Forex is all about executing the right strategy. If you are reading this as a struggling trader, the following guidelines will help you logically approach technical trading.

What is technical trading?

This is the type of trading where participants observe charts to analyze past results. They use the previous trends to predict future outcomes. The trick is to detect a pattern that is most likely to be repeated.

Traders usually take help from trading indicators. Now you should keep in mind that there is no such thing as a magic indicator or an algorithm that will turn you into a successful trader overnight. It will help if you keep experimenting until you find the best fit for yourself.

Tip 1. Increasing odds of success in trading

To become a fortunate trader, you should increase your odds of succeeding. This would minimize the risk of losing. As basic as it sounds, many traders still fail in doing this.

Why does it happen?

When your trading strategy depends on a single indicator or reference point, the success probability automatically goes down. This happens because you miss out on other aspects of the market by narrowing down your options to one.

How to avoid the mistake?

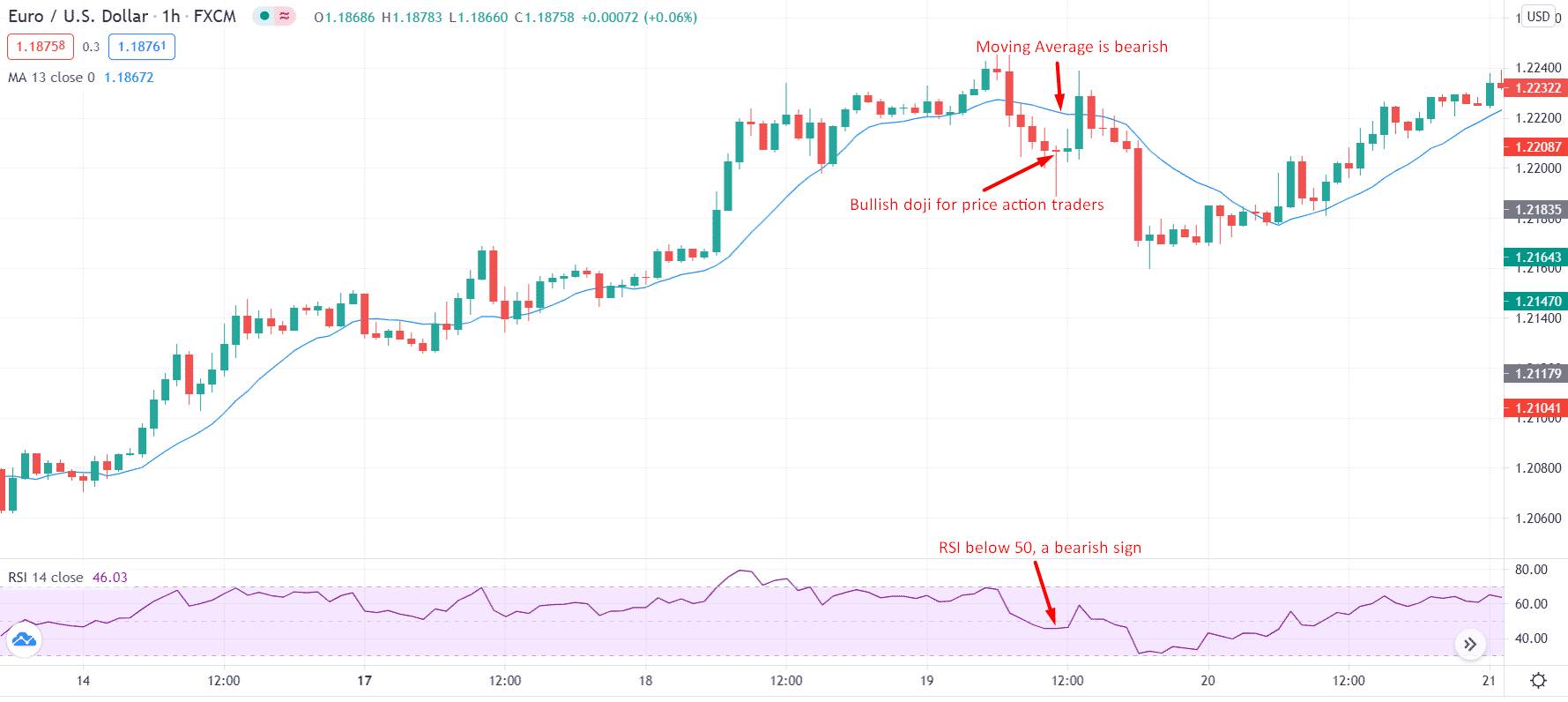

It will help if you use confirmatory tools to increase your probability of success. For example, you are a price action trader. You can pair it with a simple moving average (SMA) and relative strength index (RSI) indicator to boost your success chances. Hence, make sure to check the SMA and relative index indicator before taking a position.

The above chart suggests a bullish signal for price action traders, but moving average and RSI does not confirm bullishness. Hence, the price turned up but fell back. Such confirmatory analysis can save you from being stopped out.

