CHoCH or change of character is a significant price pattern that helps traders define a crypto asset’s future price direction from the beginning. In any financial instrument trading, lagging indicators are the main drawback that shows late signals. Therefore, most of the problems from indicators-based trading can be eliminated by using CHoCH.

Still, many traders struggle to ensure the best use of CHoCH in their trading method. The following section will see the top five trading tips that might help you make a better trading decision.

What is the CHoCH?

CHoCH or Change of Character is a price behavior used by smart money traders where the primary aim is to find the first sign of a trend change. In an uptrend, the price moves up by creating new highs, and in a downtrend, it forms new swing lows. Therefore, it is often hard to follow the trend as it will not continue forever.

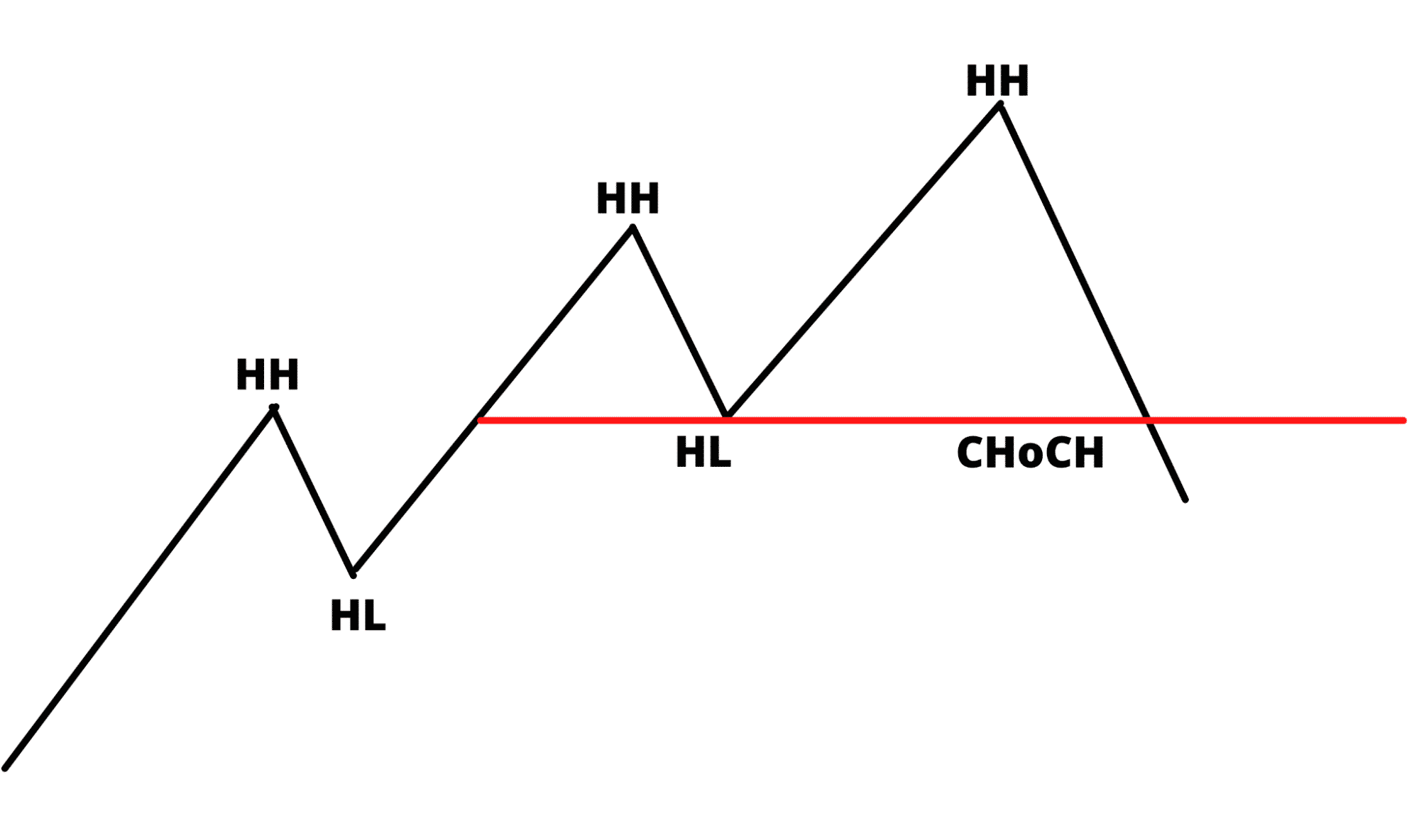

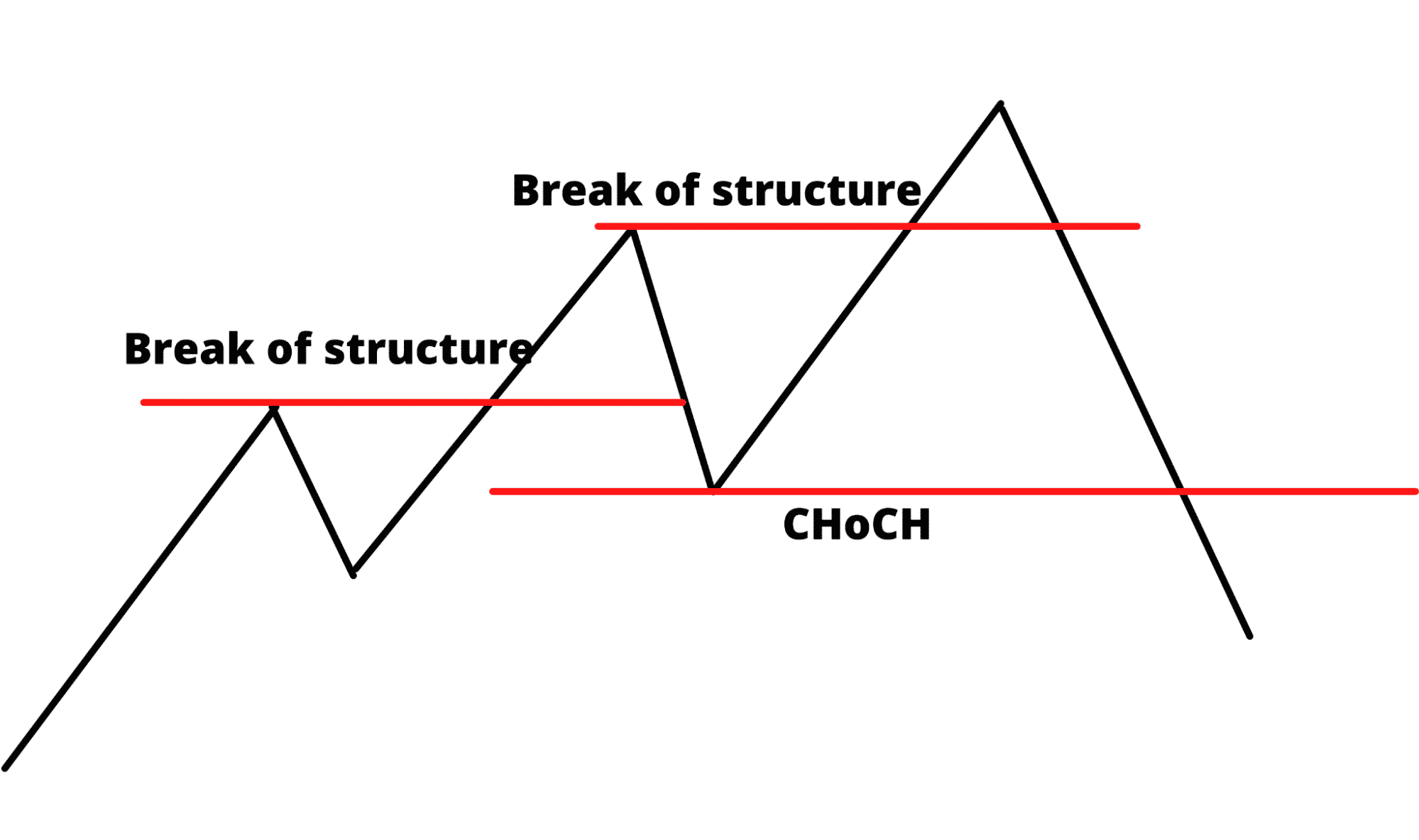

CHoCH shows the violation of swing levels after a trending movement so that investors can wait for reversal trades after finding sufficient confirmations. First, let’s see what it looks like.

The above image shows how the CHoCH forms in the bull market where the price moves higher by creating higher highs and higher lows. However, the bears regained the momentum by breaking the market structure where a new swing low formed below the immediate higher low.

Top five tips for trading with CHoCH

This section will see the top five CHoCH trading tips a trader should know before approaching to trade.

