Trend trading is a method that can offer a vast profit via analyzing momentum in a certain direction of an asset. If price moves in one general direction like upwards or downwards, it is a trend.

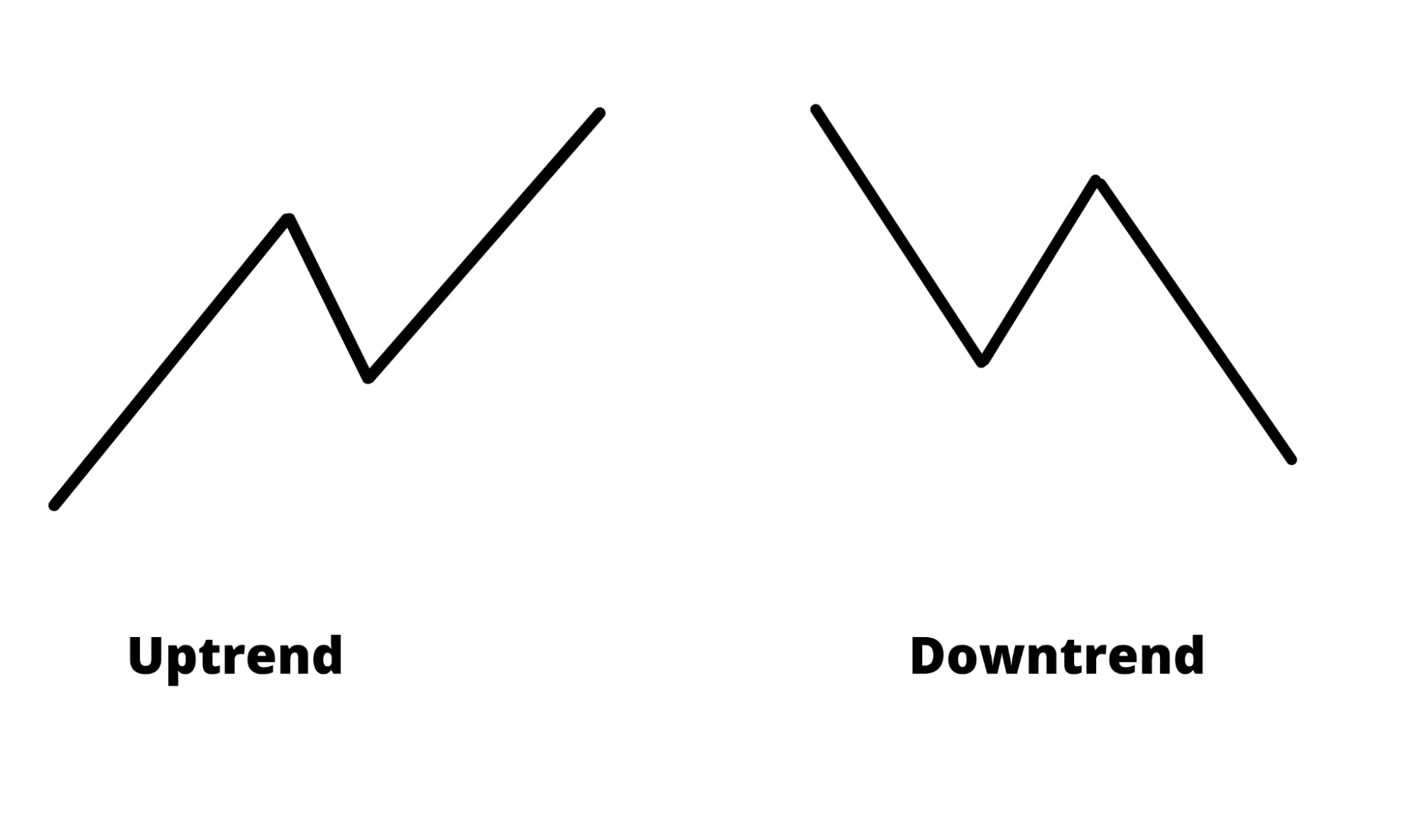

However, if an asset trend continues to move upward, a trend trader takes entry into a long position. Characterization of an uptrend relied upon higher swing lows and highs. Similarly, while the asset trends are lower, the trend traders also may take entry in a short position. Lower swing lows and highs characterize a downtrend.

The following section will see the complete trend trading crypto strategy guide that includes exact buying and selling trading methods.

What is trend trading?

The general market direction or an asset’s direction is a trend. Trends are visible by trendlines or the price action as per the technical analysis. Trendlines or price actions underscores an uptrend if the price action makes higher swing highs and lows. On the other hand, a downtrend is underscored when price action makes lower swing lows and highs.

