In the FX, many vital factors drive the price. Generally, traders consider two types of analysis — fundamental and technical to decide whether to buy or sell in any currency pair. Another fact about the forex market is that it forms with a couple instead of a single instrument. So strength or weakness in any particular currency must have some impact on another one. Besides, macroeconomics also has a significant effect on currency pairs.

Therefore, this article will discuss the top five factors that influence the FX or causes the price shifting of any currency pair.

Why is the FX unique?

The size of this market is approx. $6.6 trillion makes it the most prominent market globally and full of opportunities, and unique in multiple ways. But three reasons are most appreciable and make this market memorable:

Turnover

The forex has a turnover of approx — 3 trillion per day, which is vast. More simply, over 3 trillion dollars moves at this market every single day. Central banks, large banks, hedge funds, governments, other financial entities, and institutions trade currencies from all around the world. This number of transaction amounts went up and reached nearly 3.25 trillion a day at a reasonably rapid rate.

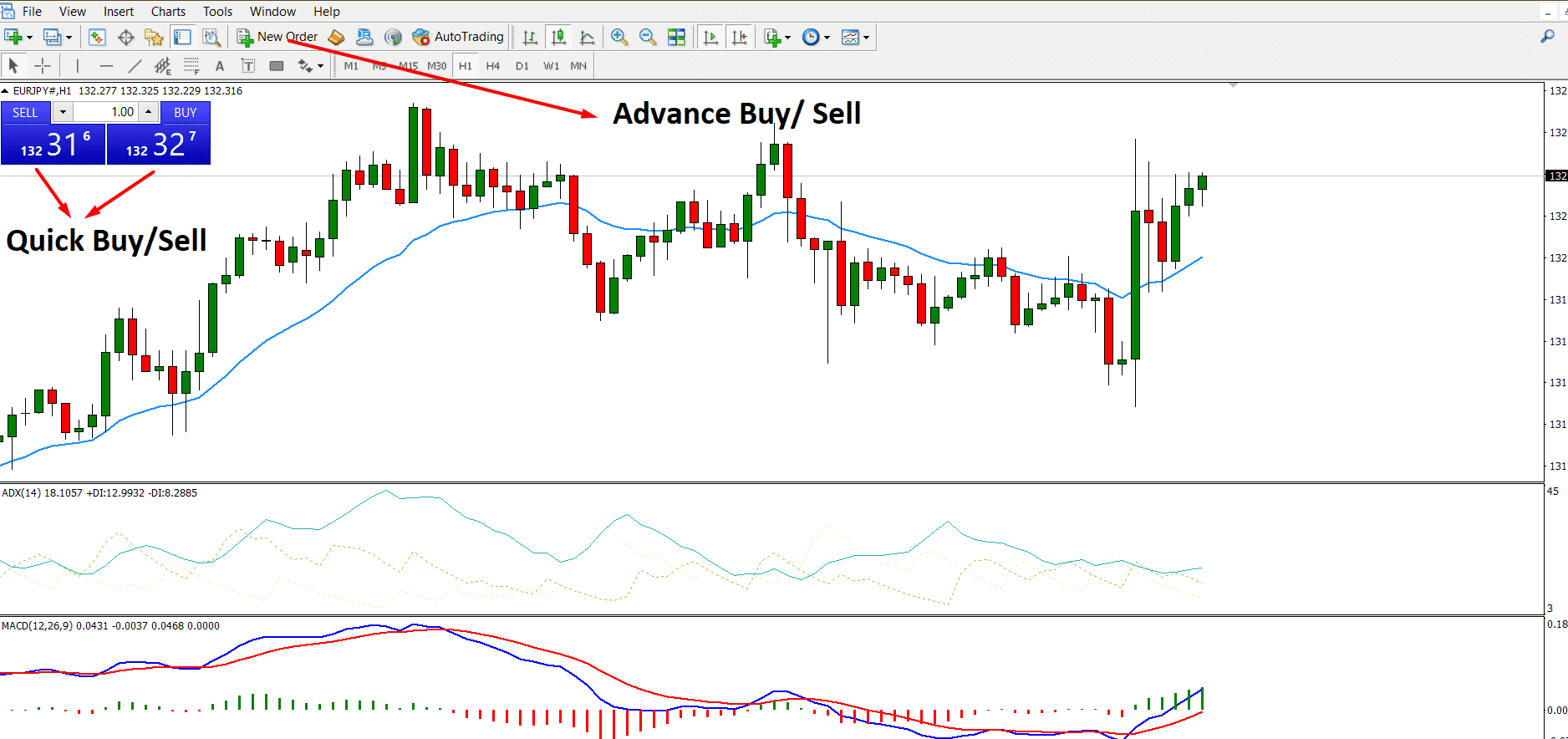

Because of the high trading volume, it is easy to find liquidity at every price rate. For retail traders, it makes trading easier. You can buy/sell any currency pairs from the MT4 chart as shown in the image below without tension of liquidity or the opposite party.

Varieties and number of traders and currencies

Another major unique factor of this market is the number of traders and currencies. Traders from individuals to the institution make the deals in the same market. By listing the top ten currency traders, five are from the US, and three are from the UK. The most prominent forex trader in the world is from Deutsche Bank in Germany. Therefore, a mass amount of transactions in currency pairs happen on the forex.

