Every successful FX trader sets a profit target, which is essential to assess the risk in a trading position and the potential risk to reward ratio. If the reward is lower than the risk, it’s not worth trading that opportunity.

Let’s discuss five tips for setting profit targets in FX trading.

What are profit targets?

Before we jump into the tips, let’s say that profit target is the fixed price point when an investor plans to exit a trade to book profit.

This price level is set before initiating the trade and can be revised with each respective trade. Thus, you can re-evaluate it at various points.

Importance of profit targets

They help you stick to your financial goals and thus are super important. FX is a fast-paced business, and it is straightforward to get carried away while trading.

If you don’t set a profit goal, the fluctuating prices because of the random movements of the market might result in a price reversal, which can lead to loss of capital.

A set profit target will alert you when to withdraw. It does limit the profit potential of the trade, but at the same time, it provides additional security. What good can a significant profit be if you end up losing it in a blink?

Success in FX trading is as much dependent on saving money as it is on making money. This is where the profit target helps. It reduces the risk ratio against the reward of a trade as well.

Tips for setting profit target in trading

Following are the tips you need to follow for setting a profit target.

Tip 1. Average daily range

In FX trading, the average daily range is the extent (in pips) a currency pair moves in a day. A measure of extent is the difference between the top and bottom of the day’s range.

This can be calculated based on the past 10 or 20 days. This is the trader’s choice. Most investors do not keep their average daily range in mind while opening a trade which is why they suffer losses.

Why does it happen?

All trading instruments have an average daily range, though it varies from pair to pair. Some pairs have a high range, such as GBP/JPY, whereas others have a low average range, like AUD/NZD.

When traders do not plan accordingly, they are more vulnerable to risks.

How to avoid the mistake?

Keep the average daily range in mind while deciding the target profit. For instance, if you are trading in AUD/NZD, you can expect an average daily range of 48 pips for 20 days.

You need to wait for 30% of the average daily range to be covered before setting up. If it goes beyond 48 pips, then the trade would shift to the next day. You do not want that because each day has a separate market dynamic.

