Forex trading strategy is a systematic approach to making money from the FX market by buying and selling currency pairs. There is no alternative to following a system in financial trading, and market participants should do hard work on creating, backtesting, and improving the trading strategy.

FX is a decentralized marketplace where traders buy & sell currency pairs and make money from the price changes. Here forex brokers work as a connector between traders and liquidity providers. Traders can see the live market of currency pairs, and any buying and selling orders become active immediately after opening the position. However, before taking a buy or sell trade, you should do a lot of study about the market.

If you don’t want to lose all of your money in the FX, read the following section to know how to create a trading strategy.

What is the forex trading strategy?

It is a complete system that includes everything a trader should do to make money from the FX.

Before starting to trade, investors should open a trading account in an FX broker and make a deposit. Later on, they can buy or sell currency pairs using the deposited amount, but the buying and selling decision comes from an approach known as the FX trading strategy.

Investors can randomly buy and sell currency pairs. No one is here to stop you from your activity, but this market is very uncertain. Even big banks and financial institutes don’t know the next move of a currency pair. Therefore, the only way to sustain this market is to follow a robust money management system strategy.

There are thousands of trading strategies in the world, depending on the trading style and elements. However, most of the traders in the world use technical and fundamental analysis before taking trades.

Technical analysis is a system to predict the price using past performance, while fundamental analysis depends on economic releases and events.

How to create a forex trading strategy?

There are thousands of trading strategies globally, and traders should find the reliable one that matches their personality. Here we will see some steps that will help you to find and create an FX trading strategy:

- Identify trading style

Before choosing a strategy, you should understand how much time you can have for trading. Some strategies are suitable for full-time trading, but they might not be practical for swing traders.

Therefore, make sure to match your personality with the trading style from the below table:

| Trading style | Time required |

| Scalping | Full time |

| Day trading | Full time |

| Swing Trading | Part-time |

| Automated trading | Part-time |

| Position trading | Part-time |

- Find a trading system

After finding your trading style, you should identify whether you focus on the technical or fundamental systems for trading.

You can make money from technical and fundamental-based trading systems, but you should have a strong knowledge of economics for fundamental analysis. On the other hand, technical analysis does not require precautions, but you should practice a lot before implementing these strategies in the live chart.

- Backtesting forex trading strategy

If you have chosen your trading style and found your desired FX trading strategy, you should start backtesting.

Backtesting is an approach to see what the price has done in the past price charts. If you have found the trading system profitable for more than 4-6 months, you can consider it as a reliable method.

- Live trading

The final step of creating a trading strategy is live testing. First, you have to open a demo account with a broker and start trading. Once you become profitable, you can start with real money but with a small amount.

Once you start to make money, you can increase the deposit gradually to increase profitability.

How to backtest the forex trading strategy?

There are manual and automated backtesting systems, and you can do this from the MT4 chart or use the trading view.

Let’s see the two best backtesting methods for FX trading:

TradingView bar replay

TradingView is an online platform that shows the real-time price chart from forex brokers. You can quickly go to the past time frame and start the bar reply.

Bar replay is a TradingView feature that shows a real-time price from the selected date. In the above image, we can see the example of a bar reply, where the real-time price was set on 2 January of 2020. If you click on play, the chart will move in real-time. You can control the speed and pause to see how your trading strategy works.

However, the drawback of this system is you cannot see any automated trading report, and it requires a premium subscription to use this feature on the intraday chart.

