Are you a trader or planning to make deals in FX? So, you must have heard about a round bottom pattern. To make your trading successful in this market, you must learn about its operation structure.

The most important thing you need to understand is the trading strategies. One of the most profitable strategies is trading with a round bottom pattern. Let’s go through the complete procedure of this strategy.

What is the round bottom pattern?

The term reveals a lot about the strategy. It’s the pattern of an arc made by the fluctuations in prices. The pattern resembles the alphabet ‘U.’ It represents the market’s transition from a bearish state to a bullish state. In this trade, the prices initially go down till they become flat. Ultimately, when buyers dominate the market, prices gradually rise, showing a curve on the graph. Another thing to notice is, you’ll always find it at the bottom of the graph. That’s why it’s said to be a bottom pattern.

The curve of U can take longer to reverse, even days, months, or years. Do you have a hectic routine? Then, you should go for this strategy.

How to trade with the round bottom pattern trading strategy?

“Patience, patience, patience!!” will be our answer. Two primary things to do are an indication of pattern and targeting the profit.

For indication, volume is the critical factor. In the beginning, the volume will be higher, which will move down to the bottom. Then, after a specific time, the volume will again rise. To indicate it, you have to draw a neckline. The neckline should be horizontal, meeting both ends of U. It’ll seem like a candlestick acting as a bridge. If there is a neckline, it’ll ensure your win for the profit.

For targeting profit, measure the distance between the neckline end and the lower low. Then, mirror this distance. It’ll show you the potential gain. For better analysis, you can mark a target in the middle of the actual target you measured. It’ll help you to figure out whether the curve will reach the target or not. Always remember, there’ll be a sure profit if the curve breakouts the neckline.

Steps for round bottom pattern strategy

Here we have summarized the essential steps to carry out this strategy:

Confirm the pattern

The most potent signal for confirmation of pattern is volume, as described earlier. Therefore, it should decline from a higher position, remain lower, and reverse to the heights.

Draw a neckline

After confirmation, draw a neckline that will meet both the bearish and bullish ends of the rounding bottom pattern.

Watch the breakout

Watch the bullish line. It should drill the neckline as a result of an increase in volume.

Trade entry

Once the stock breaks the neckline barrier, the trader should take hold of it.

Put the stop loss

It would be best if you never traded without a stop loss. Nonetheless, we’ve confirmed the pattern, yet there is no warranty of a percent profit in the market. Is it scared you to death? Well, let’s discuss the location to place it.

A trader should place the stop loss at the midpoint of the curve. Another place can be below the low of the breakout line. So, you’ll be secured to leave in case of stock blackouts.

Catch the target

The profit target should be equal to the size of the breakout. You can monitor it. As explained above, once it catches your prey, gear up for the exit.

Bullish trade set up

Let’s find out a trade setup with an example.

