Volatility is a market dynamic that you should consider when trading forex. Naturally, you would like to trade when the market moves, not when it is standing still. In forex, not all trading sessions are equal in terms of volatility.

If you want to trade with volatility at your back, the London session is your best bet. As your trading method allows, you can keep trading until the London and New York sessions overlap. The market is most active at this time. Try to avoid the first and last days of the week as markets are sluggish during these trading days, although not always.

Trading without losses is next to impossible. This is true whatever trading strategy you use. If you want to avoid losses, do not use stop losses but instead hedging (e.g., direct hedge or cross hedge).

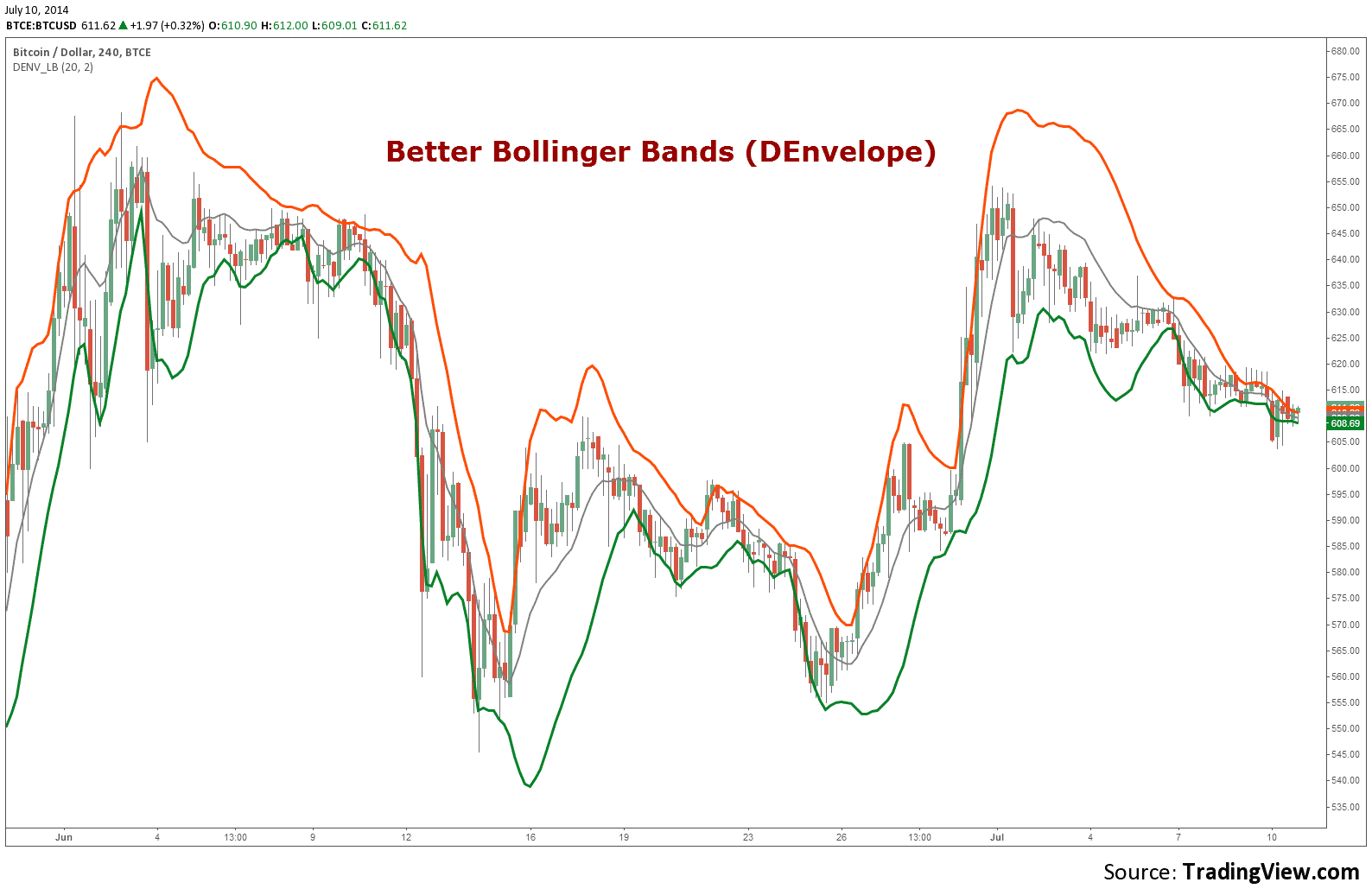

You can use various tools to gauge a volatile market. Examples include average true range, volume indicator, Bollinger Bands, etc. In this article, we will look at volatility trading in more depth, how to trade it, and how to mitigate risks.

What is a volatility trading strategy?

In forex, volatility measures the magnitude of price fluctuations from session to session and from day to day. One tool that quantifies volatility is Bollinger Bands. Traders love volatility because it provides them an opportunity to generate quick profits.

Imagine a trading day with nary a tick or two coming in. Keeping trade open for a few days because the market moves sideways is time-wasting. When the market picks up momentum and breaks highs or lows, that is where we make the most money.

However, be aware that volatility can work for and against you. You could lose a lot of money if you pick the wrong direction. That is why a stop-loss method or hedging is needed to avoid such losing episodes. You can quickly tell if a market is volatile by reading price action. When the market begins to move sharply in one direction, then volatility exists.

However, trading on this metric alone is seldom sufficient. You will never know if volatility will continue in one direction. Big market players may move price swiftly in one direction, only to have it turn around on you, dramatically pushing it the other way.

How to trade volatility trading strategy?

There are many ways to trade a volatile market. Let’s explore how to use Bollinger Bands (BB). To trade with this tool, follow the steps below:

- Put your chart on the hourly time frame.

- Apply the BB on your chart and use the standard settings.

- Wait for the market to consolidate for a while, establishing clear support and resistance levels.

- Wait for a break of support or resistance.

- Check if the price breaks one of the bands.

- Use a stop order as a hedge instead of a stop loss when the market goes against the trade.

- Determine the take profit target.

To know how to implement this strategy, we will take buy and sell trade samples in the next section.

