Many traders gravitate toward day trading as it is an exciting way to trade the forex market. This is an excellent way to trade if you have limited capital but enough time to watch charts.

With day trading, you can make money quite faster than other types of strategies. You will be in and out of the markets very often, your trades lasting anywhere from five to ten minutes. In a short period, you can grow a small capital to a sizable amount if you are successful.

Despite the attractiveness of day trading, there are still more losers than winners in this group of traders. Time and again, traders make one or more mistakes that hurt their results. That is why you have to be aware of these mistakes before you begin day trading. Try not to make them in your trading, and you will have better chances of survival and success.

Tip 1: Averaging down on forex trades

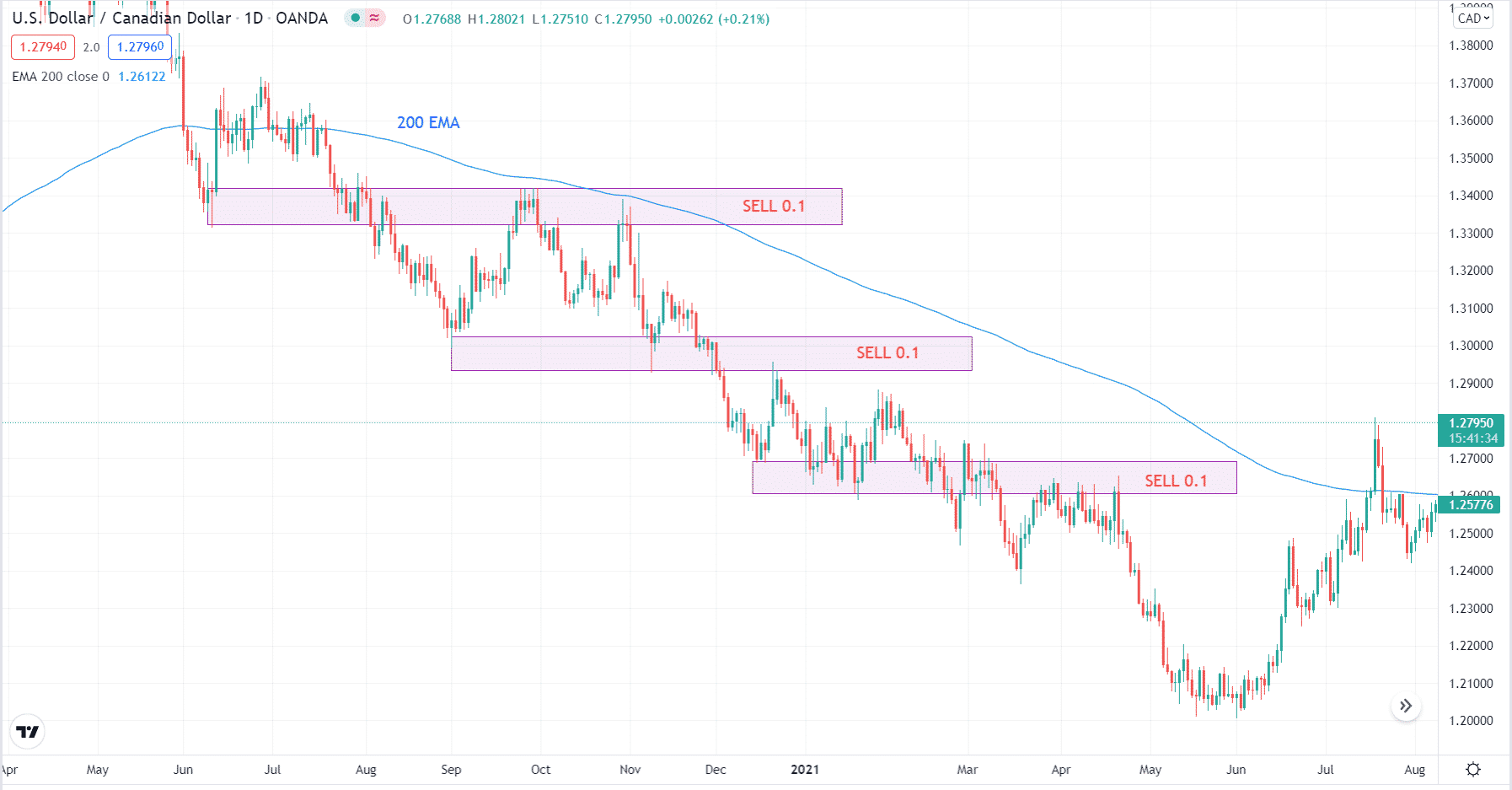

Averaging down, also known as cost averaging, is a popular method used by experienced traders in all types of financial markets. To do this, traders and investors first analyze the market sentiment and choose a bias. After that, they will determine areas in the chart where they could enter trades and build a position in a certain direction.

Why does it happen?

The cost averaging strategy is suitable for advanced traders. Because of their market experience, they can use a riskier strategy to make money. They are not concerned about precise entries. They try to find areas on the chart where the market is likely to move in its intended direction. Novice traders should not attempt to use this strategy.

How to avoid the mistake?

If you are new to trading, you must use safer trading strategies. These are those methods with clearly defined risks per trade. You can find plenty of such systems anywhere online. You can also build your own from scratch. As you gain trading knowledge and experience, that is the time to use more advanced entry and exit strategies. However, if you succeed with a more straightforward strategy, you do not have to use riskier methods in trading. At the end of the day, what matters is you make money.

Tip 2: Unrealistic expectations in trading

One of the reasons why traders fail, especially newbies, is setting high expectations. These expectations are often unrealistic, causing the trader to make decisions that subject the account to too much risk.

Why does it happen?

Newmarket participants, out of excitement, think that trading is easy and that they can turn $1,000 into $10,000 in one year; what they do next is take too large positions in every trade. This leads to rapid account growth in the beginning. When their luck runs out, they give back everything to the market, including their capital. In the end, they say trading does not work.

How to avoid the mistake?

You should set realistic goals regardless of your trading experience. If you are new to trading, setting long-term goals is often not good. Instead, you should set small milestones at first. Mastering your craft as a trader should be your priority over attaining certain return goals.

