Scaling is a means of maximizing profits and minimizing risks in a trade and is popular among experienced traders. Scaling involves reducing or increasing your open position by removing units or adding trades.

If the market moves in your favor after you open a trade, consider adding a trade in the same direction as long as you see that the trend strength is intact. Once you have made some pips and want to protect your profits, you can close out some trades or a portion of your open position to have peace of mind.

While scaling looks beneficial to the trader, there are drawbacks to consider. You will learn all the potential benefits and drawbacks of scaling in this article. We will also teach you how to do scaling the right way not to subject your account to large drawdowns.

Benefits of scaling

The major benefit of scaling is peace of mind. When you scale into and out of positions, you do not feel the pressure of making sure you get your entries and exits perfectly timed every time. While there are times when you feel like you can pick tops and bottoms with great precision, you cannot do this feat all the time.

If you seek perfection in your trading, you will end up in discouragement. With scaling, you can be more relaxed when entering and exiting trades. When looking for entries, you can use value areas on your chart for direction. These areas can be:

- Horizontal support/resistance levels

- Trendlines

- Moving averages

- Supply/demand zones

To scale into positions, divide your position into multiple parts. For example, if you usually open 0.5 lot size, you can open five trades with 0.1 lots each. Your entries do not need to be accurate. You can open one trade every time the price moves into a value area and keep adding trades until you get to your desired position. You can do the same method when taking profits but in reverse.

