Ever felt trading is too hectic and tiresome? Do you know the automation of trading strategies? Even a wild idea in your mind can be shaped into a well-carved trading system. Modern trading platforms have made it easier for traders to automate their trading strategies or create a system based on their vision, thanks to custom indicators coding.

A programmer can put your wild ideas into a custom indicator that can perform various functions, from generating trading signals to managing risk in your trading.

Let’s discuss five tips that you need to know for using a custom indicator.

What are custom indicators?

In FX trading, we have two types of indicators:

- Technical

- Custom

Unlike technical indicators, custom ones are not built into the platform. Instead, the trader has to get them custom-made from a developer.

Such indicators are specific to the investor’s trading goals and strategy. Therefore, they are built to benefit them specifically. It is a program formed individually in MetaQuotes language 4 for the user and serves as a technical indicator.

Free vs. paid custom indicator

Custom indicators are either free or paid. In addition, the platform allows you to customize an indicator for yourself for free. However, it does provide paid indicators too. So, if you are not equipped to make the indicator yourself, you can go for the paid option.

Following are the tips that you need to know for opting for this indicator.

Tip 1. Find your objectives

No matter what you are doing, you shall know what you want out of it. This brings you closer to the goal. The same is the case with custom indicators. To make them, first, specify what you want and need from them. Investors who miss this point end up losing a lot of their capital in trading.

After finding your objectives, you should now see if any of them match or are correlated in any manner. This step is crucial and saves traders from a lot of extra hassle and hard work.

Why does it happen?

Traders that do not analyze their objectives will build an ineffective custom indicator that does not suit them well. The indicator will not address their needs. A randomly made custom indicator might do more harm than benefit.

If you do not match your objectives, you will have to get a separate indicator for each one of them. This will take a lot of time and hard work. Not to mention money if you are using the paid version.

How to avoid the mistake?

Listing your objectives beforehand will give you a clear picture of the direction you need to work on.

