If you are a forex trader and want to lead a financially free life, only 500 pips per month is enough. It might be surprising to you, but in forex, trading consistency is the key.

When you seek to be a professional or successful trader in the FX market, you must master a proper plan and strategy. You may make some quick money in the forex market without correct vision and planning, but in the long run, you can’t survive. It requires specific skills and knowledge to have consistency in making profitable trading decisions.

This article is about having a target of monthly 500 pips gain. We will show you how a simple trading plan can change your financial life if you can follow and execute the plan properly.

How to calculate profits in forex trading

The FX market is full of opportunities for traders with punctuality, knowledge, and skills. It is essential to calculate the loss and profits (P&L) of the trading cause it directly affects the margin and the trading capital. Keeping track of the gaining and losing trades will help to understand the portfolio of your trading account and the sectors where you need to put effort.

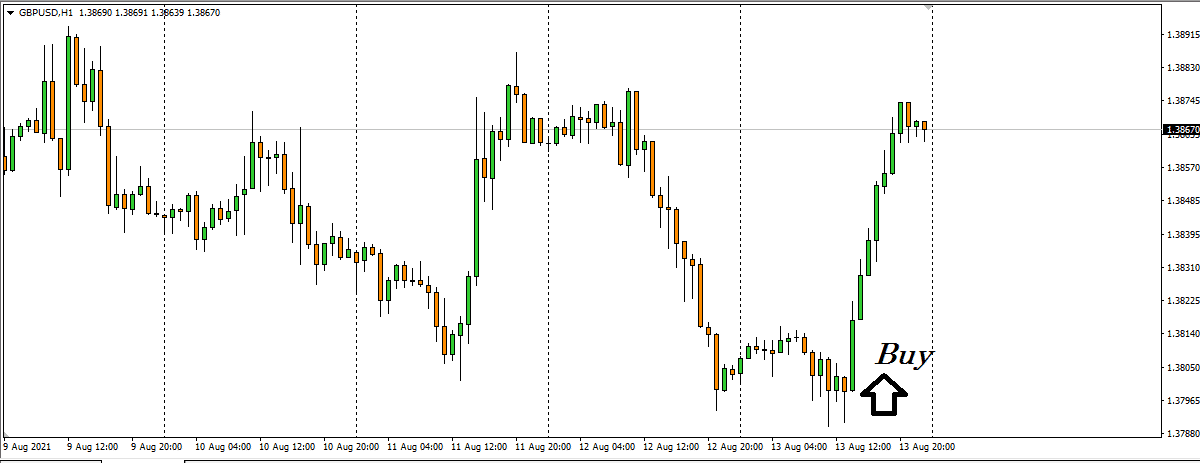

The figure above shows an hourly chart of GBP/USD, where GBP is the base currency and USD is the quoted one. It has a sharp move of 60+ pips on the current day.

- Suppose you put one standard lot of GBP/USD buy order at 1.3817 and close the position with 21 pips profits when the price reaches 1.3838.

- In that case, you will make 210$ profit from that single trade. That will add to your trading account automatically when you close the position.

Let’s look at the situation on the other hand.

- Suppose you open another standard lot GBP/USD buy position at 1.3817, and the price starts to fall.

- You close the buy position at 1.3801 with 16 pips loss. In that case, you will lose 160$ from your trading account.

The general rule is the quote currency dominates the P&L. Suppose you place a standard short position at USD/CAD, which has a current value of 1.2513, and you make ten pips profits from that order, so the closing price for that order is 1.2503.

For standard, every pip of USD/CAD is worth CAD 10, which will have CAD 100 profit for you. Then you convert that profit to USD by using the formula CAD 100 ÷ 1.2503. You can easily calculate the margin value after getting the P&L value.

What do 500 pips per month tell us?

Simply 500 pips a month tells us to have a specific profit target every month. Having a particular target of profit relates to money management and trade management ideas. Moreover, it will set a target for consistency in gaining, so you can reduce loss. If you master this goal of 500 pips each month after a certain period, you will end up making a lot of money by gradually growing your capital.

You can reduce the stress of trading when you know your goal and can avoid revenge trading. Mastering the concept of monthly 500 pips will take you to the era of successful traders. In forex trading, most newcomers lose their first deposit for the lack of trading plan and consistency. So specific profit targets help traders master the concept of fair trade and money management, which allows individuals to survive in this marketplace for the long run.

Compounding result of 500 pips a month

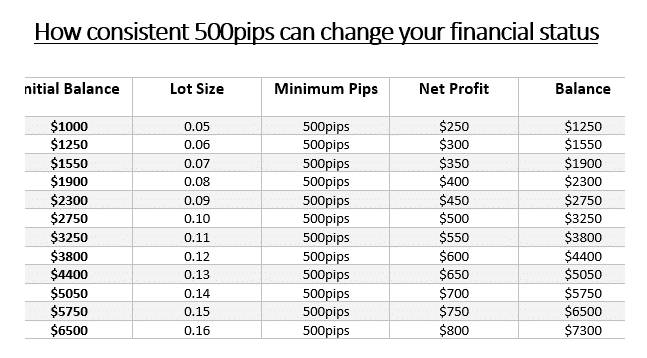

The result of gaining 500 pips per month will surprise you. It is so amazing that you can grow 7X of your capital in a year. Look carefully at the figure below.

The figure is simple; an individual starts to trade with a $1000 deposit, with a profit target of 500 pips per month. The lot size is 0.05 in the first month of trading. After the ending of the first month with a profit of 100 pips, the trader ends up with 250$ profit.

The starting balance of the second month is $1250, and the lot volume also increases to 0.06. The lot size changes every month with a growing capital. In the last month of the year, the trader ends up with an $800 profit, and the lot size is 0.16 by then. So the result is shocking, right?

The capital has become more than 7X by the end of the year. However, decent money and trade management is an undeniable factor in achieving this goal.

Why is consistency important in forex trading?

We already show you the result of consistency in trading. You can avoid under-trading and overtrading by setting a particular profit target and constantly achieving that target. It is an essential factor to become a successful forex trader. Most of the forex traders lose capital in the forex market for the lack of consistency.

Usually, maximum newcomers come to trade in the FX market with a target of becoming a millionaire. It is not impossible if you follow a stable trading plan and have consistency. Consistency in forex trading involves proper vision, target, trade management, money management, and critical factors to survive in the marketplace with the highest liquidity.

Remember, what you gain without losing is yours to spend, and you can’t be a millionaire overnight from forex trading. It is more important to survive in the market for a longer period. You must follow appropriate strategy and consistency to achieve that goal.

Final thoughts

Finally, there are a lot of things to learn in the forex market. It is a marketplace with high volatility. So it would help if you learn to survive in this marketplace without losing capital. You can’t do it without a stable trading plan, long-term vision, and consistency. We suggest doing more research and obey the affecting factors. Otherwise, you will end up losing your capital like the others.