There isn’t any single perfect approach for fundamental trading, but we have listed four of the best ones to help you with your trading career in this article.

What is fundamental trading?

It is the type of trading where you analyze currencies based on economic news and events. Unlike technical trading, where you study charts and graphs from the past to predict future trends, you use potential news and risk events to foresee fundamental trading trends.

The news can be macroeconomic events such as inflation, central bank meetings, consumer price index, etc., or global turmoil such as wars and natural disasters. A fundamental trader keeps an eye on all such news and scrutinizes the currency trends.

How to enhance success with fundamental trading?

The market is filled with technical traders who are number-savvy. It is a known fact that humans tend to believe in numbers more than words. This is exactly what technical traders do. They use historical data to draw statistics for the future. As accurate as it sounds, this technique does not cater to unexpected incidents that might change the entire market trend.

So this is where fundamental trading comes to your aid. Employing this trading technique will keep you on the look for unforeseen outcomes, and you will be able to tackle them strategically.

Tip 1. Read impacts of news

There are two types of events, high-impact events, and low-impact ones. Gather all the clues and put them together to get an idea about how the forex industry would react to the news. See stuff that has the potential to move the market. Unfortunately, most traders miss out on this.

Why does it happen?

Traders usually ignore news or are unaware of the influence it may have. For example, suppose the interest rate decisions of the US are about to come. In that case, the investors are mostly oblivious of the potential impact of an increase or decrease in interest rate decisions on the market. This might end up suffering a heavy loss because of this.

