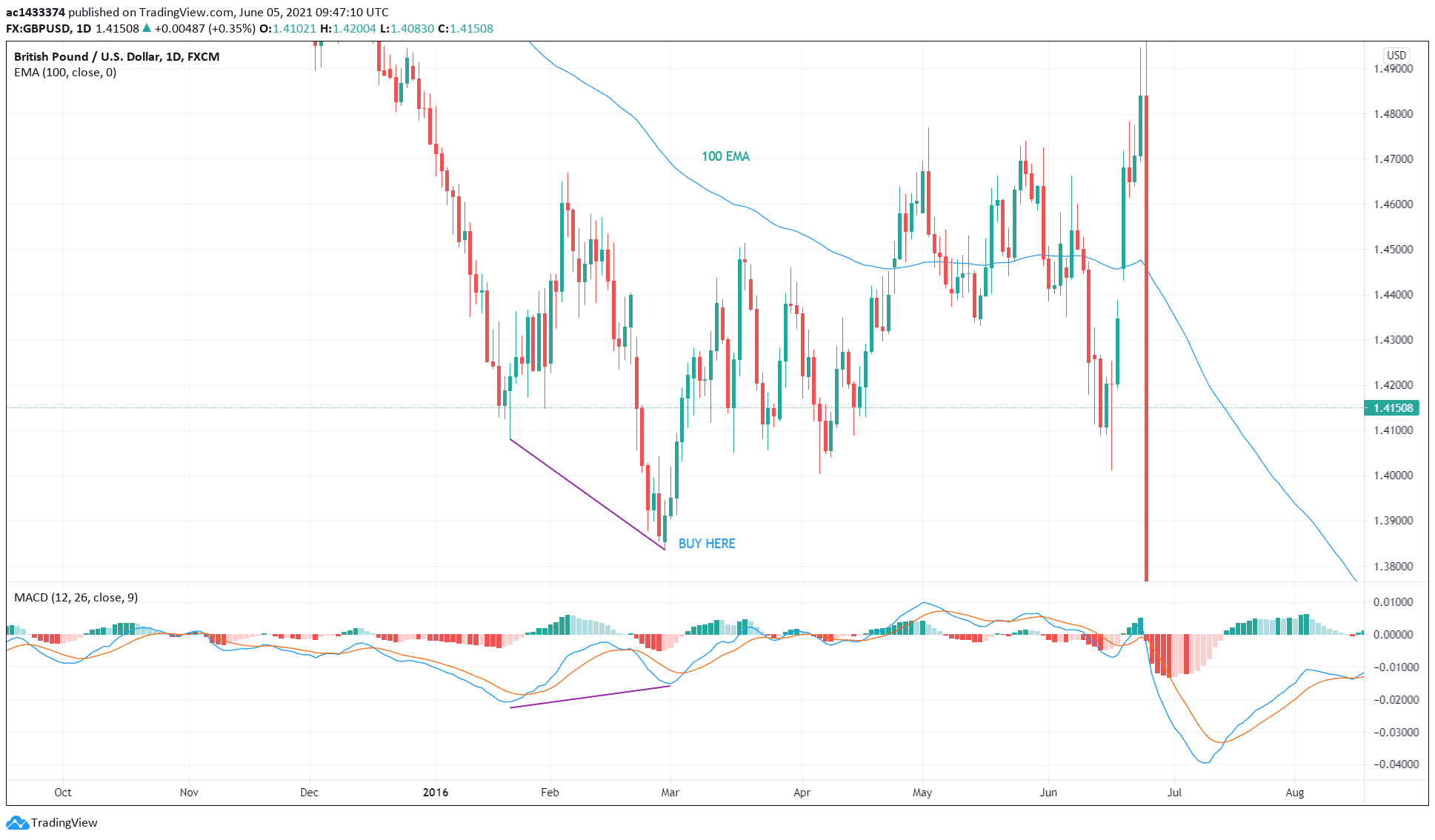

In the author’s opinion, the best one for this purpose is MACD. The reason is that MACD can also detect overbought and oversold conditions. Such conditions occur when the MACD line has moved too far from the zero line.

Refer to the above GBP/USD daily chart above for illustration. You can see the trend is down, and then a bullish divergence occurs. Taking this signal is “buying against the trend”. However, you are trading against a trend that is a bit old and losing steam.

If the market ignores the divergence and the downtrend continues, keep on adding trades every time a divergence comes up. That is how you build a position with cost averaging. Just maintain the lot size on each entry. At some point, the price will reverse or correct, which could happen very quickly.

Final thoughts

Trading without a stop loss is a high-risk trading strategy. It is not suitable for everyone. However, if you have enough trading experience under your belt, this strategy may play out. Your emotional control is another crucial element. The above sample strategy works in reality. That is a fact. You can make it work for you as well if you stick to the rules discussed.