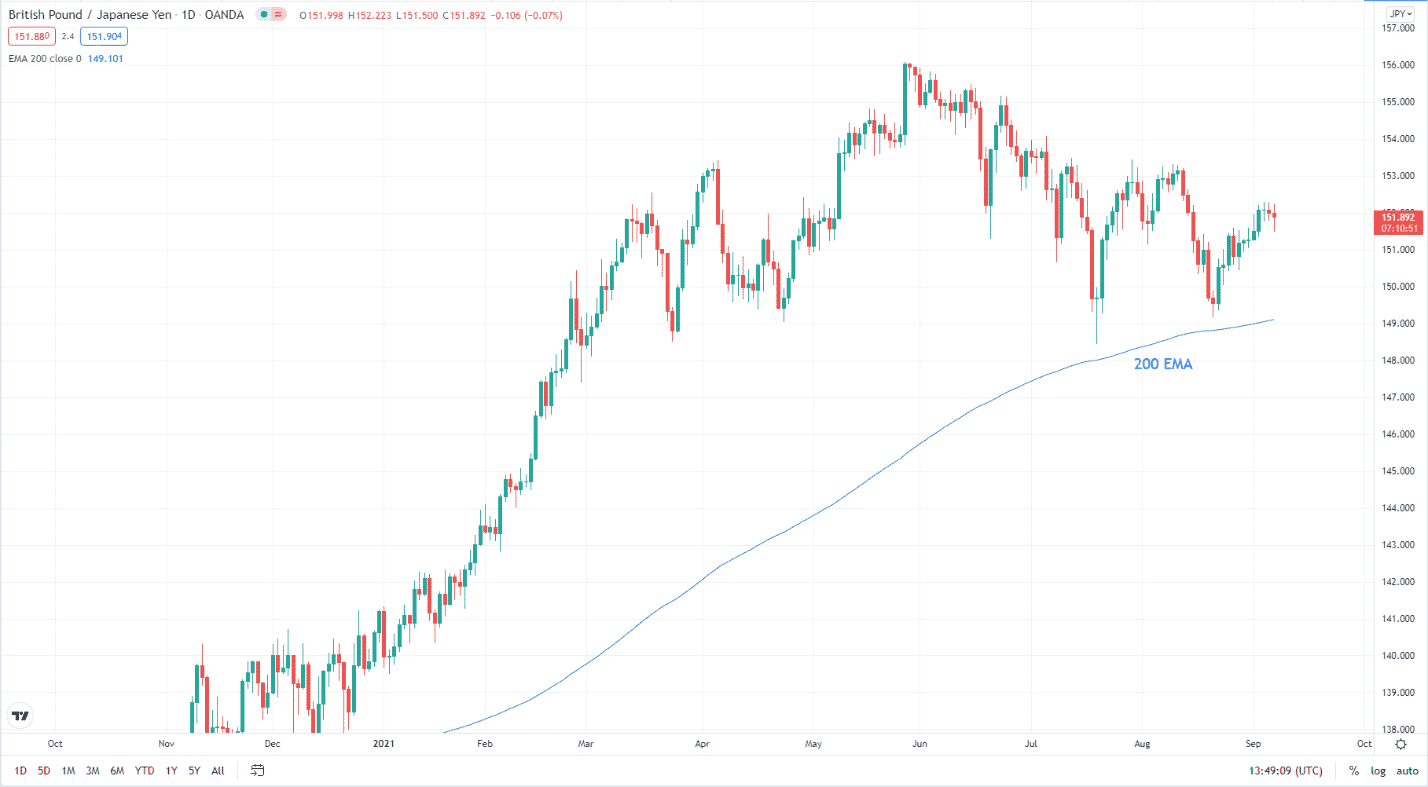

Consider the above daily GBP/JPY chart. Since the price is above the 200 EMA, you can make this market bullish. Thus, you might decide to take a long position. With scaling, you can build such a position slowly, as shown in the image below.

