Candle formation is a vital factor in the financial market. Using candles to predict future movements and making trade decisions is common among market participants. The spinning top candle is a typical candle formation on any financial asset chart, and traders frequently use this candle to generate profitable trade ideas.

However, making trade decisions depending on a single candle is not a wise idea. Combining the candle with other technical indicators and tools to determine the market context and making precious trading positions requires a particular level of understanding.

In this following section, we will discuss the spinning top candle besides explaining trading strategies. Later, we will list professional tips for risk management.

What is a spinning top candle strategy?

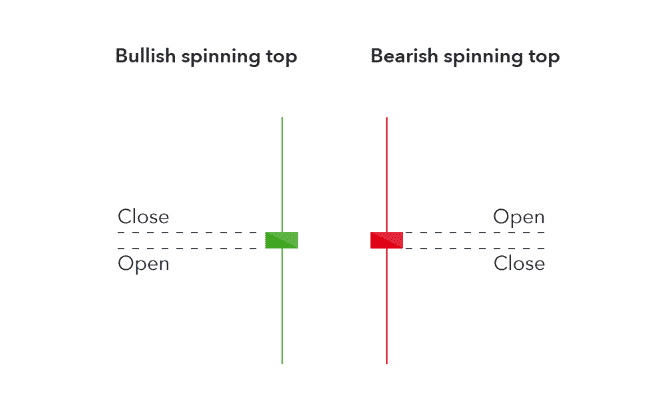

This candle usually reflects confusion among traders as the opening and closing price difference is not so vast. It is a single candle formation on many phases of price movements signaling different price directions. An ideal spinning top candle has the same size wicks on both sides of the body, and the body size will be tiny than the wicks. It can be green or red.

A spinning top candle strategy is any trading method that uses this candle formation to generate trade ideas. The bullish spinning top candle has a green body, and while the body is red, it is a bearish spinning top candle. The signals remain the same whether the body is red or green of any spinning top candle.

How to trade using this strategy?

The spinning top candle reflects confusion among participants as it has a petite body and wicks on both sides. Wicks on both sides prove that the price goes both upper and lower than the opening price and close near it.

So the formation represents a bargain or indecision during any particular period. When this candle takes place during an uptrend, it indicates that buyers are taking a rest or a consolidation occurring before another bullish pressure on the asset price. Otherwise, sellers may take over the asset price and an upcoming declining pressure on the asset price.

Meanwhile, a spinning top candle on a declining price movement reflects the same continuation or upcoming reversal signal. This candle formation generates the most potent reversal signals by appearing near any support/resistance level. It signals an upcoming bearish momentum by occurring near any resistance level, and traders expect an upcoming bullish momentum when it takes place near any support level.

How to make trading decisions?

However, it is not wise to make trade decisions depending on one candle. So experts often wait for a few next candles to ensure future price directions. Additionally, they frequently use many technical indicators and tools to determine trading positions in conjunction with the candle.

For example, you may use the stochastic oscillator for trading. When the spinning top candle occurs near any resistance level after a strong bullish momentum and the stochastic oscillator creates a bearish crossover near any overbought level signals a possible reversal, an upcoming declining pressure on the asset price.

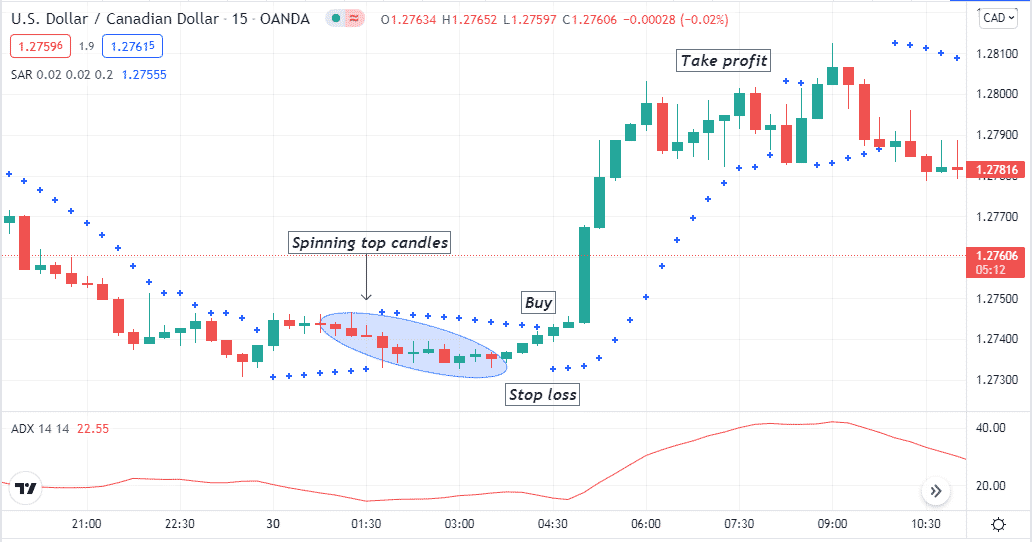

We use the parabolic SAR and the ADX indicator alongside the spinning top candle in our trading method. The parabolic dot switches positions with trend changing and detects the swing highs and lows. Meanwhile, the ADX indicator indicates the current trend’s strength by a dynamic line on an independent window.

