The dividend is a term that almost everybody is familiar with regarding stock trading. Crypto also pays dividends to its holders, but there is some difference from the stock dividends. Crypto dividends are a rewarding method that offers passive earning. Crypto dividends are paid for storing your cryptos or utilizing them for specific grounds.

However, dividends are produced through the staking process, which implies to receive a particular reward, a certain amount of the crypto has to be locked down for a company to use for validating transactions on the decentralized blockchain. When the clients hold that money in their digital wallet, their crypto is employed, and after the agreed- period, the complete cryptos are returned to them, including the guaranteed rewards.

We will explore the best five cryptos that pay dividends in the coming section.

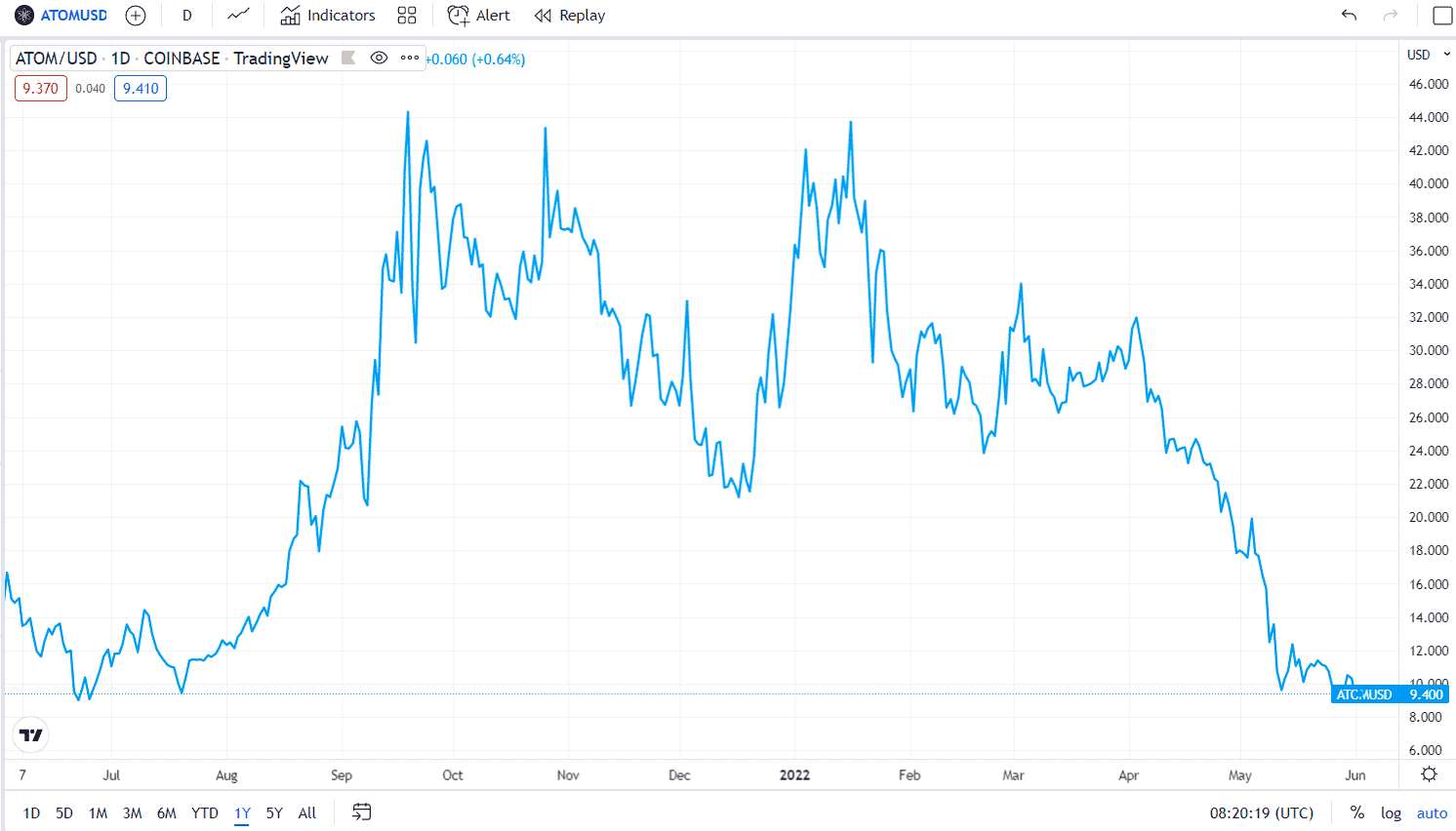

Cosmos (ATOM)