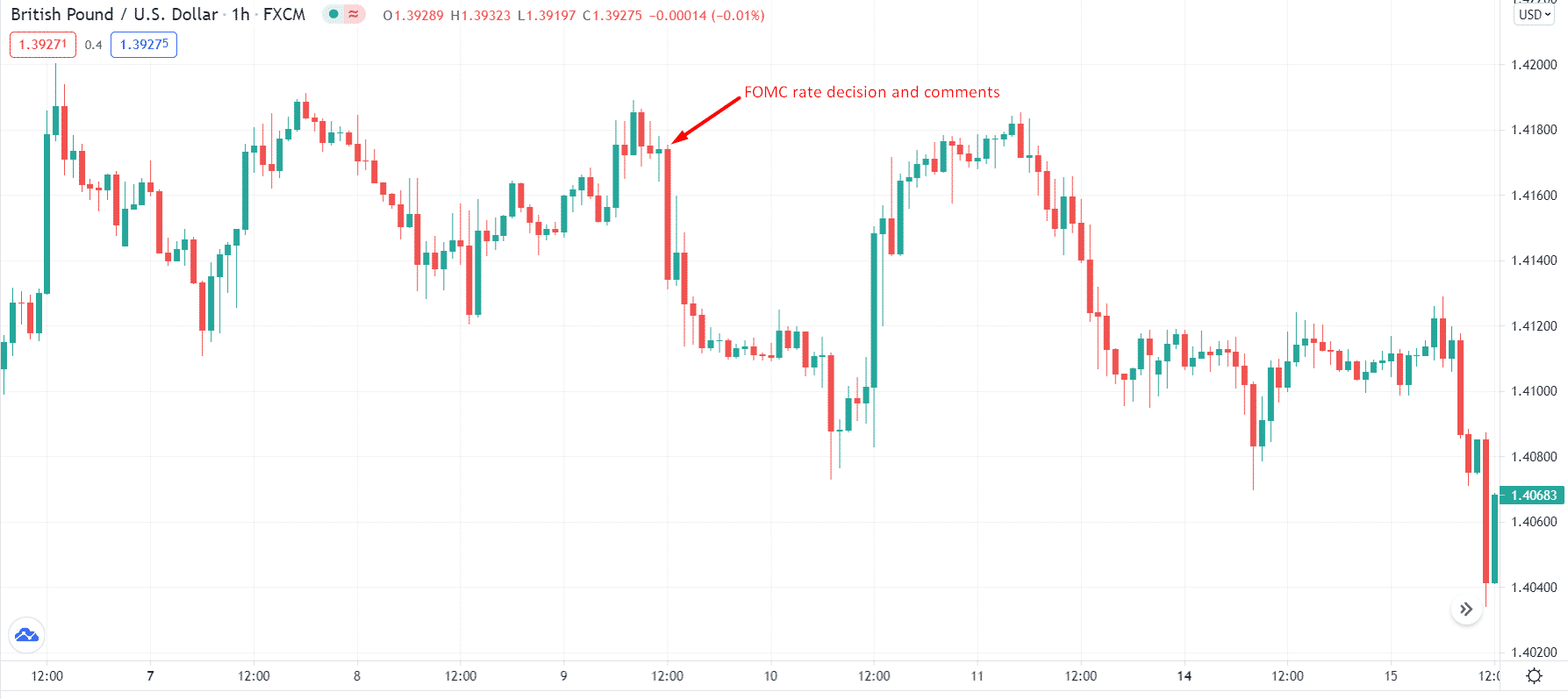

Look at the chart of GBP/USD when the FOMC rate decision came up with hawkish (urge to increase interest rates) comments that sent GBP/USD to very low in one hour.

How to avoid the mistake?

Start with enhancing your knowledge. Learn about the significant risk events that are bound to affect the market, such as retail sales data, non-farm payrolls, inflations, etc.

You can split the situation into two segments, pre-news and post-news.

- In pre-news, you find out things and their effects before they even happen. Check out the economic calendar regularly. It mentions occurrences that take place in the future with their impact. Such indicators are helpful for traders. They can give you a lead. Read news articles that will tell you what investors are expecting for a particular event to occur.

- Now that the news has broken, there are three possibilities. Either the information is stable, and the graph is a straight line, or the chart goes a spike up and a spike down then back to the middle of the graph rockets upwards, and a new trend forms.

While investing, you need to choose between the latter two situations.

- Look closely for these movements because only then will you know if the news is genuinely moving the market or the algorithm is generally moving the numbers.

- Follow market analysts who use previous figures to forecast.

- Then, match the data to the forecast to predict results. In simple words, keep yourself updated with everything happening.

Tip 2. Mark key events

This approach is pretty much related to the first one. Apart from the influence of the news, mark the key events. Check the weekly economic calendar regularly and devise your strategy accordingly.

Why does it happen?

Most investors fail at marking critical incidents because they do not know the time zones of different countries. Forex is an international market. Any happening that affects the economy of even a specific country would affect the industry.

How to avoid the mistake?

It would help if you synchronized your time zones in the FX factor or TradingView (TV) so that you can get timely updates. Note all the high impact indicators such as:

- Central bank rate decisions

- Gross domestic product (GDP)

- CPI (inflation rates)

- Purchasing manager’s index (PMI)

- Non-farm payrolls (NFP)

- FOMC meeting

Keeping track of critical events would help in determining their impact. You can enable economic events on your TV charts as well.

Tip 3. Strategize trading

You can’t survive in this industry without having a strategy. You need to develop a plan that best suits your trading style. Otherwise, it is like taking a shot in the blind, and your chances of hitting the bull’s eye are narrow.

Traders who do not form a strategy end up suffering.

Why does it happen?

Forex is a quick industry. It is natural for investors to get lost while market trends change in a moment. In addition, those who don’t map out a plan or technique often get overwhelmed. They are unable to decipher the effect that certain indicators have on certain currency pairs.

How to avoid the mistake?