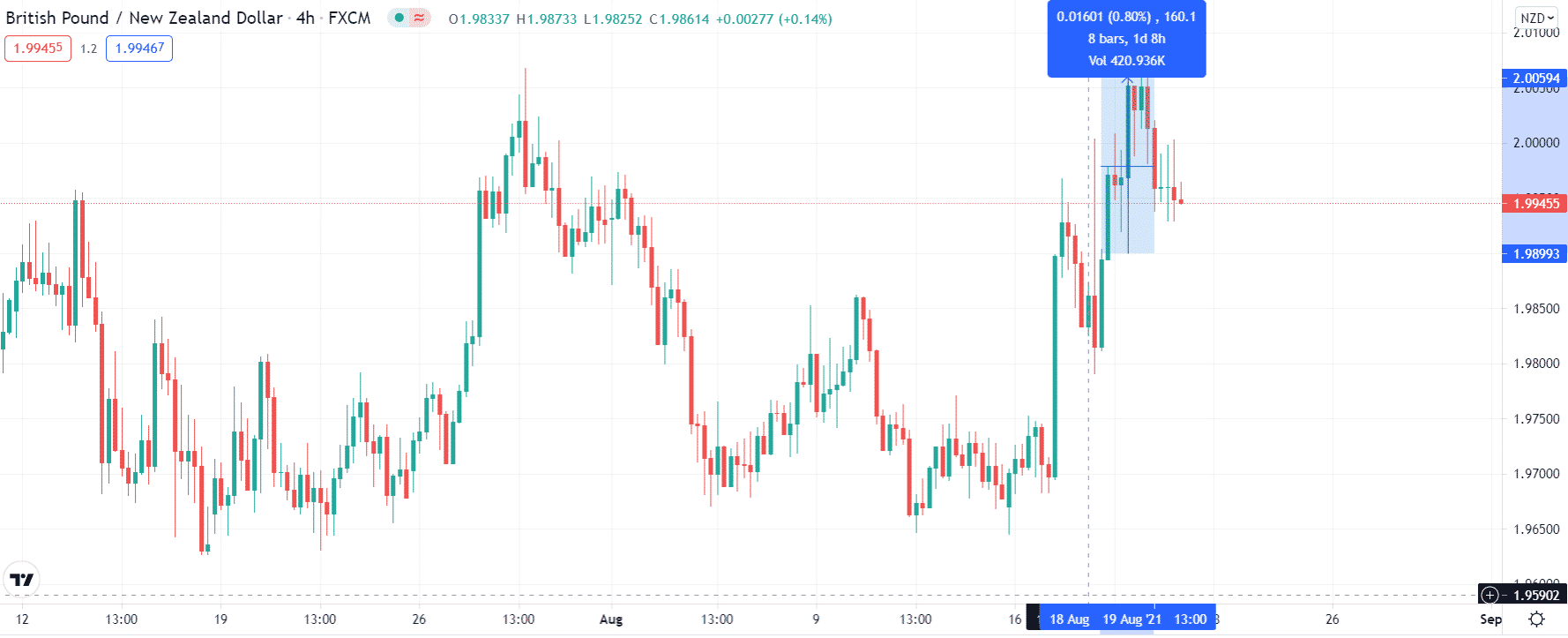

Similarly, the average daily range for GBP/NZD currency pair is 125 pips. Now, if you take a day trade in this currency pair and set a profit target of 20-30 pips, you will cover a very small percentage of the average daily range.

In this case, you will end up missing a large portion of the profit potential. As long as you set a profit target of up to 50 pips from the 125 max daily range, you will have a 75 pips margin. That is a much better choice.

It is advised to play safe.

Tip 2. Volatility

Volatility in trading measures the extent to which the price varies over a given period. When a currency’s price fluctuates up and down rapidly, we say it has high volatility.

High volatility markets are associated with fear, concern, and anxiety about where the market is going. Poor fundamentals, possible economic woes to come, or other geopolitical risks can trigger higher volatility.

On the other hand, low volatility is associated with comfort and stability. As a result, there is a lot less pressure in the market. In other words, the market is seen as more complacent.

Traders who don’t adjust their profit goals to market volatility tend to have a difficult time.

Why does it happen?

As mentioned before, FX is a fast-paced market. Therefore, you need to be prepared for anything and everything.

There are certain hours and some specific events when the market is particularly volatile. If you do not have a set profit target, there is a greater chance of you being surrounded by a swarm of losses.

How to avoid the mistake?

When the market moves quickly, the rapid moves can go in your favor. However, if you do not have a set target, you might miss the profit potential.

Assess the market movements and set a safe target for yourself. Once that target is achieved, close the trade in time to avoid any drawdowns. This is a calculated risk that you need to take.