The most influential currencies, which control the central portion of the market are:

- USD

- Euro

- British pound

- Japanese yen

- Swiss franc

- Canadian dollar

- Australian dollar

- Hong Kong dollar

- Swedish krona

- Norwegian krone

As a result, there is a considerable possibility of making money from the price changes among these currencies. In particular, there are six significant pairs, 28 cross pairs, and lots of minors and exotic pairs to trade in the forex.

Trading time

Finally, another unique aspect of forex trading is this is a 24 hours market. So during the weekly working days, you can trade anytime you want. Also, the forex doesn’t go crazy on the weekends. It does not require any confirmation from any party while taking an entry. Therefore, you can make trades any time from Monday to Friday according to your choice.

What affects the FX?

The most significant player in the forex is central banks. So the macroeconomic data have substantial impacts on the forex market. Simply the central bank’s decisions like interest rate decision, inflation rate, terms of trade, central banks policies, social and political strength or weakness has significant impacts on the FX.

Sometimes the market actively reacts to changes in economic indicators, while politics has minimal impact. And sometimes, on the contrary, critical macroeconomic events are not capable of seriously shaking the market. At the same time, it would seem that a not-so-significant statement of a politician can give a strong impetus to the exchange rate movement. And it will always be so: economic and political aspects will replace each other in the degree of influence on the forex.

Let’s discuss the top essential fundamentals, that change forex market sentiment:

