In trading, there is a strategy that brings out the adrenaline rush in traders. But, of course, the strategy we are talking about is scalping.

Scalping is a trading style in which you open and close positions in a matter of seconds or minutes. Then, you go in and out, making an excellent 2 to 4 pips in a blink of an eye. Although it is a popular trading strategy, many traders don’t know how they can scalp adequately.

In this guide, we’re going to talk about the top four tips to improve your scalping strategy by following a few simple techniques.

Tip 1. Multiple time frame analysis

While trading, traders use a top-down method called multiple time frame analysis. This method allows you to see the longer-term trend while finding excellent entry points to analyze high winning probability on a minor time frame chart.

The technique of looking at the same currency pair in several periods is known as multiple time frame analysis.

For multiple time frame analysis, you’ll look at the daily or weekly charts and then return to a 1-minute or 5-minute chart and take your positions.

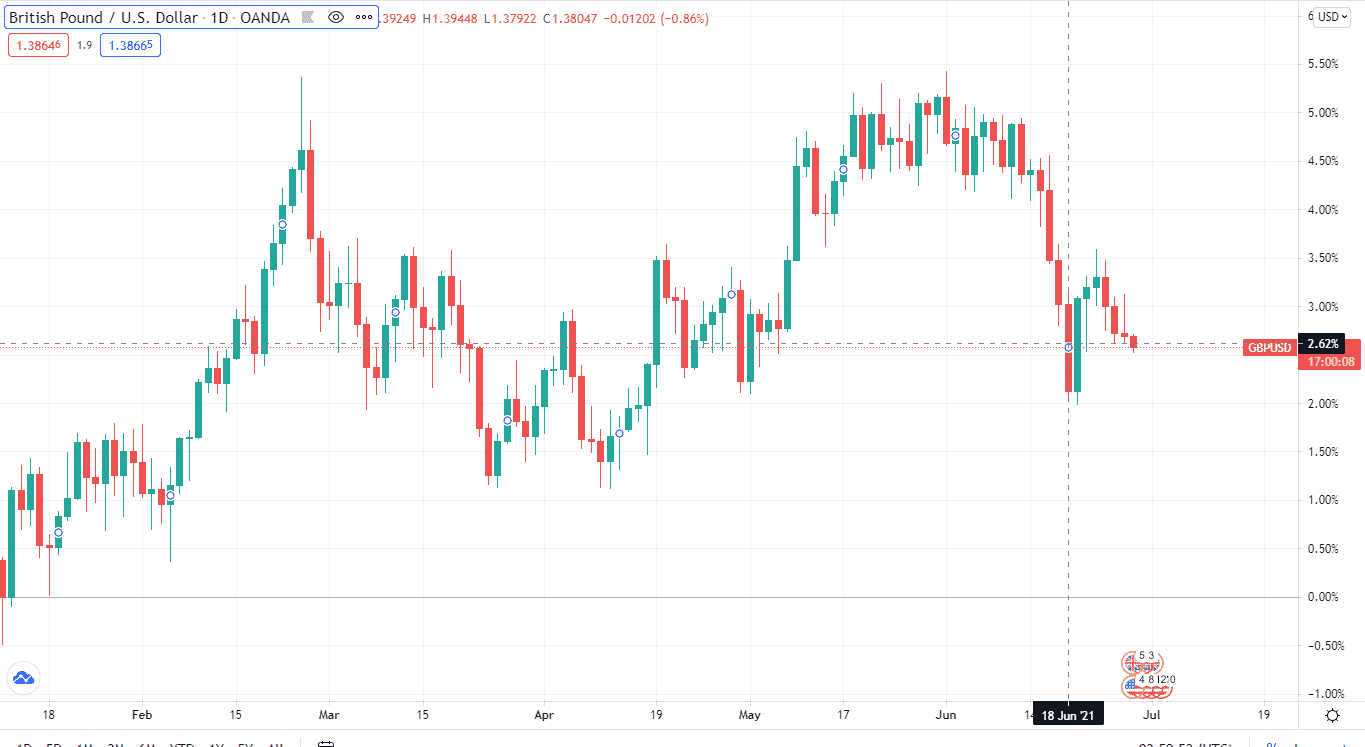

Let’s explain this on the chart.