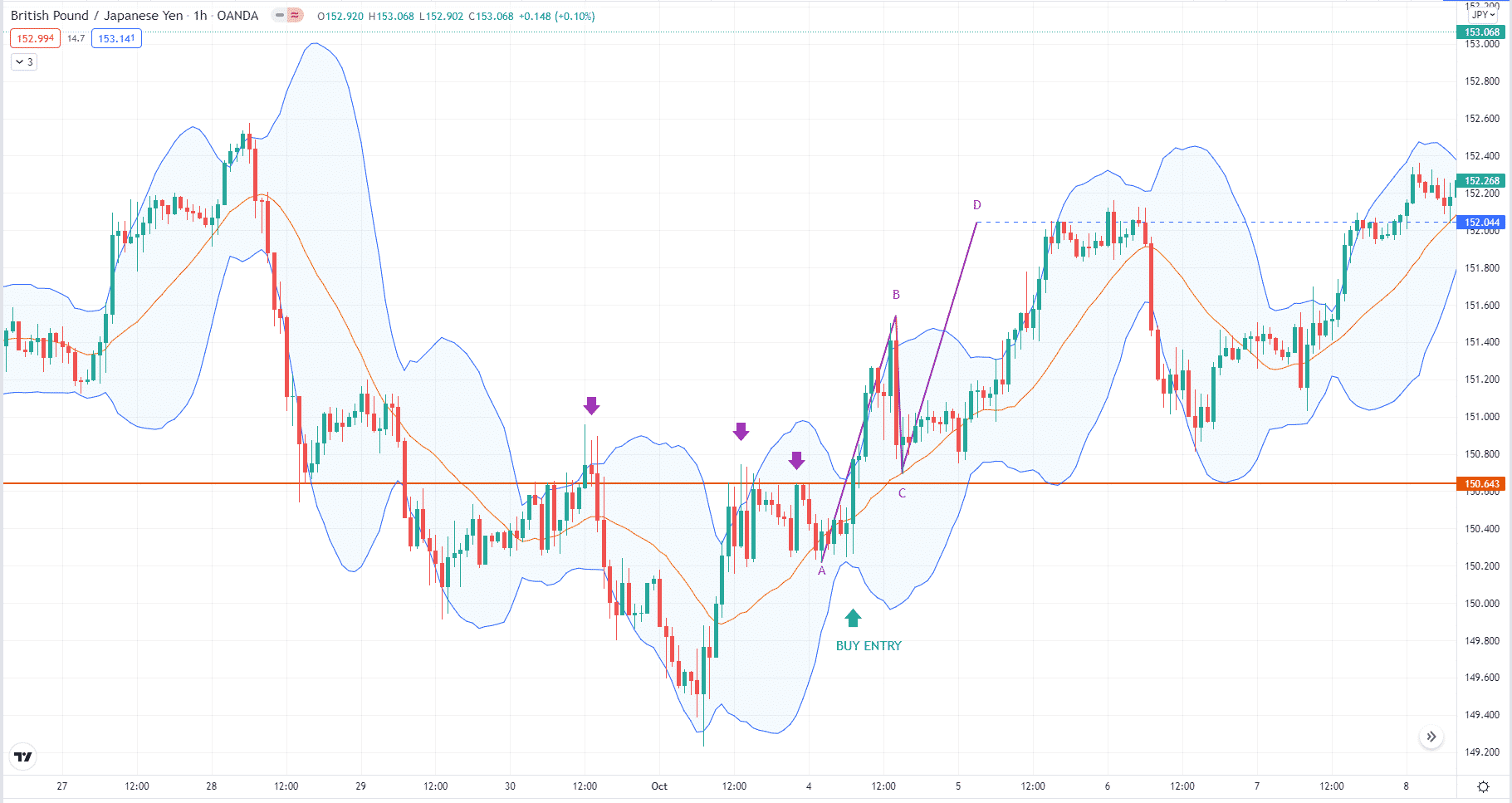

Bullish trade setup

Let us consider a buy trade using the above chart. Here you can see that price established a level of resistance as marked by the orange horizontal line. Price tests this level three times after it has become resistant. See the down arrows in purple. Eventually, a big bullish candle breaks above this level. It even manages to close above the upper band.

Entry

At the close of the breakout candle, we can initiate the buy trade right away.

Stop loss

We can put the stop loss a little below point A.

Take profit

Then we put the take profit at the level of point D, expecting the completion of an AB=CD pattern. The setup plays out quickly and favorably in our favor after entry.