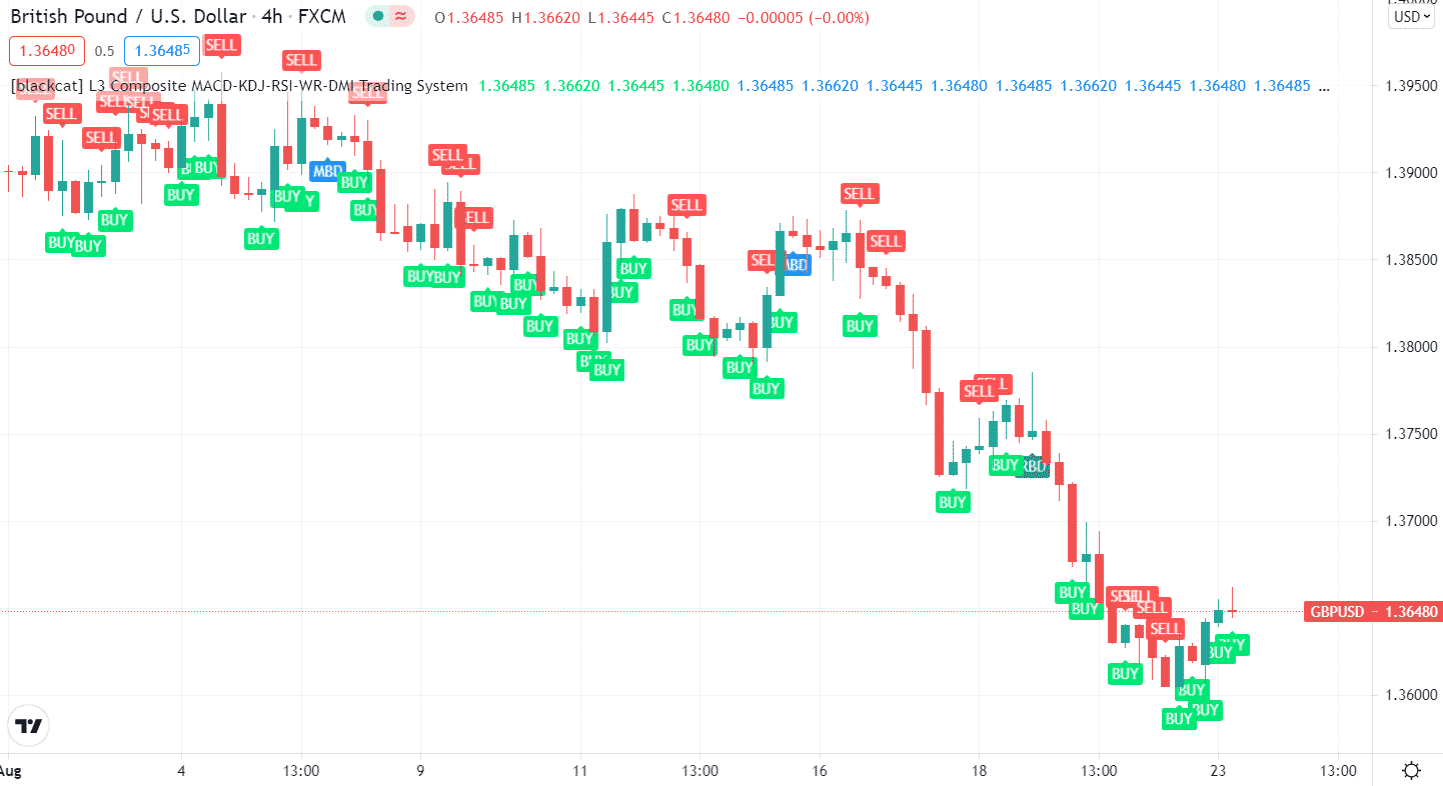

You can specify an average daily range, volatility, overbought and oversold levels, and clear marking of ranges and trading sessions as your objectives. A random system would look like the following with plenty of perplexion on the chart.

2222

These are the jobs you demand from your indicator. Once that is sorted properly, you can move towards the developing process.

Remember to match your objectives before diving into the development process. There is a high probability that at least two goals are similar enough to be paired together.

If that is the case, you should get one indicator for them. This will help the trader in many ways. If not, you will have to develop separately customized indicators for each one of them.

