Hedging is a practice used by traders of all stripes to safeguard one position from bad price changes. Hedging often entails opening a second position that is likely to correlate with the original asset being held negatively. It means that if the price of the first asset falls, the second position will undergo a complementary and opposite movement that compensates for those losses.

In trading, investors can utilize a second pair to hedge an existing position that they are hesitant to terminate. Although hedging decreases risk at the cost of gains, it can be a helpful strategy in FX trading to safeguard profits and avoid losses.

If you are new to the financial sector and want to hedge your positions, you need to thoroughly study and learn these strategies. In this article, we will uncover and grasp the forex hedging strategy and its proper use.

What does hedging in forex mean?

It is the process of decreasing losses by executing one or more trades that counterbalance an existing position. Hedging’s purpose isn’t always to eliminate risk but rather to reduce it to a defined quantity.

The FX market is the world’s biggest and most liquid, making it tremendously volatile. While volatility is frequently regarded as an unavoidable element of the FX trading experience, numerous hedging tactics can be used to limit the level of forex risk associated with each transaction.

Currency hedging can safeguard against various currency risks, including changes in inflation levels, interest rates, and unexpected news.

How does FX hedging work?

Hedging forex involves opening a position – or many positions – that move in the opposite direction of your current trade. The goal is to get as near to a net-zero balance as possible.

While you could close your first transaction and then re-enter the market later, adopting a hedge allows you to retain your first trade on the market while profiting from a second.

Hedging against currency fluctuations

Currency hedging occurs when a trader enters into a contract that protects them from changes in interest rates, exchange rates, or other unanticipated events in the FX market.

Currency pairs that can be hedged include major crosses, including EUR/USD and USD/JPY, and more minor and exotic currency pairs. Well, this is because the FX can change direction in response to political or economic events in any nation, causing each currency’s value to grow or fall.

Forex hedging strategies

To limit currency risk exposure, various hedging measures can be implemented. The following are the two most frequent:

- Hedging directly

- Hedging against correlation

Hedging directly

The first method is referred to as straight FX hedging. That’s when you already have a trade on a currency pair and open a trade on the other pair.

For example, if you were long on EUR/USD, you might execute a sell order with the same trade size. This transaction would result in a net profit or loss of zero, based on the costs of executing each trade.

While many traders would just close out the initial position, incurring any loss, a straight hedge would allow them to profit from the second trade that would avert this loss.

Direct hedges aren’t always possible on many trading platforms because of the total net-off of the trade.

