The forex market is a competitive field that involves different types of participants, from retail traders to large financial institutions to high-tech trading systems. In recent years, traders have been engaging in high-frequency trading (HFT) to outsmart other traders.

While this type of trading is relatively new, it has gained traction over the years. It is expected that by 2028 the market share of HFT will reach $500 million.

One advantage of HFT is being able to get in ahead of the pack when opportunities arise. Since a program executes trades on your behalf, you can trade while you sleep. When the system is profitable, you could build a fortune in a short period.

If you are looking into the possibility of doing HFT, this article will lay down the foundation. Here we will explain HFT in more detail, how it works, and how to manage risks.

What is high-frequency forex trading?

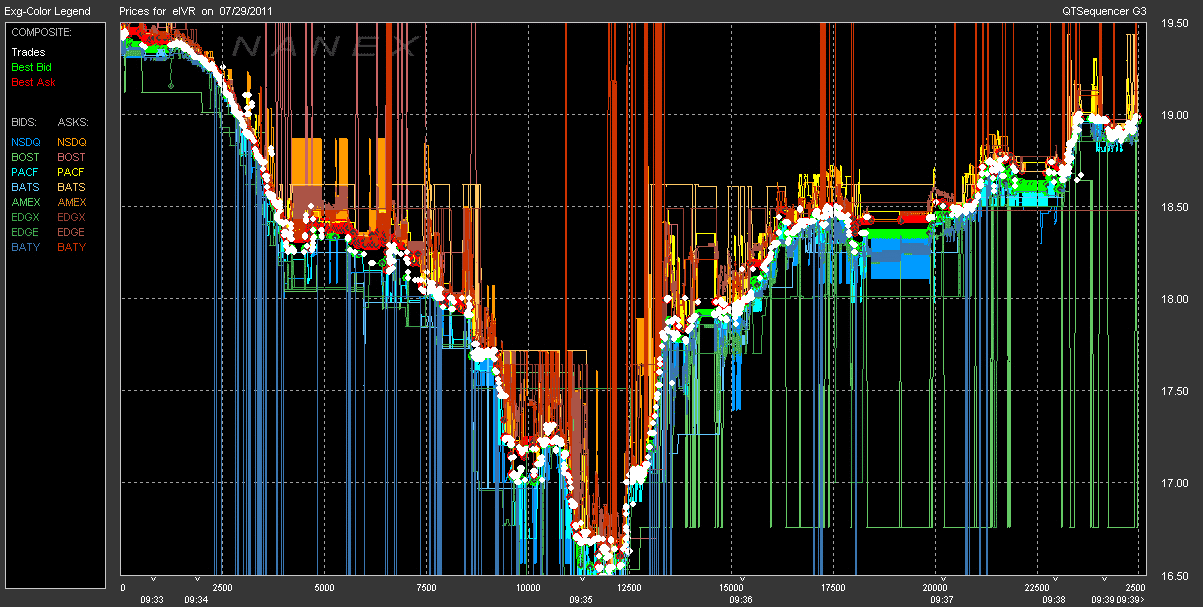

HFT applies not only in forex but also in other financial markets. In this discussion, we limit the coverage to forex. HFT refers to the process of executing a large number of trades at lightning speeds. Because of the speed requirement, humans could impossibly keep up. If you engage in this business, you will need a powerful computer to carry out transactions. See sample setup in the picture below.

HFT has the following distinguishing characteristics:

- Huge volumes of trades

- Quick cancellation of trades

- Very short holding time for trades

- Trades are closed at the end of the trading day

- Small target profit per trade

HFT uses complex algorithms to forecast price actions and execute entries before the market turns at each inflection point. It does not intend to capture large price swings but to cash in multiple times when currency pairs move as expected.

HFT setup

How high-frequency forex trading works?

You can liken HFT to expert advisors put in turbo mode. HFT programs process market data and use a large set of technical indicators to find trading opportunities. These programs fall into four types based on the algorithm being used.

The four types of algorithms are outlined below:

- Hedging

Trade correlated assets to reduce trade risks.

- Statistical

Analyze past market data to forecast future actions.

- Execution

Perform specific actions as designed by the programmer.

- Direct access to the market

Access different platforms to find market inefficiencies that they can take advantage of.

HFT is a form of algorithmic trading. While you can say all HFT is algorithmic, not every type of algorithmic trading requires high-frequency entries. HFT systems may use a combination of the above algorithms to find trade entries.

Is high-frequency forex trading worth it?

HFT generates profit by taking a large number of trades and setting small profit targets. While each trade may result in minimal profits, the volume of trades taken allows you to realize a sizable income. There is no guarantee that you will succeed when you use HFT systems. If you find a profitable system, there is no doubt you can succeed.

Since most expert advisors fail, the same can be said of HFT systems, as the latter is an upgraded version of the former. The only way to find out is to find someone who has implemented an HFT system.