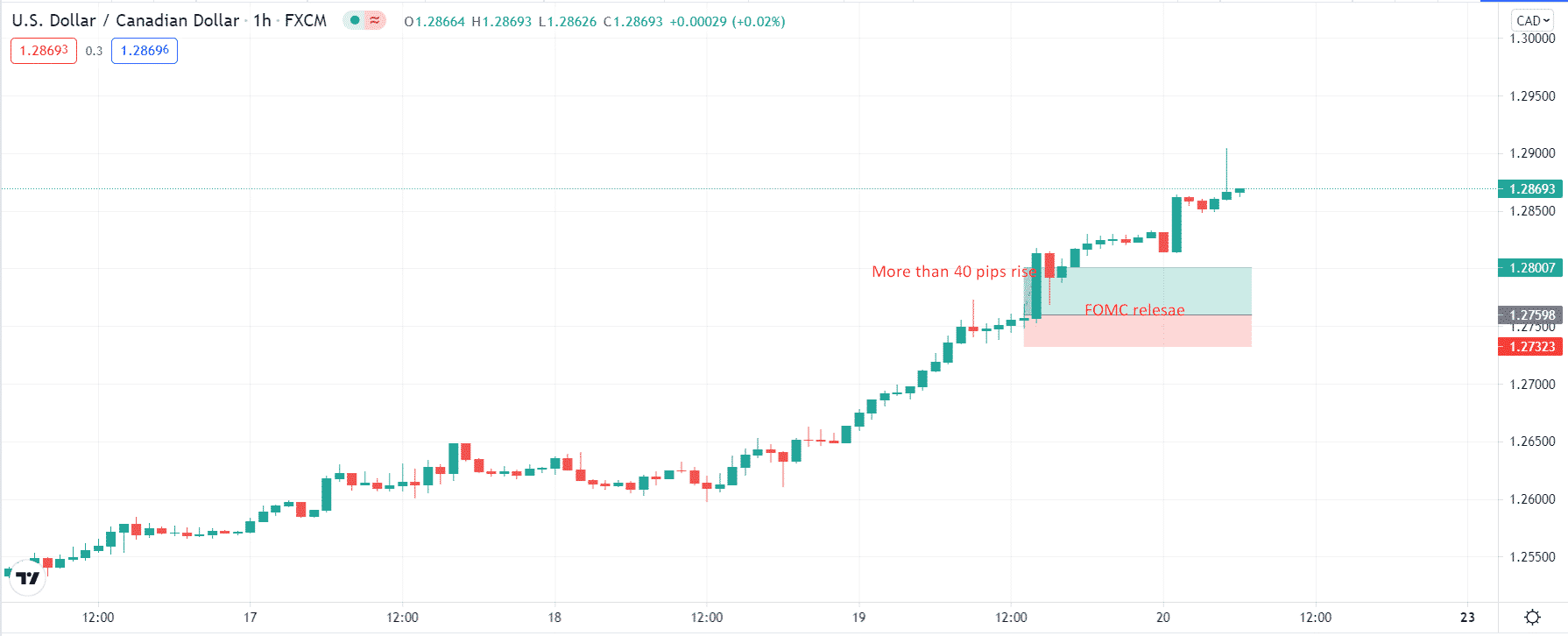

For example, if an FOMC event occurs while trading the USD/CAD pair, you will see that 50 pips get covered pretty easily in either direction. Therefore, a profit target of 40 pips will be appropriate in this case.

Tip 3. Swing lows/highs

Swing lows and swing highs are the potential support and resistance levels. These are the points from where the market can reverse.

The support and resistance levels can be used as the stop-loss and take-profit levels. Therefore, you need to observe them closely while setting a profit goal.

Traders usually fail at it.

Why does it happen?

When you set the profit target pretty high or lower than the support/resistance levels, there is a higher chance that the market might create a double top or bottom and reverse.

This is why traders miss the profit potential.

How to avoid the mistake?

