Slippage may be either a welcome surprise or an unpleasant bonus, depending on how they go. It is defined as the difference between the real cost and the estimated cost in economics. Its value may be +,-, or 0.

This article will introduce you to the role of slippage in FX trading and ways to minimize its risk. It is influenced by whether the order is a sell or buy, whether it is an open or close order, and how the rate moves. So get a better understanding of it and some steps you can take to minimize your risk when trading. If you want to learn how to reduce the risk of losing money due to slippage?

How can I make money from slippage in FX trading?

This type of situation most frequently occurs in dynamic, unpredictable markets that are predisposed to sudden and unexpected twists in the market.

Price differences can be positive or negative based on the nature of the market movement, the length of your position, and whether you are opening or closing the position.

Even if it affects your positions, you might still be charged a higher rate for certain orders. With the best trading policies, if a price moves beyond its tolerance limit between the period you place the order and the time it is executed, the order will be rejected.

The advantages of this are that you are somewhat protected from the negative consequences when opening or closing a position. Nevertheless, if the price changes in your favor, brokerage firms will fill your order at a more advantageous price.

You can also use limits or guaranteed stops on your open positions to defend yourself from slippages as an alternative to this. Limit orders allow you to reduce this factor when executing or terminating a deal since a limit order only fills at the price you specify. In contrast, guaranteed stops close the investment once the asset’s price drops to the specified limit. Upon triggering the latter, you must pay a premium.

How does slippage occur?

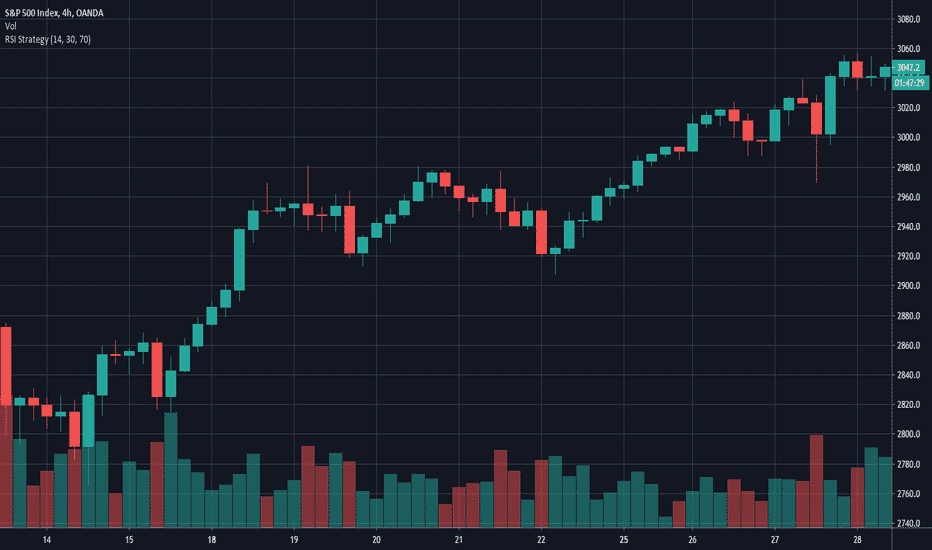

There is a tendency for slippage to appear when market activity is minimal. Low liquidity markets have fewer market traders available to take the other side of a trade. Hence, a longer time gap exists between submitting an order and completing it after a buyer or seller is located.

As a result, an underlying asset’s value can fluctuate, resulting in the loss. Pricing can move rapidly in volatile markets – even in the fraction of a second it takes to place an order.

Role of slippage in FX markets

The most common cause of slippage during forex transactions is a busy market with low liquidity. The problem usually arises on the less-favored currency pairs, as high liquidity and low fluctuations are prevalent in popular pairs like GBP/USD, EUR/GBP, and USD/JPY.

Take, for example, the case in which you choose to open a long position on a highly volatile currency pair like EUR/USD after it was priced at $0.7026. It is possible that the item’s value increased to $0.7028 in the time between ordering and having the order executed.

If this were the case, then you would have just encountered overpayment because you would have bought at a cost more than you originally expected.

When to watch out for it?