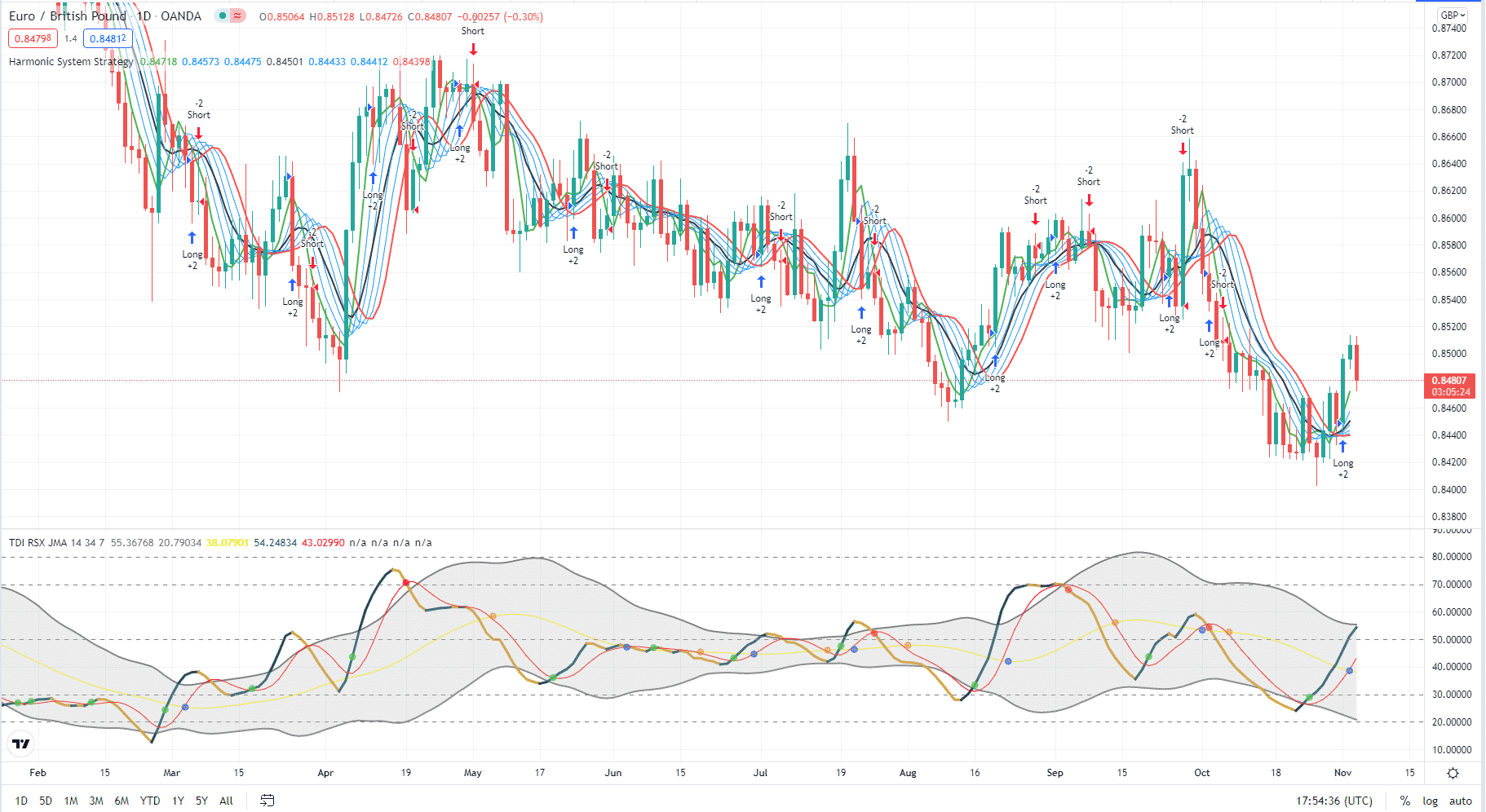

Bullish trade setup

Typically, high-frequency trading involves the use of one or two trading systems when looking to find entries. You can also make the case that entries are based on a battery of indicators. If all indicators give the same signal, then the trading program will take a trade. Upon entry, the robot may execute one or more trades, and the lot size would be way larger than common robots do.

In the above chart, you can see a long signal given on the right-most part of the chart. Your entry would be right after the signal shows up. To maximize profits, trades are typically trailed instead of using hard take profit values. Meanwhile, the robot could specify the stop loss or keep it in the memory and trigger as the market situation requires.

