Traders use different methods to extract profits from the forex market. One popular way is carry trading. If you think not many traders are involved in trading forex swaps, think again. The number of participants trading currency swaps has increased by 33 percent from 2016 to 2019. This trading activity itself has a daily trading volume of $108 billion.

With carry trading, you can approach FX dealing in a more relaxed way. You will not need in-depth technical or fundamental analysis to make trading decisions. What you need is information about the long and short swaps. Anytime you get a positive long or short swap, you can pull the trigger right away. However, the better strategy is to wait for the swap and price action to align before engaging.

That is possible if you want to make money by collecting forex swaps, but you will need to time your entries. This article will look at carry trading in more depth, understanding how it works and how to mitigate risks.

What is swap in forex?

It is a form of commission that your broker either pays or charges when you keep a trade longer than one day. In principle, you will earn a swap when you take long positions and pay a swap for short positions. However, this is not true in practice. If you look at the details for each symbol in your trading platform, you will see that the swap for both long and short positions is negative. This is the case most of the time. With that, whatever position you take, you are bound to pay swap.

On a few occasions, you will be lucky to see positive swaps in some pairs. However, you will realize that the positive swap is way smaller than the negative swap for the same pair. Therefore, making money by collecting swaps is possible, but you might not earn enough cash if you trade with small capital.

How can I make money from swap in forex trading?

Let us take an example to illustrate the concept of swap trading. Let us use Japanese yen (JPY) and Canadian dollar (CAD) in this example. At the time of this writing, JPY has a -0.10% interest rate while CAD has 0.25%. The interest rate difference for the currency pair CAD/JPY is then 0.35%. This means you can earn a swap by buying CAD/JPY. Simple, right?

Well, not too fast. It would be pointless to buy CAD/JPY when it moves against you for about 500 pips in a month. The best way to go is to wait for the pair to show signs of bullish momentum. For example, you can wait for the pair to trade above long-term moving averages or create a bullish market structure. Consider swap as a bonus for keeping the trade open for a while.