Tip 2. Scale-up risk

Taking on risks can be scary, but then it’s a part of the game. Scaling up your risks time and again can be beneficial to your overall strategy. When your winning streaks increase, say you made five to six consecutive successful trades and gathered some additional amount out of it, that is when you should scale up.

Most traders do not understand when to take more risks.

Why does it happen?

If not done correctly, “scaling up” might empty your capital because investors usually do not know when to withdraw. Taking calculated risks is the ultimate trick. Scale-up when needed but learn your limitations. Load risk in small portions.

How to avoid the mistake?

You can avoid losing by taking it slow. For example, you had a deposit of $200. After winning, you made $250. Those additional $50 provide the capacity to expand your trading volume. You can now multiply the number of positions. If you were first taking one part of 0.02, you could directly add another class of 0.01 with it.

Open multiple positions, increase the position sizes, spend more time on swapping, use better indicators, and you will handle it fine.

Tip 3. Scale down risk

In technical trading, analyzing each move is the key to success. Just like scaling up, there are times when you need to scale down. It is delusional always to expect profit. It will be best if you keep losing insight.

Most traders tend to increase risks after losing, whereas this is when they should be scaling down.

Why does it happen?

Losing can be stress-inducing. In the haste to recover the losses, you might expose yourself to greater risk, which will do more harm than benefit.

How to avoid the mistake?

Take a step back. Know when to withdraw. Use this time to re-evaluate your options and make the next move strategically.

