Grid trading method is a trading approach that uses mathematics in forex trading simply. Therefore, if you want to build a trading strategy using an automated trading method, you can consider the Grid method or use this concept in your strategy and make reliable ways to make money.

However, it is not wise to start using any trading method without a proper understanding of implementation. This short passage will guide you to use the Grid pattern trading strategy, including complete explanations of buy/sell using this method and professional risk management tips.

What is the Grid pattern forex strategy?

The Grid pattern trading method is a unique method many traders call a no-loss trading method. This trading method involves constant buying and selling, which is an automated trading technique, but you can also practice the method manually. This trading technique applies to trending or ranging market movement. When you seek to create a successful Grid pattern trading strategy and execute it manually, it requires learning some unavoidable facts such as fundamentals, the way of the market work, brokers commissions, and current market dynamics.

The commission is essential as the Grid pattern works well in a moving market. Moreover, it is a relative fact to the margin of the trading capital. So without reasonable commission, it will limit the Grid pattern trading method.

How to trade using a Grid pattern trading strategy?

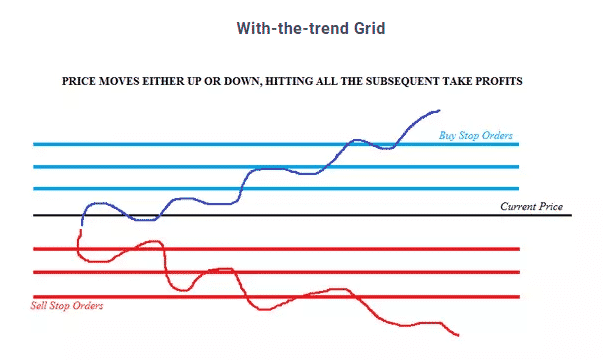

The Grid pattern trading method is unique as it doesn’t involve using any technical indicators or tools to execute trades. The concept is simple: the price movement reaches different levels and triggers the trade on a step by step basis. The only loss is when you are out of money or less capital. You can make a considerable profit using this trading method, or if you implement it wrong or make mistakes, it can lead you to lose a tremendous amount of money. You can apply this method in both a trendy and a volatile market.

In a trendy price movement, you can get the ideal outcome when the price reaches the bottom or top of a trend. In a trendy Grid technique, you should consider the reversal points as you can lose your profit amount alongside gaining losing position sizes. Traders usually limit their Grid orders to deal with the reversal. Some traders also cancel their orders in opposite levels to prevent unnecessary costs such as swap fees and spread fees.

On the other hand, in a volatile market, the regular Grid, more specifically trend Grid strategy, will fail as if you place to buy above the set price and sell below the set price, it will lead you to loss. So, in this case, you may open buy orders below the set price at standard intervals and, conversely, open sell orders above the set price at typical interval levels.

Many traders use technical indicators such as ADX, Moving averages, or momentum indicators to determine the current market context before executing Grid orders. Otherwise, they apply the Grid pattern concept to automatic trading methods.

