Foretelling the direction of the cryptos’ price may go is quite tricky. Indicators play the role of saviors for solving those difficulties.

MYC indicator is a tool conjoined with technical analysis to help traders anticipate the crypto’s price movement with more precision. However, technical analysis contingents upon previous data to provide the mathematical probability of price action. Then data from the equations are then outlined on a graph and positioned alongside a trading chart that assists traders in making decisions. Those mathematical probability structures become the indicators.

The MYC indicator will allow you to experience a fruitful crypto trading journey. The following section is for you interested in knowing the trading strategy using this tool. Here we will mention some basic mistakes made by the trader when utilizing this indicator and how to avoid those mistakes to make your trading succulent.

What is the MYC indicator?

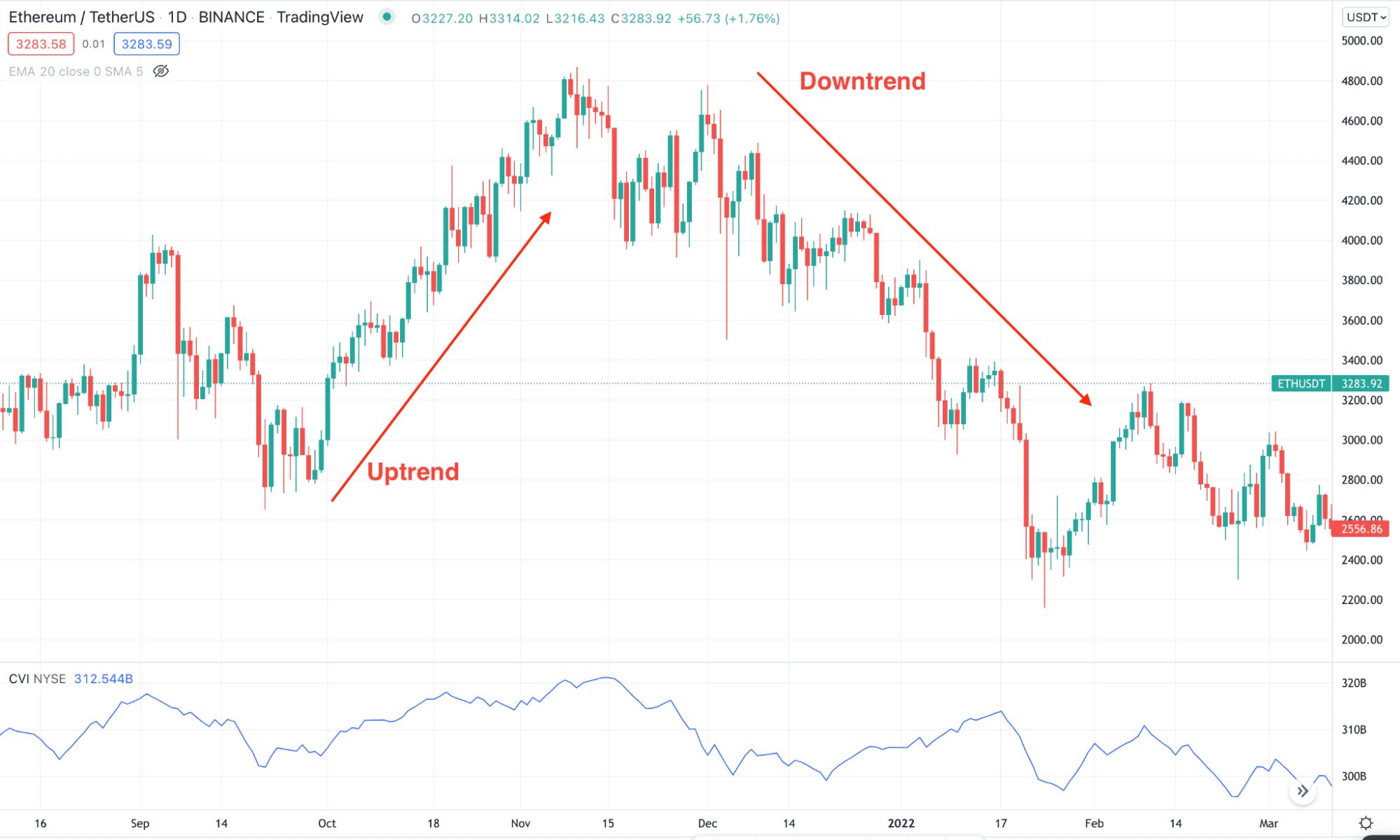

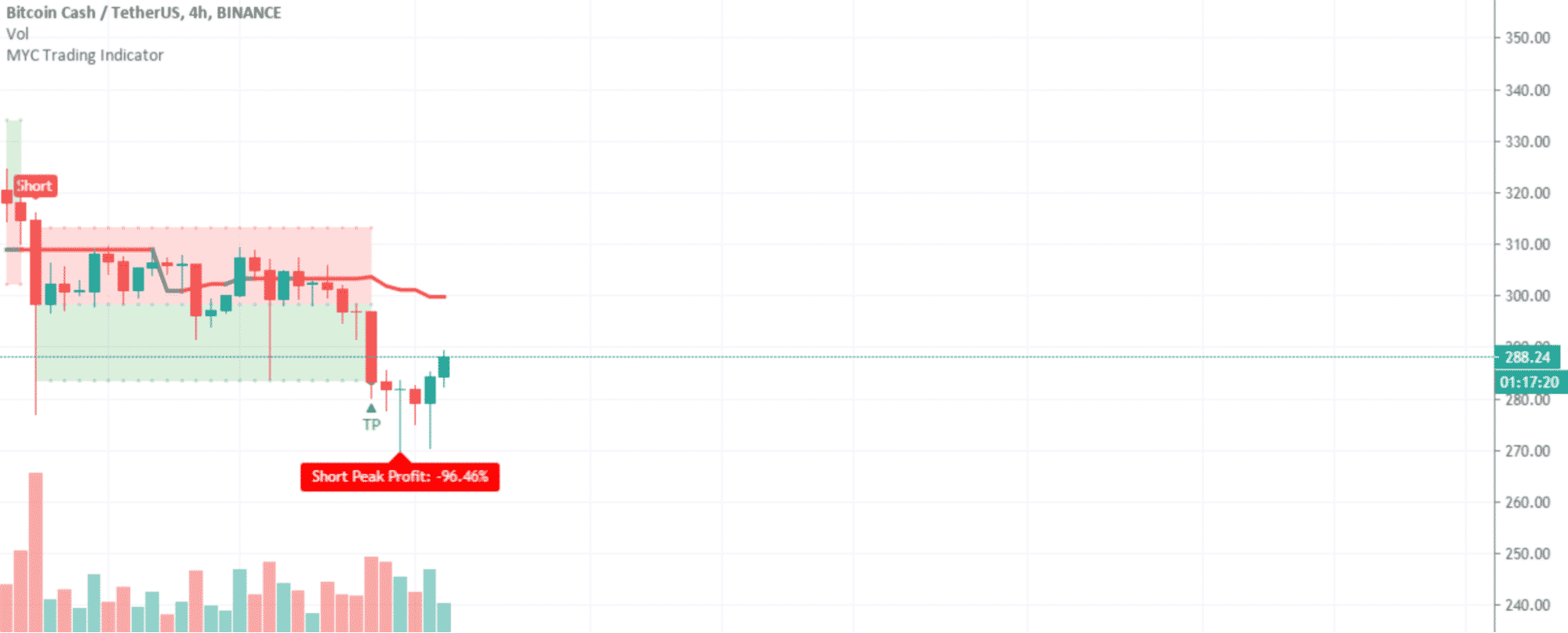

It is a private indicator that utilizes trend analysis and momentum oscillators to calculate the time that crypto may set foot in a bullish or bearish condition. The trendline is the prime aspect of the indicator. The trendline depicts when the price intertwines upwards, showing that a long signal is possibly produced.

Unlike other public indicators, the indicator gives approved entry and exit points. It allows traders to focus more on calculating their position size or the leverage size. Conversely, if the price navigates downwards, it possibly shows a short signal is generated.

