In the financial market, leverage trading refers to borrowing capital to perform trades. It usually enables participating in significant trades while you don’t have enough capital. The crypto industry also supports this concept of borrowing money to invest in any crypto asset.

This article enlightens the leverage trading crypto and lists the top five tips to use this feature effectively to generate more profits. It is only profitable, and you can multiply your profit by implementing the concept through sustainable trading techniques. However, when using leverage for crypto trading, following specific guidelines is mandatory to obtain the best results.

What is leverage trading crypto?

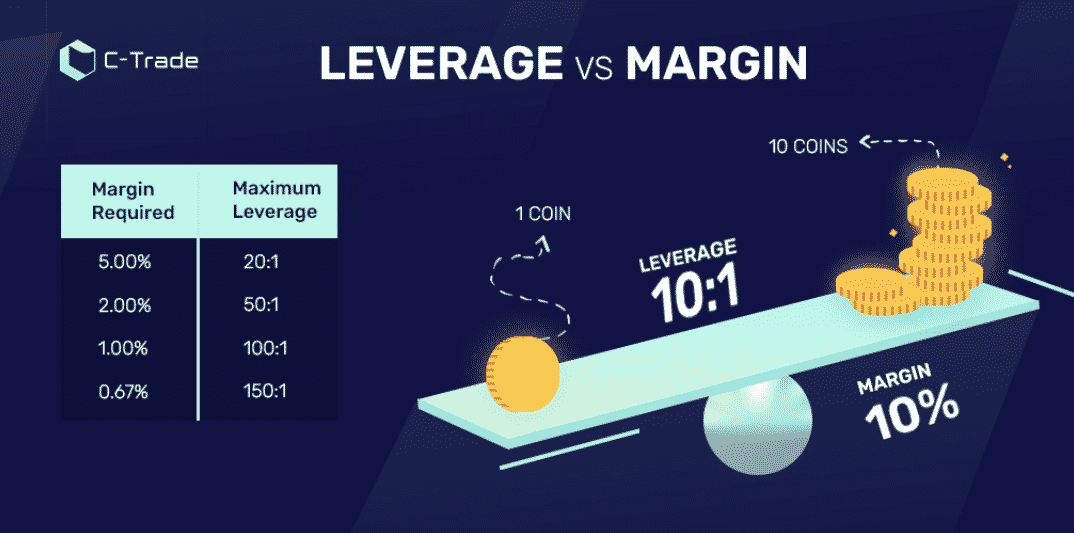

This method’s investment amount is “collateral” and depends on the margin amount. It enables utilizing trading skills to multiply return amounts by borrowing another crypto. For example, you may want to invest $1000 in Bitcoin, and you are using a feature of 10X leverage.

You can execute your position with only $100 collateral. When the price movement goes against your order, your margin will decrease. You may have to reinvest or increase collateral to continue your position; otherwise, your account may blow up or lose your capital.

Top five tips for using leverage trading crypto most effectively

It is better to follow some specific guidelines to obtain the best results when following leverage trading in crypto assets. This part will briefly discuss the top five tips to use the leverage feature effectively.

Tip 1. Select the exchange platform wisely

When choosing the exchange platform to conduct leverage crypto trading, it will be wise to check several factors such as security, asset offerings, minimum deposit amount, leverage offerings, user feedback, etc. You can find dozens of good crypto exchange platforms that allow leverage crypto trading or borrowing capital to amplify profits.

Why does this happen?

It happens as conducting some additional research enables choosing the best exchange platform. Crypto assets are volatile, so choosing platforms is essential as your capital will be under their asset management, and you will execute your trades using their platform interface.

How to avoid mistakes?

When choosing an exchange platform, compare different crypto exchange platforms’ features and offerings to determine the best platform. You can easily get ideas about any platform by checking user feedback and interface comparison.

Tip 2. Choose the crypto asset carefully

When you choose any exchange platform that suits your expectations, it is time to select your desirable asset to make investments. It is essential to wisely determine any crypto project as crypto investors seek data about any crypto before deciding, such as the base of the project, technology and community behind the project, future projections, price performances, etc.

Why does this happen?

It happens as these are the essential aspects of any crypto asset. So checking on these factors allows a basic understanding of the project’s potential.

How to avoid mistakes?

Check the utility, usability, and liquidity factors when choosing any crypto asset. When the project involves more utility, it will be more demandable, and liquidity enables the exchange of the product anytime. Choose any asset with the potential to grow in the future and open positions according to the long-term trends.

Tip 3. Manage risks and opportunities

When using a leverage trading crypto strategy, choose the strategy carefully as a 1% drawdown may lead you to a massive loss. For example, you may open a position using 20X leverage with $100 collateral, enabling opening a $2000 position on any particular asset. The price may draw 2%, so your collateral declines by 40%.

Why does this happen?

It happens as you open a significant position comparing your collateral, which may amplify your profit amount to increase your loss. So it is better to execute all operations carefully and be conscious when choosing methods or elements.

How to avoid mistakes?

Don’t use much leverage to make quick money. Better utilize your capital by opening the most efficient trades that suit your collateral amount, as this system depends on your collateral and the margin you use for trade execution.