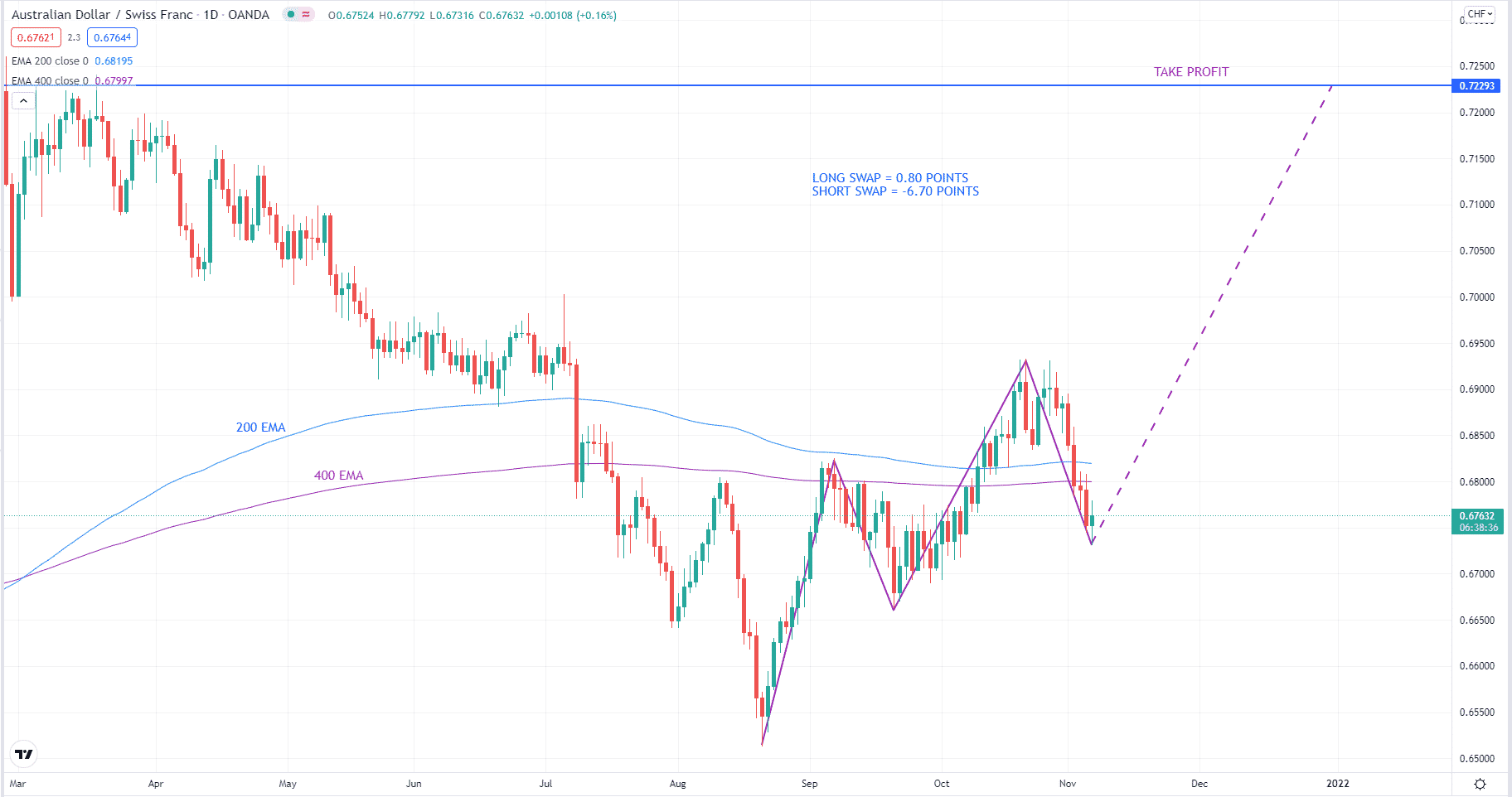

Bullish trade setup

Above is the daily chart of AUD/CHF. As shown, the long swap is positive at 0.80 points. Take note the unit of measurement is the point, which is a tenth of a pip. The current market setup offers carry traders an opportunity to trade long. The reason for that is two-fold. First, you have a positive swap to the long side. Second, the current market structure is bullish, referring to the last four swings marked as shown.

For this setup, the most logical take profit is the high of the peak to the leftmost part of the chart. The horizontal blue line marks this on the chart. If the market moves in the direction suggested by the step-up ladder structure, you could make money from the price movement and forex swap.