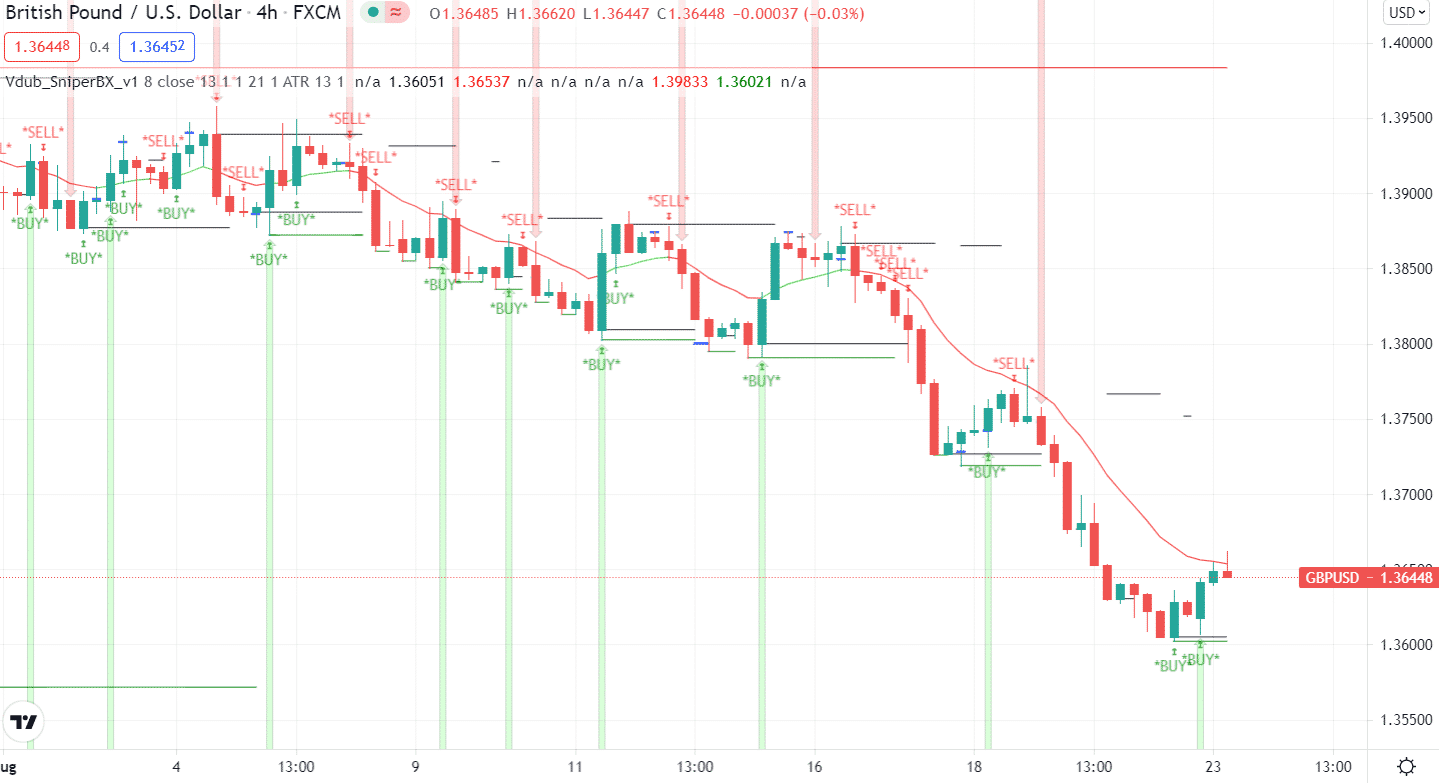

For example, take a look at the following system. It fulfills the objective of finding support/resistance, seeking key rejection zones, candlestick variation, and arrow pointers for exit and entry.

Tip 2. Make trading easier with custom indicators

The sole purpose of the custom indicators is to make your trading easier. What you do manually that takes time and effort can be replaced by custom indicators.

Why does it happen?