Tip 1. Identify the trend

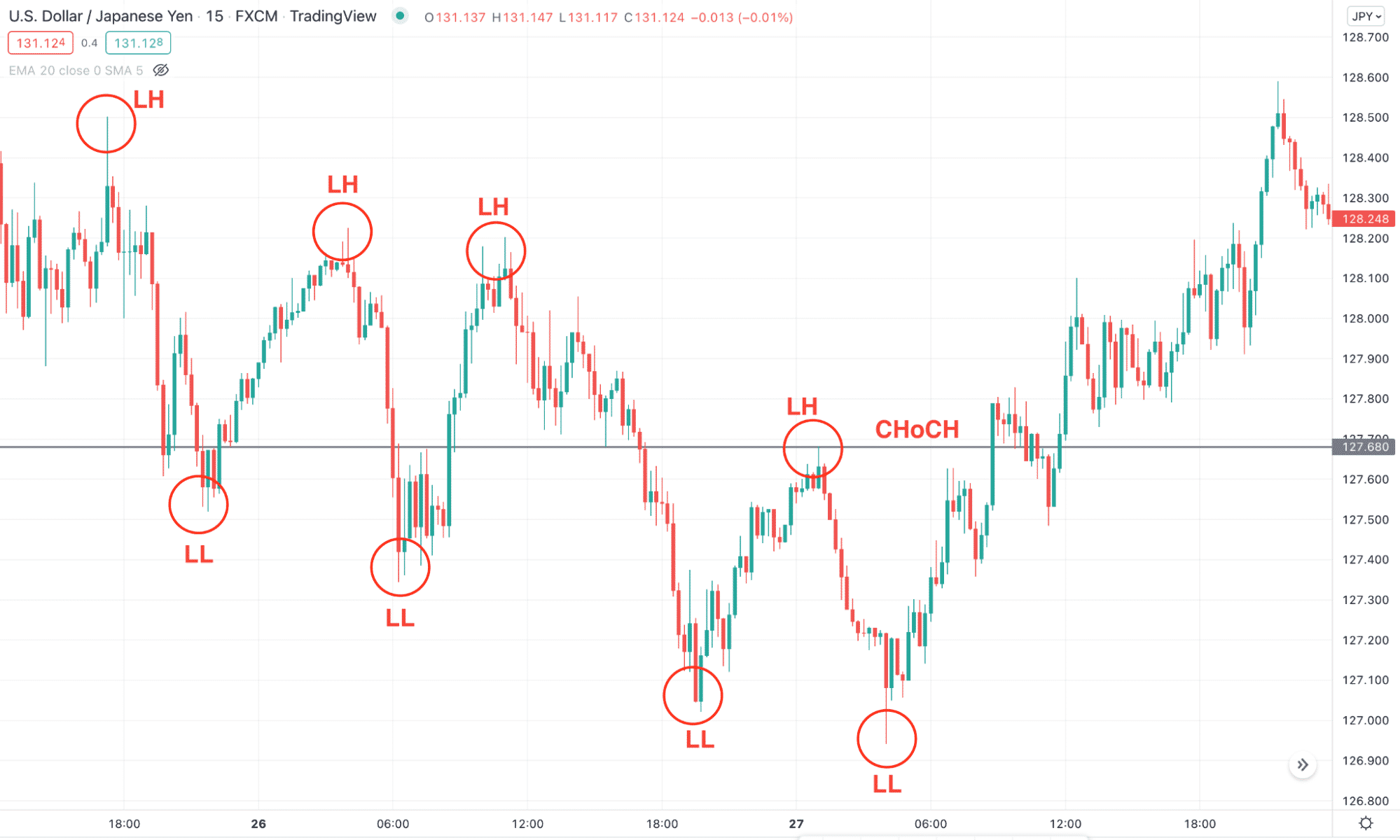

Before approaching CHoCH trading, investors should have a clear idea about the market trend. It is easy to find CHoCH in a trending market. On the other hand, there might be several violations of near-term swings in a consolidation that might make CHoCH trading harder.

Why does it happen?

People often forget the broader market structure and focus on only near-term swing levels in finding the CHoCH.

How to avoid the mistake?

It is elementary to find the trend by looking at near-term swing levels. In an uptrend, there should be consecutive higher highs. On the other hand, there should be lower lows in a downtrend. Therefore, the CHoCH will be the first bearish break of structure in a bull-trend and the first bullish break of structure in a bearish trend.

Tip 2. CHoCH is not a trend-change

CHoCH is the violation of near-term swing highs or lows while the broader market direction remains within a trend. In general, the breach of these swing levels indicates an uncertainty to the market regarding the trend continuation, but it is not wise to believe it is a trend change.

Why does it happen?

Creating higher highs and lower lows is helpful for traders to find a trend. Therefore, investors often believe that the violation of lower lows or higher highs might shift the market direction at any time, which is not correct.

How to avoid the mistake?

