EUR/USD has the most trading volume in the forex market, making it tradable with any strategy. Moreover, the post-Covid recovery in the US and Eurozone has created an excellent opportunity to invest in this pair. Based on our findings, EUR/USD has a higher possibility of showing a decent movement in Q3 2021.

Before taking an investment decision, expert traders always do homework on any currency pair before placing any order. The assignment happens in both ways, the technical analysis and the fundamental analysis.

- Technical analysis involves calculating the market data by many technical factors, matching price movement patterns with several popular technical patterns.

- Fundamental analysis involves the macroeconomic data and geopolitical facts that affect particular currencies. For instance, the recent coronavirus pandemic had a significant impact on the financial market, where a robust recovery may create a possibility of making profits.

This article discusses the Covid-19 impact on the EUR/USD pair, a remarkable fundamental fact that affected the whole world economy. Moreover, we’ll have the technical and fundamental outlook of EUR/USD for Q3 2021 and discuss the inflation effect of USD and the impact on the pair EUR/USD.

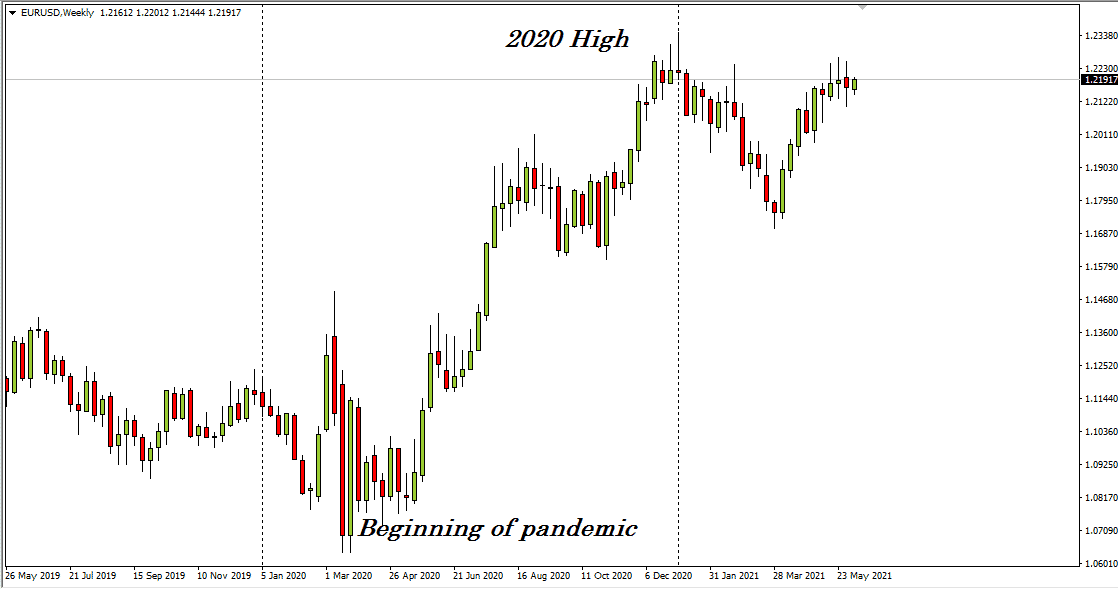

EUR/USD recap: Covid-19 effect in 2020

The corona pandemic became a worldwide issue by April 2020, and the world market started to show influence by the pandemic, and there was dramatic movement on financial assets. More or less, every financial investment, such as currency pairs, cryptos, stocks, commodities, etc. Some of them started dramatic movements as the world began to suffer from the Covid-19 Pandemic. So the pandemic also shows its impact on the world’s most traded pair, EUR/USD.

The world started to suffer from Coronavirus since the beginning of the pandemic. Unfortunately, the response was not the same for every country, so the suffering was also not the same. Many nations applied lockdown to protect citizens from the Coronavirus.

Different country’s politicians and policymakers also took many other steps to prevent the Coronavirus. The United States faced a higher number of deaths from the Coronavirus, while some other European countries faced the same disaster. As a result, the Covid-19 became a health concern for both nations in Europe and the United States.

The above fig shows how EUR/USD made a sharp uptrend move since the beginning of Coronavirus.