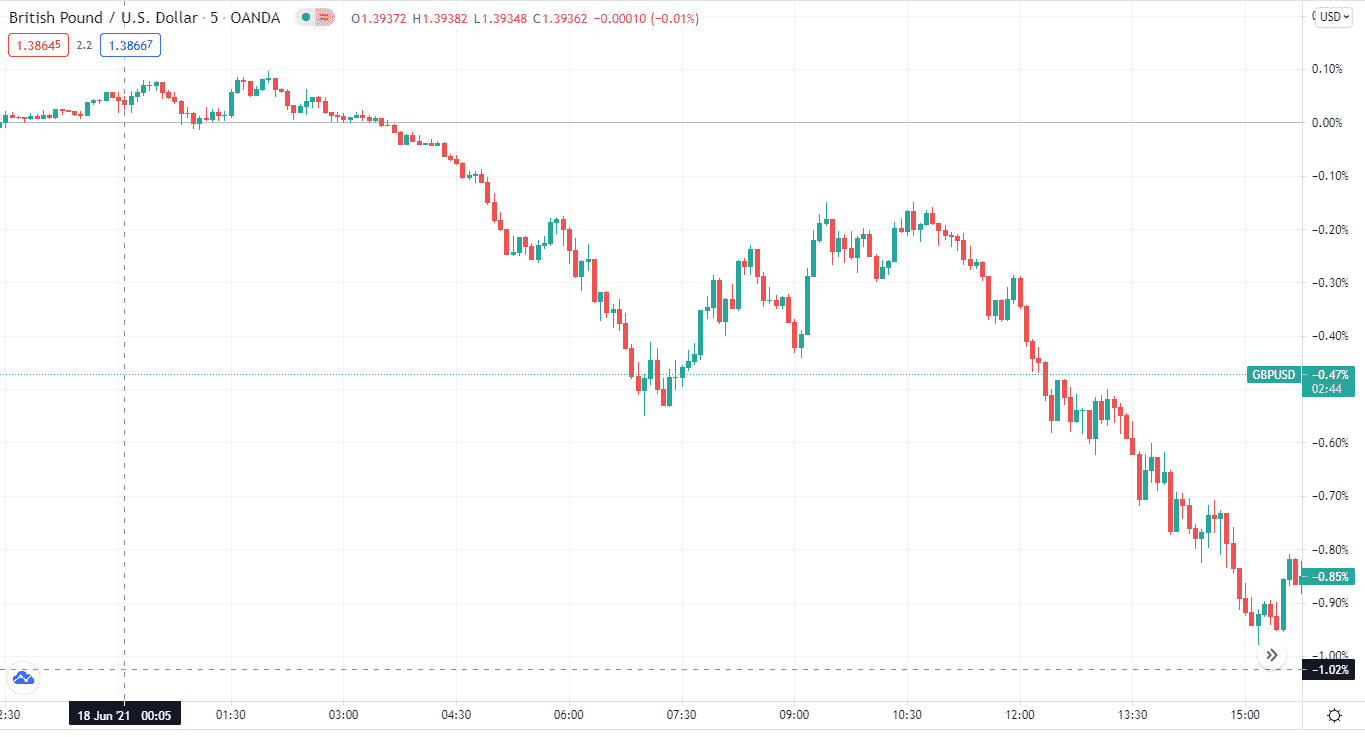

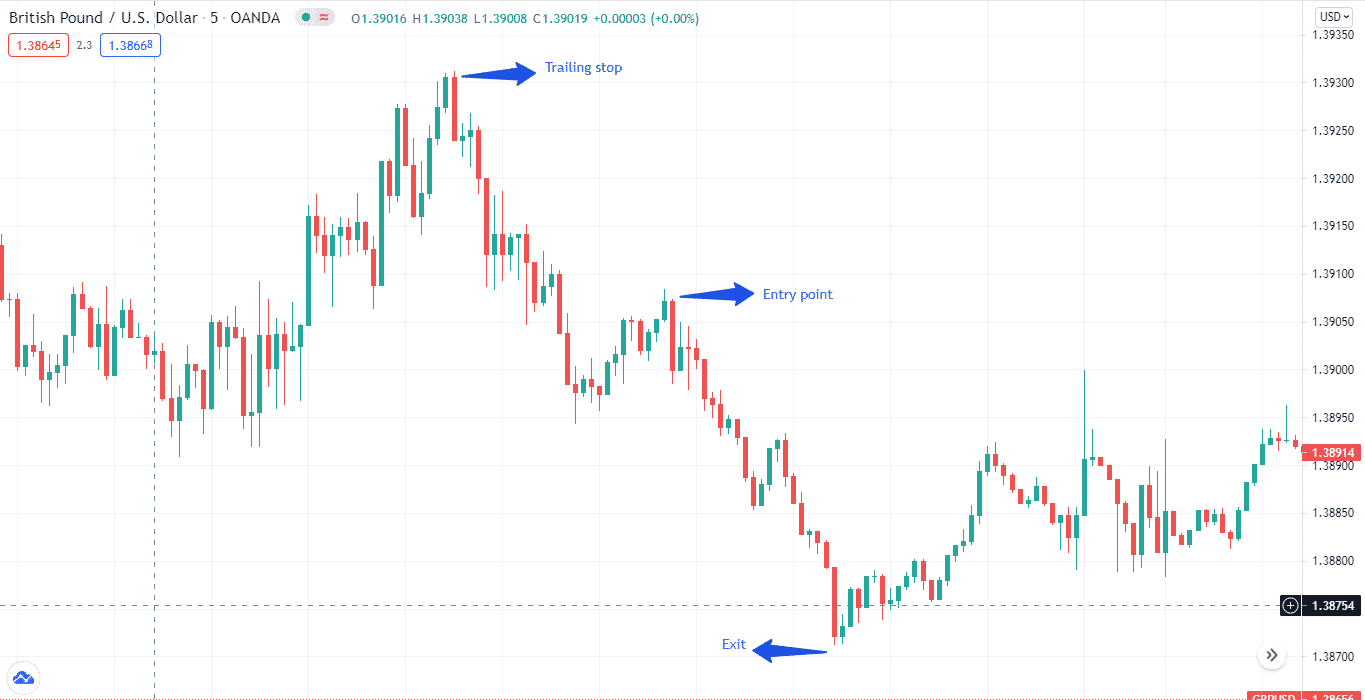

Below are daily and 5-minute charts. As you can see, there’s a bearish candle on June 18th on the daily chart. However, when you return to the 5-minute chart, you can notice that the overall trend is downwards.

At this point on the chart below, you can take your scalping positions.

Why does this happen?

Several time frames are starting from 1-seconds to yearly. The shorter the time frame, the more false signals it will show.

How to avoid a mistake?

Using a larger time frame can help you avoid false signals.

Tip 2. Support and resistance

Support and resistance detect price levels on a graph by pointing to swing lows and swing highs.

- Support level illustrates swing lows

- Resistance shows swing highs

Therefore, you can look for buying opportunities at the support level and sell positions at the resistance level.

