Crypto backed by gold means digital assets that usually track the performance of the precious metal gold. Historically gold is among the safe haven investments during uncertainty, and investors turn their capital into gold to reduce risk during unpredictable situations. So it makes sense that these gold-backed cryptos become attractive investments to crypto investors.

However, several gold-backed tokens are available in the crypto industry, and gold backs them in different ratios depending on the project features. This article will introduce you to the best five cryptos that enable making brilliant profits.

What is gold-backed crypto?

They are digital derivative assets that are usually pegged to the price of gold. These assets are pegged with gold prices with different ratios. For example, a single coin may represent particular troy ounces or grams of gold.

Investors usually use these digital assets to hedge against the volatility of crypto. These investment assets have become popular among crypto investors as these assets enable accessing abilities to the physical gold market without involving illiquidity, transport inconveniences, volatility, and transferability issues.

Best five crypto backed by gold

Several gold-backed cryptos are available in the crypto industry with different feature offerings. Most of these coins are ERC-20 tokens, although there are some exceptions. It is worth checking or verifying claims of any gold-backed crypto project as the best ones will always be transparent.

According to our research, the best five gold-backed crypto projects are:

- Digix Global (DGX)

- Tether Gold (XAUT)

- Perth Mint Gold Token (PMGT)

- Gold Coin (GLC)

- Paxos Gold (PAXG)

Digix Global (DGX)

What is DGX?

Each DGX token represents the value of one gram of gold and the foundation period is 2014 in Singapore. This token is currently available on many major exchange platforms, including Hotbit, KULAP, Indodax, and ProBit Global. It is an acceptable option for investing in physical gold and gold ETFs.

Let’s take a look at the basic info of DGX at a glance:

- Fully diluted market cap: $1,138,675

- Live market cap: $1,070,876

- Circulating supply: 54,623.27 DGX

- Total supply: 58,000 DGX

- Max supply: not available

- Volume / market cap: 0.0006134

- Minimum purchase: $50-$600,000 for gold bar, $150 for gold ETF, and $0.50 for the tokens