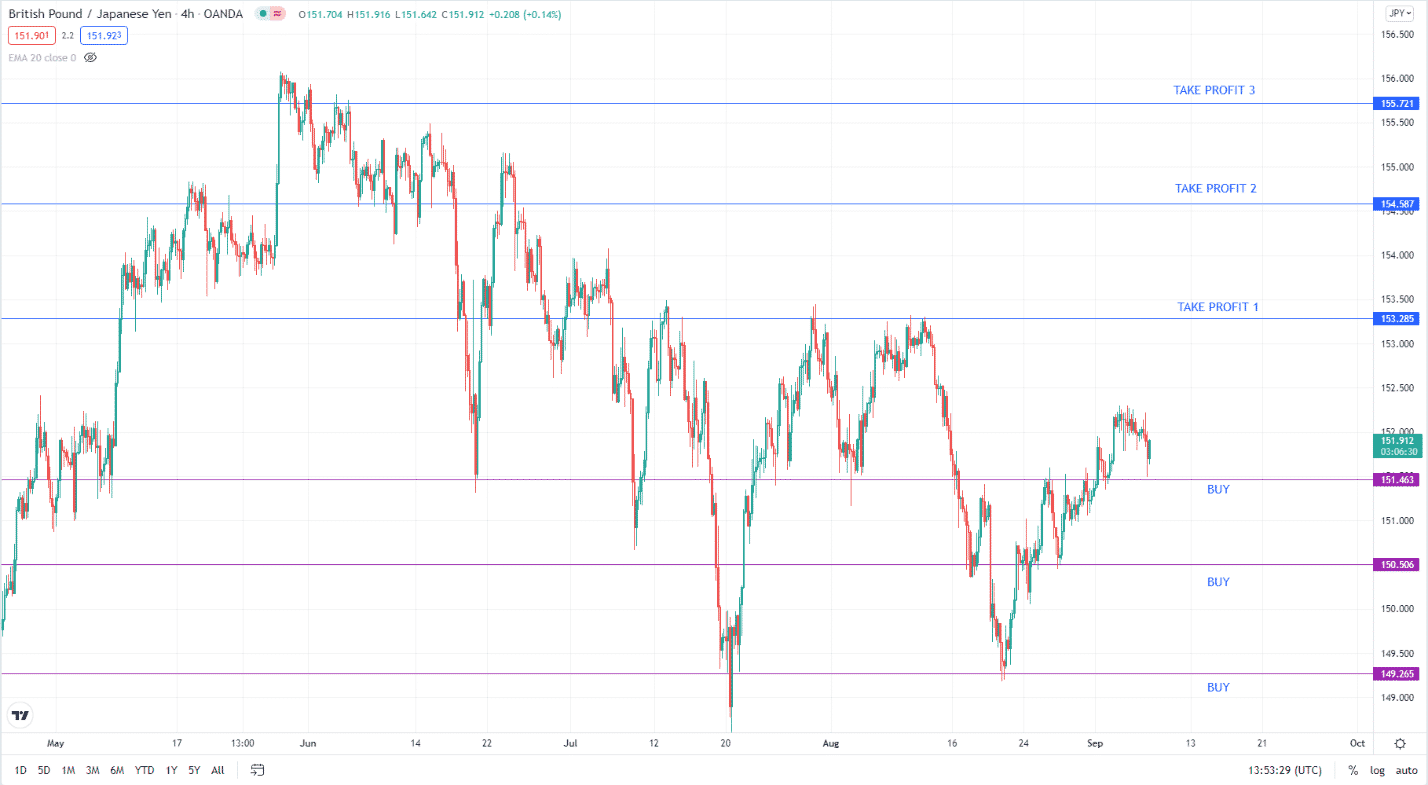

We go down to the four-hour chart to draw necessary support and resistance levels. We have identified three support levels where we could place buy trades. Every time the price drops down to one of these levels, you open a buy trade. In this case, your long position will have three buy trades if the price goes all the way down to the last support level.

We can also use the same concept when taking profits, assuming price moves in our favor. You could use the first resistance level to take profit of the last trade, second resistance takes profit of the second trade, and third resistance takes profit of the first trade.

With this method, you do not have to watch your chart all day, waiting for the price to hit any of the support levels to take a long trade or close the open buy trades. You place buy limits in each of the three levels or set profit targets, and then you can walk away to do something else.

Drawbacks of scaling

The main downside of scaling is more risk exposure as you add trades to your open position. As a trader, you are a risk manager, and your job is to manage risk.

The second downside of scaling is reduced profit as you take off some portions of your position. As traders, we engage in forex trading to make money. Since this market is volatile, it helps to lock in some profits when the trade is profitable and let the trade run risk-free. However, as you mature as a forex trader, you will come to realize that making money is secondary in importance to protecting your capital.