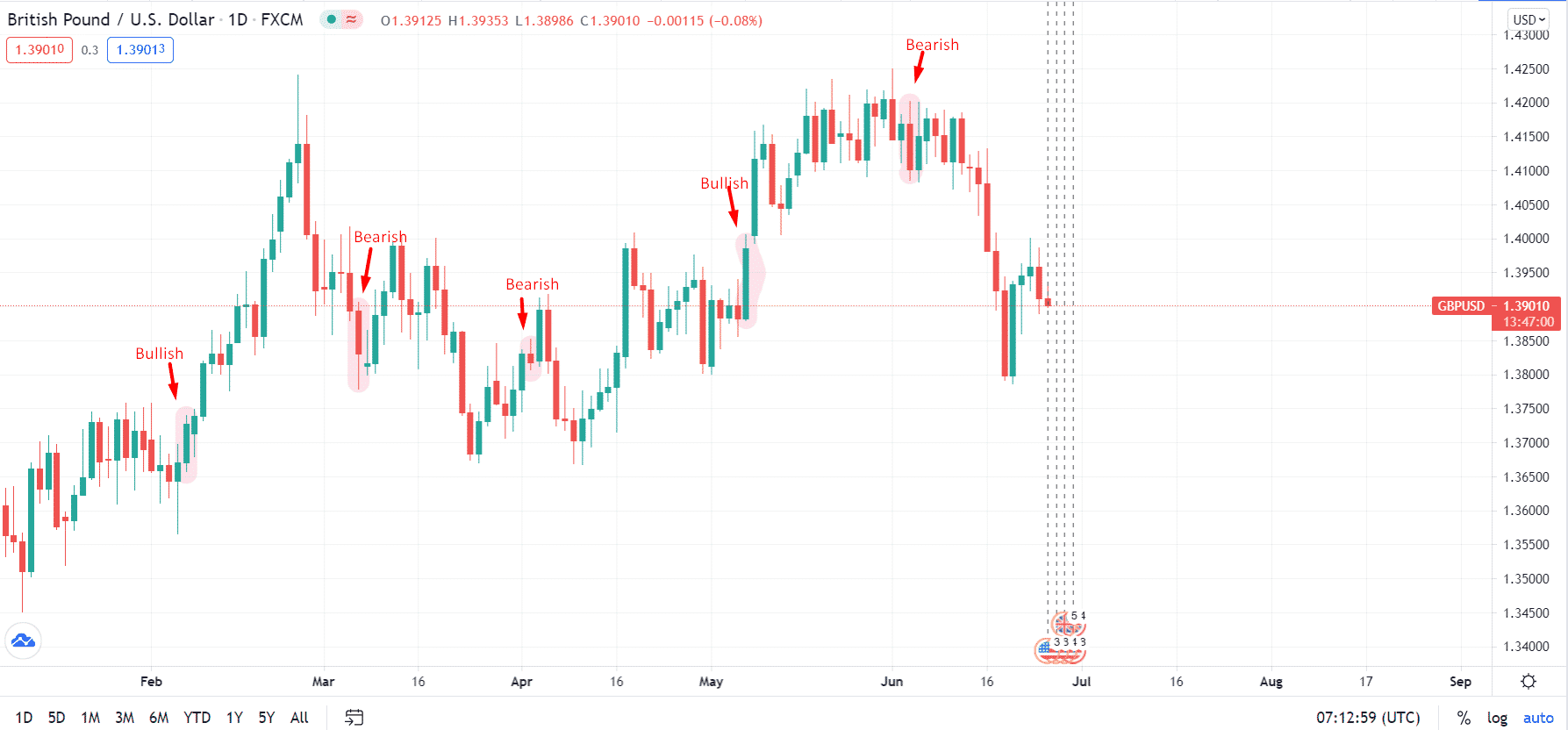

Form your strategy in a way that yields a positive net result. For example, non-farm payroll is one of the indicators in fundamental trading. Its data is released on the first Friday of every month. First, study the market reaction to all the previous releases and draw a commonality factor. Now check the effect it has had on a specific currency pair such as the USD/JPY pair or the GBP/USD pair. Finally, see how various pairs reacted to the data to decide your next move.

The above chart shows NFP data release days. Three out of five times, the GBP/USD pair went bearish while twice it went bullish. We can assume that the market looks more tilted towards the downside on NFP day. Hence, we can look for selling opportunities.

You can sell the pairs with the lower interest rate and buy the ones with a higher interest rate. The difference between the two will be your profit. However, this is a long-term strategy and may incorporate several other factors.

Tip 4. Supply and demand in trading

It is significant to understand demand and supply dynamics to comprehend better the forex industry’s present and future price actions.

In simple terms, supply is the amount of selling volume available, whereas demand is the extent to which it is required. Currency pairs reach a point where they can be overbought. It is called the “selling zone” because that is the high time for sellers to make money. “Demand zone” is the total opposite of it. It is when the value of the currency pair drops. This is a golden time for buyers to purchase.