Cosmos is one of the most famous staking cryptos as it pays a high percentage of dividends or rewards at almost 8%. Also, as the Cosmos’ ecosystem is successful, the dividend percentage will gradually increase.

The project is objected to as an “Internet of blockchains” via making a connection bridge among numerous blockchains. Although plenty of methods are available for crypto assets, there is still a lack of methods supporting the effortless swapping of crypto assets between various blockchains.

- Approximately 100 numerous companies are exploiting Cosmos to develop their projects up to this point.

- Cosmos has a unique trait in that it utilizes the sidechain networks to allow different decentralized networks and cryptos to integrate with each other.

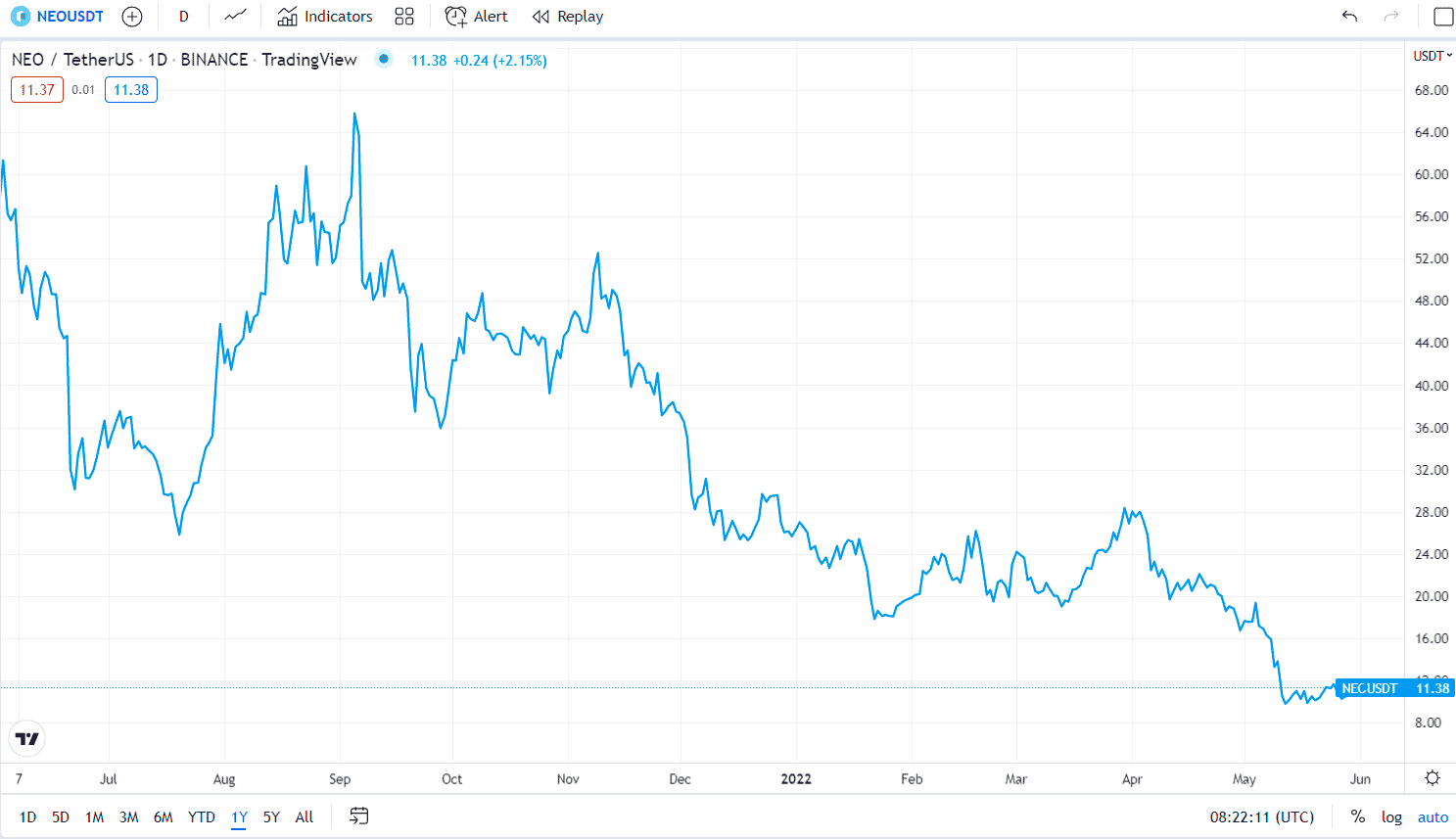

NEO (NEO)

Another dividend-paying crypto that is growing day by day is NEO. NEO is China’s first blockchain project and the government is intended to turn NEO into an industry-leading blockchain. It pays around 2% of dividends which is not as high as the various passive income cryptos. But NEO still bashes up numerous financial systems opportunities that certainly have gone outmoded.

- NEO utilizes a Delegated Byzantine Fault Tolerance consensus algorithm where the NEO community chooses mining nodes. The selected nodes must be connected to an explicit performance essential while sustaining a minimum amount of NEO coins.

- NEO is trying to develop an organic digital economy ecosystem that enhances the digitization of real money and assets in the real world. The ecosystem will work via a peer-to-peer network that stimulates registration, depository, transfer, trading, clearing, and settlement.

