Investing in cryptocurrencies needs an additional understanding of volatility to keep the fund safe from unusual price fluctuation. On the other hand, the higher volatility opens room for profit, which is often hard with the traditional forex or stock market. Therefore, crypto investors should follow some additional rules to remain safe with their portfolios.

Overall, cryptocurrency investors are more innovative and skillful than traditional stock traders. If you want to build your crypto portfolio with a higher success rate, you should remain skeptical in every situation. In the following section, we will see a complete trading guide, including a list of potential crypto assets that you should know.

What is the crypto optimist crypto skeptic?

The skeptical approach is broadly followed by financial professions, where people need to remain active in every situation, whether it is positive or negative. Finally, this term indicates an investment decision for financial traders where retail traders should stay cautious about the institution’s activity.

The bitter truth of the financial market is that most retail traders lose money because of not having in-depth information about smart money. For cryptocurrency, investors who have enough buying power can change the market trend at any time with their trading volume.

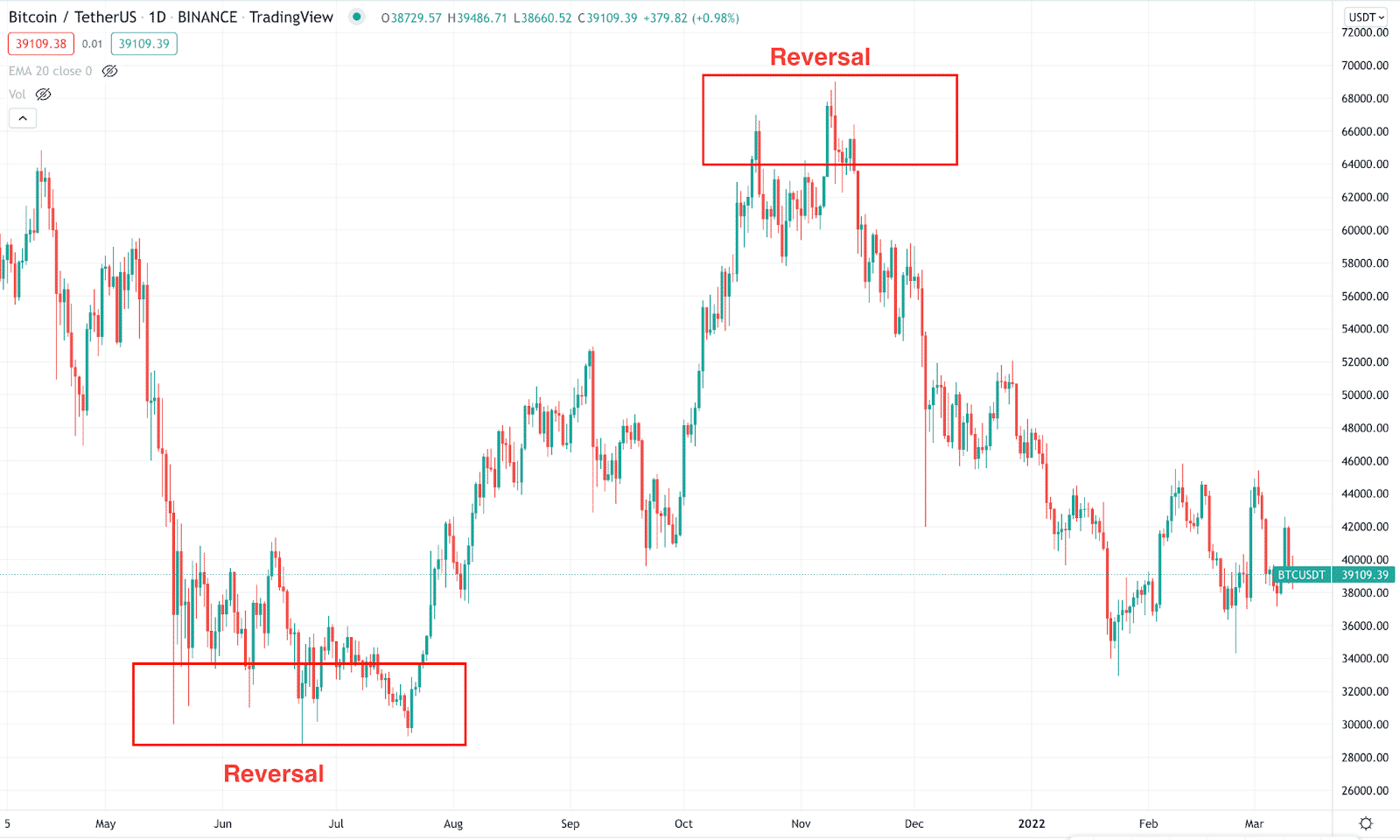

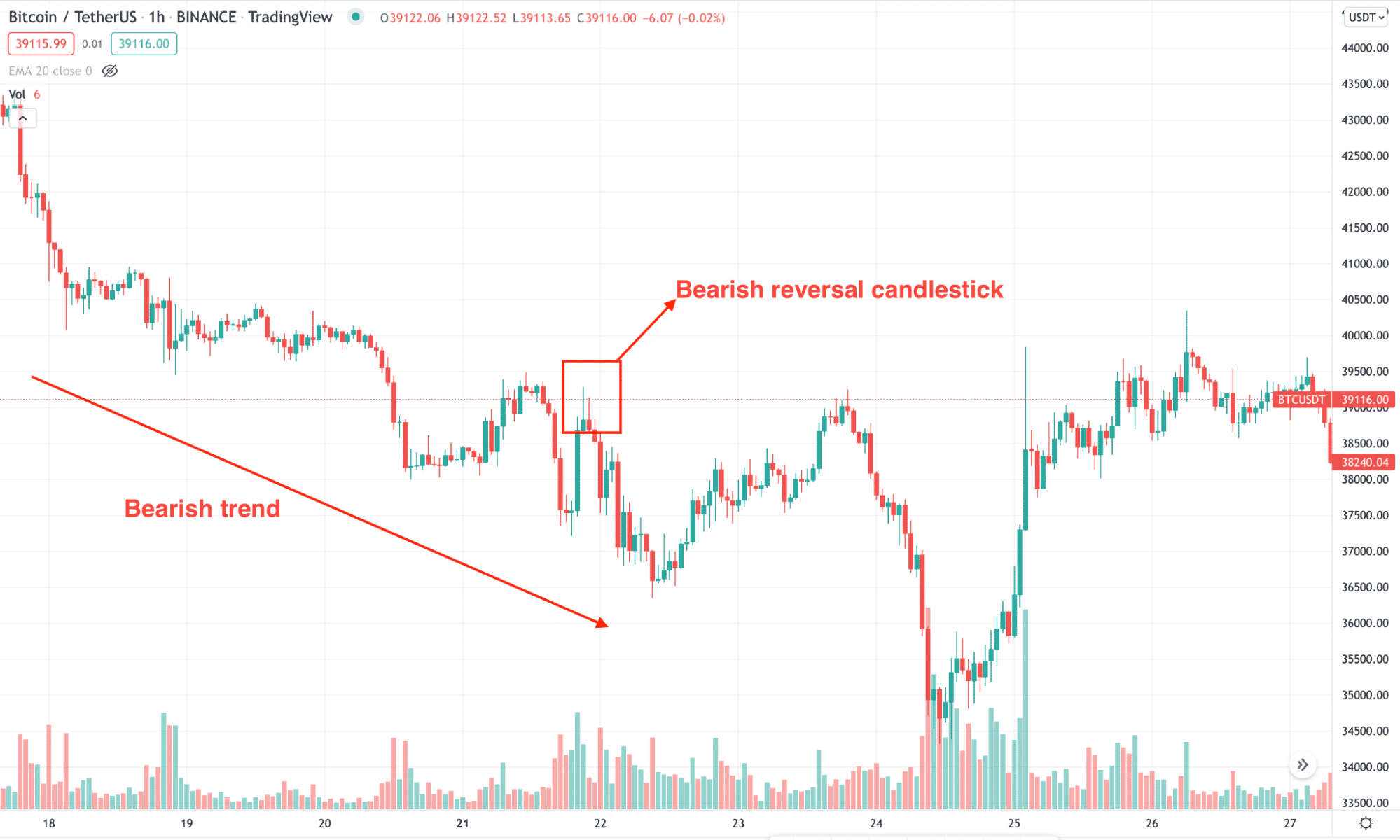

The above image represents the bullish and bearish trend of Bitcoin, where it is clear that the major price movement came with a reversal momentum. Once the price moves lower, people start thinking of taking short trades. Finally, the wale is ready to buy when enough short trade orders have appeared.

In this manner, you cannot chase smart money, but once you have enough knowledge about them, you can easily make money by riding them.

Top five tips for trading with crypto optimist crypto skeptic

If you want to see yourself above the general trader, the following section is for you. Here we will see what an intellectual person takes trading decisions that most retail traders ignore.

Tip 1. Follow whales footprint

Any trading method should explain what smart money can do with the price. One of the critical weaknesses of smart money is that it cannot fill their orders at one time. Therefore, after making a decent movement, the price revisits the entry before showing the actual movement.

Why does it happen?

Institutional traders have enough buying power to make the situation harder for finding the opposite party. For example, if any wales want to sell the $10B value of Bitcoin, he needs buyers who are willing to buy such an amount. Therefore, instead of selling $10B in one order, they sell $5B, $3B, and $2B.

How avoid the mistake?