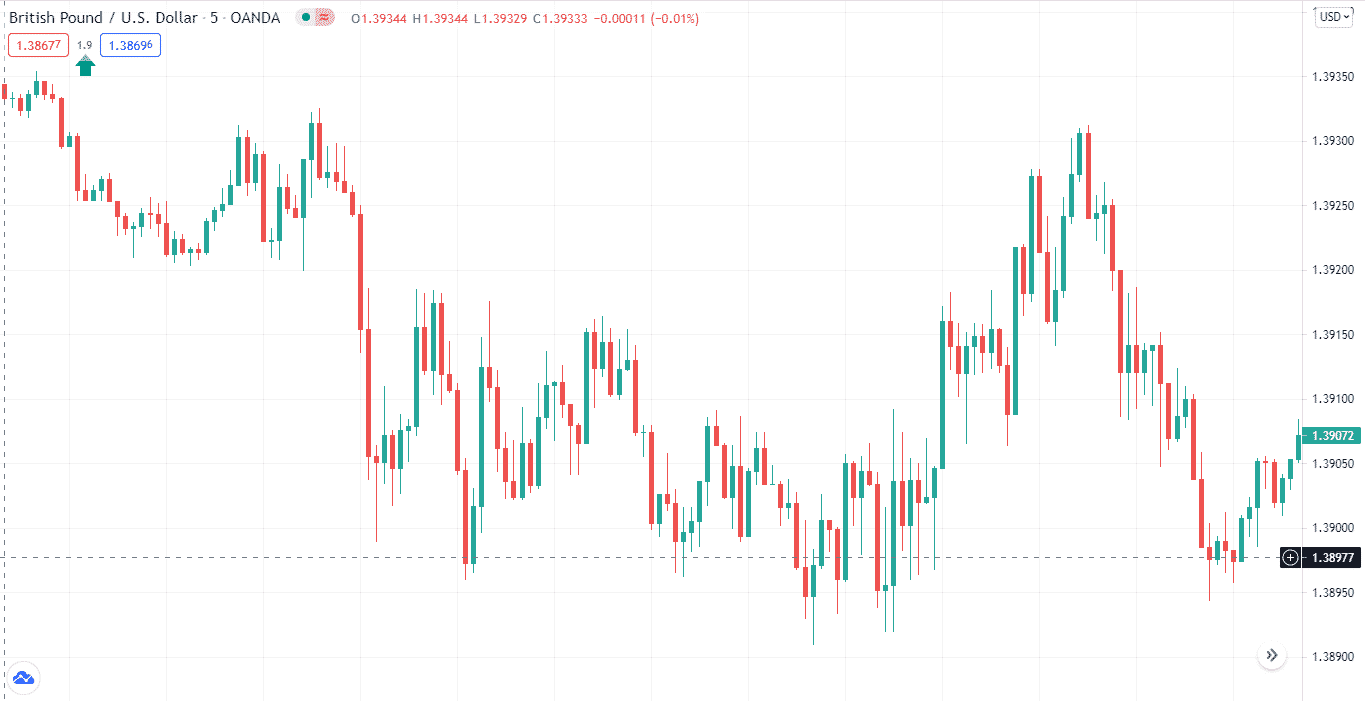

As you can see on the above chart, there’s an uptrend at the support level and a downtrend at the resistance level. As a scalper, it’s essential to understand these levels, as you can see the price fluctuations and forecast what’s going to happen next.

What does this happen?

The price makes several peaks and troughs on the chart. Peaks are resistance levels, where troughs are support levels.

When the price makes a peak, it retraces back to form a trough. Similarly, when the price creates a trough, it goes upwards to form a peak. This is like a circular motion.

How to avoid the mistake?

To boost your scalping approach, you need to enter the support levels and exit the trade on the resistance levels. Again, there’s no rocket science here. You can quickly identify price’s swing lows and highs by following the price action.

Tip 3. Test different pairs

As a scalper, there’s a lot to digest for you daily. But the most important aspect is choosing a currency pair.

