What exactly is a grid, and how does this trading technique work? The FX Grid trading strategy is a technique that tries to earn a profit on the natural movement of the market by posting buy-stop orders and sell-stop orders at regular intervals above and below a preset price. Because levels are set on both sides, this is sometimes referred to as a double Grid trading approach.

This article will explain what a Grid trading strategy is, how to execute one, some example scenarios, its pros and limitations, and dispel any misunderstandings you may have about this method.

What is a Grid trading strategy?

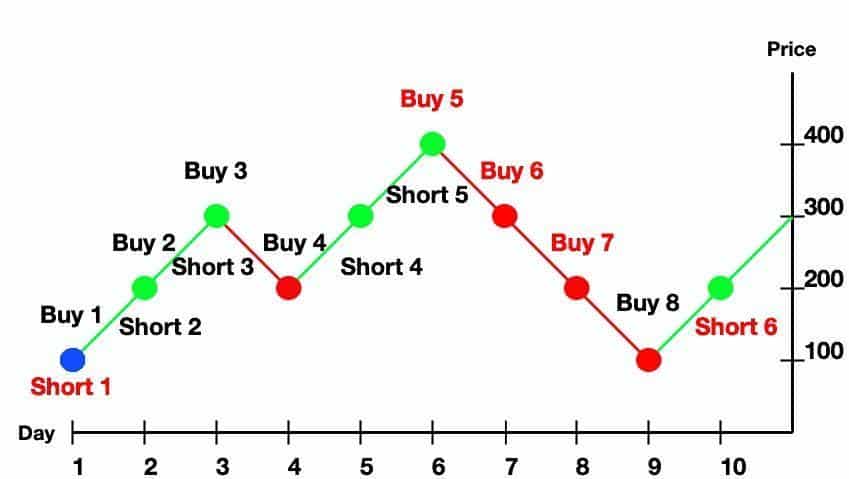

It is a technique that involves placing a predetermined number of sell or buy orders at regular intervals above or below a specific price to target profits rather than stop losses.

When the market price reaches a predefined goal, and a profit is recorded at a close, an equal number of buy or sell orders are placed above or below the set price. This results in a Grid of orders that resembles a fishing net for producing profits back and forth in the fluctuating market.

The foundation of the Grid trading method, as stated above, is to achieve profitability based on the concept of “mean reversion.” In nature, a discrepancy between all arbitrage trading pairs is prone to “regression.” Therefore, this trading strategy is exceptionally responsive to fluctuations.

The price of a futures contract, for example, is vulnerable to regression to its spot price, and the prices of perpetual and futures contracts are also prone to “regression.” As a result, the Grid trading approach and arbitrage trading are considered twins in the cryptocurrency market.

How does it work?

Grid trading benefits from not requiring market direction projections and allowing the procedure to be completely automated. However, severe losses are a risk if the market continues to go in one direction and the orders generate larger holdings.

Limiting the Grid to a few orders is critical, or the profits might turn into losses. A no-loss Grid trading method may be developed if a few requirements are met:

- It’s a Grid trading method that solely trades longs.

- There is no monetary compensation for holding the position.

- The market is less likely to collapse to zero.

- You have enough money to keep the positions at zero.

You may create a safe Grid trading strategy that guarantees no losses with these conditions. Risk management is essential to the success of such a strategy. When using a simple strategy, you buy when the market is falling and sell when it is rising. The with-the-trend Grid is more advantageous when the price runs in a consistent pattern. When the price fluctuates, Grid scalping against the trend becomes more profitable.

However, the risk is unregulated in this case, and the trader may lose money if the market moves in a certain manner. As a result, establishing a stop loss level is critical to avoid holding a lost transaction forever.

Bullish trading setup

Let’s dive into a bullish trade setup.

Entry

Buy stop entry orders are set above the current market price in a Grid trading technique. These orders will instantly place you into a long position if a bullish breakthrough occurs.

Stop loss

It is a tricky part of the strategy. First, we manage the losses with the help of hedge orders. Otherwise, we can manage by keeping the stop-loss of all orders just below the local lows.

Take profit

You can wait for the price to enter consolidation and exit all positions. Otherwise, you may place a 100 pip TP from your first order.

Bearish trading setup

Now, the time is to look for a bearish setup.

Entry

In a Grid trading technique, sell stop entry orders are set below the current market price. If a bearish breakthrough occurs, these orders will instantly place you into a short position.

Stop loss

First, we manage the losses with the help of hedge orders. Otherwise, we can manage by keeping the stop-loss of all orders just below the local highs.

Take profit

You can wait for the price to enter consolidation and exit all positions. Otherwise, you may place a 100 pip TP from your first order.

The benefits and drawbacks of using the Grid trading strategy

Such trading has a significant benefit in that it eliminates the need to determine a market trend. You may walk away from your computer knowing that no matter how the market goes, you won’t miss a profit opportunity if you create a grid of pending orders.

However, this strategy might be risky if the take-profit levels are not met shortly after opening a trade. Furthermore, maintaining a massive volume of pending orders usually entails processing more transactions.

Although Grid trading requires less human intervention, it needs regular market monitoring. When a trend starts, you should cancel any open orders against it. Then, check for triggered positions to ensure that the price does not revert before it reaches the take-profit level you’ve set, leaving you exposed to significant losses.

It is critical to learn how your market performs and manage the risk/reward ratio using your other analytical indicators to develop an effective Grid trading strategy.

How to manage risk in Grid trading?

Grid trading is a kind of absolute return strategy utilized by investors in medium-to-low frequency arbitrage trading. The amount you invest throughout the medium to long term is calculated to be risk-free. However, before investing, you should consider the risks involved, like forced liquidation risk in a one-sided market and fees of funding and transactions. In addition, you have to make sure to cover transaction and funding fees from profit by creating larger grids.

Final thoughts

Risk-averse traders want to determine whether their assets are hedged. On the other hand, Grid trading is naturally hedged as it involves numerous agreements, and successful trades may compensate for unsuccessful trades. Moreover, you may limit risk by attentively analyzing the bots trade and setting stop-losses and take-profits.