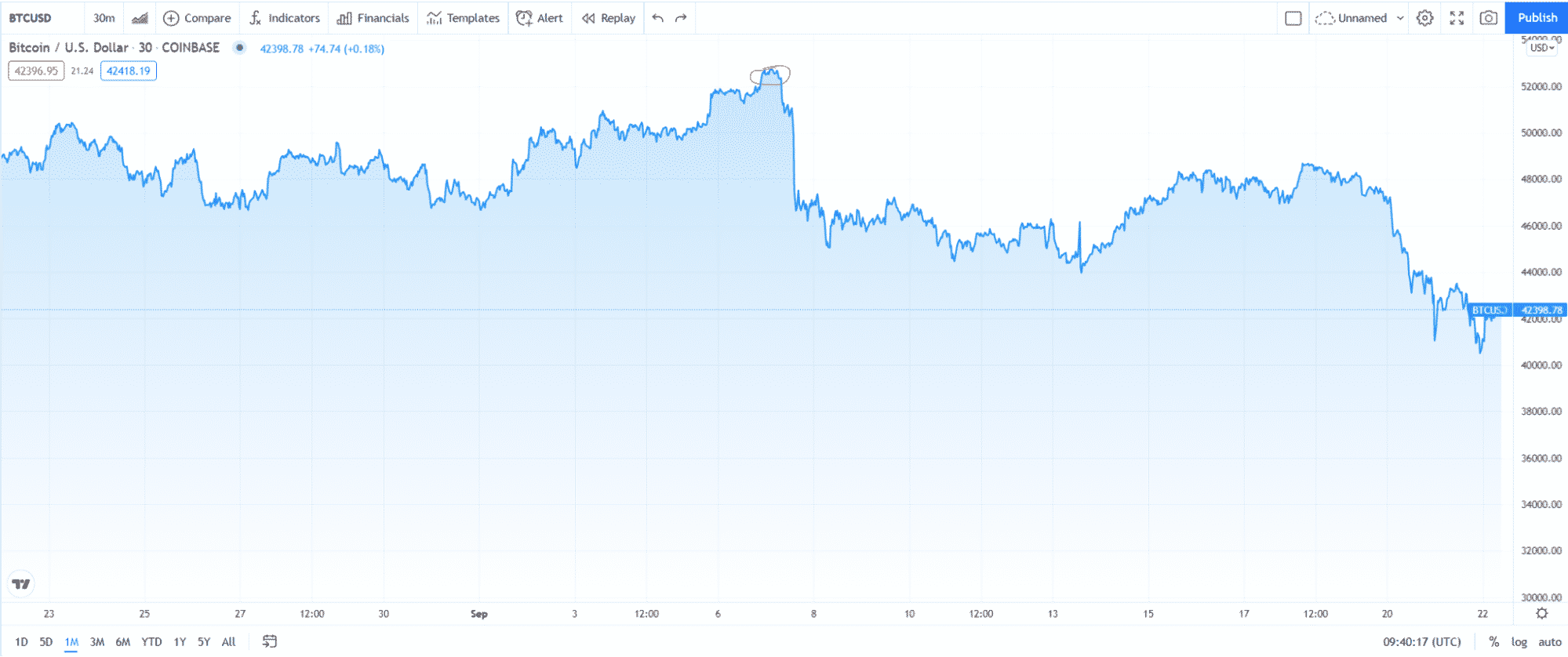

Thus, on the monthly below chart, the price of Bitcoin on the 7th of September 2021 was $52,705. Many traders believed in frantic growth and did not close positions for growth. At the same time, BTC dropped to $46,845, leaving unprofitable traders with inflated expectations.