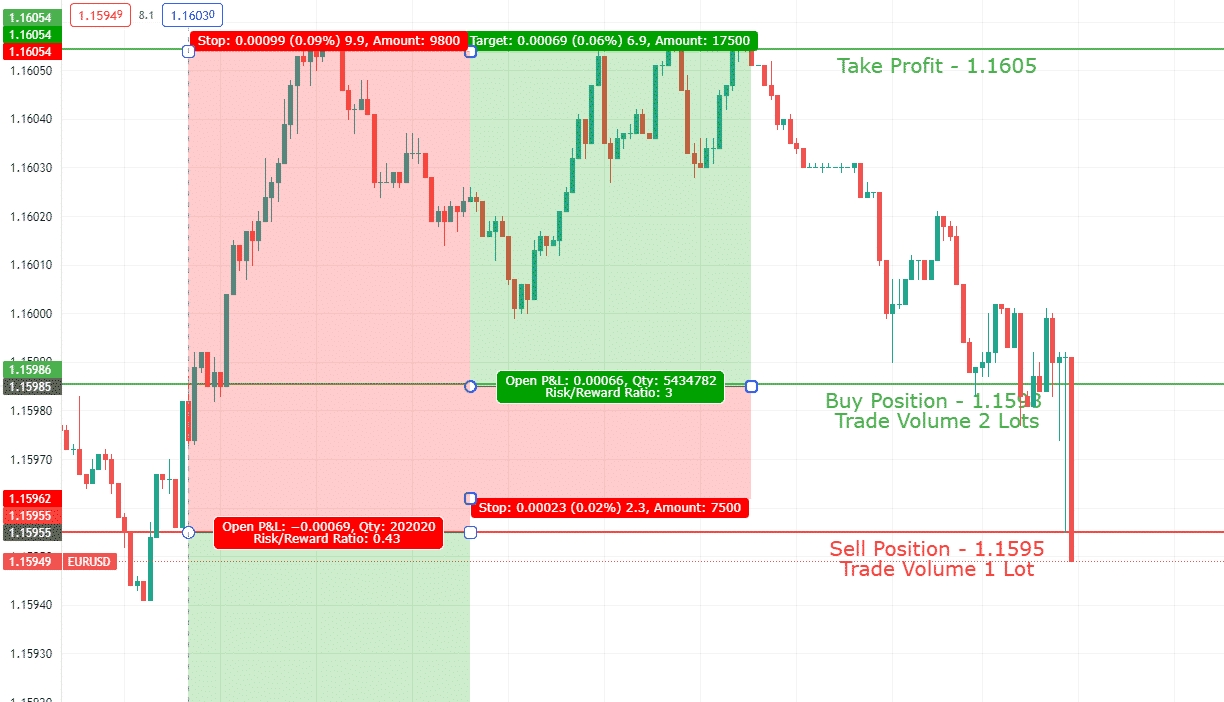

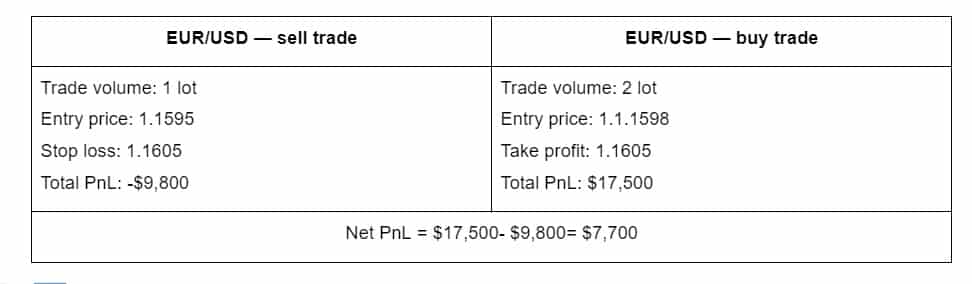

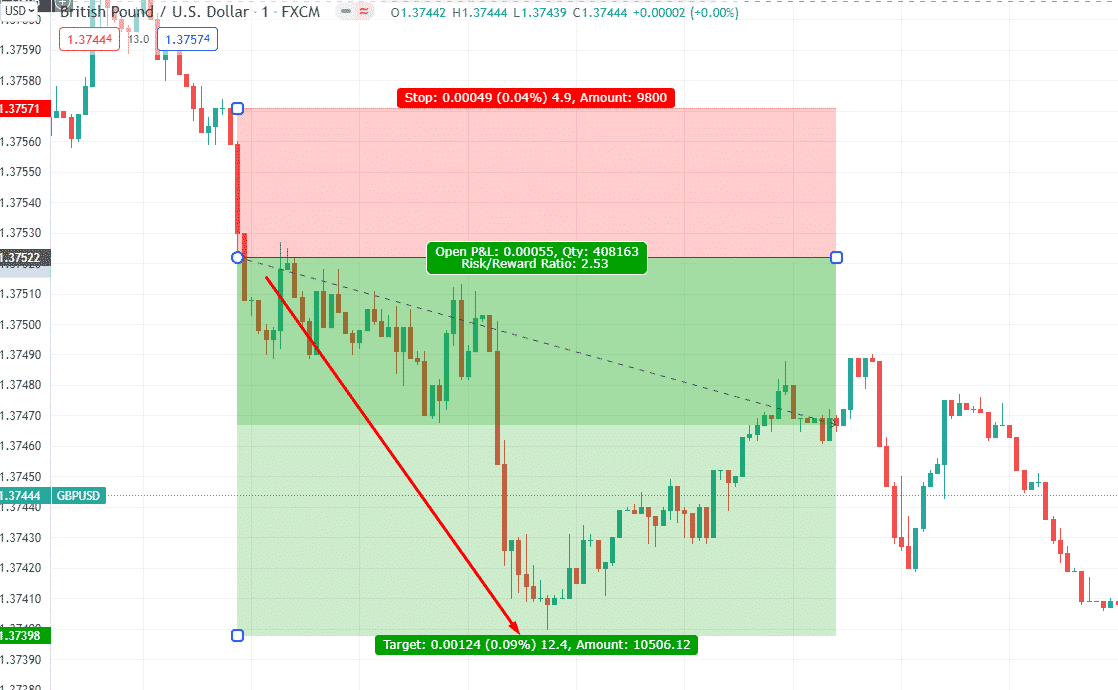

Hedge trade setups

Hence, with a direct heading, our profit could be $7,700, although our sell trade was a bad decision. But the hedging strategy helped us make an excellent profit here.