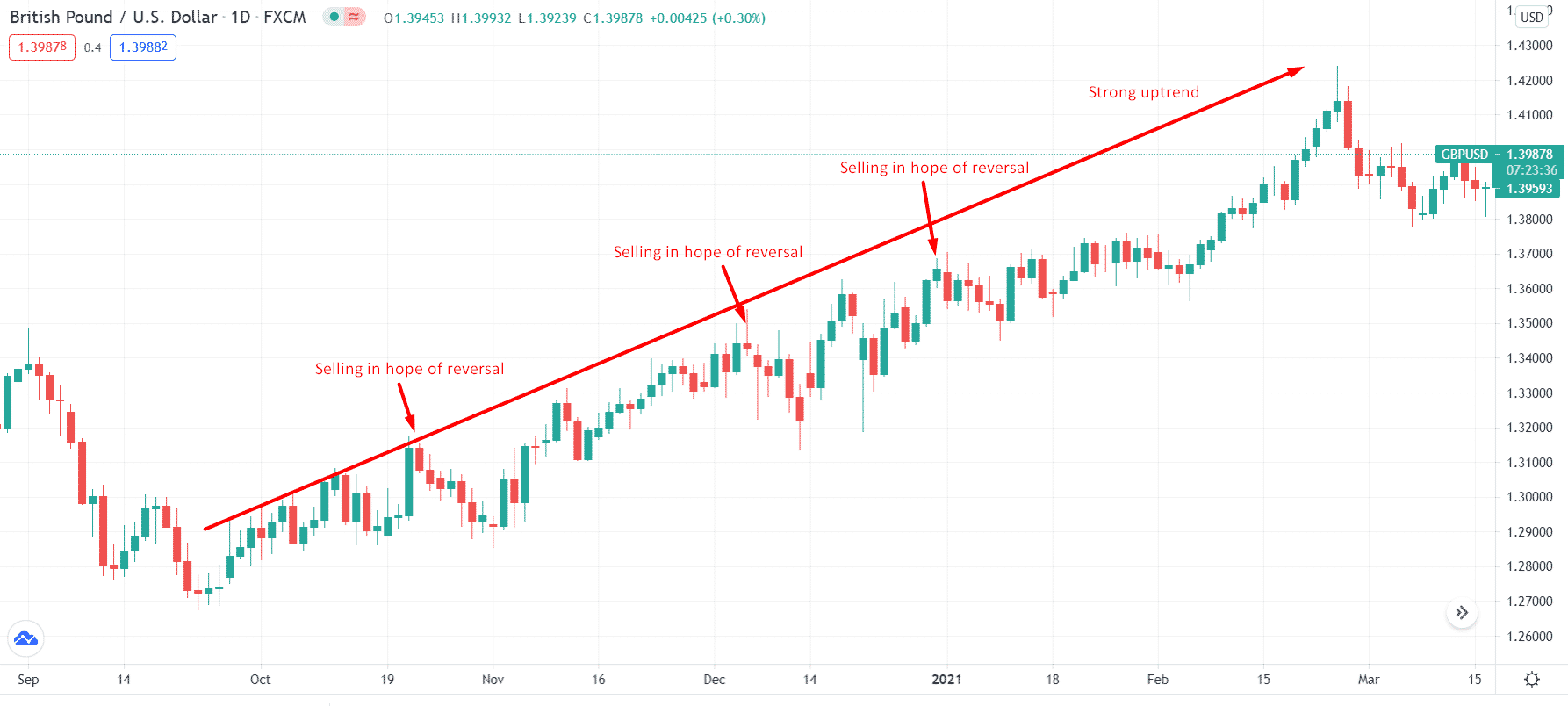

Look at the above chart. What if you keep selling in this strong uptrend in the hope of a reversal and keep being stopped out? You would have lost a substantial amount of capital.

Bring your risks down. For example, if you were trading at a volume of 0.03. After facing a 10-15% loss, it’s best to reduce your trading volume to 0.01.

Tip 4. Diversify portfolio

Diversification is the technique that works to lower the overall portfolio risk. When one particular trade is suffering, the others will do well. This minimizes the losses.

Investors lose large sums of money because they put all their capital in one trade.

Why does it happen?

In hopes of winning big, traders end up putting all their money in one place. This augments the probability of losing the entire capital.

How to avoid the mistake?