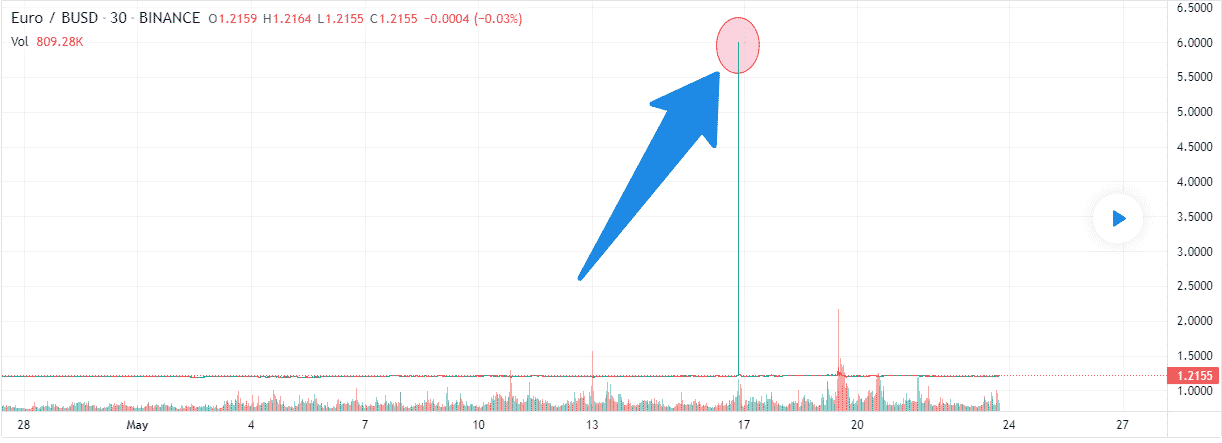

Whenever there are major events in the news, there is often slippage. For example, whenever a bank announces its policy or rate changes or when a company releases earnings or changes its top management, you may experience an increase in volatility, increasing your risk of losing money.

For instance, a change in company leadership isn’t always predictable, such as announcing a change in the chief executive. In addition, it is often unclear what will be announced at other meetings, such as the Federal Reserve and the Bank of England.

How to manage risks?

If you want to eliminate the impact of slippage on your financial transactions, follow these steps:

Trade markets with low volatility and high liquidity

When dealing in low-risk and high-liquidity markets, you can reduce the possibility of loss. Due to it, the price is less prone to changing rapidly, and the market’s high liquidity ensures that many participants will accommodate your purchase.

Additionally, you can limit your trading hours to those that see the most activity to minimize your exposure to price fluctuations. Because of the high liquidity of these hours, this is when you will experience the most profit. This means that your transaction is more likely to be completed promptly and at the price that you specified.

Apply guaranteed stops and limit orders to your positions

As opposed to other types of stops, guaranteed stops are not liable to slippage, so your trades will terminate at precisely the level you specify. However, unlike other stops, guaranteed stops will charge a premium if activated. As a result, they are an ideal strategy to safeguard yourself from the consequences of a market-moving in opposition to you.

In the meantime, limits can help lessen the probability of slippage when you are starting a trade or collecting profits from a lucrative trade.

Find out how your provider treats slippage

Some brokerages will still process the order when one opens or closes a position, even if the value moves contrary to them. However, this will never happen when you work with an authentic brokerage firm since our order processing system will never fulfill the order at a level below what you requested, although it may be denied.

As a result of our tolerance levels, FX brokers limit either side of your target amount. Upon submitting your order, they will implement it at the specified level if the market is within this limit when your order is placed. Therefore, the broker will take one of the following actions if the price moves outside of this range.

It is ensured that you obtain a higher rate if the price moves up. In this case, the FX broker cannot close the position before the payment slips to a more favorable level. You will receive the bonus profit.

The price will be declined if it moves beyond our permissible level of opposition to you, and they will ask you to submit it at the current fee instead.

Final thoughts

There is no exact way to avoid slippage when trading. It is a sudden market movement during the brief interval between submitting an order and its execution by a broker or exchange.

Slippage can be minimized by trading during a market’s most active period, preferably in markets with low volatility or by choosing highly liquid markets. You can benefit from slippage as well as suffer loss, as you may get a better deal than you anticipated. Limit your trades and place guaranteed stops to protect yourself from slippage.