Stop-loss is a way to get out of the market with some losses that ultimately save the trader’s investment. A perfect stop-loss can maximize profitability and minimize the loss in intraday trading.

In forex trading, central banks and governments are major participants moving the market alone. Before 1990, it was costly to do FX business for retail traders, and intraday trading was impossible.

Nowadays, it becomes accessible, and you can even start trading forex with a little as $100 in the intraday chart. However, making money or having constant profit is not so easy for individuals. A proper strategy, money management, trade management, punctuality, etc., are essential characteristics of a successful forex trader.

The term ‘stop-loss’ is significant by any means to any forex trader. Today in this article, we will discuss stop-loss. Why it is essential and how to set stop-loss. Moreover, we will discuss when to expand stop-loss at intraday trading.

Importance of stop-loss in intraday trading

Day trading involves entering and exit from trade on the same day. Here traders make money from short-term price swings that require close attention to the price. Therefore, the risk comes from the intraday price swings.

An appropriate trading strategy with a perfect stop-loss is the only way to reduce risk on the capital. Besides, stop-loss helps to avoid emotional trading. Day traders generally have a better education and discipline. Being a successful day trader often requires the excellent skill of technical analysis, a high degree of self-discipline, and objectivity. So the use of stop-loss can count as a prominent part of intraday trading.

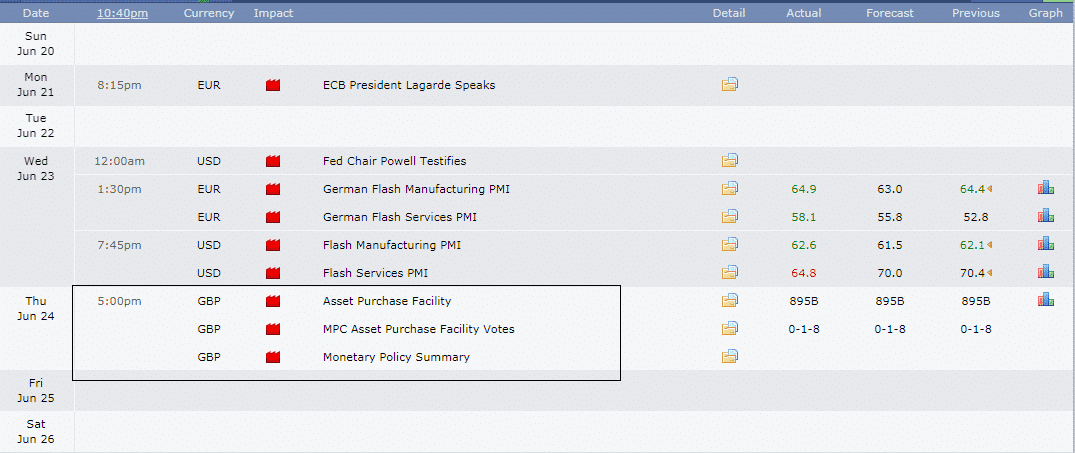

News trading is a popular technique for intraday traders. Scheduled announcements include:

- Earnings

- Job data

- Socioeconomic events

- Microeconomic events like interest rate, GDP data, etc.

- Any events that make certain moves on currency prices and create opportunities for day traders.

Day traders often use leverage in their trading and attend small market moves that occur for fundamental events. They usually do scalpings or take positions for a small gain, range trading, news-based trading. To do all such kinds of trading, a trader must use stop-loss. The reason behind this is so simple; the forex market is a highly volatile and decentralized marketplace.

You can’t always make positions toward the price movement. If the price starts to move against your order, stop-loss helps you wipe out your previous profits and capital. Professionals use 1-2% of their entire capital in their orders.

How to set stop-loss in day trading?

There are several ways to set stop-loss in day trading. This part will discuss the top three popular ways to set stop-loss that suits day trading strategies.

Set stop-loss with candlestick

Day traders have high skills in technical analysis. Often they catch swing trades which allows traders to look at every individual candle during analysis. So the stop-loss they set also by using candles. For example, look at the figure below.