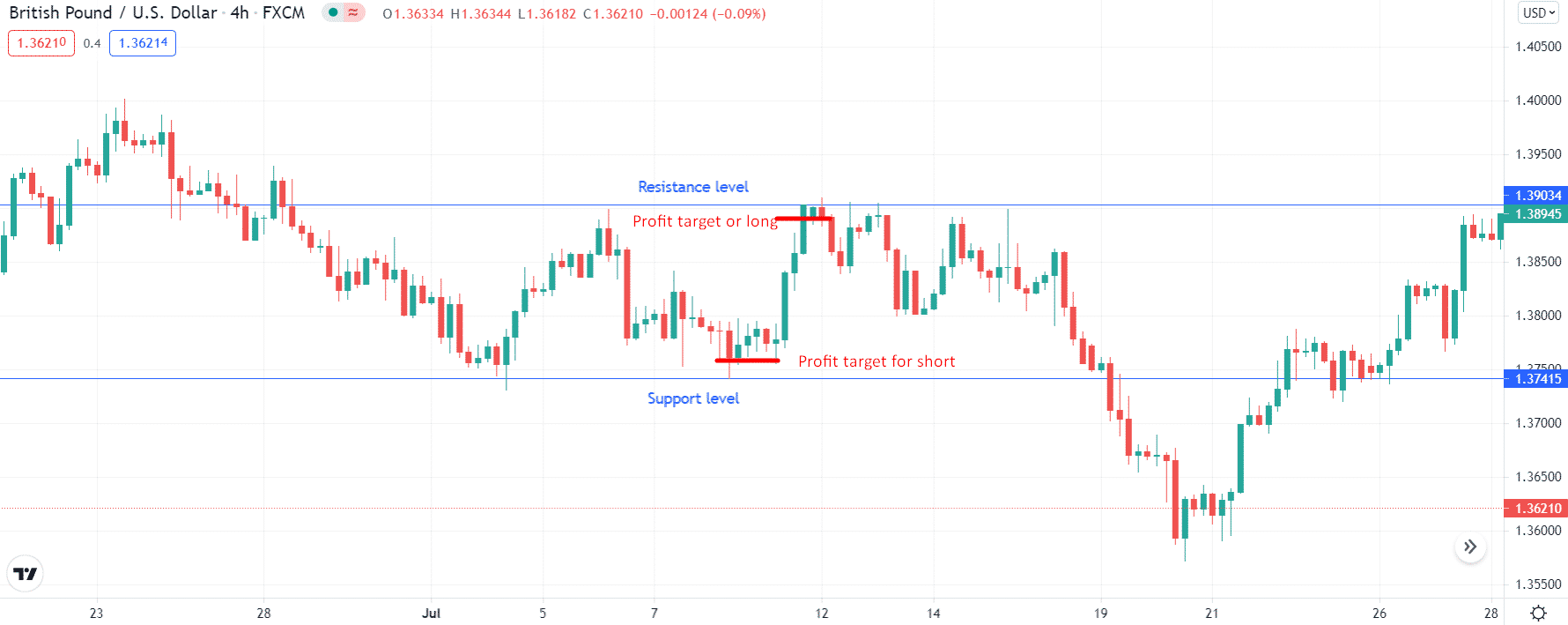

It would help if you always used a buffer in your trades and identify important support and resistance levels on your chart.

For a short position, set your profit goals a few pips above the support level. Whereas in a long position, seal the profit target a few pips below the resistance level.

Tip 4. Fibonacci levels

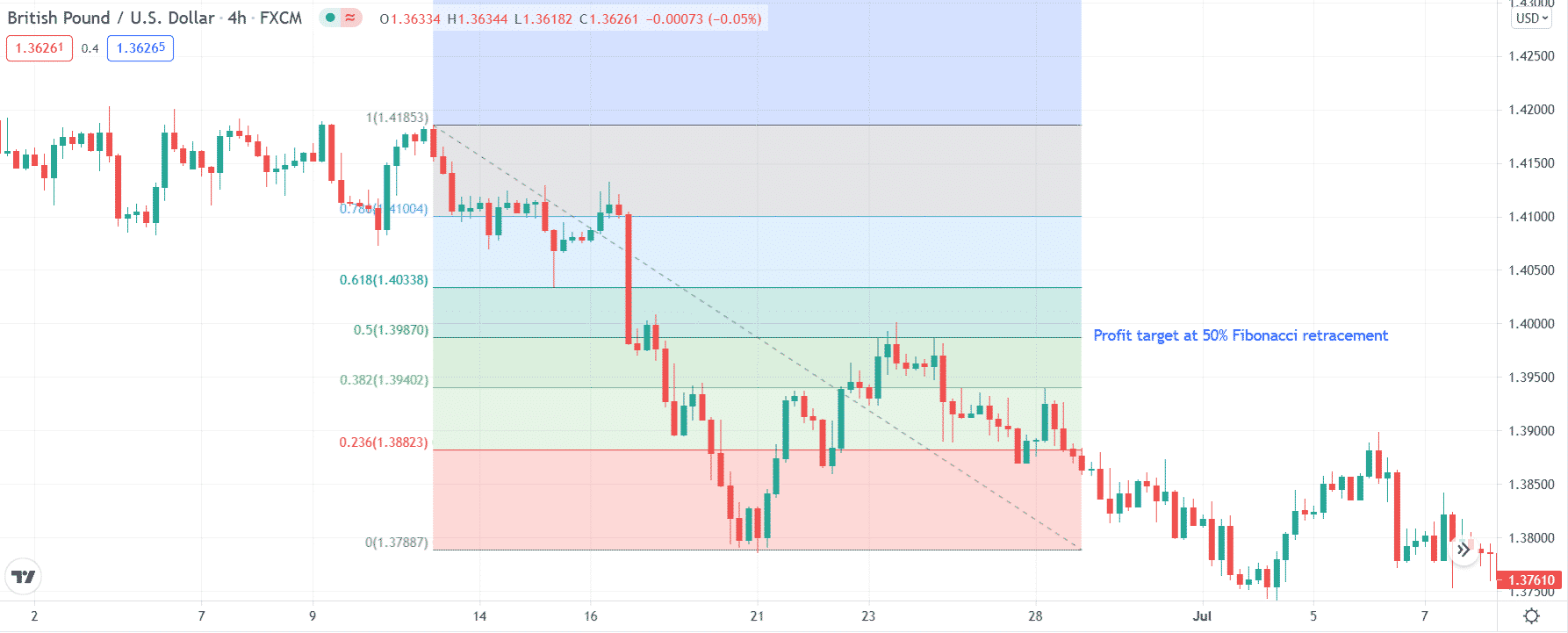

Sometimes you neither get swing lows/highs on the chart nor the horizontal levels. In that case, if a huge trend passes, it can be hard to understand the extent to which the counter-trend can retrace.