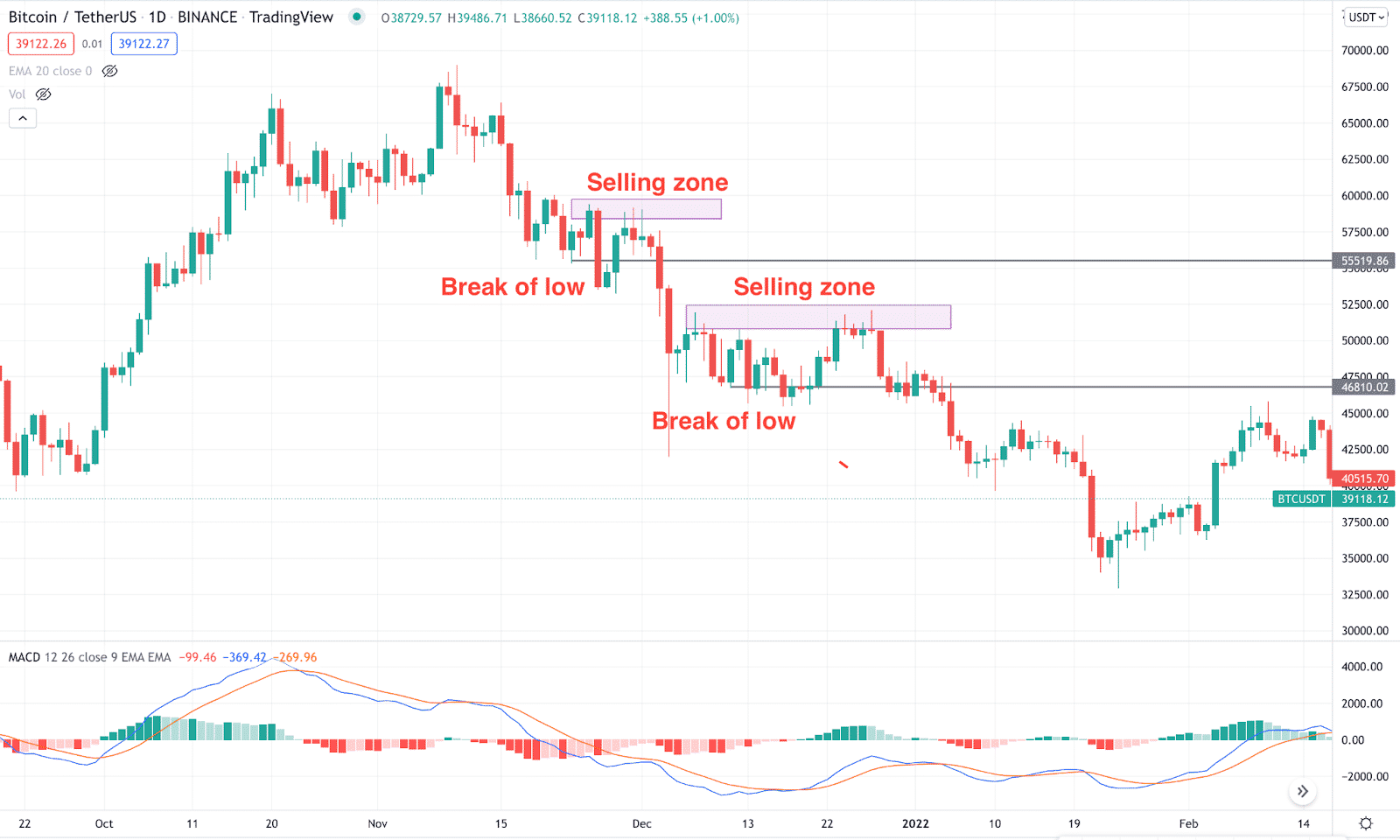

Traders should read the price action to find whales’ movement to pick the right price, as shown in the example below.