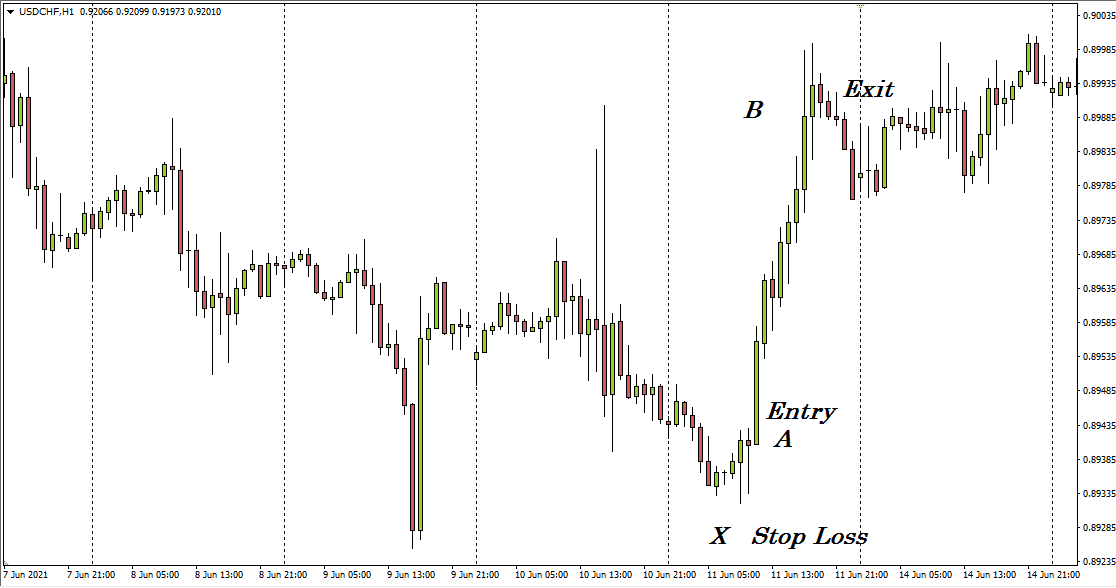

The figure shows a 1-hour chart of USD/CHF. It indicates that the price had a dramatic movement on the previous day.

Following the intraday rejection, a bullish trend takes place the next day, and the price reaches near point A. It’s an ideal place to take a buy position. So the initial stop-loss will be below the previous rejection candle’s low with a buffer of 10-15 pips. Simply below the long-legged hammer, where it clearly shows the buying pressure starts.

Set stop-loss with the price level

Range trading is another popular way of trading. Intraday traders often make positions by observing certain dynamic and static levels of support and resistance.

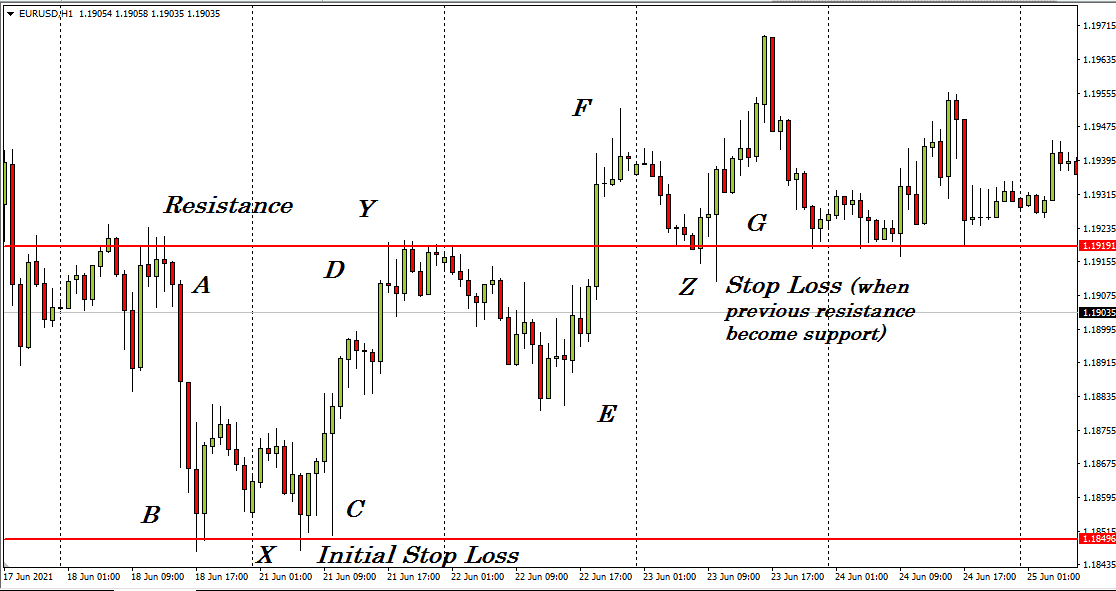

The fig above shows a 1-hour chart of EUR/USD.