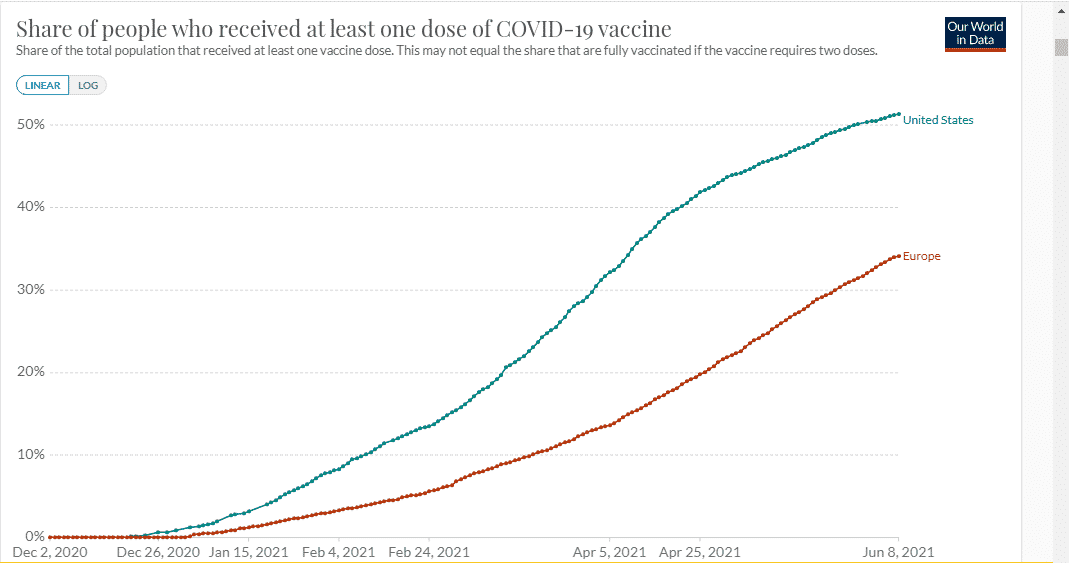

However, the world started to search for remedies from the Coronavirus, such as vaccines or cures. The medicine and healthcare regulatory of the United Kingdom gave temporary approval for Pfizer–BioNTech vaccine back on 02 December 2020. That was the first approved vaccine, followed by other USA, Russia, and China vaccines. After the approval, the nation started to vaccinate the country to prevent Coronavirus and having a reopening. So the slow economy gets boosted.

This figure shows the vaccination of the United States and Europe. The USA has direct access to the vaccine, so they started to vaccinate the nation rapidly, and as of writing, 51%+ people of the USA got at least one dose of Coronavirus vaccine.

The figure for Europe is 34%+ which is slower than the USA, as they depend on other nations such as the USA or UK for the vaccine. So in comparison to coronavirus recovery, The USA is on an advance based on vaccinating and reopening. Note that Germany has developed a vaccine named mRNA vaccine for Coronavirus.

These vaccine developments show that the Eurozone and the USA economy may shift their business momentum to strength.

Is there any possibility of making money from trading EUR/USD in Q3? Let’s see in the following section.

EUR/USD technical analysis for Q3

In this part, we’ll make the technical outlook of EUR/USD for Q3 2021 that might help you to make a reliable trading decision.