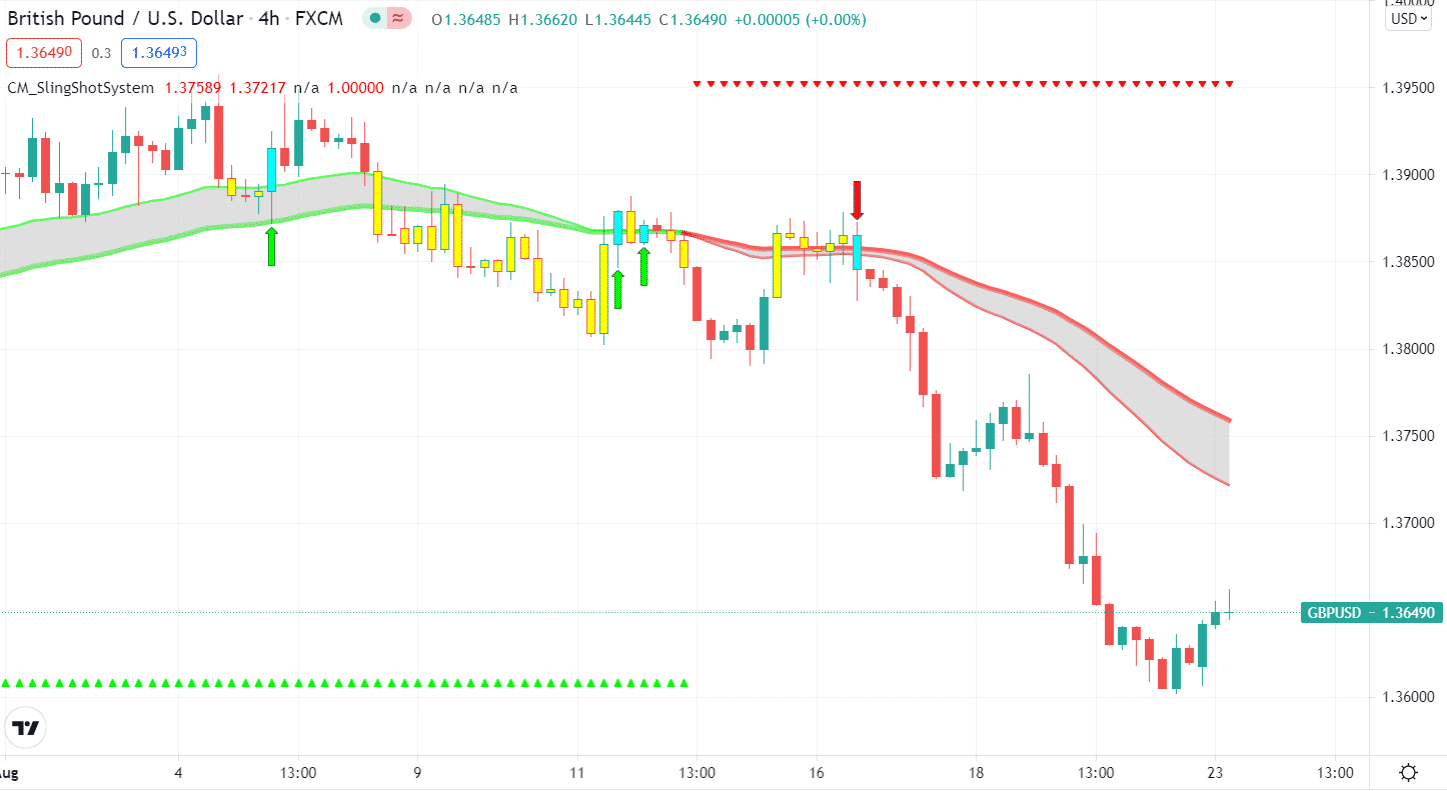

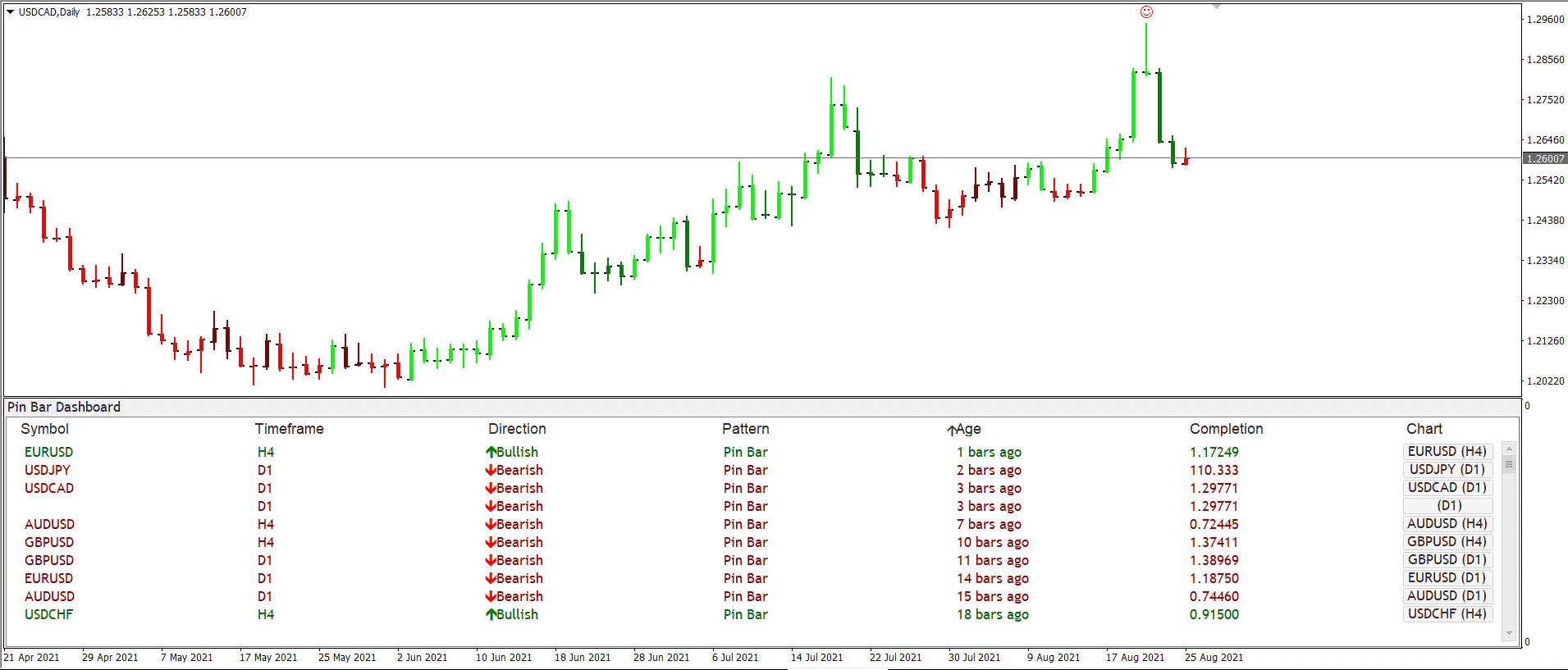

Let’s say you grab a trend move when a pin bar (bullish or bearish) appears on the chart. Also, you want to filter the trend by using non-traditional candlesticks that change color only when a reversal occurs. You may find it too hard to perform this on 28 currency pairs. Alternatively, if you apply it to one or two pairs, you will end up with very few trading opportunities every month.

How to avoid the mistake?

You can resolve this by simply finding the custom indicators that alert you when a pin bar appears. Then you can find an Fx trend scanner indicator to filter trends by removing noise in the candlesticks.

Have a look at the pin bar dashboard indicator and forex trend scanner.

You can see the dashboard showing where a pin bar exists, and the chart shows red color only when a downtrend is confirmed. Same way, it changes color to green when an uptrend is confirmed.

Tip 3. Find the free version

Free stuff does not always mean questionable quality. The same is the case with custom indicators. Just because you are spending large sums of money on your indicator does not guarantee it will suit your requirements.

Why does it happen?

As discussed before, the indicator needs to meet your preset objectives. This can be a little hard for paid indicators.

If they do not suit you, this means you will lose a large sum of money and precious time. At times, this is not worth the risk.

How to avoid the mistake?

Look for a free version of your required indicator. You can then experiment and build an indicator that caters to all your needs in the best possible manner.

If a free version is not available, try to find a paid version that offers a free demo. This will give you an idea of what you are getting yourself into.

For example, suppose you are looking to build an indicator that captures different oscillators together to find a consensus on buying or selling. You can find a system like the following for free.