- From point A-E, any buy order, the stop-loss will be near point X, below the support level.

- For any sell order, the stop-loss will be near point Y adobe the resistance level.

- The price breaks the resistance level by EF and again tests the level and rejects, making an excellent static level.

- When the price reaches near point G, the previous resistance level becomes support level.

- After getting point G, the stop-loss will be near point Z for any buy order as long as the support level is valid.

Change stop-loss with fundamentals

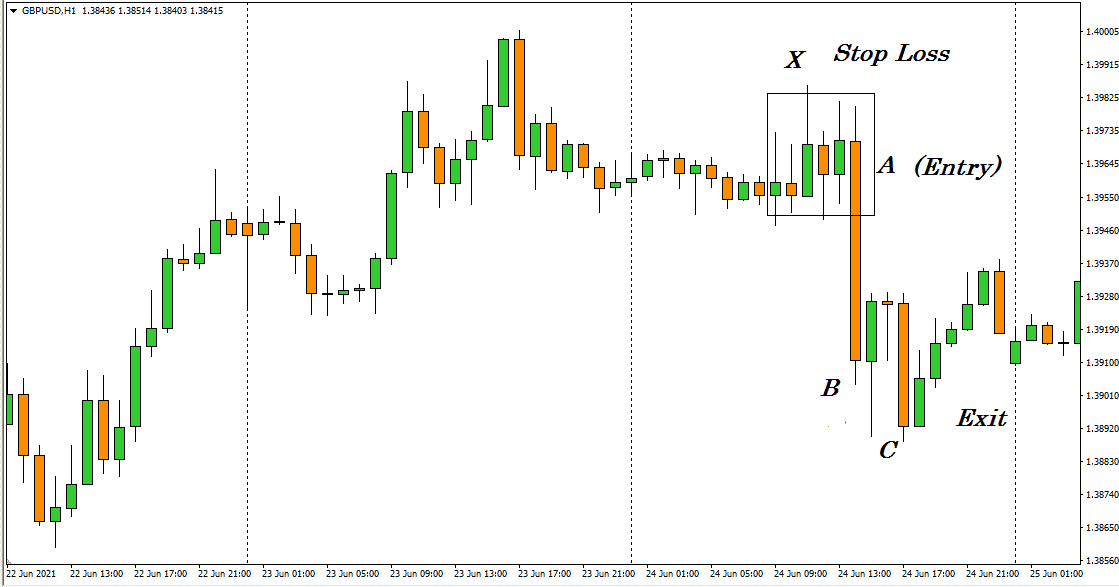

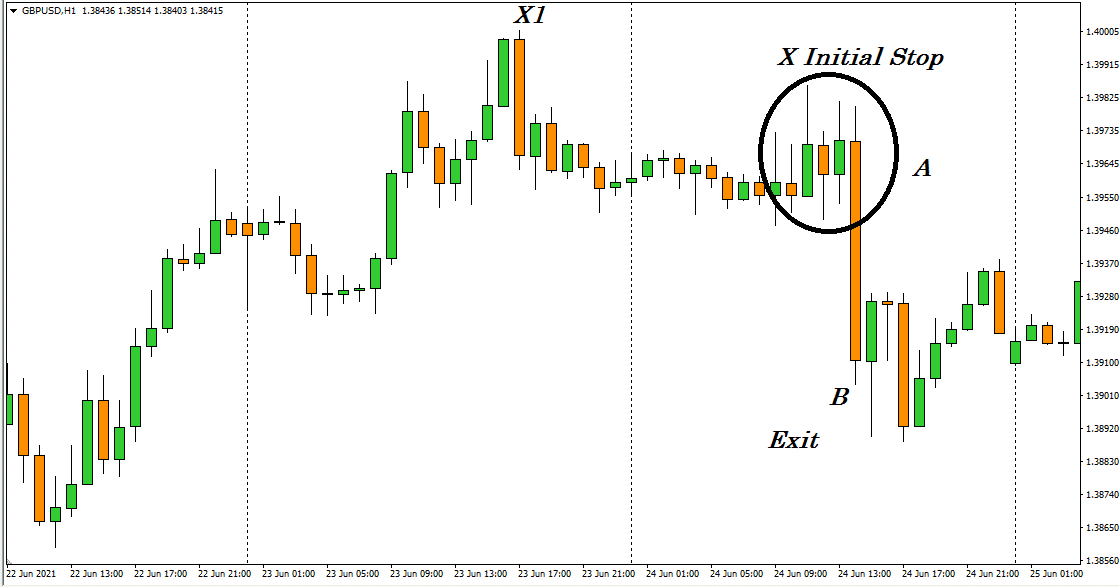

Daytime traders take part for a specific time, so their target is also different from medium-term traders. They enter the market following some particular event at potentially profitable levels. For example, look at the 1-hour chart of GBP/USD below.

The marked area shows the uncertainty of price movement as traders wait for the monetary policy data from the Bank of England.

- You may take a sell position near point A, and the initial stop-loss is near point X, above pre-event swing.

- After the news release price reaches near point B, you may set your stop-loss at the breakeven point near A or below it.

- Lastly, you can exit from near C.

When to expand the stop-loss in intraday trading?