Tip 4. Diversify your portfolio

You can diversify your portfolio using this leverage feature in crypto assets as it enables opportunities to invest many assets alongside making a single trade. For example, you can invest in another asset, invest in NFTs, provide liquidity to decentralized exchanges (DEX), staking, etc. So there are several options available to utilize the amount you borrow using the leverage feature.

Why does this happen?

It happens as crypto exchange platforms utilize your borrowing amount in many sectors. So you can multiply your investment capital or amplify your profit by using this leverage feature.

How to avoid risk?

When using leverage, it is mandatory to conduct sufficient research before investing in any crypto. It is better to avoid using leverage when you cannot define or implement any potentially profitable investment strategy. Moreover, when you understand blockchain products, you can utilize your skill and make vast money through this leverage trading feature in crypto assets.

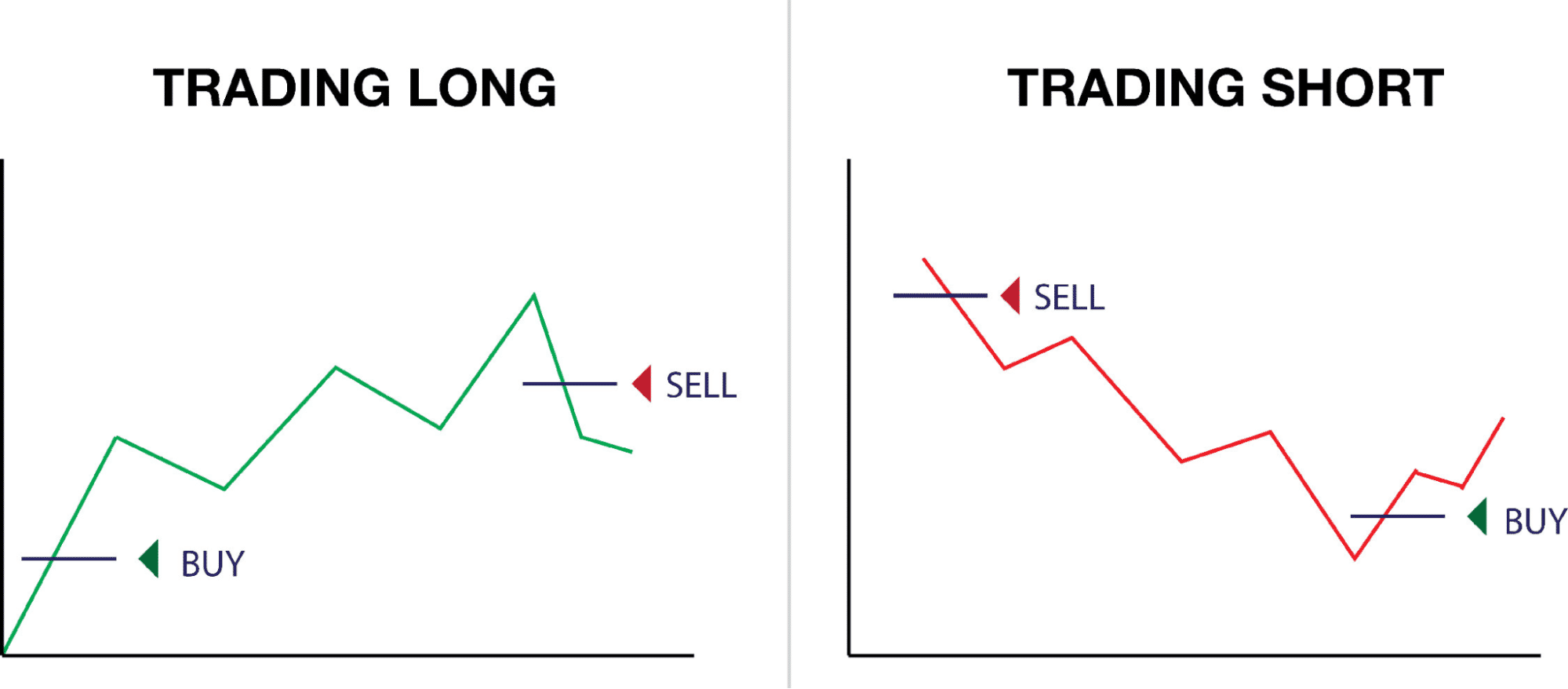

Tip 5. Long and short scenario

It is better to have a basic understanding when executing long or short positions. For example, you may have a $1000 deposit and use 10X leverage. So you may open a long position worth $10k in crypto X. Meanwhile the crypto price may be floating near $40k and increase 20% in value. So you get $2000 profit.

Now, when entering a short position using the same concept and parameters. If the price declines 20%, you get an opportunity to buy the same amount at a $2000 discount price; Meanwhile, if the price increases 20%, you need an extra $2000. So your account needs to add more collateral or lose your capital. On the other hand, if the price declines by 20%, you lose your investment or have to deposit $1000 more as collateral to continue your position.

How does this happen?

It happens as leverage trading increases your purchase power.

How to avoid mistakes?

When using leverage, don’t use the full potential of your wallet through leverage; try opening more trades than risk all your capital in a single position. Moreover, focus on flexibility factors of margin trading alongside utilizing proper trade and money management concepts while making investment decisions.

Final thought

Finally, when using any leverage crypto trading strategy, try to protect your account and ensure that all market contexts will favor your decision before executing trades. Otherwise, you may end up losing your collateral.