Scaling technique

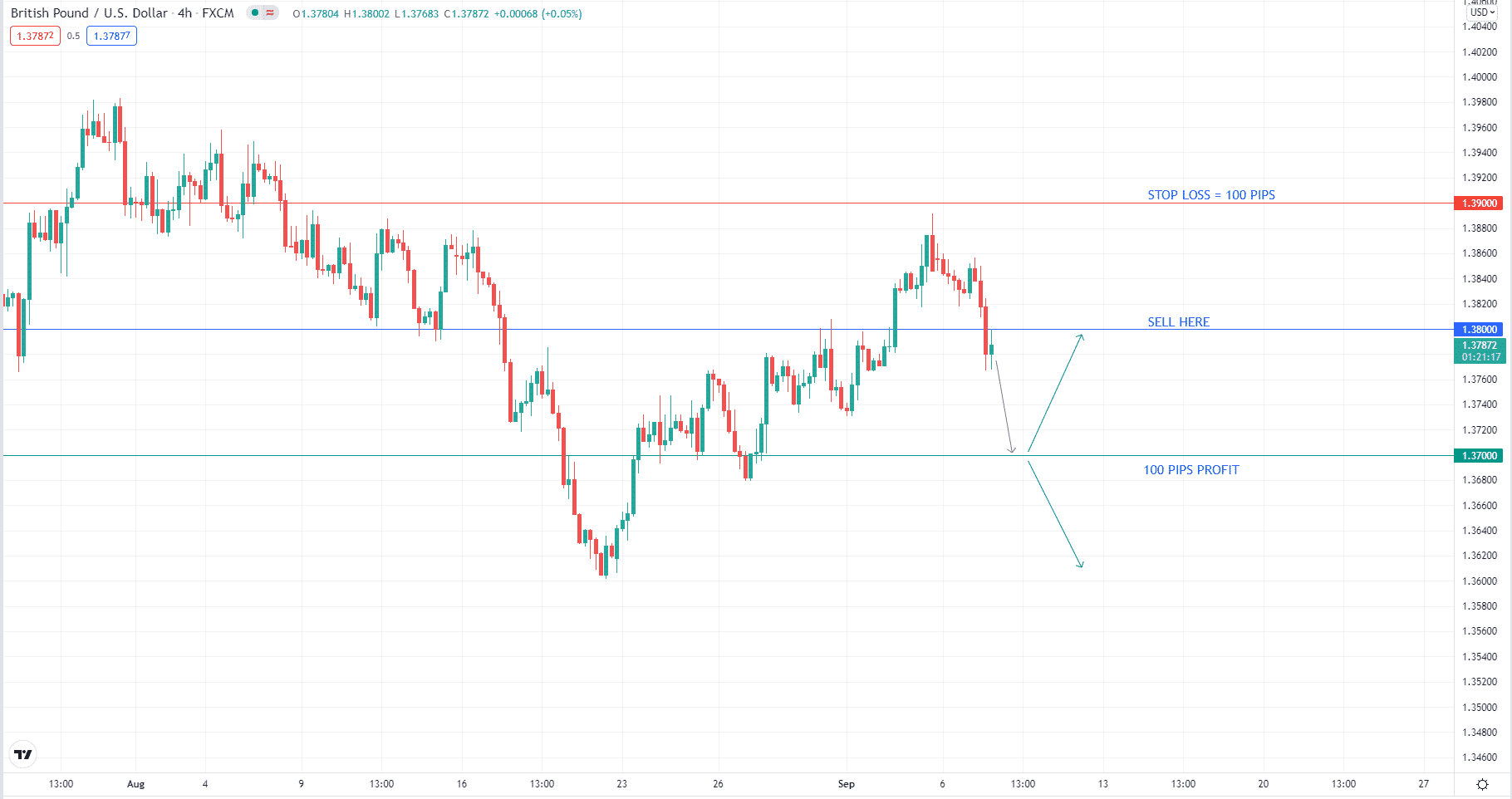

Let us use an example to illustrate how to scale out of position. Suppose you sold 10,000 units of GBP/USD at 1.38000. Let us assume you have $10,000 in your account. You put your stop loss at 1.39000, which is 100 pips above your entry price.

Then you put your take profit target at 1.35000, which is 300 pips below your open price. With 10,000 units of GBP/USD (value of one pip is $1) and a stop distance of 100 pips, your position involves a risk of $100, which is one percent of your capital.

After a while, GBP/USD moved down to 1.37000, which is 100 pips in your favor. At this point, you have a floating profit of $100, or one percent of your account. When you check the economic calendar, you find out that the Fed will release news that could weaken the US dollar.

If you think this news event could draw dollar sellers into the market and do not know if the pair will continue its selloff, you could consider locking in some profits. This leads you to a decision to take half of the position off the table at 1.29000.

As you do this, you secure $50 of profit. Now you are left with 5,000 units of GBP/USD in the short position. At the same time, you move the stop loss to breakeven to trade for free. Two scenarios could happen from here onward. Either price goes up and takes out your stop at 1.38000, or it keeps going down.

In the first scenario, the market closed the trade with zero loss. In the second scenario, you are bound to make more profits. The trade-off here is that the remaining position will generate fewer profits than it could have had the original position been maintained. Refer to the chart above for reference.

Final thoughts

Scaling in and out of position is a technique often used by experienced traders. A novice trader would hardly grasp this advanced concept in currency trading. For example, closing half of an open position might sound foreign to a newbie, and he might think it is just a concept, not an actual possibility.

In the future, if you have gained more knowledge and experience, you could dive deeper into scaling if this money management method appeals to you.

Of course, scaling is not suitable for everyone. Having this knowledge is not a requirement for trading success. As long as you use a sound money management scheme, you can succeed in this business.