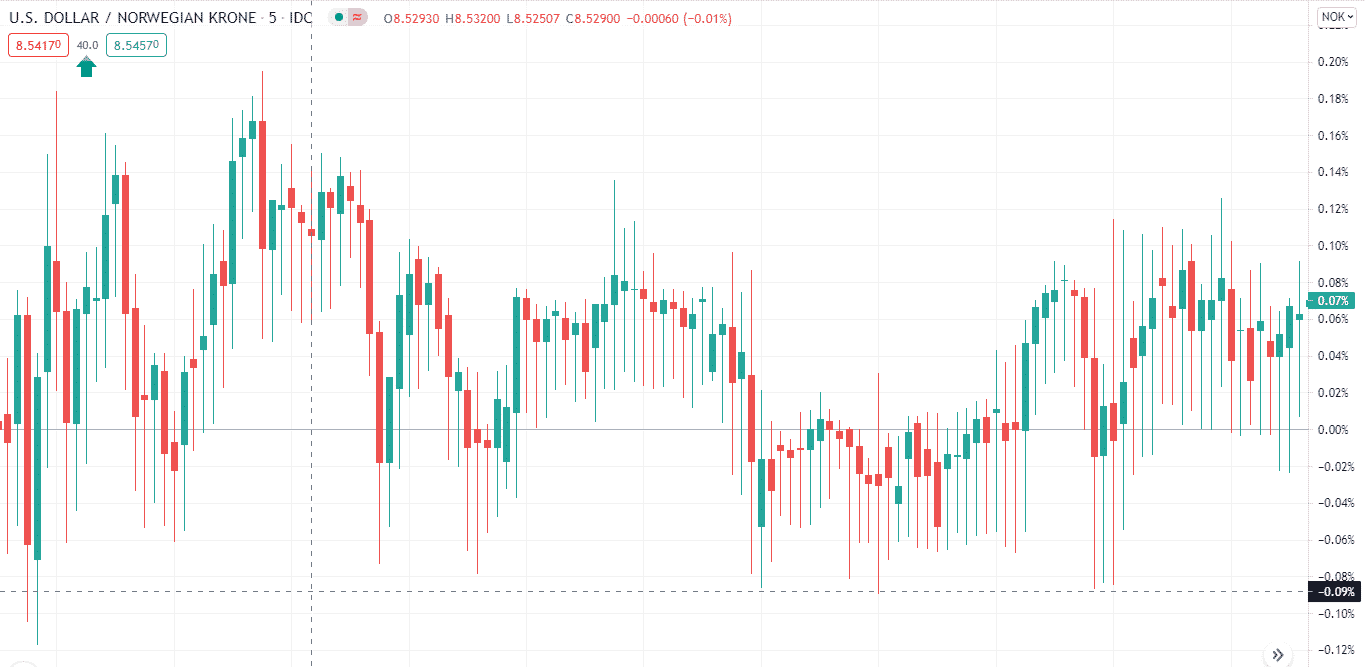

Various forex pairs range from majors like GBP/USD, minors such as EUR/JPY, and exotics like USD/NOK.

The thing with minors and exotics is they have a higher spread. And even on forex majors, the spread varies. As a scalper, you don’t want the spread to eat your small profits. Therefore, you don’t have to stick with one pair in scalping.

Look at the spread on USD/NOK against the spread on GBP/USD. Spread indeed depends on your broker, but no broker offers spreads on exotics similar to FX majors.

Why does this happen?

Currency pairs have different volatility and liquidity. Some are more volatile than others. Therefore, they have large spreads.

How to avoid a mistake?

Pairs may help you get a lot of bang for your buck with your approach. You should test your strategy on multiple pairs.

Major, minor, and exotic pairs are the three basic types of pairs. All of them have the potential to be volatile, but minors and exotics are the volatile ones. So, it would help if you tried forex majors to reduce the spread.

Tip 4. Trailing stop

A trailing stop lets you lock in your profits and protects you from losses. To place a trailing stop, you set it as a standard stop-loss order. If you are going long, then you put a trailing stop below the entry point. On the other hand, if you are short, you place it above the entry point.

The good news is most brokers allow you to have a trailing stop order, so you don’t have to place it manually. However, there’s a catch. While stop-loss doesn’t move when the price moves, a trailing stop moves in your favor when the price moves, locking your profits.

Why does this happen?

When you look at the price in smaller time frames, the price makes several moves instantly. As a result, a regular stop-loss order might not be practical, as you don’t have enough room to give to the trade.

How to avoid a mistake?

By placing a trailing stop, you can limit your losses. This is because it’ll move as the price moves, locking in your profits.