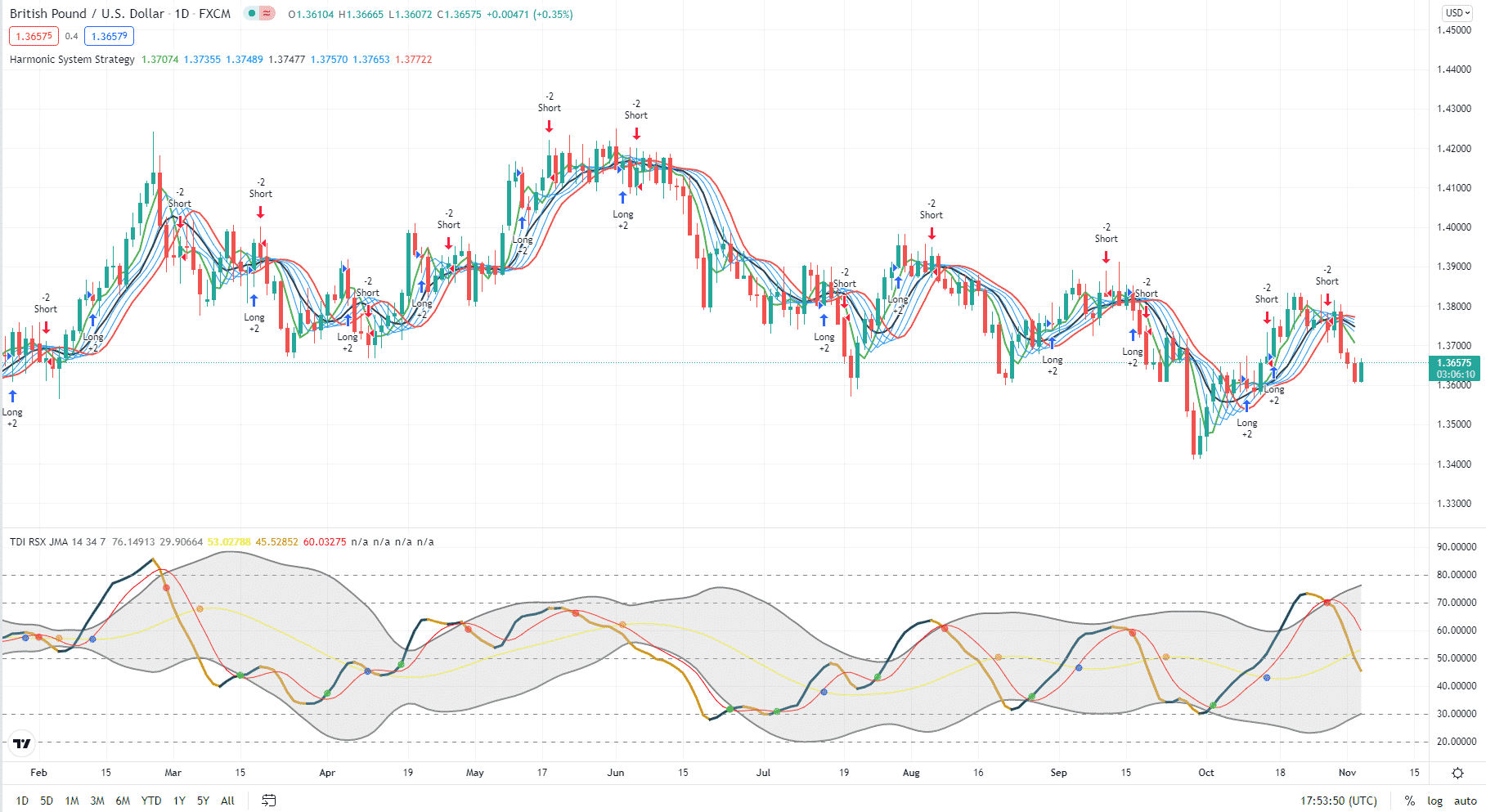

Bearish trade setup

Very often, high-frequency trading programs make use of multiple trading systems when finding trade entries. You can say these programs enter trades at the confirmation of multiple indicators. That is entirely possible. If all such indicators signal an entry, the robot will take action immediately. The program may open multiple positions during entry, and the volume is typically higher than that of standard robots.

In the GBP/USD daily chart above, you might have noticed the short signal at the right part of the chart. The sell entry is triggered immediately after this signal. To use dynamic targets, programs often use stop trailing. Depending on the program’s design, the stop loss could be overtly defined or covertly stored in the memory.

How to manage risks?

Setting up your system to enable high-frequency trading requires the purchase of trading software and an application programming interface typically. The latter allows the communication between platforms and applications. You would need the assistance of experts to set up your trading system, and the cost involved would be high.

It would take a lot of initial investment to set the program running. If your trading fails, you are bound to lose your trading capital and your initial investment. Therefore, you need to do a lot of research to find an HFT system that works. You need months of testing using historical data and forward testing to confirm that the system works if you find one.

Final thoughts

HFT involves executing thousands of trades at huge lot sizes using a program that runs on a fast computer. If you are not a risk-taker, this type of trading is not suitable for you. Also, HFT requires a significant investment to get started, from purchasing software to allocating a large capital. If you are an advanced programmer, you might be able to get away with buying software. Still, you will need money to upgrade your computer and internet connection to make HFT possible.