The Jurik STC system for MT4 is a profitable trend reversal trading system that can generate a fair outcome from an ongoing market trend. This strategy is mainly forced on minor retracements or pullbacks while the market is trending in one direction. Moreover, we will use multiple trading indicators like the 100 exponential moving average (EMA) and Jurik STC, and Bollinger Bands (BB) set up to increase the trading probabilities.

What is the Jurik STC system?

The Jurik STC system is based on Jurik indicators with BB and EMA. This system is very well organized, and it is based on highly accurate indicators. As we only work on probability, this system can generate probable high trade in a row. Moreover, you can apply this trading method on any currency pair, and it works best in 15 minutes to the daily time frame.

Jurik STC system for MT4

As a trend reversal strategy, we have to identify the primary trend on the higher time frame to get highly accurate trades. However, the currency market is full of uncertainty. As an analyst, we can only predict the market by 70% to 80%. That’s the reason we have to develop a high-accuracy trading strategy by utilizing multiple indicators.

Let’s have a look at trading indicators for the Jurik STC trading system for MT4:

- Jurik STC (the level at 5 and 95)

- 100 EMA

- Bollinger Bands (30,2)

Exponential moving average

By estimating trend heading throughout some period, EMA is like SMA. Nonetheless, while SMA essentially ascertains an average of price data, EMA applies more weight to more current data.

While deciphering EMA, utilize the same guidelines that apply to SMA. As a result of its distinctive estimation, EMA will follow prices more intently than a corresponding SMA. Moreover, EMA is commonly more delicate to price movement. Keep that in mind. EMA can be a twofold-edged blade. On one side, it can assist you with distinguishing trends sooner than an SMA would.

On the other hand, the EMA will presumably encounter more momentary changes than a corresponding SMA. Also, moving averages can likewise demonstrate support and resistance territories. A rising EMA supports the value activity, while a falling EMA gives resistance to price action. This strengthens the selling system. Thus the price is close to the falling EMA and purchasing when the price is close to the rising EMA.

Bollinger Bands

Bollinger Bands are technical indicators that John Bollinger developed in the 1980s. You can use them in every market like stock, futures, currencies. BB indicator offers exceptional insights between price and volatility. However, you can also use BB to identify the overbought and oversold levels of the market.