Hedging against correlation

Establishing a correlation between FX pairs is a typical hedging approach. This would include picking two currencies with a strong positive correlation. It means finding FX pairs that move in the same direction and then putting opposing positions on them.

For example, the most frequently reported positive correlations are GBP/USD and EUR/USD. This is due to the UK-EU relationship in terms of geography and political alignment – though the latter may shift in the coming years.

So, if you have got a long position in GBP/USD, you might hedge it by shorting EUR/USD.

When using a correlative hedging approach, consider that your portfolio’s exposure now covers numerous currencies. While the positive correlation succeeds when the economies move in lockstep, any divergence might affect how each pair moves – and hence your hedge.

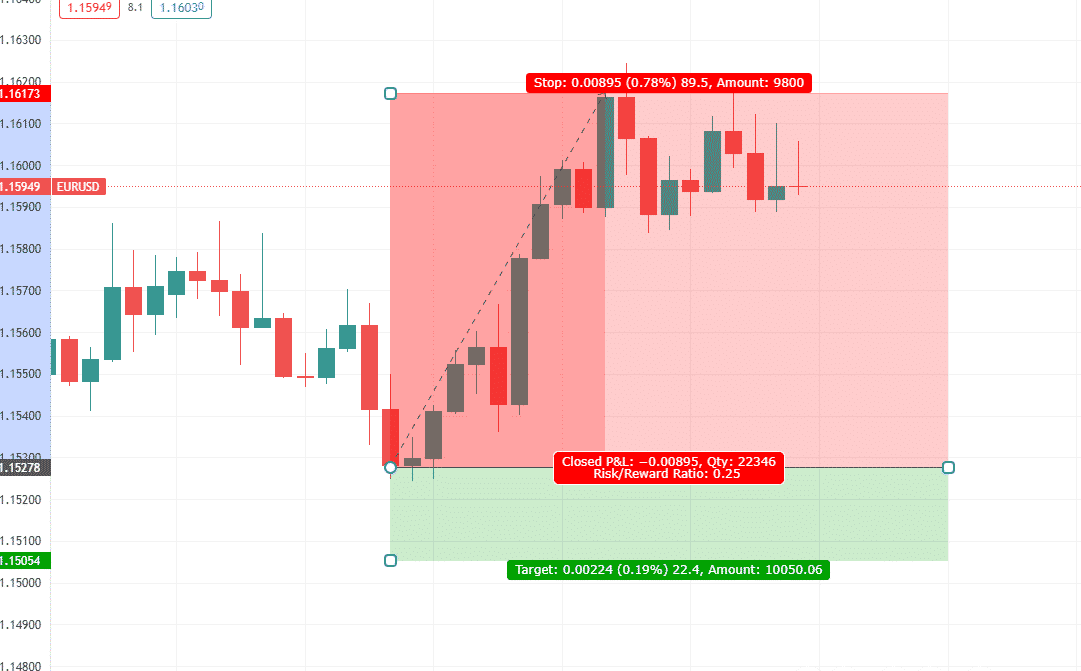

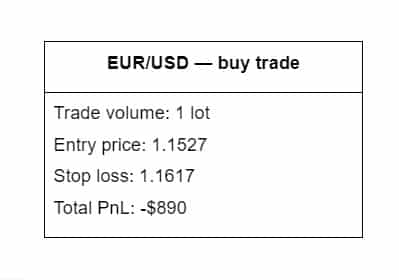

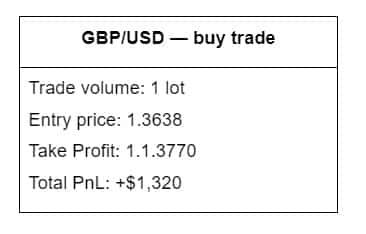

In hedging against correlation, we opened a sell trade in the EUR/USD pair at the 1.1527 level, which went south. In such a situation, we have two options: either close EUR/USD at a loss or hedge it with a correlated currency pair.

With that being said, we opened a buy trade in GBP/USD to hedge our position in the EUR/USD pair. Thus, the EUR/USD ended up with a loss of $890, and the GBP/USD helped us secure a $1,320 profit.

With the hedge against correlation strategy, we go home with a profit of $430.

Final thoughts

Professional investors can use their knowledge of market volatility and the factors influencing these price fluctuations. Moreover, their expertise with the FX correlation matrix can help them secure their profits and continue generating revenue by using timely forex hedges.