Tip 3: Risking more than 1-2%

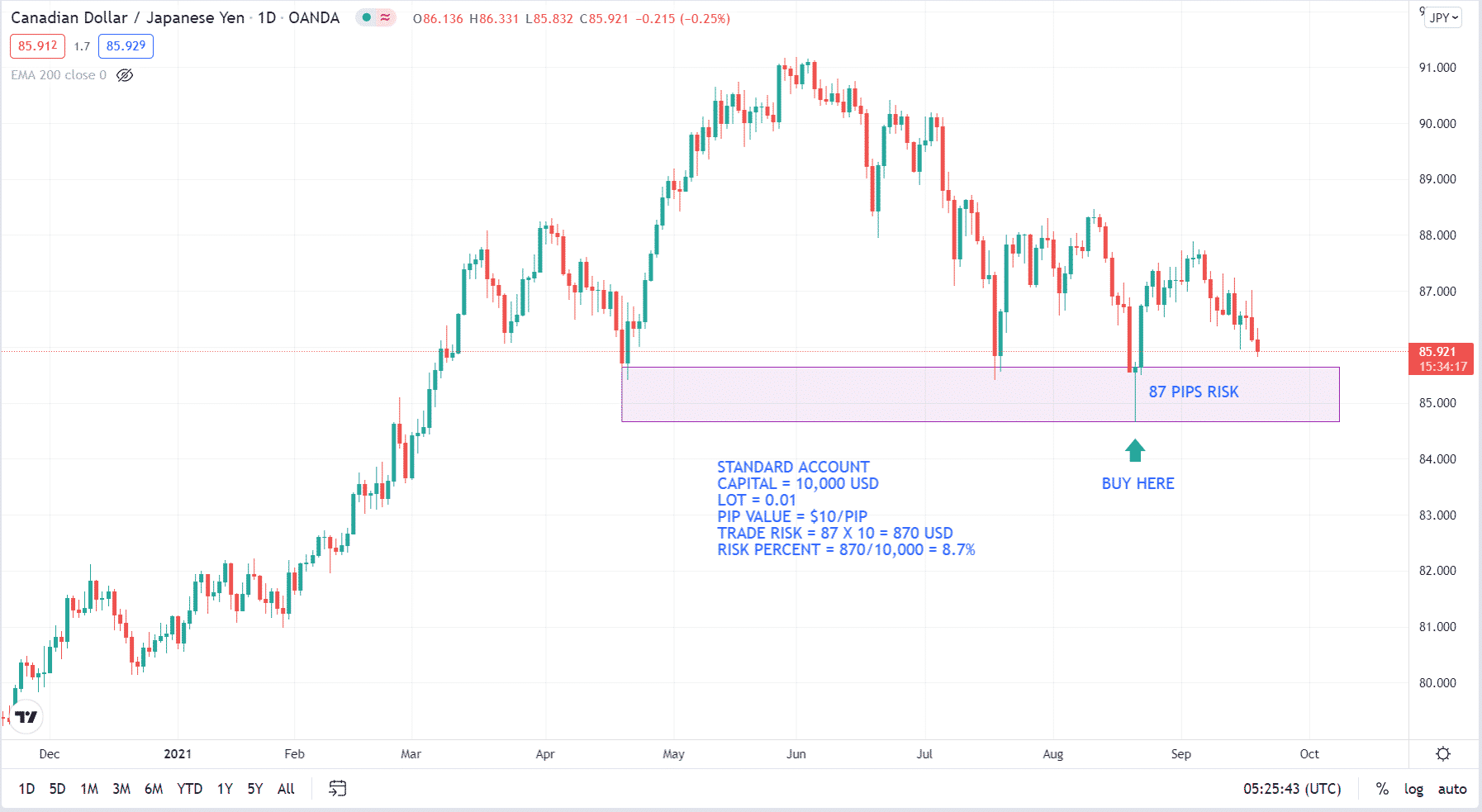

Taking too much risk per trade is possibly the most frequent mistake among traders. Perhaps you feel that your account is growing very slowly, and you get impatient. As a result, you magnify your trade risk to realize greater profits.

Why does it happen?

This issue is related to the mistake covered in the previous tip. Maybe you set too high a goal to achieve, and your progress seems too slow. If you make a few dollars per trade and trade infrequently, you might find it hard to imagine reaching your $10,000 goal at the end of the year. Thinking about this could get the best of you.

How to avoid the mistake?

One mantra in FX risk management is that you should only risk an amount you are comfortable losing. In practical terms, this means not risking more than one or two percent of your capital on one trade. While many new traders are aware of this rule, they find themselves time and again violating it.

They couldn’t control their urge to limit the risk per trade. To address this, there is a need to change your mindset about trading. If you want to succeed, you should focus on managing risk and keeping your account safe. If you do that, profits will start pouring into your account.