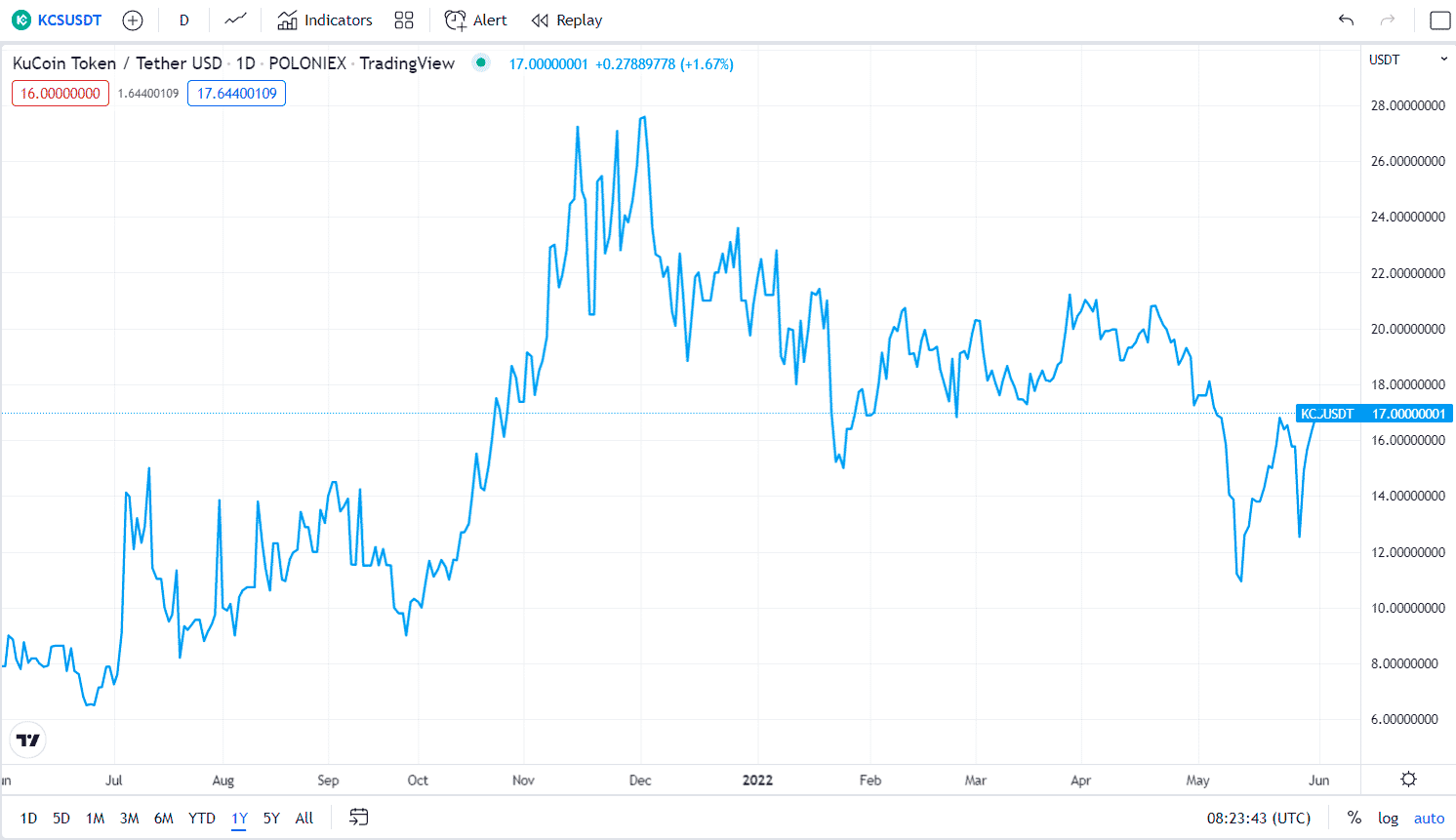

KuCoin (KCS)

KuCoin is a digital currency exchange that was introduced back in 2017. It has its native ERC20 token KCS and has made its place among the popular dividends-paying cryptos. KuCoin pays dividends of around 50% of what it makes from the trading fees paid by the exchange clients. However, the amounts of the payments differ from month to month as the trading volume undulates. Also, it pays the dividends daily, and the stakeholders pick up the threads of benefits and the growth of KuCoin.

- If a trader holds more than six tokens, he’ll become entitled to gain the daily dividends. And the dividends will rely on the total number of coins that the trader holds and the total volume of trades within the exchange.

- The reason behind the huge success of KuCoin is that it provides the benefits of the airdrops and management rights apart from the dividends.