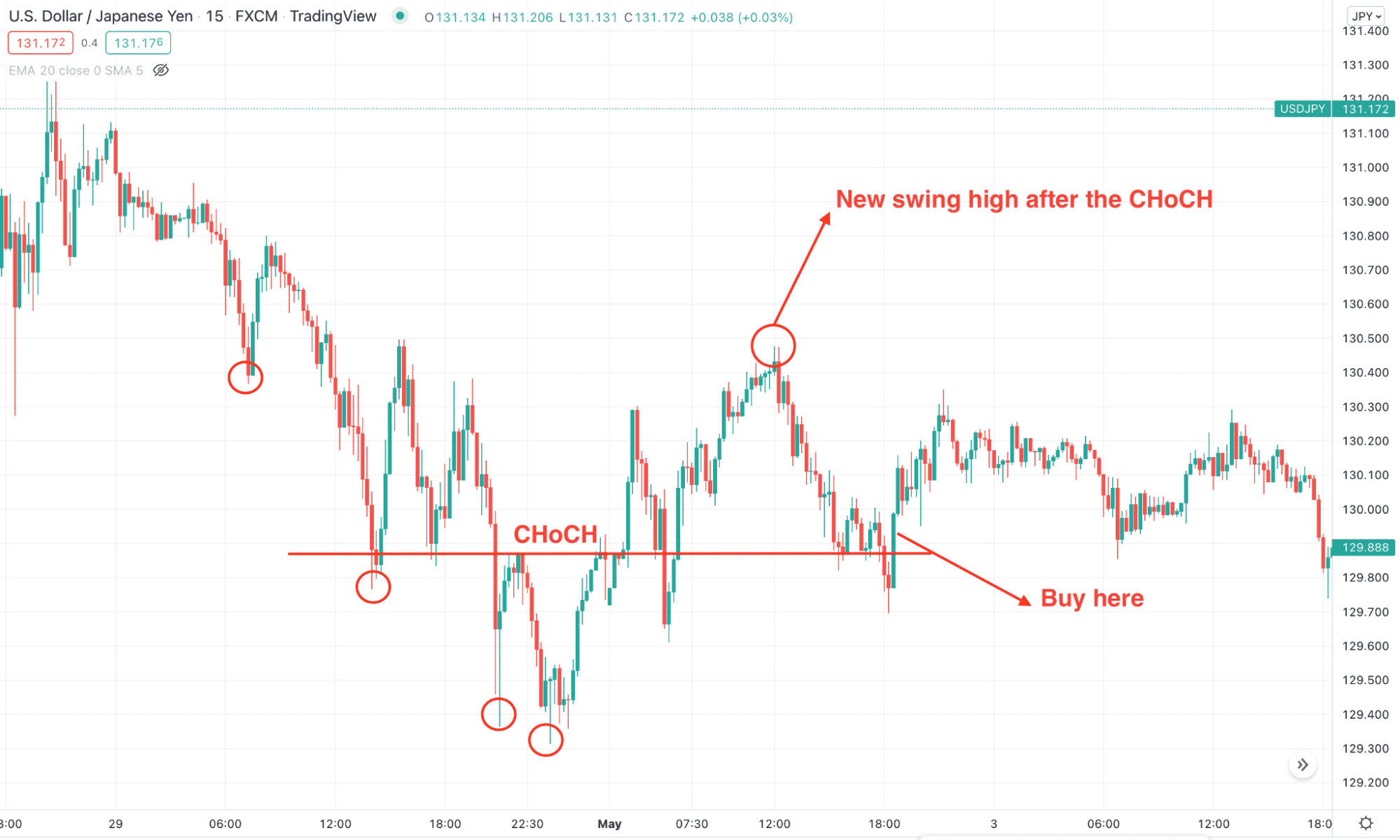

The first thing traders should do is wait to confirm the trend change. CHoCH is the first sign that the opposite party has altered the current market structure, but it is better to wait for another swing level before taking a trade.