Tip 4: Prepositioning trades for news in the FX market

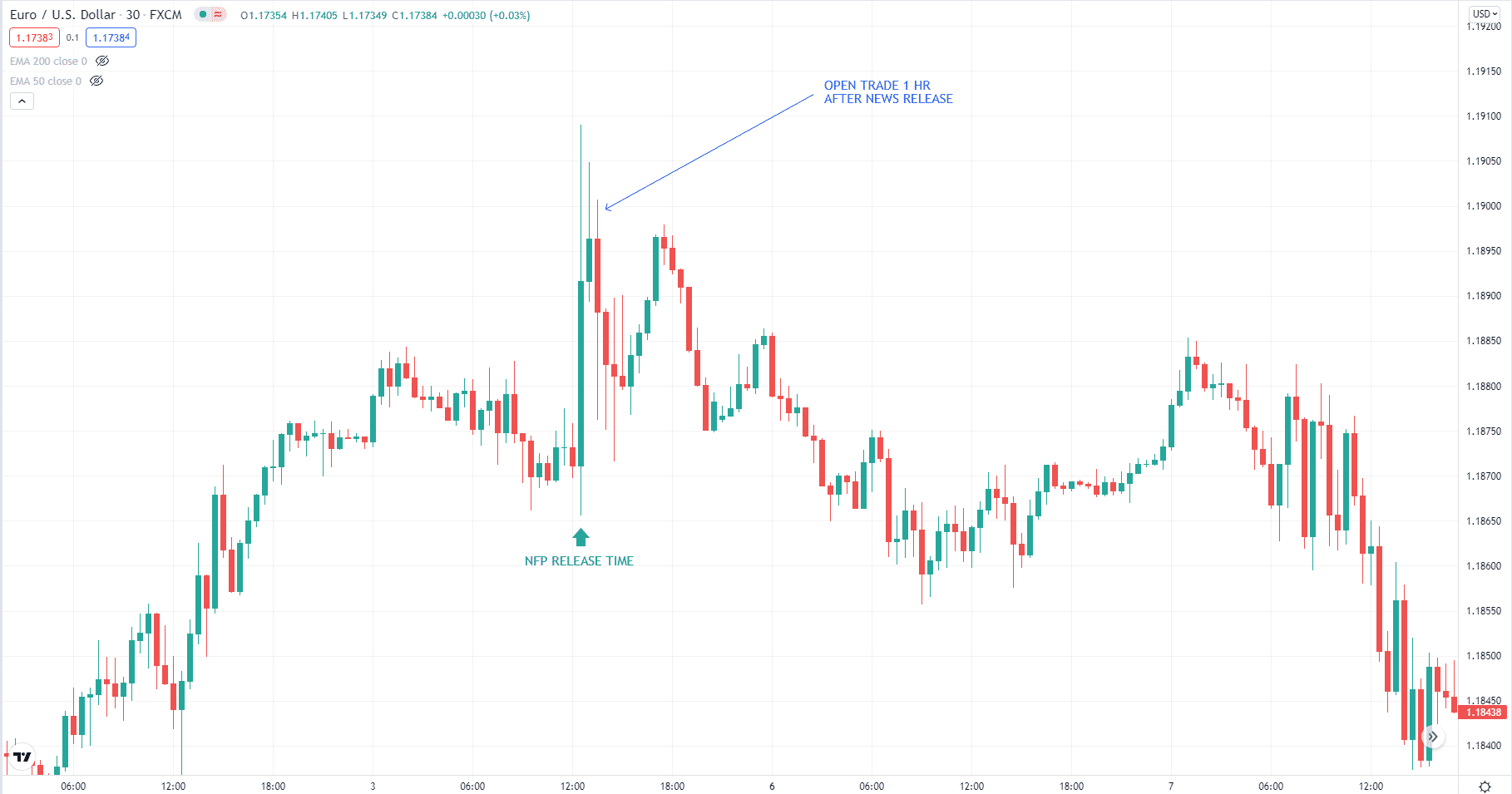

Many instruments rise and fall dramatically and quickly shortly after a news announcement. Predicting which way the market may go and initiating a trade before the news release is generally not the best approach. At times, the price may fluctuate up and down several times before picking a direction. While you can make quick bucks with this tactic, you are equally prone to losing big time when the market does not move in your favor.

Why does it happen?

You might have heard somewhere that price discounts the news. What this means is that market price reflects the impact of news announcements. Because of this, traders try to predict the next big move by finding clues on the chart. When they find such, they execute trades ahead of the news in hopes of making profits quickly before volatility runs out.

Entering during or shortly after the news release is difficult due to slippage, gaps, and enlarged spreads. Taking the wrong side of the market, these traders covered the position after a significant loss because the trade was closed late. More often than not, this is the time when most newbie traders blow out their accounts.

How to avoid the mistake?

Rather than making a speculative trade before news announcements, you should enter trades after the events when the market has stabilized. Volatility might still be there, but not as violent as when the news came out.

Tip 5: After news trades in the FX market

Trading after the news is a suggestion you will often hear from experienced traders. They say market participants should start trading when market volatility has returned to normal. While this is true on most occasions, there are times when markets experience a second wave of volatility. Sometimes, it happens one hour after the news release.

Why does it happen?

On rare occasions, markets experience a second surge of activity after the release of high-impact news. Because this is not common, traders are often caught by surprise, leading to unexpected losses.

How to avoid the mistake?

If you are a news trader, there is no other way around this. You have to be aware that it happens from time to time. To protect yourself, make sure you set stop losses to your trades all the time.

Final thoughts

Expectations must be managed accordingly by accepting what the market is giving you on a particular day. In general, market participants are more likely to find success through understanding the common pitfalls and how to avoid them.