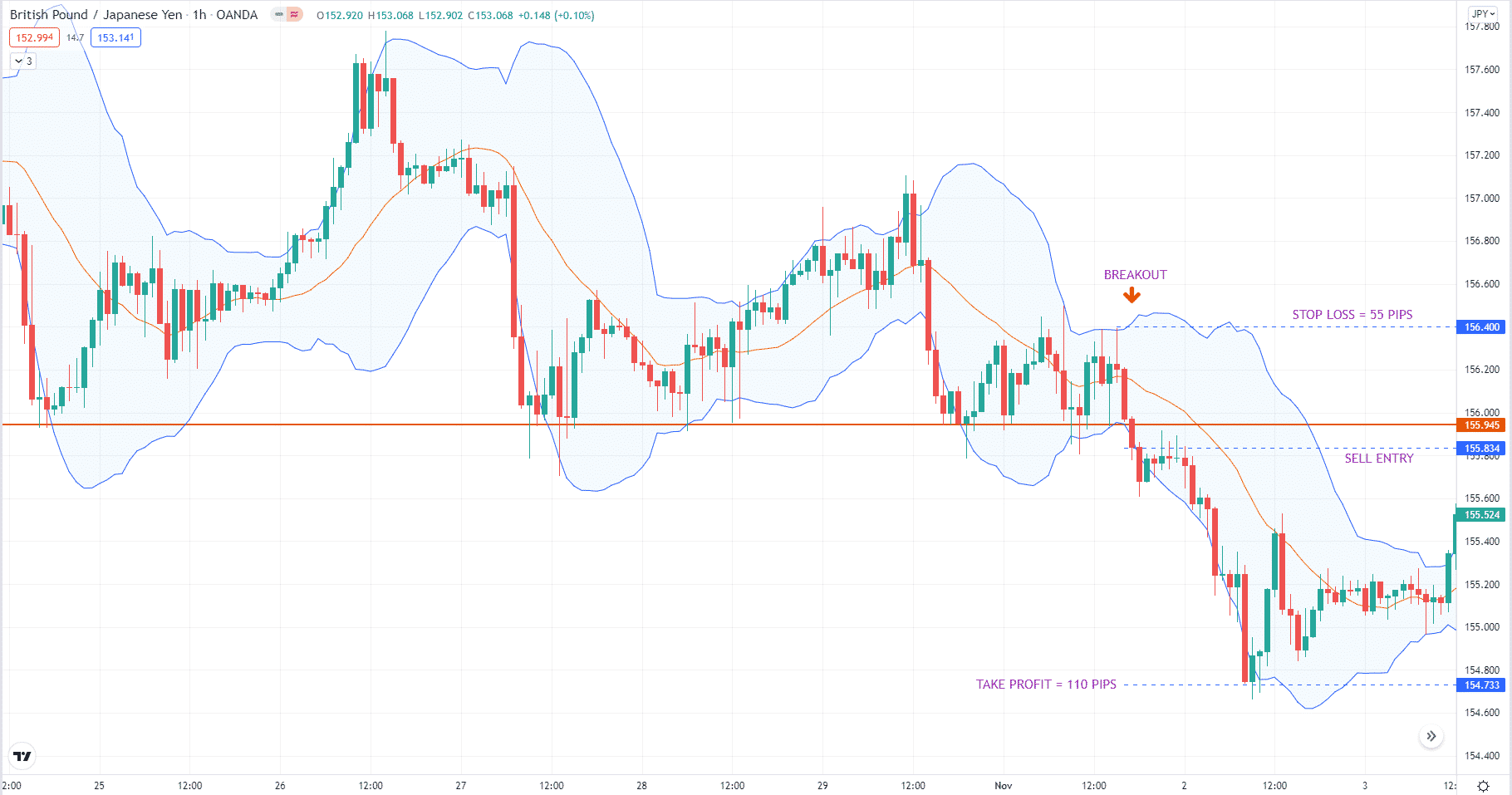

Bearish trade setup

Entry

We find a sell entry on the same instrument above. As you can see, price prints an obvious support level that has been tested around five times. This level is the orange horizontal line shown above. Finally, price breaks and closes below this level. After the breakout, we can execute our sell trade.

Stop loss

Here we can use a tentative stop loss to define our take profit level. Instead of an actual stop loss, you can use a buy stop to hedge the trade in case the breakout fails. In this situation, the breakout is legit, reaching our defined target of 110 pips below entry. This is an example of using a 2:1 reward-risk ratio in setting targets.

How to manage risks?

Having this mindset in trading is not only impractical but also dangerous. As already pointed out, making a profit without losses is impossible. Without accepting a loss, you could subject your account to heavy drawdowns, which you will unload at some point. Trading with volatility in mind is generally effective as long as setups are strongly qualified. This is because price normally continues to move in the breakout direction after building strength to break a level.

Still, this strategy is not guaranteed to result in profits. That is why you have to protect your account from unexpected losses by using stop loss or hedging.

Final thoughts

Volatility trading is an exciting trading strategy to implement. It is aligned with the concept that markets spend most of their time range. When they trend, you can expect a lengthy move in the trend direction. Before this happens, the price typically builds momentum by oscillating in a range. This will give it enough strength to break out and trend.

You can use the strategy presented in this article if you like. Alternatively, you can build on this strategy and develop your trading plan. You can use any indicator of your choice. Whatever you use, make sure your system is written down and reviewed at regular intervals.