Entry

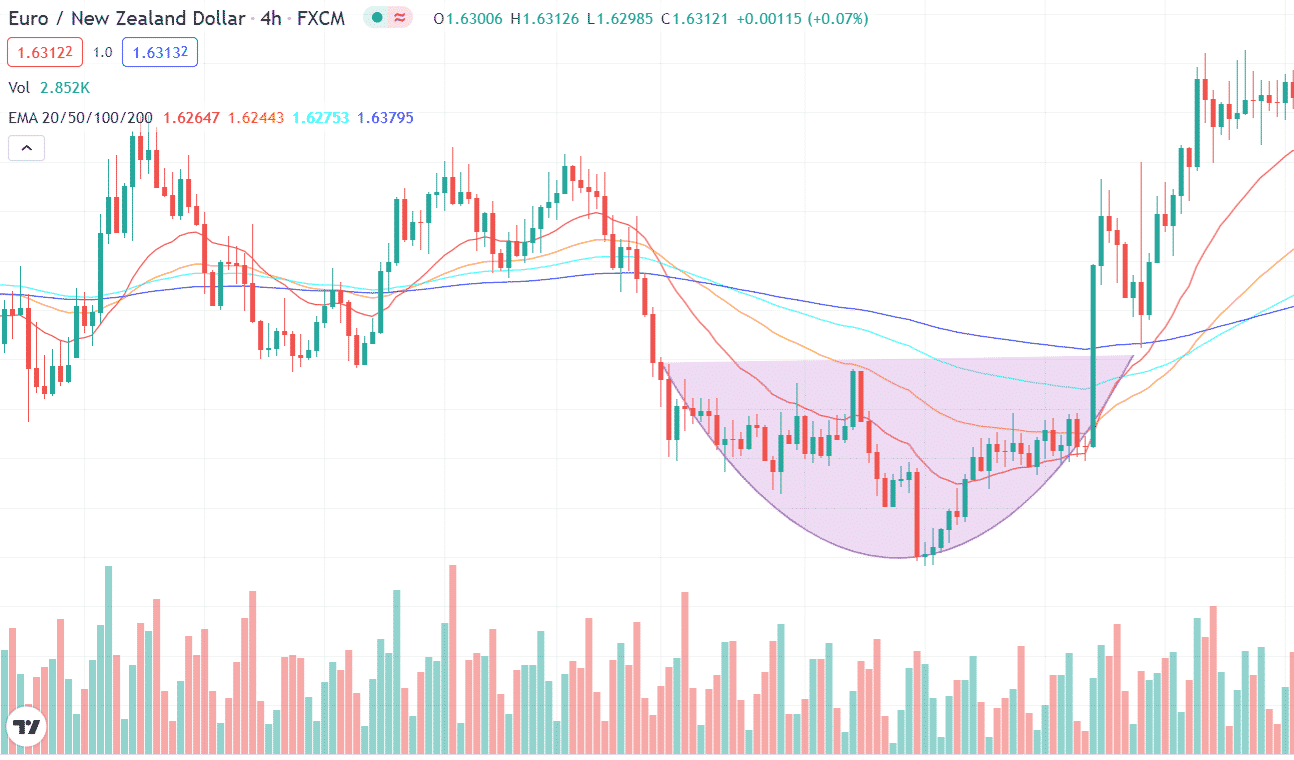

Here is a chart of EUR/NZD. You can see a rounding bottom. It looks like half a circle.

Wait for a breakout to occur. You may place a buy limit order just above the local high within the rounding bottom zone. Your order will be triggered when the breakout occurs.

Take profit

You can put the take-profit limit around the next resistance level. You can see the resistance level through your naked eyes on the chart. However, correlate the take-profit level with your stop-loss to allow a risk-reward ratio greater than one.

Bearish trading setup

Now, let’s find out a bearish setup with an example.

Entry

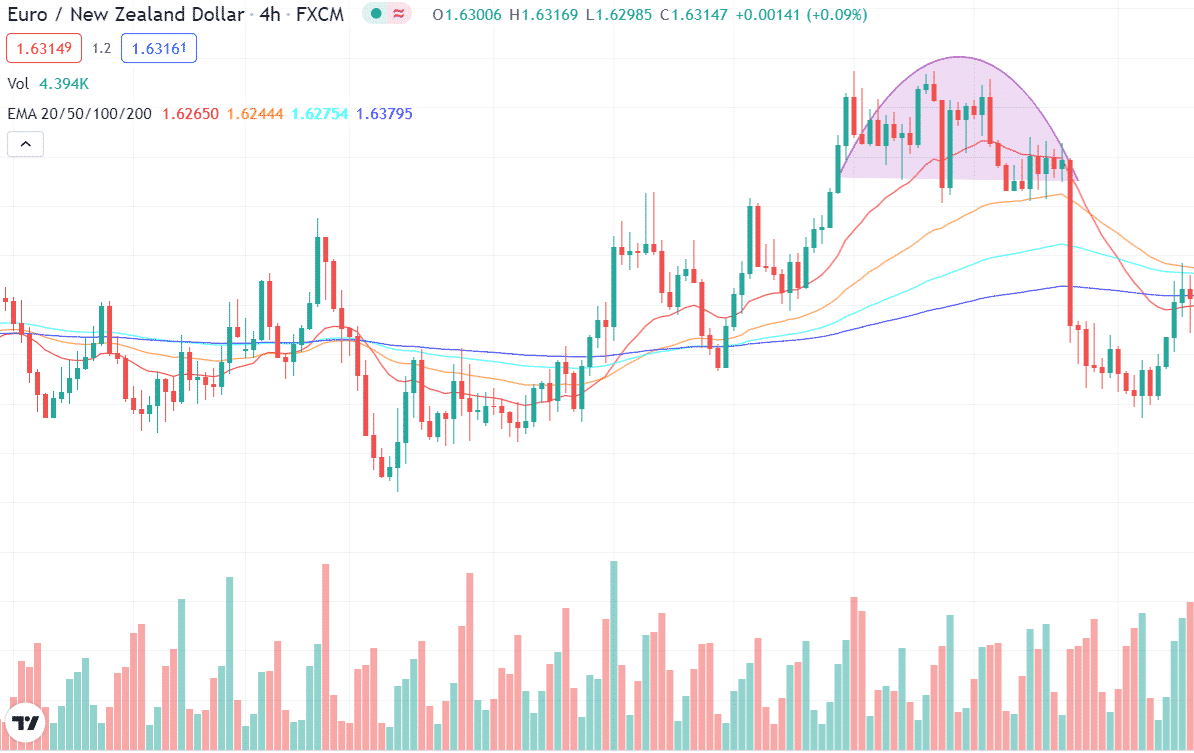

Have a look at the EUR/NZD chart below.

Once you find the rounding pattern on top of an uptrend, be ready for a bearish entry. Find the local high within the rounding zone and be prepared to enter on the breakout downside. You may place a sell limit order just a few pips below the local lows.

Take profit

You may place a take-profit limit around the next support level. It can be a horizontal level or demand zone as well.

How to manage risks?

Risks are part of trading. But, are you aware of the risks in this trading platform? Risk management is the factor without which you can’t think of getting your profit to its fullest.

Keep in mind that you can risk only 3 to 5% of your investment. So before learning to cope with risks, recall the risks of Forex trade; market, leverage, interest rate, liquidity risk & risk of ruin.

Here are the filtered tips to reduce your risks, irrespective of whether you’re a newbie or an expert.

- Learn about FX trading

- Use stop loss

- Use ‘take profit’

- Never risk more than your budget

- Lessen your leverage use

- Be practical while making predictions

- Make a trading strategy

- Be ready for the worst

- Control your emotional roller coaster

- Diversify the FX portfolio

Final thoughts

Rounding bottom pattern is a doubtless profitable strategy, yet it pays to those who wait for long. It can take years to reverse in a bullish form. You have learned the whole procedure of this trade before to start.