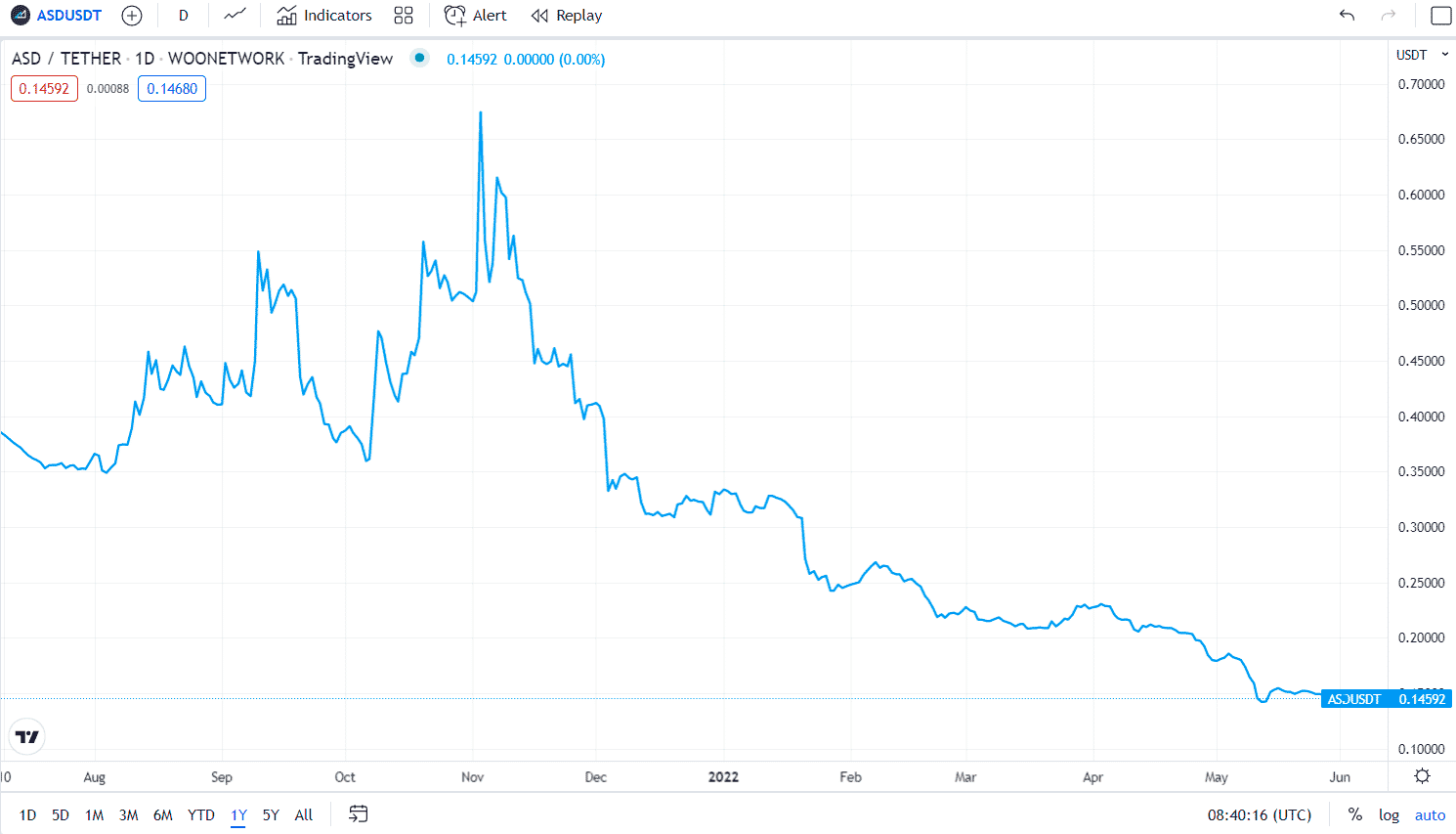

AscendEX (ASD)

ASD is another crypto that pays dividends to its holders. ASD is the native coin of the AscendEX, which is a digital currency exchange. ASD provides a portion of the income generated from the transaction fees to its investors as earning dividends. The crypto dividends rate is around 80% that AscendEX pays its investors from the exchange fees income. It is a Singapore-based exchange that was introduced back in 2018. Also, the popularity of ASD has been increasing over the years, along with a sharp growth seen in 2021.

- AscendEX has withdrawn a fund of $50 million from Polychain Capital and Hack VC, and the fund fast-tracked international market entry for them by becoming a company in 2022.

- Currently, AscendEX is serving more than 1 million retail traders and institutional traders. It also has assets in terms of boosting up gains of its investors.

Komodo (KMD)

Komodo is a unique dividends-paying crypto and focuses on offering confidentiality via proof and security of zero-knowledge. The Komodo team utilizes the Delayed Proof of Work (dPoW) protocol as a consensus system. However, the users have to stake at least 10 KMD in their wallet to earn the dividends which are around per annum 5% of the total they have staked.

- In terms of earning dividends, the stakeholder must stake a minimum of 10 tokens. It is possible to receive dividends even when the client has gone offline and this feature made Komodo unique from others.

- KMD is deemed to be one of the coins having its primary use case focusing on the privacy of its users. In doing so, KMD is protected by Zcash Zero-Knowledge proofs so that the users can make transactions that are 100% untraceable to maintain anonymity.

Final thought

In the end, staking is an outstanding chance to hold some of these coins mentioned above to generate smart passive income through earning dividends regularly. Earning dividends is the idea of gaining passive earnings while your cryptos are sitting securely in your wallet.

It is perhaps a great way of making money without taking the risk associated with trades while trading on an exchange. Moreover, after confidence that the idea of earning dividends is paying off to you, you may go with the larger investment as it will bring you the larger gains.