Most fundamental traders follow the news but miss out on the supply and demand factors on the charts.

Why does it happen?

This happens because most institutional investors keep their entry and exit points too close to the supply and demand levels. This puts novice traders at a higher risk of loss if they ignore those key levels.

How to avoid the mistake?

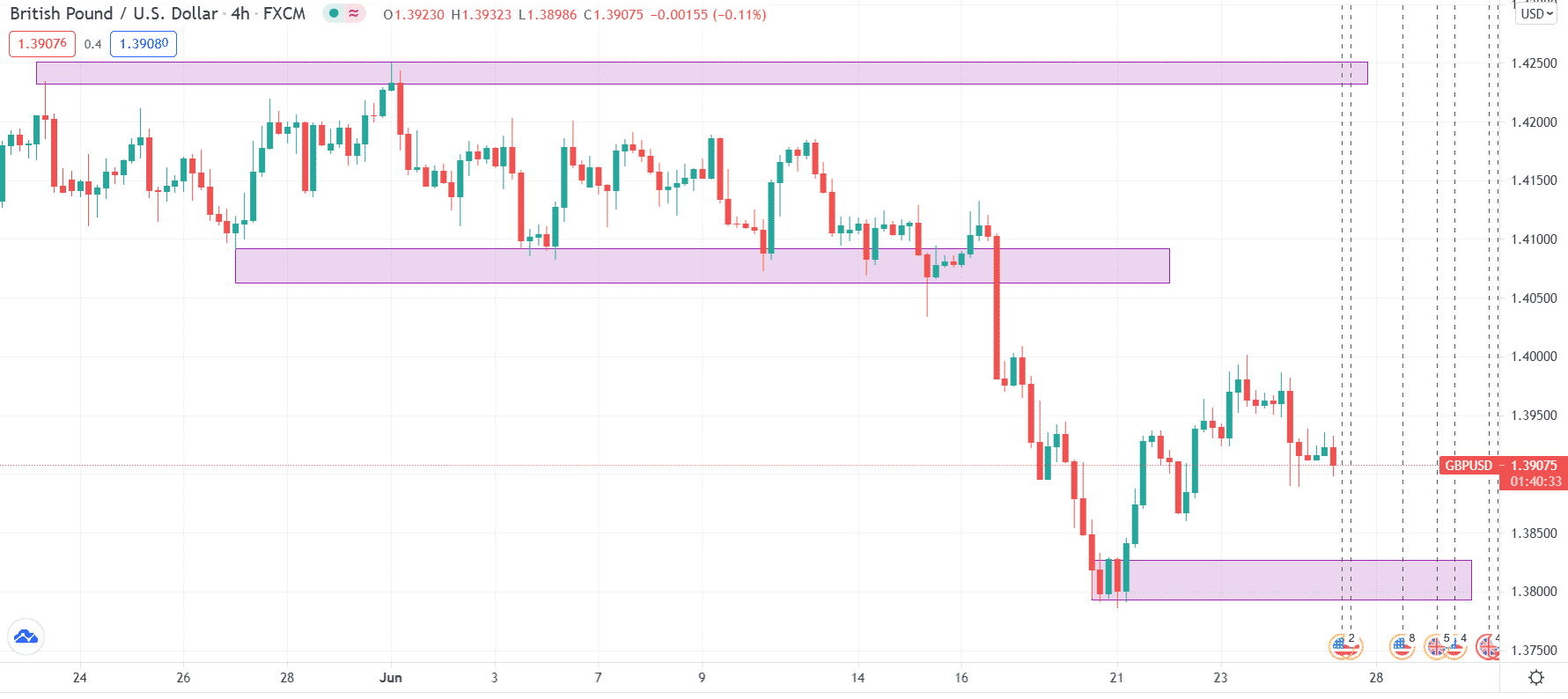

Create supply and demand zones on your daily and 4-hour charts. Keep them in mind while making any decision.

Final thoughts

No matter what trading strategy you employ, you should have basic knowledge of fundamental trading. It might sound easy, but it requires skill and experience to master this trading technique. However, fundamental trading itself is not enough to conquer the market. Combine it with some supply/demand zones, and you are good to go.