Bullish trade setup

When seeking selling opportunities, spot a spinning top candle near the finish line of a downtrend. Then observe when:

- The parabolic dot starts taking place below price candles.

- The ADX value increases above 20.

Entry

When these conditions above occur after any spinning top candle near any support level, declare an upcoming bullish pressure on the asset price. This method suggests opening a buy position here.

Stop loss

The initial stop loss level will be below the current swing low with a buffer of 10-15pips.

Take profit

The spinning top candle doesn’t give any idea of the profit target. Continue the buy order till the bullish momentum lasts. Close the buy order when the parabolic SAR dot switches position and the ADX value decreases.

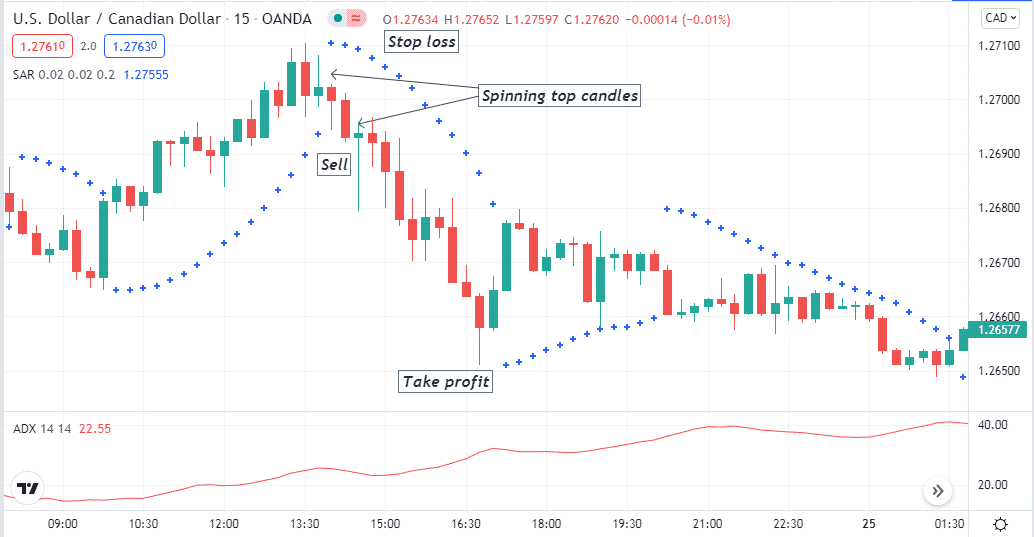

Bearish trade setup

When seeking selling opportunities, spot a spinning top candle near the finish line of an uptrend. Then observe when:

- The parabolic dot starts taking place above price candles.

- The ADX value increases above 20.

Entry

When these conditions above occur after any spinning top candle near any resistance level, declare an upcoming bearish pressure on the asset price. This method suggests opening a sell position here.

Stop loss

The initial stop loss level will be above the current swing high with a buffer of 10-15pips.

Take profit

The spinning top candle doesn’t give any idea of the profit target. Continue the sell order till the bearish momentum lasts. Close the sell order when the parabolic SAR dot switches position and the ADX value decreases.

How to manage risks?

Trading with a spinning top candle involves various risks. In this part, we will share professional tips to manage risks in trading:

- Don’t enter early on trades; wait for the next few candles after spinning top beside carefully observing indicator readings.

- Use a multi-time frame analysis to learn the actual price direction and eliminate fake swing highs/lows.

- Check the economic calendar before placing trades, and don’t enter using any spinning top trading method during any major fundamental events.

- Use proper stop loss for any open positions. Another trade management method is to shift stop-loss levels while continuing the trades. For example, you open a buy position and continue the order. Shift the stop loss at or above the breakeven point while the price creates a higher high.

Final thought

A spinning top candle generates potential reversal trade ideas line hanging man, doji, hammer, candle formations. We recommend waiting till the next few candles to finish formation before making any trade decision.

You can use many other trading indicators such as MA crossover, MACD, the RSI, etc., to create invincible trading strategies with spinning top candle formation.