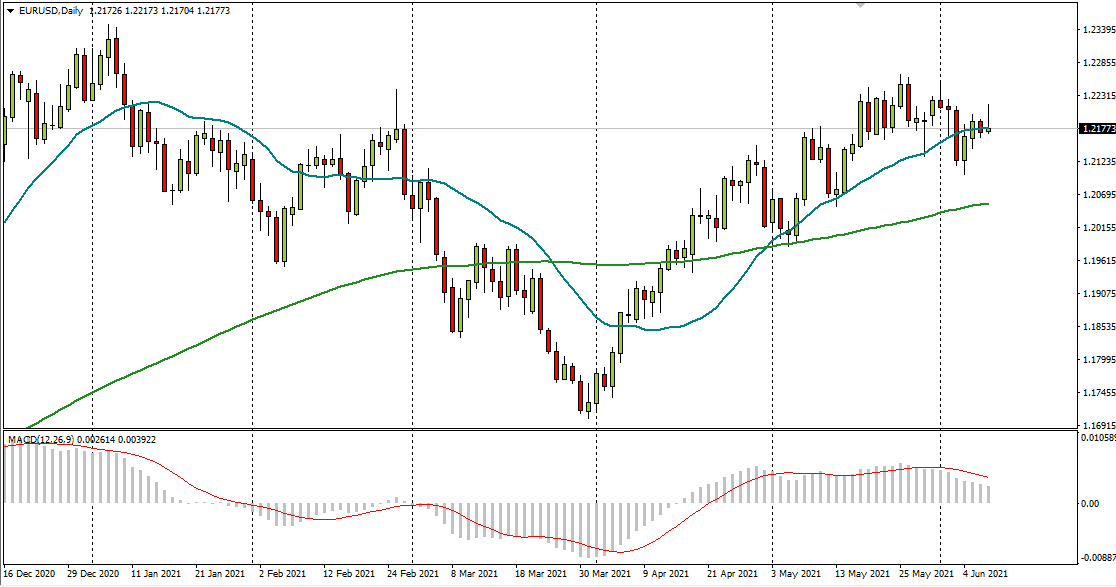

EUR/USD daily chart

The daily chart shows that the price is floating near 1.218, just at the level near 20 SMA. If the price closes below this level, EUR/USD may open a window towards 1.205 (near 150 SMA). The MACD window also confirms this pair is losing bullish pressure.

- Immediate support is 1.205, followed by 1.17, March 2021 low.

- Primary resistance is near 1.226 (May 2021 high), followed by 1.234 (January 2021 high).

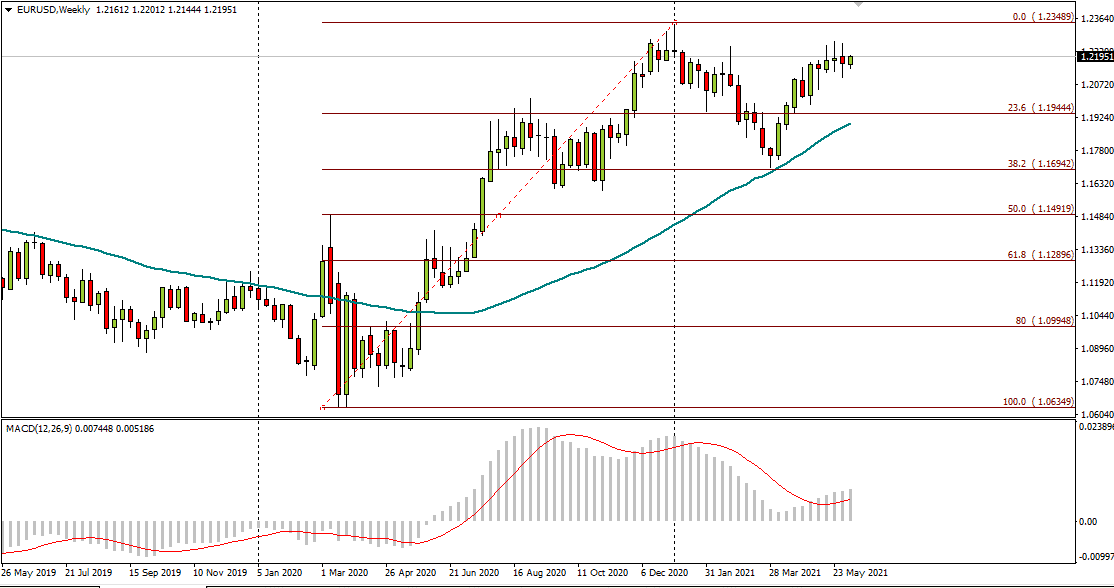

EUR/USD weekly chart

By looking at the weekly chart, it made a straight upward movement since the pandemic. It is now trading near 1.22. The lower low of 2020 was 1.06, and by the end of 2020, this pair reached near 1.235. From Jan 2021, this pair started to correct. It reached near 38.2% fib level of 2020 move near 1.17, which is also the low of 2021.