№ 1. Interest rate decision

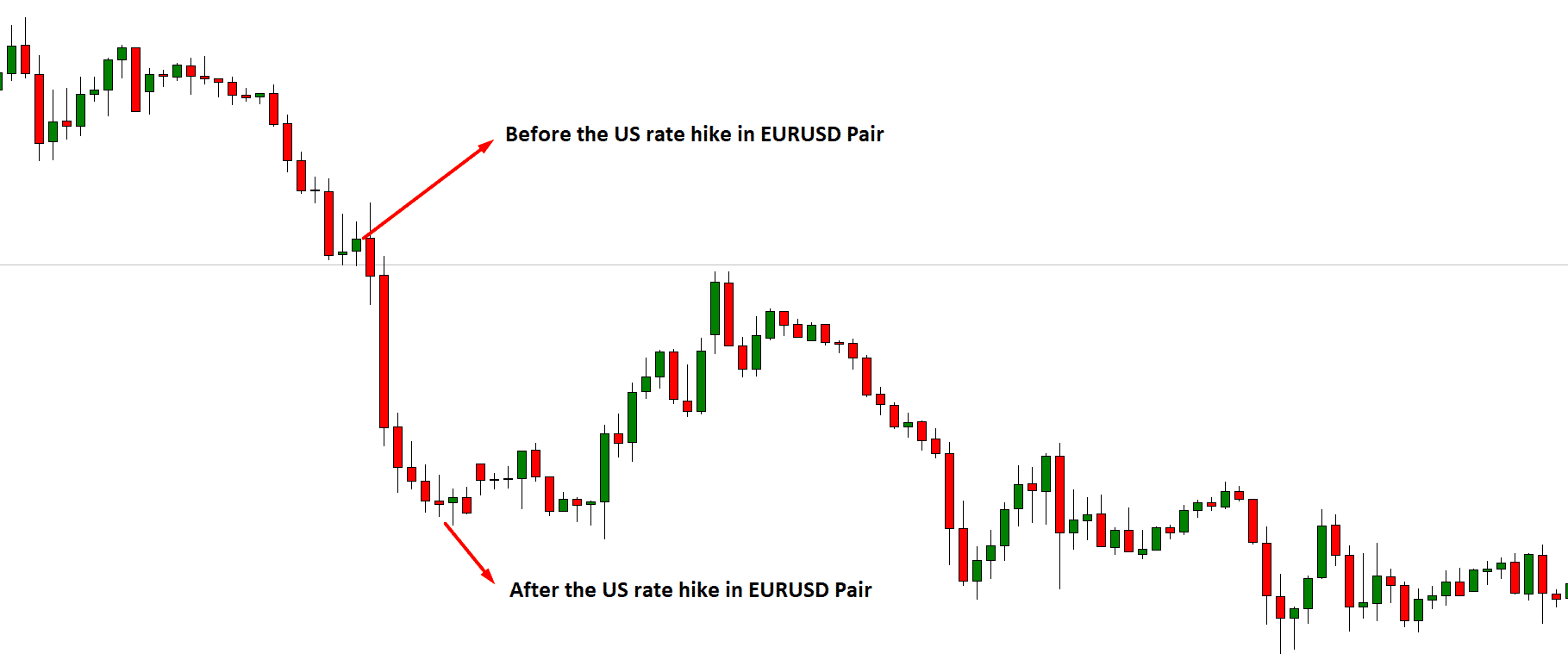

The interest rate decision is one of the top ratios that affect currencies. A higher interest rate offers the lenders higher returns relative to other countries. So the higher interest rate attracts investors worldwide to put their money on that particular currency, and the exchange rate rises. So the opposite type of impact happens if the central bank decreases its interest rates. However, if the interest rate is much higher, that may hurt specific currency if other related factors don’t support it simultaneously.

When the interest rate rises, usually, the price of a currency pair moves towards the direction. Therefore, traders can easily make money by following the trend with an appreciative trading strategy.