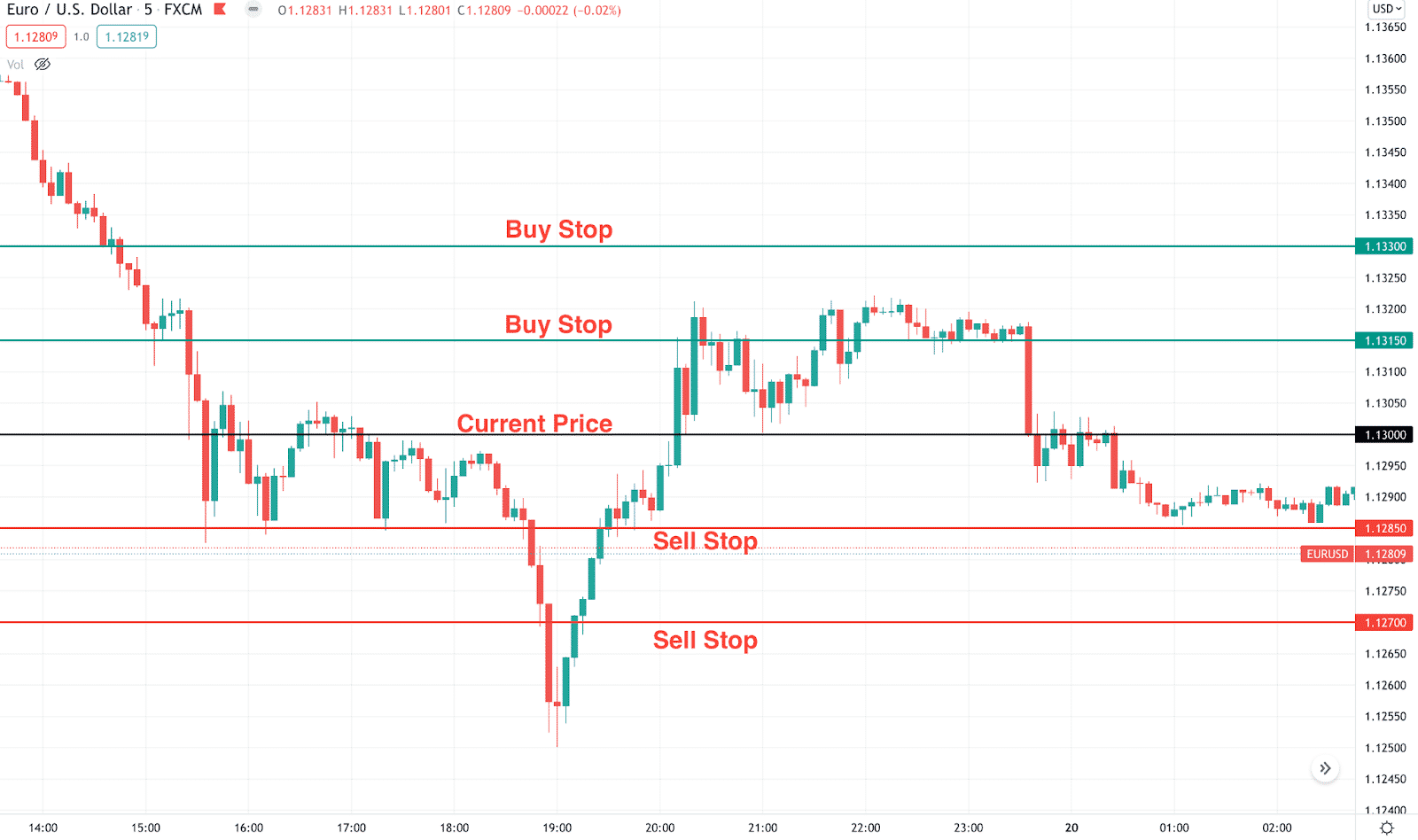

When seeking to place any Grid trading strategy, determine:

- Interval points such as 10pips, 15pips, 50pips etc.

- Select the starting point of your Grid.

- Determine what method you will apply as with the trend or against the trend.

Bullish trade setup

For example, the GBP/USD pair is floating near 1.3520, which is a short-term resistance level, and its range is from 1.3470 to 1.3570. You may want to place buy orders in the direction of bullish momentum using the Grid pattern.

Entry

This method uses an interval point of 10pips. So the entry levels will be

- 1.3510

- 1.3500

- 1.3490

- 1.3480

- 1.3470

Stop loss

The stop loss will be near 1.3450. So a total of 200pips you are risking it all buy executes without triggering any sell orders and the price hits your stop loss level.

Take profit

When it comes to making profits through the Grid trading method, you have to learn to manage risks and losing positions and make profits if you execute all trades manually. A forex trader with good skills can turn losing positions into profits.

Bearish trade setup

At the same range, may price starts to decline from the resistance level. Then your sell Grid will activate to generate profits.

Entry

In that case, the sell positions will be at

- 1.3530

- 1.3540

- 1.3550

- 1.3560

- 1.3570

Stop loss

The stop loss level for sell orders will be above the range near 1.3590. So you are risking a total of 200pips if no buy order triggers and the price hits the stop loss while all sell orders are active.

Take profit

This method has no actual profit target, but investors should monitor the trade to find the major reversal point. In that case, finding the major supply and demand levels is essential.

How to manage risks?

This part includes the risk management tips as follows below:

- Be aware of non-opposing trading pairs when the system loses the hedging feature that can lead you toward unlimited losses. To avoid this, traders often use wide stop losses.

- Confirm that your position size and Grid configuration are within the limit. So you don’t get a margin call.

- Averaging the entry/exit prices is one of the most positive features of Grid pattern trading. This method should increase profitability and reduce risk when you apply it appropriately.

- The essential part of using a Grid pattern strategy is understanding the market range before actually generating trade setups or determining the entry/exit points.

Final thought

Finally, when using the Grid trading method, you may not multiply your trading volume frequently. It is crucial to follow discipline to make constant profits through this trading strategy. Moreover, don’t risk beyond your reasonable limits or enter trades when you can’t understand the market context or the method well.

Like all other trading methods, the Grid trading strategy also involves advantages and disadvantages. It requires a certain level of mastering the concept before applying it in live trading. Practicing demo trading can help to use any Grid pattern trading method frequently.