In all the markets, uptrends and downtrends take place. However, numerous traders choose to trade by following a similar direction of the trend. Conversely, other traders following the contrarian strategy try to identify trades against the trade or reversal. Also, trends happen in data, as economic data of a month increases and decreases monthly.

How to trade with trend trading crypto strategy?

A variety of strategies for trend trading is available. Each of the strategies utilizes various indicators along with price action formulas. In terms of managing risks, a stop loss is a must-use regardless of which strategy is used. In case of an uptrend, stop loss is put under a swing low before entry or a different support level. Besides, a stop is usually put above the before swing high or a different support level in case of a downtrend.

In most cases, traders utilize these techniques combinedly while scrutinizing opportunities for trading. From a trader’s perspective, maybe they consider a breakout via a resistance level to point out a potential start of a higher move still when the price is trending above a particular moving average then only enter into a trade.

Bullish trade setup

If you are looking for a buy trade, then you can follow the guidelines below:

- First, you have to identify the market trend.

- If it’s in a downtrend, look for a price to reverse back and break over the resistance level.

- After a bullish breakout, check the dynamic level of 20 EMA; it resides over the price or below the price.

- If the dynamic level of 20 EMA resides below the price, it’s a buy signal.

Entry

When all the trading conditions are met that we have mentioned above, it signals a probable upcoming bullish pressure on the crypto price. So, you can open a buy position as the candle closes over the resistance level.

Stop loss

The most logical stop-loss order level will be below the last swing level with at least a 10-15 pips buffer.

Take profit

You can place the take-profit order by calculating at least a 1:3 risk/reward ratio. Or else, you can take the profit when the price breaks below the dynamic level of 20 EMA.

Bearish trade setup

If you are looking for a sell trade, then you can follow the guidelines below:

- First, you have to identify the market trend.

- If it’s in an uptrend, look for a price to reverse back and break below the support level.

- After a bearish breakout, check the dynamic level of 20 EMA. Is it residing below the price or residing above the price.

- If the dynamic level of 20 EMA resides above the price, it’s a sell signal.

Entry

When all the trading conditions mentioned above signal a probable upcoming bearish pressure on the crypto price, you can open a sell position as the candle closes below the support level.

Stop loss

The most logical stop loss order level will be above the last swing level with at least a 10 – 15 pips buffer.

Take profit

You can place the take profit order by calculating at least a 1:3 risk/reward ratio. Or else, you can take the profit, when the price breaks above the dynamic level of 20 EMA.

How to manage risks?

Uncertainty is the most certain thing in trend following trading methods. Hence, it is very significant to manage the risks because of the frequent uncertainty while using the trend following method in your trading. Regardless of what method is used, trading is associated with risks. Successful traders are well aware of the uncertainty of what the future may bring. So, giving thought to the fact that traders must keep ready total rock-ribbed money and risk management procedure without any choice.

Having a robust risk management approach helps in reducing losses. It further protects the traders from losing the entire amount of their trading account. The time traders encounter losses, the risk takes place. Therefore, managing the risk may open up more money-making opportunities in the market.

Furthermore, it is the vital but most overlooked obligation for progressive active trading. Ultimately, by missing out on a solid risk management strategy, even a trader generating meaningful gains may end up losing all of those with only one to two unlucky trades.

Stop-loss and take-profit points are the two major approaches that a trader can outline the plan of action in between. Master traders are aware of the selling and purchasing price they are inclined into. So, they can easily determine the return opposite of the potential of the price reaching their targets. If the traders find the adequate evaluated return, they go for the trade execution.

Pros and cons

| Pros | Cons |

| The volatility of the crypto market may bring lucrative chances to make a profit with trend trading. | The high volatility of the crypto market may bring a higher level of risk. |

| It is a 24/7 market that provides more gaining opportunities with trend traders. | The crypto market is comparatively small, causing a lack of liquidity. |

| Traders may start trading regardless of account size as no existing regulation exists. | Trading cryptocurrency is an advisable long-term investment. |

Final thoughts

Conceivably, you may obtain a better understanding of trends trading from this article as it is an opportunity with which many traders can gain a generous amount of profit. It gives an excellent allocation to your portfolio for trend trading, helping decrease the risk by its diverseness.

As per various studies, HODL is the best strategy that traders must keep in mind. Hence it is significant to keep the long-term holding and the trading capital. Also, one should not push things at the time of starting. Traders must stay cool-headed to make an entry. It is best to take time and utilize all the diverse analyses before starting.