№ 2. Inflation report

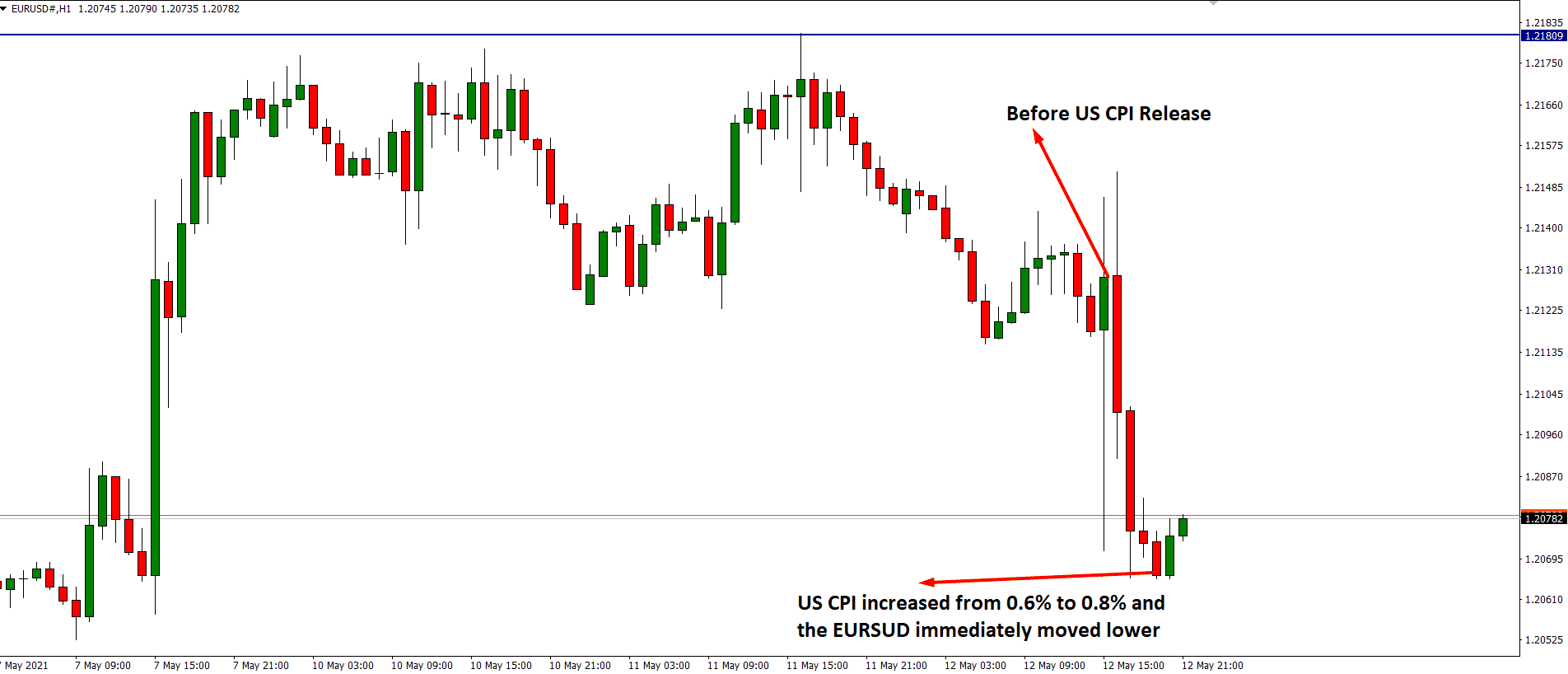

Central banks are the authority to print banknotes and coins. They control their money by inflation and deflation. A currency with a constant lower inflation rate defines a more robust economy. A lower inflation rate means the currency value is higher and purchasing power will increase. On the other hand higher inflation rate means the purchasing power will be decreased and lower the exchange value of that currency. However, the inflation rate is associated with the interest rate.

Let’s have a look at an example of how price reacts after releasing the CPI inflation report.

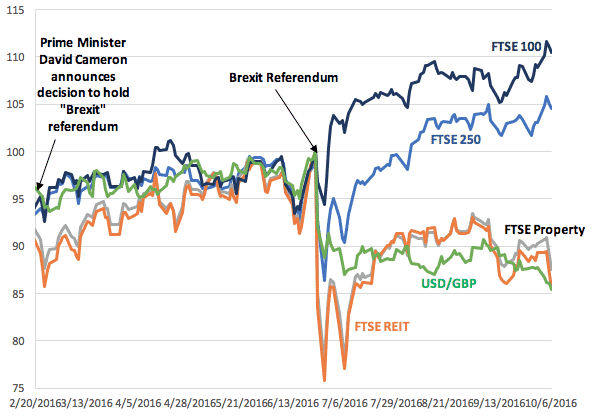

№ 3. Political stability

Political stability is one of those microeconomic factors that have a direct impact on the economy. Foreign investors always seek a stable economy to invest their money. Traders are constantly monitoring political events and news. The primary information, including shifting govt, adjustment on foreign policies/regulations, govt spending, etc., has a significant impact on the economy. Positive data and a stable economy are always preferable to invest in. Simply the fiscal policies have an essential role, or dramatic outcomes happen for it. For example, the Brexit vote decision caused a dramatic movement for the British pound since the beginning.