Top five tips for trading with MYC

Indicators utilize graphs and equations to understand better what buyers and sellers should possibly do next. Although crypto signals do not assure the price shifts with 100% accuracy, their effectiveness comes from price momentum. The more momentum is seen in a direction, the more difficult it is to stop.

Here are the top five tips mentioned below. Following these tips while using the indicator may become more beneficial, and traders may generate more profits from grabbing the winning trades.

Tip 1. Use additional indicator

Applying the MYC with extra indicators may be the savior to avoiding false signals. Conjoining the trend-following indicators and MYC is potentially a better match.

Why does it happen?

In terms of better risk management, applying the stop-loss and take-profit levels may be advantageous. No matter how best the trading technique is applied, there is no 100% guarantee that the method may always provide accurate signals.

How to avoid the mistake?

When creating a trading strategy by utilizing the MYC, make sure that you do not mix it with the same kinds of indicators because their signal-providing origins can also come from the same points and may reduce the predicting ability.

Tip 2. Follow the trend

Market context is a system that identifies the trend’s criteria and has four elements:

- Impulsive

- Corrective

- Volatile trends

- Non-volatile trends

If the price makes new highs and lows recursively, it is alluded to as an impulsive trend. It shows the potential price continuity of the current trend. Besides, It is a corrective trend while the price barely makes new higher highs or lower lows and depicts a market reversal. However, in the case of the market, going together with the corrective structure depicting a market reversal implies a volatile trend. And the non-volatile trend surfaces with the impulsive market momentum during the price endeavors to continue the current movement.

Why does it happen?

Mainly, the market context is the conjoined price action and currency market circumstances incorporated into your selected price action signal. Not just the call that can make a good trading strategy, but the signal that makes sense within the market context it is set inside is behind a better trading setup.

How to avoid the mistake?

Traders may get quickly excited by a certain market trading setup and may miss all the context it’s beginning in. Such as, suppose you have two similar pin bars, but it is dependent on the market context, whereas one pin bar may be adding value to the trades, while another may end up being only junk.

Tip 3. Try not to forget the risk management

The crypto market is flourishing rapidly, and the market’s total cap exceeded $1.36 trillion in 2021. Seeing the expansion, many traders almost miss out on the fact that the crypto market is risk-associated.

Why does it happen?

Suppose you are keen to invest in cryptos and buy a stable crypto project with the full amount of your deposit. Unfortunately, the circumstance goes unexpected, and your invested project’s price dips by half, which implies that you are losing 50% of your entire deposit only by a solitary deal.

How to avoid the mistake?

In terms of keeping away from such circumstances, calculate the trade size. Do not get affected by emotions; rather, think rationally and take purposeful strides.

Tip 4. Stick on large-cap cryptocurrencies

Market capitalization works as a caliber to understand the value of crypto. Although it is an extensively utilized concept still, before making any trading decisions collect more information. So, the market cap is utilized as a standard of the reputation and dominance of cryptos.

Why does it happen?

The market cap concept is constantly facing criticism regardless of being utilized extensively. The crypto’s market capitalization somewhat discloses the long-term reputation.

How to avoid the mistake?

It is always suggested to do thorough and detailed research beforehand and then pay attention to all the influencing factors that may affect the cryptos you are keen to invest in.

Tip 5. Consider uncertainty

There is no such method that may generate guaranteed profits. So, you always have to decide when to trade and when not to. Having a clear picture is significant before taking entry into trades. The controlling power of the crypto market is in the hands of market giants, and you must be aware of it. Since the market is extremely volatile, it is obvious that here someone will win while someone will lose.

Why does it happen?

Having less knowledge of the market perception is one of the major downsides amidst the many other associated barriers to trading in the crypto space.

How to avoid the mistake?

Most of the time, amateur traders fail to identify the entry points and exit points before beginning any trade, making them just run after always to catch the highest prices. It happens only because the amateur traders only go with their optimism. So, you should mandatorily gather knowledge before starting to trade.

Final thought

The MYC is a unique tool for analyzing the market and providing insight into the direction the crypto price will move. It gives clear indications and specifies the overall trend. Hence, always try to heed the tips mentioned above in the time trading via utilizing the MYC to catch more high-yielding trades.