In that case, you can use Fibo levels. However, most traders make mistakes here.

Why does it happen?

Fibonacci levels range from 0-100. As a result, traders who do not target the right level often end up in hot waters.

How to avoid the mistake?

Most traders target the 50% level. So, you need to set the profit target at a 50% Fibo retracement level too.

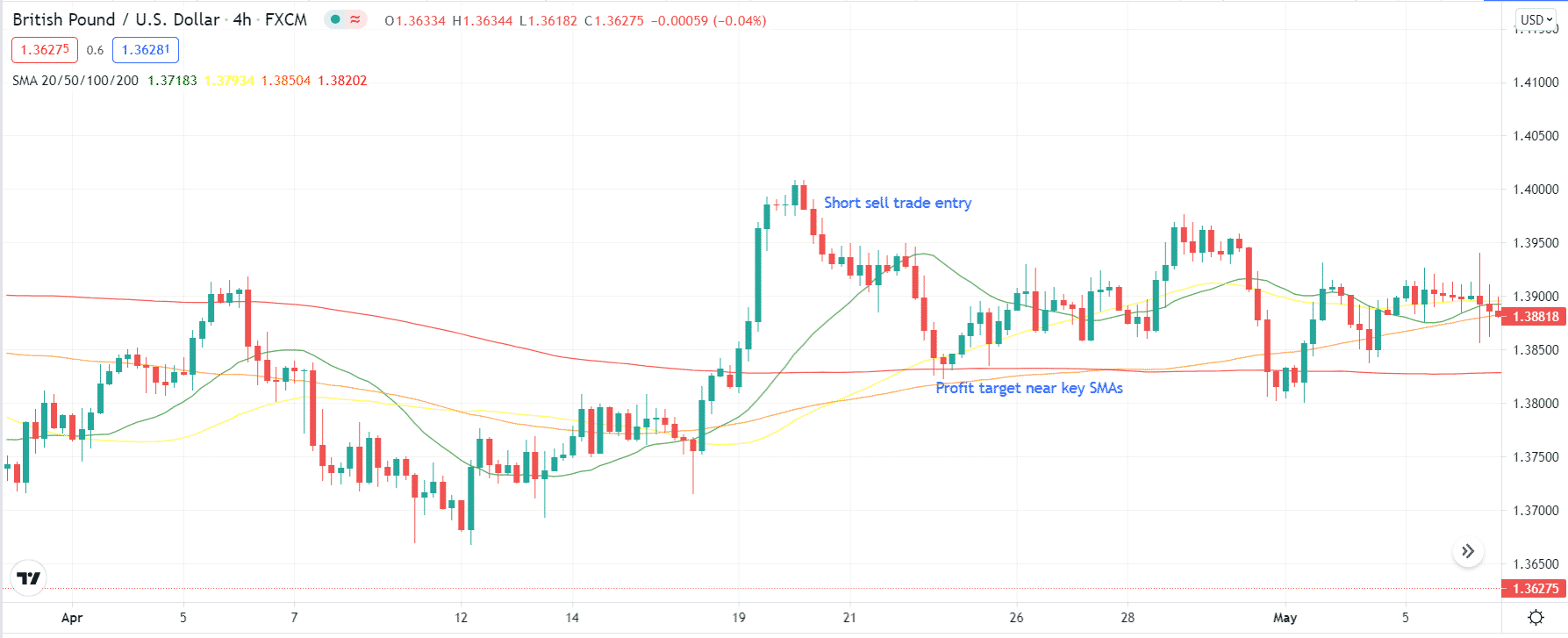

Tip 5. Simple moving average (SMA)

Sometimes you can have both the Fibonacci levels and the swing low/high. However, if you need a bit more confirmation, you use the simple moving averages.

Traders do suffer drawdowns despite observing the former two.

Why does it happen?

When you depend on only one piece of information, it can be dubious, leading to losses.

How to avoid the mistake?

Pair SMAs with other indicators for reliable results. Traders mostly take SMAs of 20 periods, 50 periods, and 200 periods. These are the key moving averages. The price usually gets rejected close to them. Hence, you can exit a position in profit near these levels.

Final thoughts

Along with your trading strategy, profit target helps a great deal in specifying your limits. They add discipline to your trading life and protect you from unnecessary losses. Use the tips mentioned above to determine your profit target, and you are set for trading.