It seems 52 SMA supports the price on the weekly chart near 1.17. The MACD window is also suggesting bullish pressure on the EUR/USD daily chart.

- So the primary support is near 1.20 — price action and historic event level, followed by 1.17.

- Immediate resistance is 1.235 — high of 2020, followed by 1.255 — previous high.

- 1.275 — historic event level.

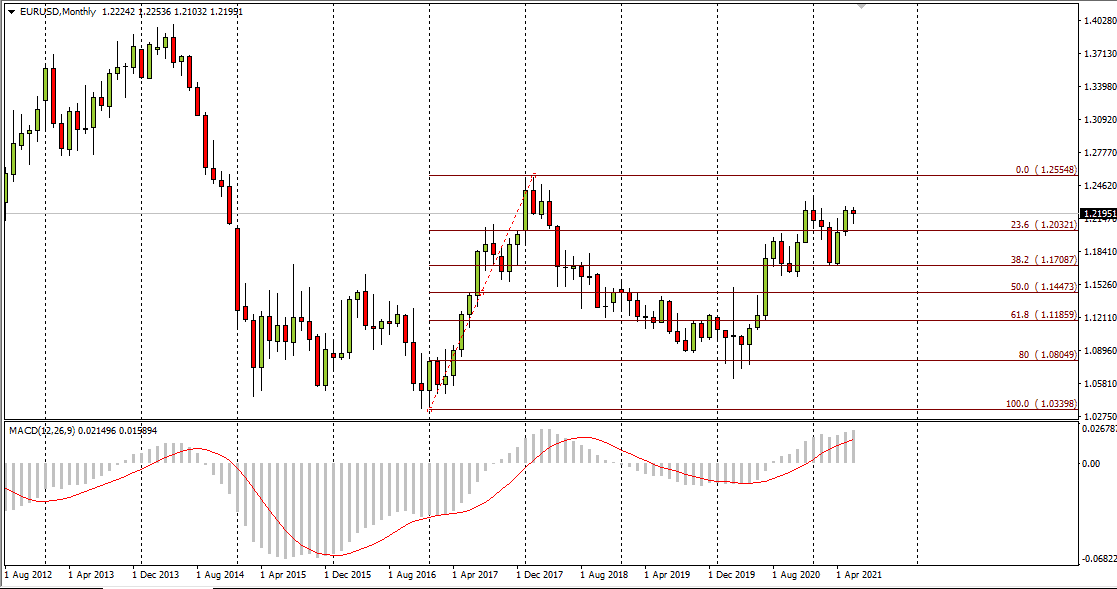

EUR/USD monthly chart

The monthly chart shows the price remains on a straight uptrend. We put the fib at the previous uptrend, so the price reached near 80% fib level and started to make an uptrend again.

- Primary support for EUR/USD pair is near 1.20 — 23.6% fib level, followed by 1.17 — 38.2% fib level.

- Immediate resistance is near 1.235 — previous high, followed by 1.259 — 61.8% fib level of last big down move

- 1.32 — 80% fib level of the previous significant downtrend.

Fundamental analysis for Q3

The US economy cooled down due to the fear of inflation data, and the tech market also started to slow. Moreover, the recent NFT data wasn’t supportive of the USD. Besides, the decline in yields suggests that markets are buying the Fed narrative of transitory inflation pressures.

So the banks expect the US yield to remain low for the next few months and expect a reduction in product purchases and a strong USD. The vaccination progress of the US is also positive for the USD as the faster reopening will boost the economy.

On the other hand, the EUR remained underpinned by the vaccination campaign in Europe. It’s not so rapid as they are dependent on other countries for the coronavirus vaccine. Anyway, Investors around the globe are waiting for the next FOMC meeting on 16 June and the ECB press release on 10 June.

Final thought: can US inflation fear affect EUR?

So obviously, the US inflation fear can affect the EUR. Investors are waiting for the press releases from the central banks. If the inflation does not rise and remains the same, this pair may stay above 1.20, and the range for Q3 can be between 1.20-1.25.

We suggest keeping an eye on macro events such as interest rates, policies changing, inflation rate, GDP, and data that may reverse the pair EUR/USD trend.