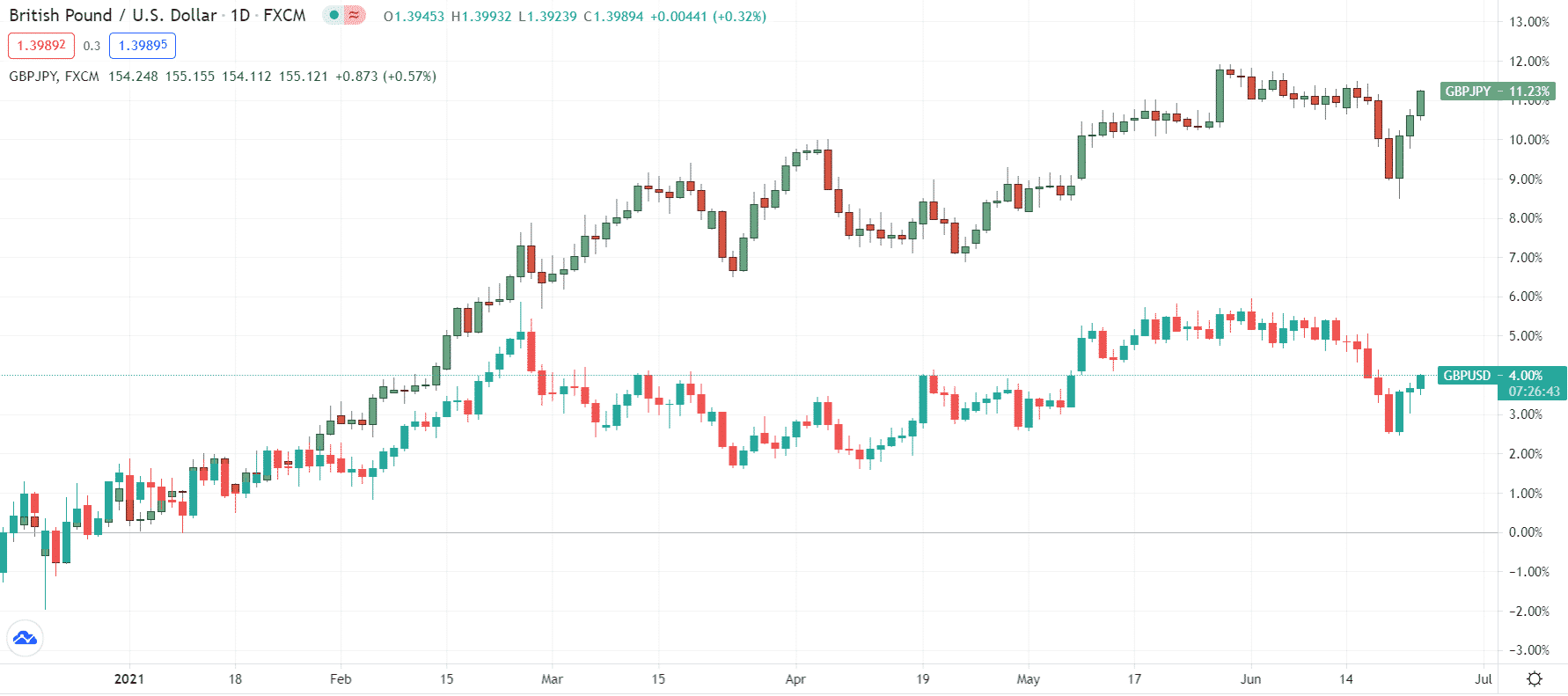

It will help if you trade with multiple currency pairs. For example, you have a currency pair of GBP/USD, and you derived a fair return from it around 5%. Now, if you test the same strategy on the GBP/JPY pair, you may get a profit of 8%.

Look at the chart above. Both GBP/JPY and GBP/USD have identical moves, but GBP/JPY has higher volatility. It means you can enjoy more profits using the same strategy applied to the GBP/JPY pair.

Hold a diversified basket of currencies. Invest in currencies of different nations. When one currency value goes down, you can benefit from the other. The technique is pretty straightforward. Divide your risks, and the gains will go up. Reduce the overall risk exposure and smooth out drawdowns.

Tip 5. Tackle losses

You must have heard the phrase, “Hope for the best but prepare for the worst.” It would help if you employed this in your trading life. Losing is the most unattractive part of trading, but you have to deal with it.

Why does it happen?

Losing is inevitable in FX. There can be multiple reasons behind it. It would help if you studied the grounds to circumvent them in the future. Not knowing the market well enough, not having a strategy, over-trading, poor fund management, etc., are a few reasons why traders mostly fail in forex.

How to avoid the mistake?

We have been stressing about this since the start. Whenever you face a loss, take a break. Don’t give way to emotions. You have to deal with the situation practically. Many people jump towards renewing their strategy from scratch. This is not the wisest of the moves. Assess your account statement, study the charts, observe the entries and exits and note your mistakes. Some follies must be recurring. These are the ones you need to fix.