Tip 5. Trading session

A trading session is a period during which banks and other trading market players trade.

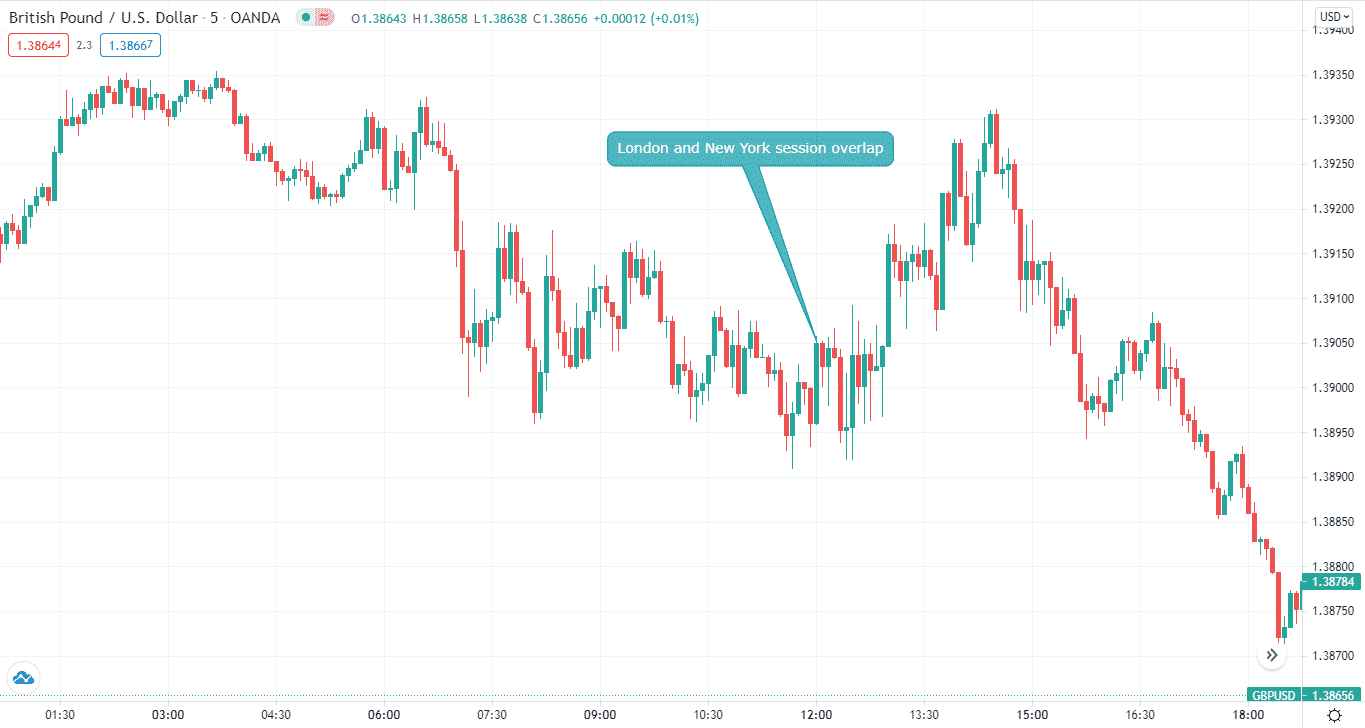

London, New York, Sydney, and Tokyo, are the four introductory FX trading sessions. The most vibrant sessions are London and New York, as volatility is high. For your scalping strategy, you need to take positions in these two sessions.

Let’s once again look at the chart. This candle represents a London/New York sessions overlap. As you can see, we got a big beautiful bullish candle.

Why does this happen?

As more players are involved in trading, volatility increases. The London session is the busiest session on the planet. Of course, this surges volatility. And when you want to enter and exit quickly, you need to take a good look at volatility.

How to avoid a mistake?

You can take positions during the London and New York trading sessions or when these two overlap.

Final thoughts

Scalping doesn’t have to be complicated. By following the tips mentioned above, you can take your trading to the next level.