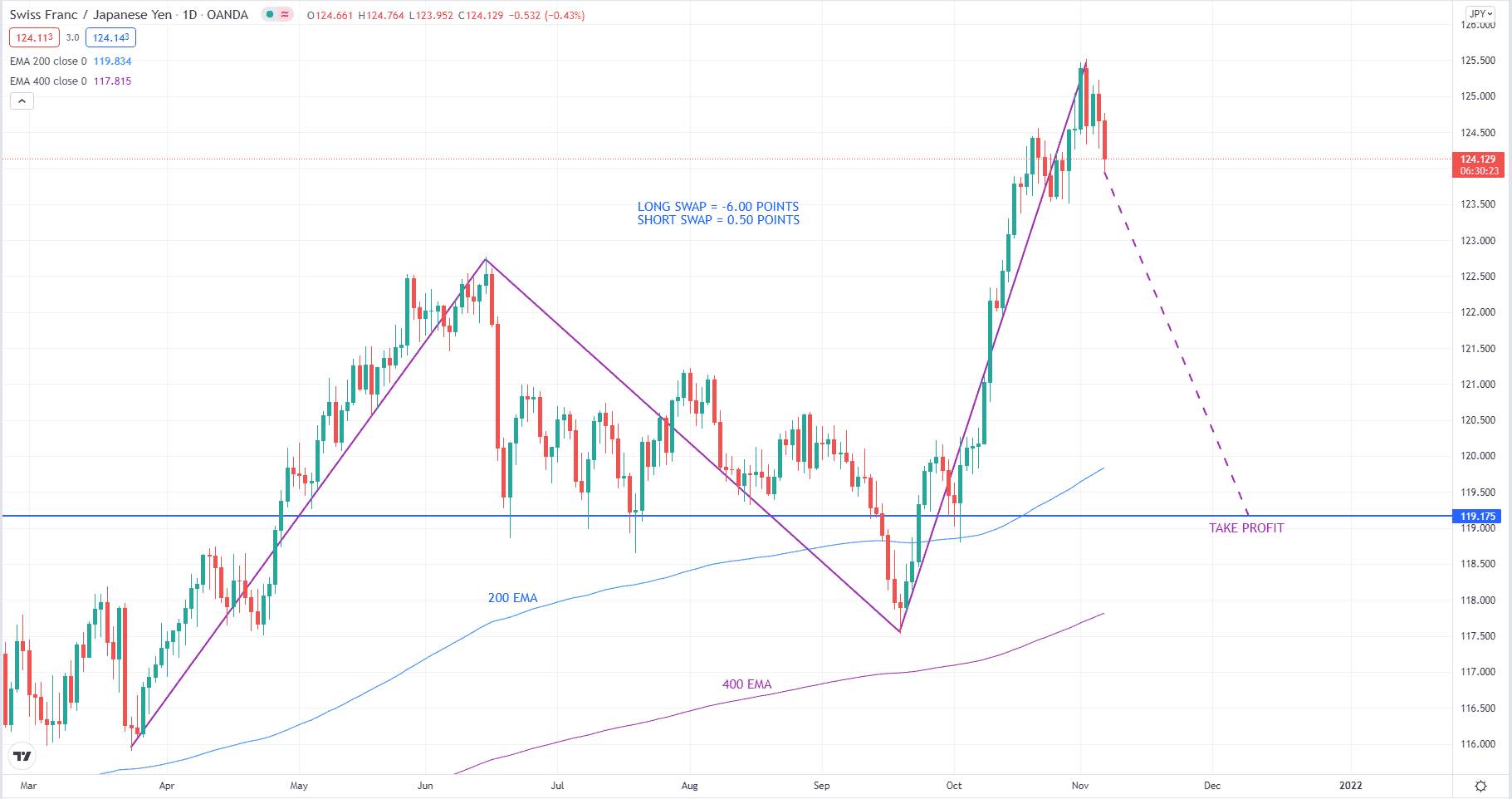

Bearish trade setup

Refer to the above daily chart of CHF/JPY. As you can see, the short swap is positive 0.50 points. The current market condition is bullish as the price is above the 200 EMA and 400 EMA. However, you can make the case that the price is already overbought. As such, it might pull back to get new buyers from demand zones.

Due to the positive swap to the downside and the overbought reading. The best take profit target here is the support level as shown. If you notice that price begins to falter as it moves down, consider exiting your short position because the daily trend is strongly bullish. Apart from the moving averages, the market structure tells that the market is bullish and may be just correcting.

How to manage risks?

Although carry trading looks attractive as it offers traders two ways to make money, you must contend with risks. The three primary risks are exchange rate risk, leverage risk, and interest rate risk.

Exchange rate risk

This risk has been discussed at some length in the foregoing sections. The concept of trading forex leisurely seems enticing, but in truth, carry trading does not give you this freedom. You must monitor the changes in interest rates among currencies to find new opportunities or let go of existing positions. Still, you cannot do away with your market analysis lens to understand where the market would go over the long term.

Leverage risk

With any trading strategy, over-leveraging is one of the main reasons cited for beginner losses. Even experienced traders fall victim to this sin from time to time. Leverage risk does not always mean having an account with exceedingly high leverage such as 1000:1. What it means is taking a position whose volume or lot size is too high for the account. When you over-leverage, one or two trades could spell disaster if the market heavily moves against your positions.

Interest rate risk

The interest rate differential between the quote and base currencies will affect your return when you hold a trade for a long time. If the difference expands, your carry trade will lead to decent profits. If it contracts, the trade profit will be lower than what you expect.

Final thoughts

Making money by collecting swaps can be profitable if you are in for the long term and manage positions properly. As your positions age, the swaps they generate can cushion them from drawdowns caused by market fluctuations. To dampen the effect of price oscillations, consider hedging winning positions with correlated instruments.