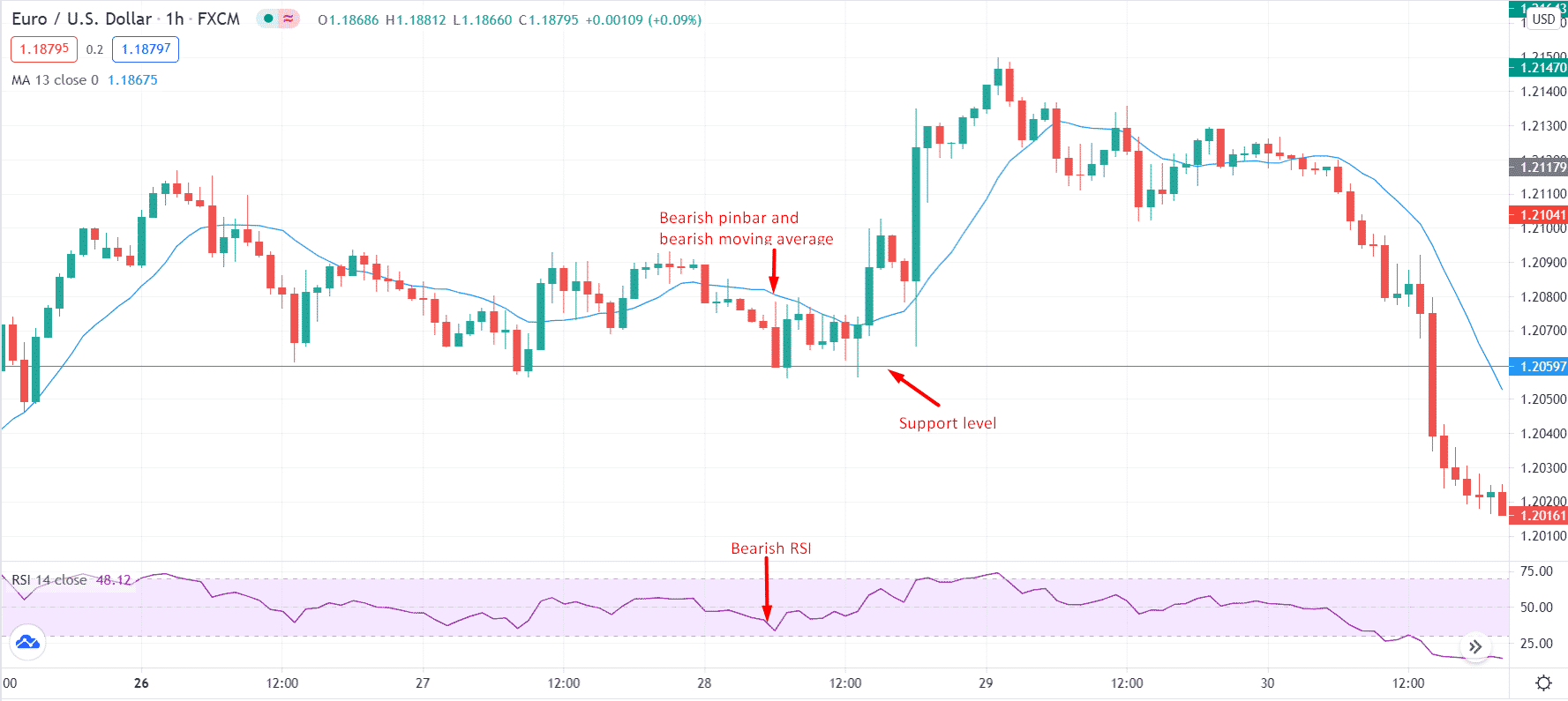

For example, you repeatedly took a sell position near when the price was already at its support level. Due to this, you could not achieve your expected results. Next time while making a trade, be careful not to repeat the fault.

Observe the above chart. Moving average, RSI, and candlestick patterns gave a signal to sell, but a support level nearby couldn’t let the sellers dominate the market.

Final thoughts

So this is a tricky business. Every day lots of people quit because they can’t take it anymore. You can either be one of them or choose to be the top 10% that succeed. Make a plan for yourself and employ the approaches mentioned above to achieve your goals.