We are talking about a volatile marketplace. So traders may always take flexible steps to deal with any uncertainty. It is a game for the big financials where individuals can only make money to get at the game with the significant participants from little price movement.

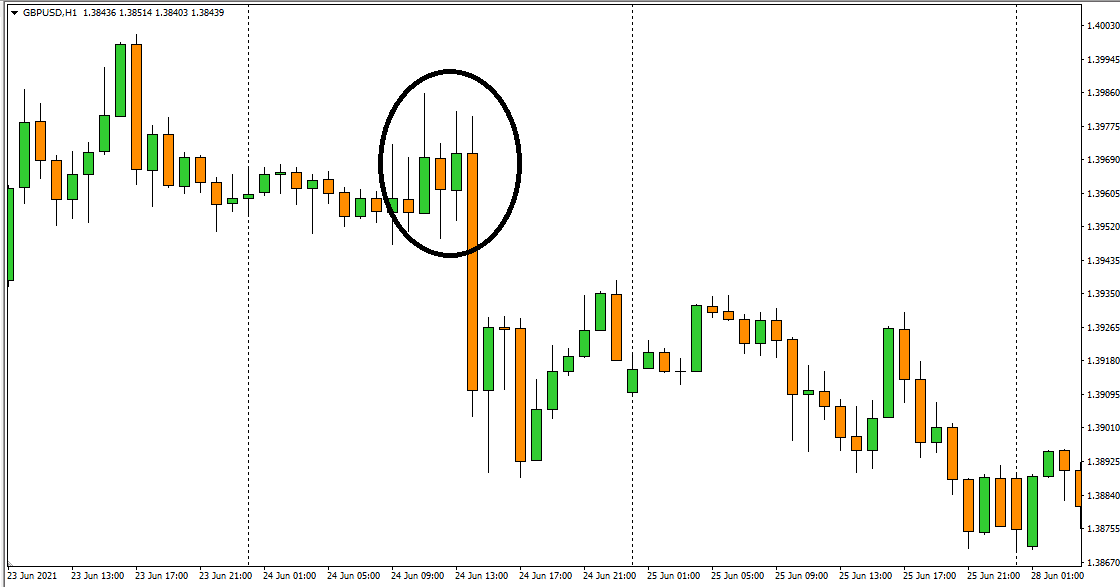

To do that, you must set a flexible stop position to avoid intolerable loss. Fundamentals come with uncertainty; smart traders often use more comprehensive stop-loss to avoid stress. For example, look at the figure below the hourly chart of GBP/USD.

The marked area shows the monetary policy uncertainty as traders are waiting for the press release from the Bank of England. When the price remains at the substantial area, for a sell order, you may set your stop-loss to near point X or can use a wide stop-loss above the previous high near point X1.

When the price reaches near point B, set your stop-loss at the breakeven point near A or below it. You can also use a trailing stop at the fundamental event to increase profitability and reduce risk.

Final thoughts

Finally, we suggest practicing and more research before using any strategy at your trading account. If you can’t have satisfying market data that supports the price movement and the system, don’t enter the market. Stop-loss helps you to avoid the risk and increase your profitability. It helps to handle the emotional stresses that unplanned traders face.