Tip 3. Tips during the trading entry

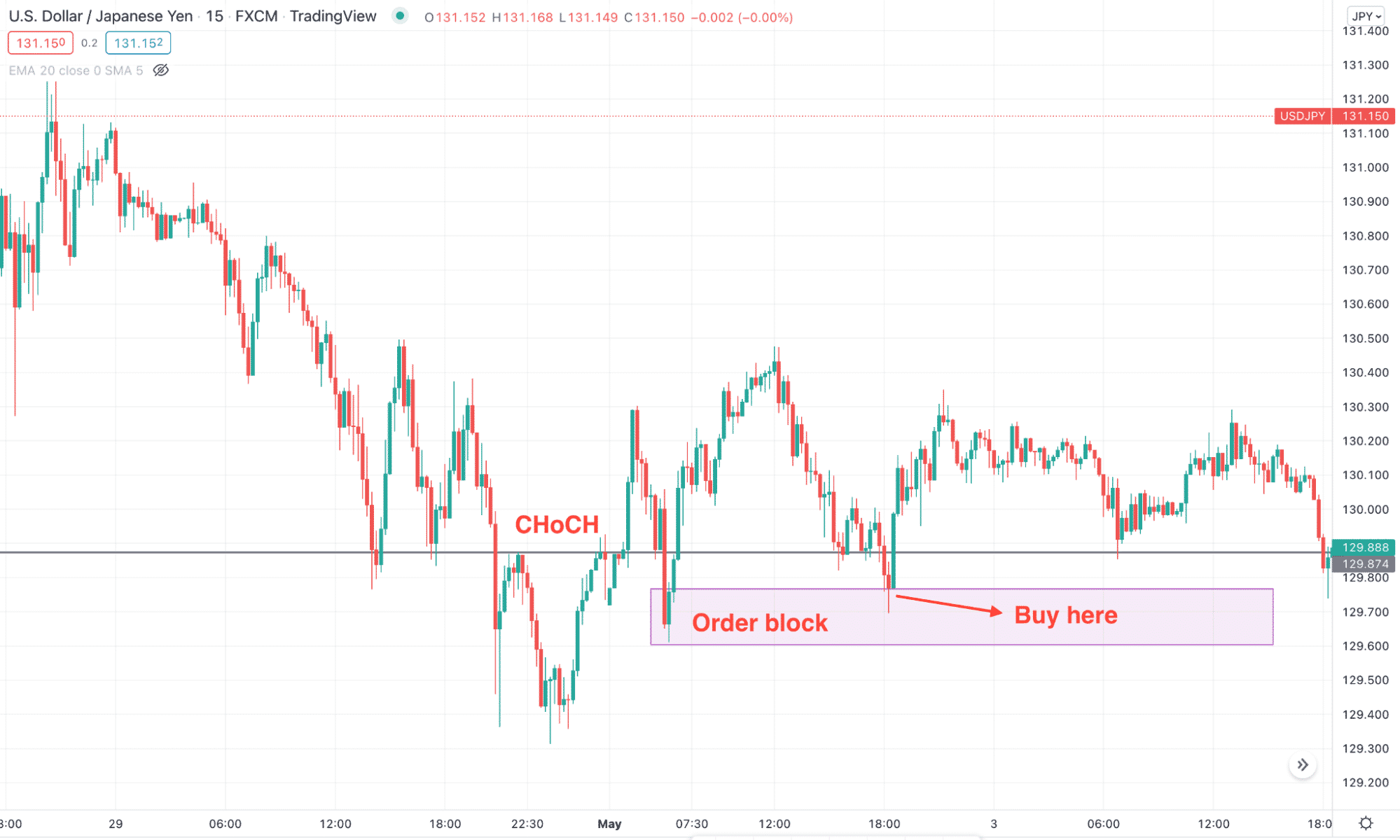

Many traders struggle to find reliable trading entries after the CHoCH. After seeing the confirmation of trend changes, investors should wait for a trading setup based on supply-demand areas.

Why does it happen?

Novice traders often take trades based on the break of the structure during the CHoCH formation. However, the price might rebound immediately if sufficient information regarding the trade change is unavailable.

How to avoid the mistake?

In the CHoCH trading, investors should wait for the price to reach any reliable order block and form a reversal candlestick pattern. After that open, the trade is based on the market structure where the primary aim is that the price will reach the near-term swing level.

Tip 4. CHoCH and break of structure

The break of structure is a common term in smart money trading. When the price moves beyond the near-term high or low, it signifies that the price breaks the structure. On the other hand, during the CHoCH, the same scenario appears, although there is a difference.

Why does it happen?

Many traders become confused to find a difference between the break of structure and CHoCH. However, in both cases, the price makes a new high, so it’s generally true to consider all cases as structure breaks.

How to avoid the mistake?

The first thing a trader should not be that all CHoCH comes with a structured break, but it happens on the opposite side of the trend.

Tip 5. Trade management in CHoCH trading

The success rate in CHoCH trading is high, which often influences investors to put less effort into the trade management. However, the inappropriate use of trade management would negatively impact the trading result.

Why does it happen?

This mistake happens to most new traders, focusing on trading methods rather than trade management. On the other hand, success in financial trading depends on how investors use risk management techniques.

How to avoid the mistake?

It is essential to have a good trading strategy to succeed in crypto trading, but the ultimate success depends on the risk management system. During the uncertain market movement, no strategies work well where expert traders keep themselves away by not taking any trades.

Final thought

CHoCH trading strategy would increase your trading profitability related to the smart money concept. This method follows how banks and prominent financial institutes take trades with a more significant volume. Overall, if you can eliminate all the mistakes mentioned above in this trading, you can create a decent trading portfolio.