MetaTrader 4 strategy tester

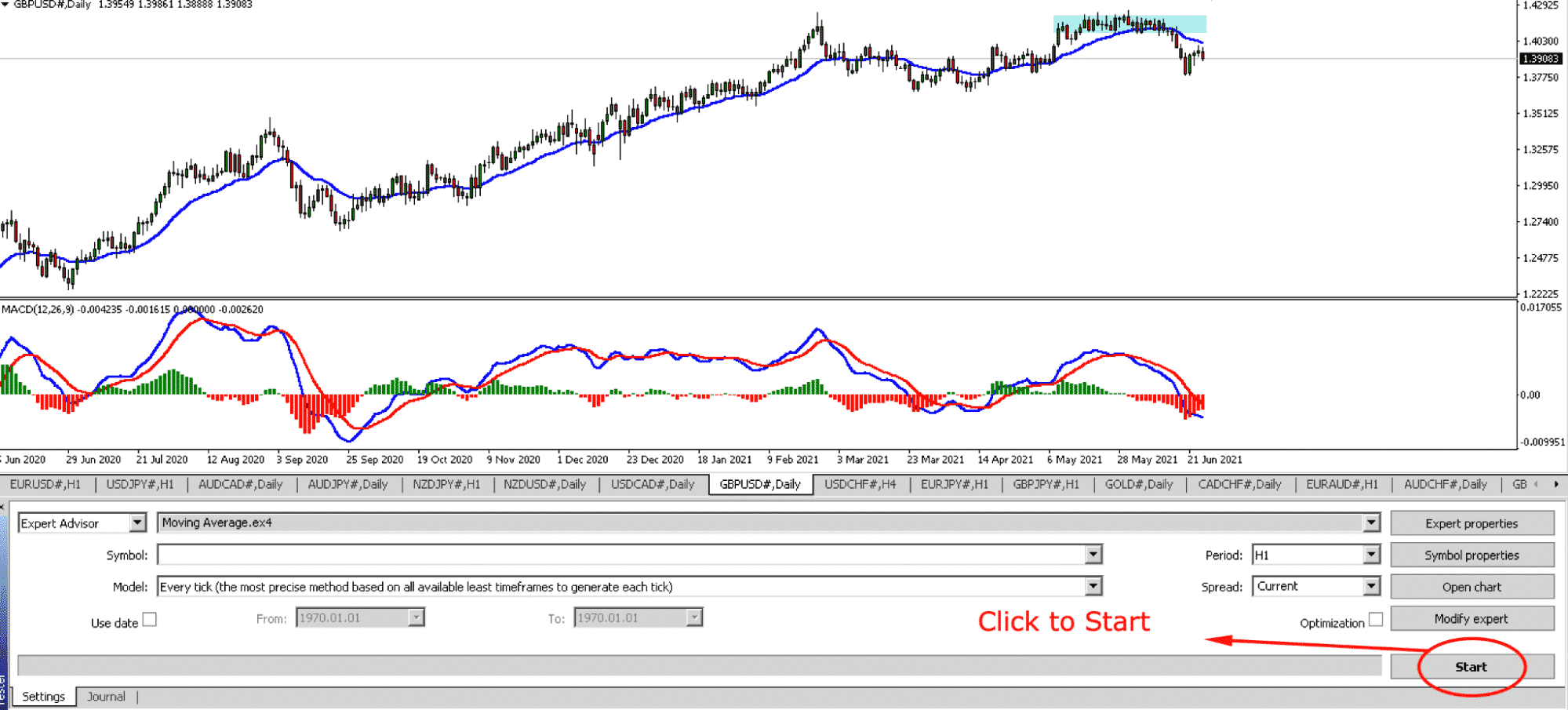

Strategy tester is an MT4 feature where you can see the trading report for a particular trading system and expert advisors. You can initiate the strategy tester by clicking “CTRL+T” and then select your trading strategy.

After that, once you click to start, the testing will initiate, and you can see the report of profitability and risk level.

Tips to improve trading strategy

The FX is changing from time to time, and you have to change your trading style to match the market’s requirements. Your trading strategy may become obsolete if you don’t like to improve it.

Let’s have a look at some tips that can help you to improve the strategy:

- Always maintain a trading journal and evaluate the trading performance every week

- Keep track of trading history every month

- Make sure to minimize trading risks in a volatile market condition

- Do not trade or minimize the lot size during uncertain market conditions

- Always focus on altering and improving trading conditions to make the strategy better

Final thoughts

In the above section, we have seen steps to create an FX trading strategy with tips to perfect the strategy. However, mastering a trading system requires a lot of practice and effort, and there is no alternative to investing time in it.

Some traders require years to become profitable, while some traders need only a month. It ultimately depends on consistency and practice.