№ 4. Speculation

The global capital market is the most visible indicator to observe an economy or the economy’s health. There is a series of information about the institutions, govt, etc., making their deals and regulatory data about certain currencies. Besides the stock, commodity, treasury price fluctuations, bond, security market, etc., data drives the currency/economy.

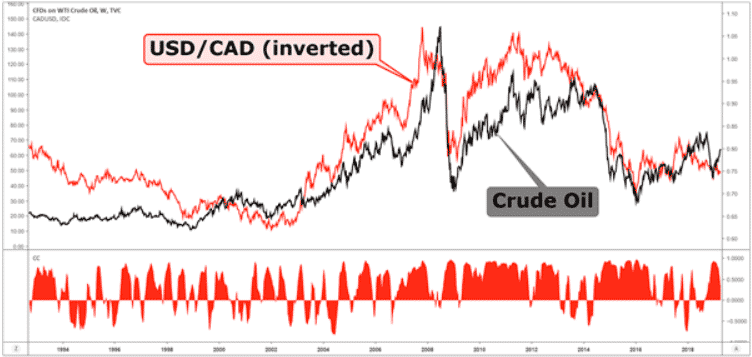

For example, the Canadian dollar is so much correlated with commodities such as metals and crude oil, and a rally in crude oil has a positive impact on it. It also goes up with the crude oil price comparative to other currencies. Like forex traders, commodity traders also rely heavily on the economic data for their trades. In many cases, the same financial data has a direct impact on both markets.

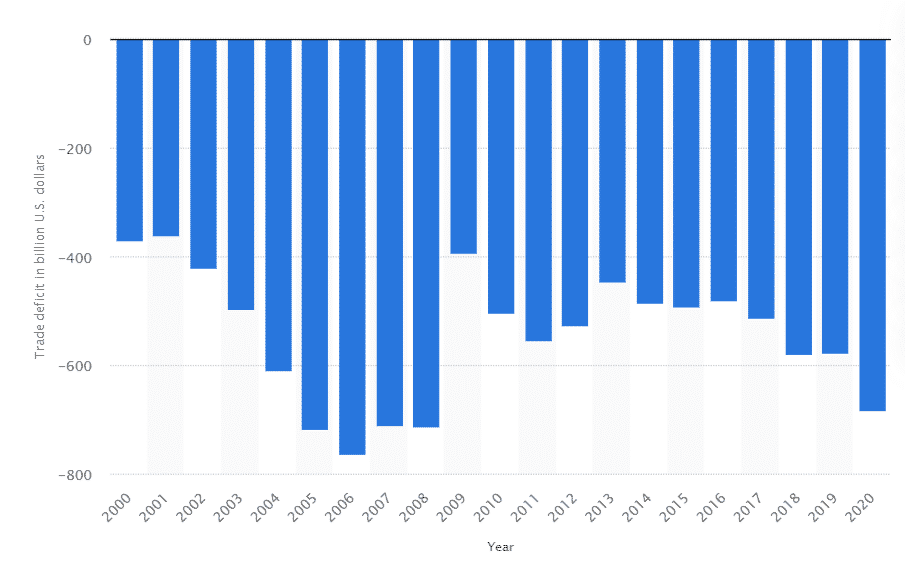

№ 5. Trade balance & terms of trade

Another critical factor is the trade balance between the two countries. That is, if the import or export tax rate changes, the trade balance may also change. This impact is due to changes in the flow of currency inside and outside the country. Central banks only use monetary policy, while governments or presidents decide on import and export taxation policies. Therefore, these two branches of government must be independent of each other.

Conclusion

The macroeconomic factors affect the currency directly. More specifically, the strength and the value of a specific currency depend on some key fundamental factors. Knowing the vital economic factors will help you keep vogue your position with the market upbeat. The FX is very competitive and complete with opportunities. Proper knowledge, a bright mindset, trade, and money management are the primary characteristics of a professional trader.