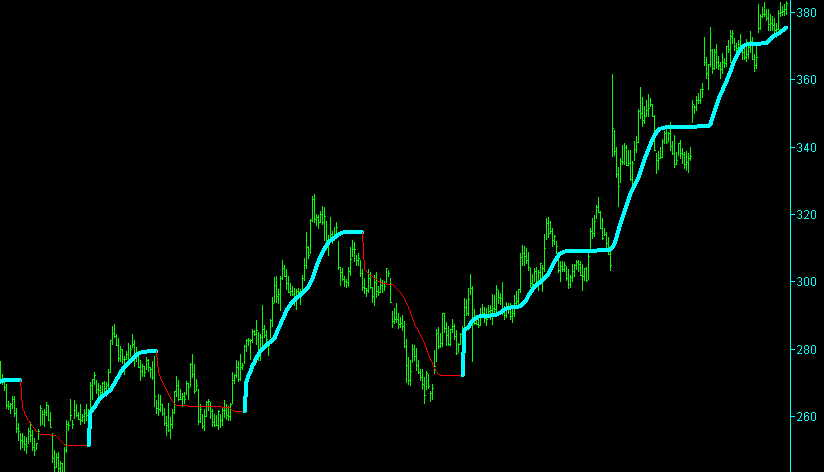

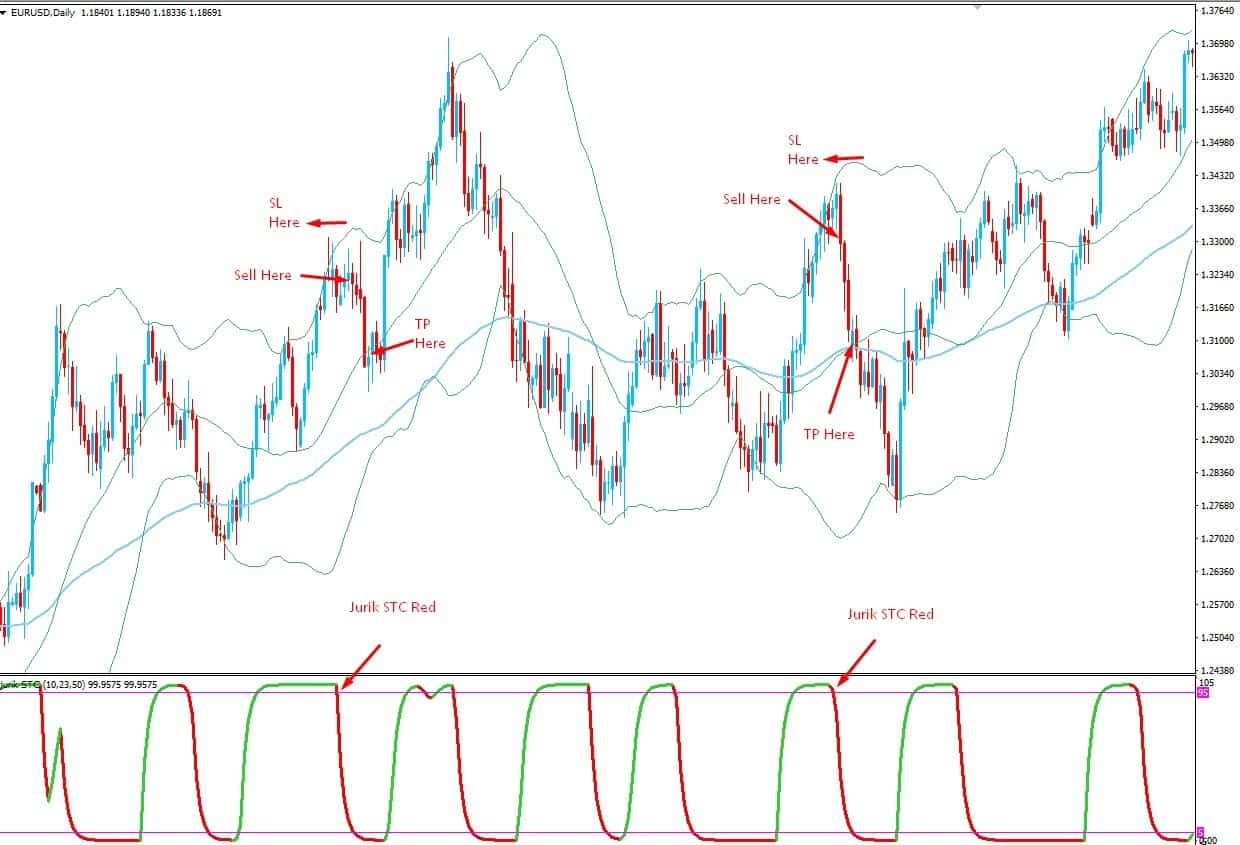

Let’s have a look at the visual illustration of these indicators.

Bullish trading strategy

The Jurik STC trading system for MT4 is appropriate on all time frames from 5 minutes to daily. However, the one hour and four hours give high gains as they squeeze out the short-term impacts of the economic events.

However, you can trade on any currency pairs you wish, such as GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/NZD, etc.

Bullish trading conditions

- The market is trending downward

- Jurik STC green

- Jurik STC breaks above the oversold level 5

- No entry if the price is out the BB upper band

Entry

After confirming all the trading conditions, you should wait for the candle to close and execute the buy trade as soon as the candles close. Do not enter before closing the candle because it may impact your capital if the trade goes against you.

Stop loss

The stop loss should be below the BB lower band with 20 – 25 pips buffer in the D1 time frame and 10 – 20 pips buffer on the H1 and H4 time frame.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk: reward ratio. Therefore, if your stop-loss is 20 pips, you should set the take profit at 40 pips. Alternatively, you can take the profit when the price hits the BB middle band, or you can wait until the Jurik STC turns red.

Bearish trading strategy

The bearish trading method is likewise applicable to all time frames from five minutes to daily, where the one hour and four hours can provide high outcomes as they essence the short-term impacts of the economic events.

However, you can trade on any currency pairs you wish, such as GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/NZD, etc.

Bearish trading conditions

- The market is trending upside

- Jurik STC red

- Jurik STC breaks below the overbought level 95

- No entry if the price is out the BB lower band

Entry

After confirming all the trading conditions, you should wait for the candle to close and execute the sell trade as soon as the candles close. Do not enter before closing the candle because it may impact your capital if the trade goes against you.

Stop loss

The stop loss should be above the BB upper band with 20 – 25 pips buffer in the D1 time frame and 10 – 20 pips buffer on the H1 and H4 time frame.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk: reward ratio. Therefore, if your stop-loss is 20 pips, you should set the take profit at 40 pips. Alternatively, you can take the profit when the price hits the BB middle band, or you can wait until the Jurik STC turns green.

Final thoughts

The Jurik STC trading system for MT4 is the most profitable trading method because it depends on the high accuracy indicators. Therefore you can achieve decent results at the end of the month. However, in forex trading, there is no 100% guaranteed profit in each trade.

To get a better outcome from this trading strategy, you should utilize the proper money management system and better psychological states.