Tip 4. Find reviews

A lot depends upon the reputation. Avail it to your benefit. Make sure to check reviews of a custom indicator before buying it. As basic as it sounds, most traders do not follow this step.

Why does it happen?

Imagine spending so much time and energy building an indicator only to find out that the platform was not the ideal fit for you and your efforts are in vain now.

It doesn’t feel good and happens when traders get a little over-excited about getting started and forget to run a background check.

How to avoid the mistake?

- Make sure to check the reviews. Opt for a platform that is tried and tested. The platform should have thousands of reviews. It signifies that the platform is credible.

- Categorize those reviews as positive and negative. If most reviews are against it, you must drop it right away and move to the next one.

- Go through all the negative reviews to see if any of them hampers your objectives. If yes, you shall leave it and move on to the next indicator. If no, you shall proceed. Once you are satisfied, move towards the developing process.

Tip 5. Find live test results

You must search for live test results of a custom indicator. This further adds to the credibility of the indicator. Investors who tend to miss this step find themselves in trouble later.

Why does it happen?

An indicator might seem good in theory, but you can never be sure about it until you live to test it.

How to avoid the mistake?

Choose the aforementioned free demo option to test your indicator. If that’s not available, you can connect with fellow traders who are live testing the indicator. You can find them in communities like MQL and MyFxBook.

Final thoughts

Trading is a tricky business but having an efficient indicator makes the job a lot easier. Follow the steps mentioned above to develop your ideal custom indicator. Make sure to have clear objectives, and do not forget to review and pretest them.