Tip 2. Understand the trading volume

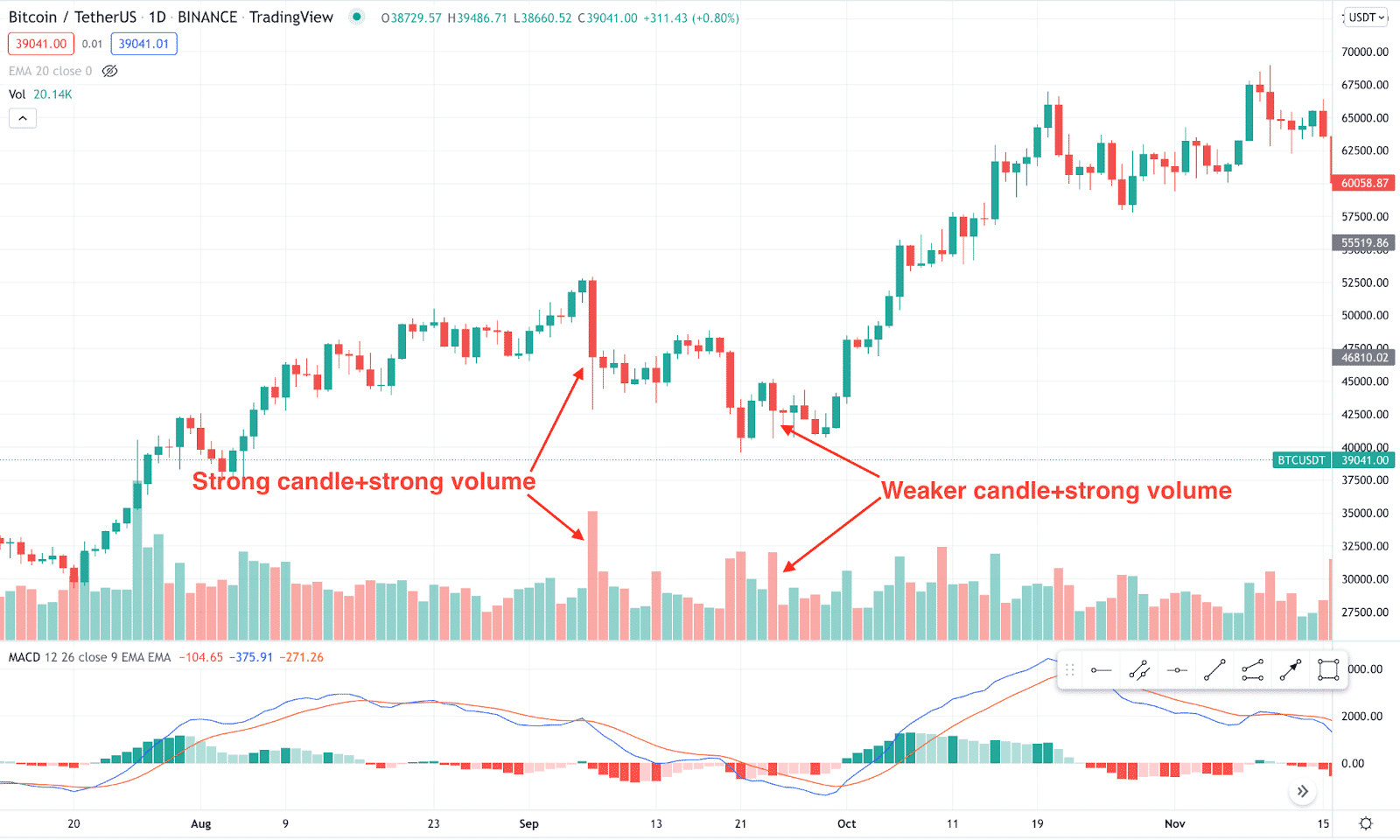

Trading volume represents how much buy or sell orders appear in a time frame. A good understanding of trading volume allows investors to know whether it is an actual movement or just to create panic.

Why does it happen?

When the candlestick appears with a higher momentum than the previous candle with an increase in volume, we can consider the movement as actual. On the other hand, strong price movement with a small change in volume creates an anomaly that might reverse the price in the future.

How avoid the mistake?

Make sure to follow this guideline in your trading:

- Strong volume + strong price change = good momentum

- Strong volume+ weaker price change = possible reversal

- Strong price change+ weaker volume = possible reversal

Tip 3. Read price action

You cannot make money in any financial instrument trading just by looking at the project’s portfolio or fundamentals. Investors should have a clear knowledge about the price action that includes the knowledge of candlestick, trend, technical analysis, etc.

Why does it happen?

The price action defines what bulls and bears are doing with the price. You should find a price location where bulls are getting more robust, and bears are losing their strength if you want to buy. Otherwise, there is a possibility of making a loss.

How avoid the mistake?

The best approach in price action trading is to use multi-time frame analysis. Investors should find the price direction from the higher time frame and take trades from lower time frame price analysis.