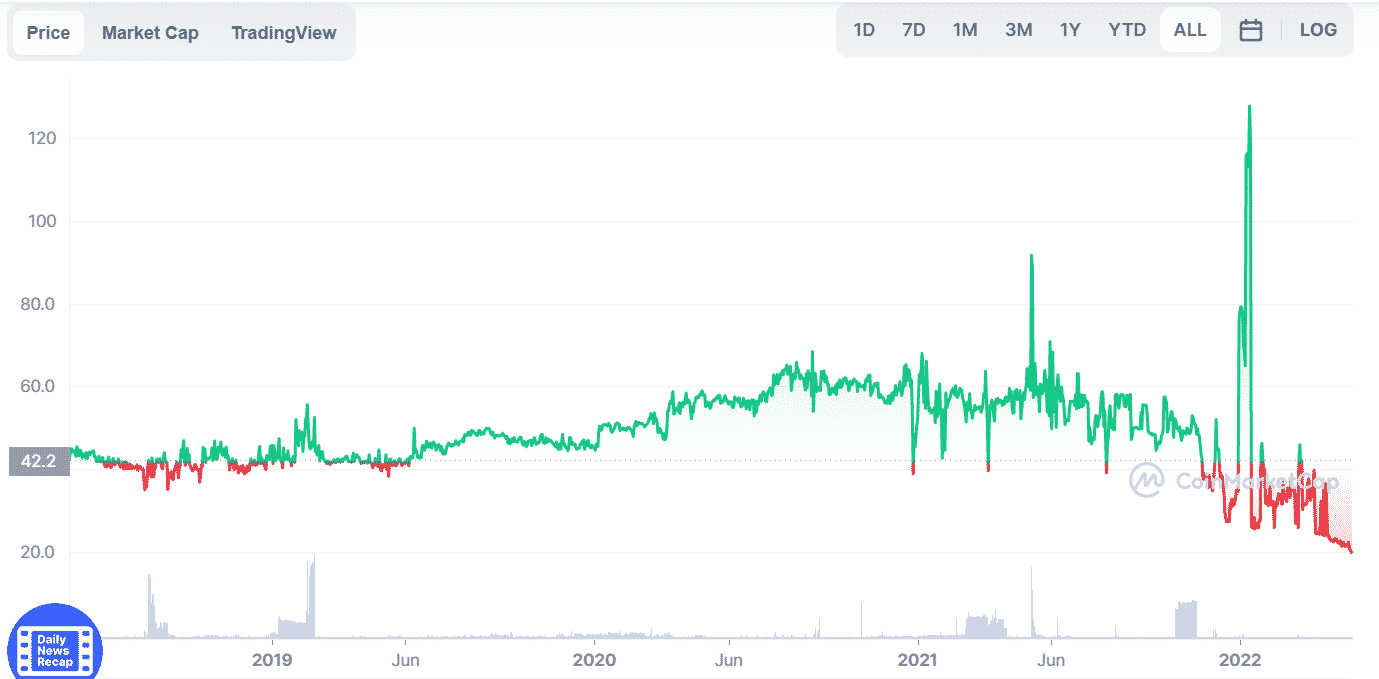

Price-performance

DGX token is currently floating near $19.60 today with a 24-H trading volume of $658. This token created the highest peak near $127 in January 2022.

DGX price prediction 2022

Many crypto analysts predict the price per DGX token might hit near $54 by the end of 2022.

Tether Gold (XAUT)

What is XAUT?

Another crypto enables investors to direct exposure to physical gold like all other gold-backed cryptos. Each XAUT token represents the value of one troy ounce of gold, and TG commodities limited offers this token to investors. This token is currently available on many major exchange platforms, including FTX, Bitfinex, Gate.io, Uniswap (V3), and BTSE.

Let’s take a look at the basic info of XAUT at a glance:

- Fully diluted market cap: $463,734,615

- Live market cap: $463,591,517

- Circulating supply: 246,524.00 XAUT

- Total supply: 246,524 XAUT

- Max supply: not available

- Volume / market cap: 0.0003213

- Minimum purchase: 50 XAUT

Price-performance

XAUT tracks the performance and fluctuates as the price of gold in the global market. The price of this token is currently floating near $1879.79 today, with a 24-H trading volume of $149,069.

XAUT price prediction 2022

Many crypto and commodity experts expect the price per XAUT token might hit a maximum of $3,061.52 by Dec 2022.

Perth Mint Gold Token (PMGT)

What is PMGT?

It is an ERC-20 token, a tokenized version of the GoldPass certificate. Trovio is the developer and issuer of this token, and each token represents one fine troy ounce of gold stored in the central bank grade vaults of The Perth Mint.

Let’s take a look at the basic info of PMGT at a glance:

- Fully diluted market cap: $2,206,780

- Live market cap: $2,206,780

- Circulating supply: 1,157.21 PMGT

- Total supply: 1,157 PMGT

- Max supply: not available

Price-performance

This token spiked near 187K in Q2 of 2021 and is currently floating near $1906.9 today.

PMGT price prediction 2022

Many crypto experts anticipate that the price per PMGT token can hit nearly $ 2561.86 by Dec 2022.

Gold Coin (GLC)

What is GLC?

Another gold pegged crypto enables many investors to invest in physical gold with smaller capital. The pegged ratio is 1:1000 per ounce of gold.

Let’s take a look on basic info of GLC at a glance:

- Fully diluted market cap: $3,739,056

- Live market cap: $2,260,720

- Circulating supply: 43,681,422.00 GLC

- Total supply: 44,010,144 GLC

- Max supply: 72,245,700 GLC

- Volume / market cap: 0.002178

- Minimum purchase: not available

Price-performance

The price per GLC token spiked near $0.69 in Apr 2022. This coin is currently floating near $0.045 with a 24-H trading volume of $3,640.

GLC price prediction 2022

Many experts anticipate the price per GLC token might hit near $0.40 by Dec 2022.

Paxos Gold (PAXG)

What is PAXG?

It is an ERC-20 token that runs on the ETH blockchain. The launching period of this token is Sep 2019.

Let’s take a look at the basic info of PAXG at a glance:

- Fully diluted market cap: $620,476,608

- Live market cap: $620,391,721

- Circulating supply: 329,225.30 PAXG

- Total supply: 329,225 PAXG

- Max supply: not available

- Volume / market cap: 0.03571

Price-performance

The price of PAXG tracks the performance of physical gold and per token represents the value of one ounce of physical gold. The price of this token is floating near $1884.99 today with a 24-H trading volume of $22,246,914. The recent peak of the PAXG token was near $2055.55 in Q1.

PAXG price prediction 2022

Many crypto analysts anticipate the price per PAXG token might reach near $2,625.82 by Dec 2022.

Final thought

Finally, these are the top gold-backed crypto that enables most probabilities to increase in value in the future as gold can surge upside down with various fundamental facts. We suggest conducting additional research before investing in digital assets such as verification systems, user feedback, future projections, security features, etc.