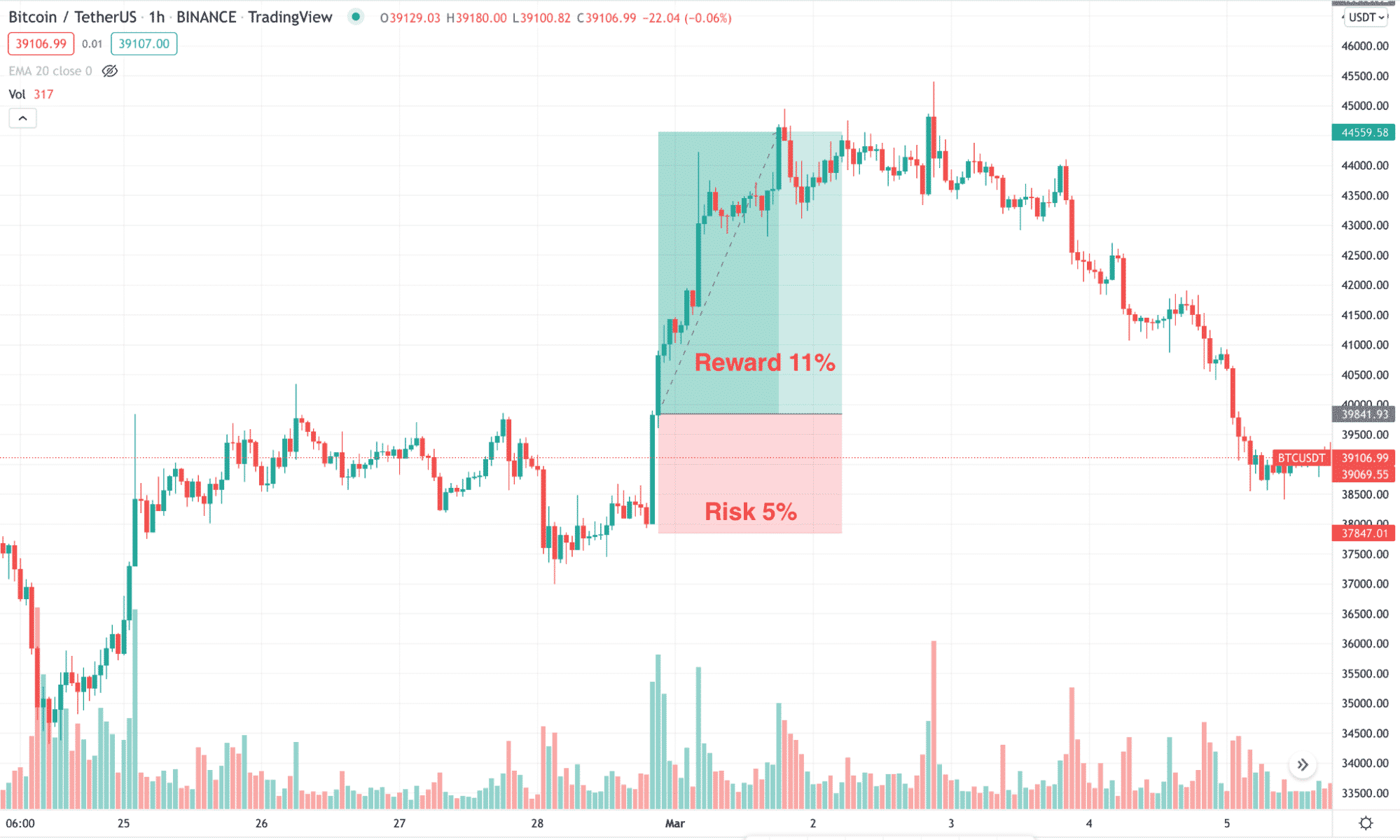

Tip 4. Risk and reward

You are not a good trader until the risk per trade of your strategy is lower than the reward. You cannot risk $100 to gain $10. The financial market is uncertain, where any unexpected situation might eat all of your gains at once.

Why does it happen?

The number of losing trades and the number of winning trades have nothing to do with profitability. If the risk is lower than the reward, you can still make money with a low-profitable trading method.

How avoid the mistake?

In any trade, investors should follow at least 1:1 RR in a trade to define the risk per trade. On the other hand, the higher return with lower risk is good, but traders should consider the probability. For the crypto space, the HOLDing approach is famous for the crypto space, where a trader holds their trade for long-term gain.

Tip 5. Understand the risk

Risk is a common term that a trader cannot ignore in the financial market. The financial market is ever-changing, and the new technology and implementation of AI make trading more difficult. In that case, you cannot consider the financial market as your ultimate solution for the future.

Why does it happen?

The financial market is susceptible to any geopolitical and national news where any possibility of a weaker economic growth influences investors to take money out of the market. In that case, a substantial price fluctuation happens with increased volatility.

How avoid the mistake?

Investors should invest the money that they are not ready to lose. Another approach is to diversify the portfolio in several markets to reduce the overall risk.

Final thought

The global cryptocurrency market is a decentralized marketplace where no one can complain about any price action. In that case, investors should remain skeptical while buying or selling a crypto asset besides following a sound trade management system.