The Vortex technical indicator pinpoints the commencement of a new trend or the continuance of a pre-existent trend in financial markets. The tool came from Viktor Schauberger’s work. Viktor was an Austrian inventor; he studied water flow in rivers and turbines. Moreover, there is another moderate influencer named J. Welles Wilder. His directional movement concept moderately influences the Vortex.

Using the tool will make your crypto trading journey fruitful without any doubt. Here we will discuss basic mistakes traders make while using this tool and how to avoid them to keep your trading juicy. The following section is for you if you are keen to know the trading strategy using this indicator.

What is the Vortex indicator?

It contains two oscillators capturing positive trend movement and negative trend movement. Despite the relatively complicated mechanism, the indicator is quite handy to decipher.

It has two lines:

- Uptrend line (VI+) that is green-colored

- Downtrend line (VI-) that is red-colored

The core idea of using this indicator is to identify trend reversals and validate current trends. However, crossing over the negative trend indicator or a base level activates a bullish signal in the case of a positive trend indicator.

On the other hand, a bearish signal activates while the negative trend indicator passes over the positive trend indicator or a base level. The Vortex indicator always has an entirely bullish or bearish bias, above or under these levels.

Top five tips for trading with Vortex

The tool is well-known that most professional traders utilize widely. Using the indicator is very beneficial in terms of clutching profitable trades. Here are the top five tips mentioned below. Following these tips while using the tool may be advantageous, and traders may gain more profits.

Tip 1. Use additional indicator

Applying the tool along with additional indicators may aid in avoiding false signals. A combination of trend-following indicators and the Vortex is a potential good match.

Why does it happen?

Using the stop-loss and take-profit levels while trading may be beneficial for managing risk better. Because no trading method, regardless of being the best is, existed, that may not be able to offer a precise signal all the time.

How to avoid the mistake?

When developing a trading strategy using the Vortex indicator, avoid combining it with similar types of indicators since their signal-providing stems may also be similar sources which may lessen their power of anticipation.

Tip 2. Follow the market context

Market context is a system that identifies the trend’s criteria, which has four elements.

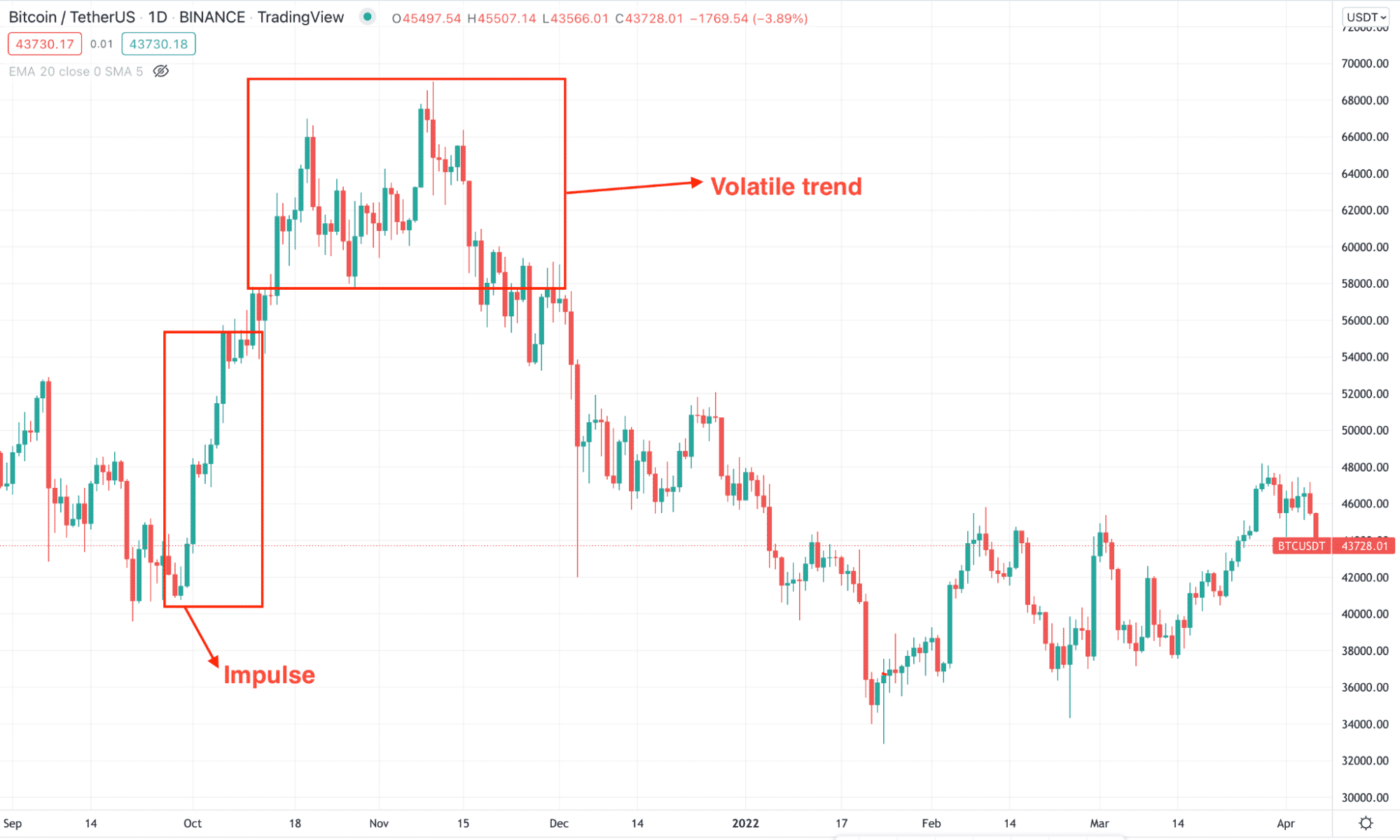

- Impulsive

While the price develops new highs and lows invasively, then it is counted as an impulsive trend. It depicts the possible price continuation of the current trend.

- Corrective

The condition is called corrective market structure when the price hardly develops new highs or lower lows. The corrective market structure indicates a market reversal.

- Volatile trend

If the market goes along with the corrective structure, indicating a market reversal, it is a volatile trend.

- Non-volatile trend

It emerges with the impulsive market momentum while the price endeavors to continue the current movement.

Why does it happen?

Context is the adjacent price action and current/recent market conditions that add to your preferred price action signal. It is not only the signal that may create a good trading setup but also the call makes sense within the market context it is set inside.

How to avoid the mistake?

It takes no big deal to be excited about a certain trading setup in the market meanwhile missing out all about the context it’s started in. For instance, you may have two similar-looking pin bars but rely on the market context where one may be worth trading and another may end up being worthless.

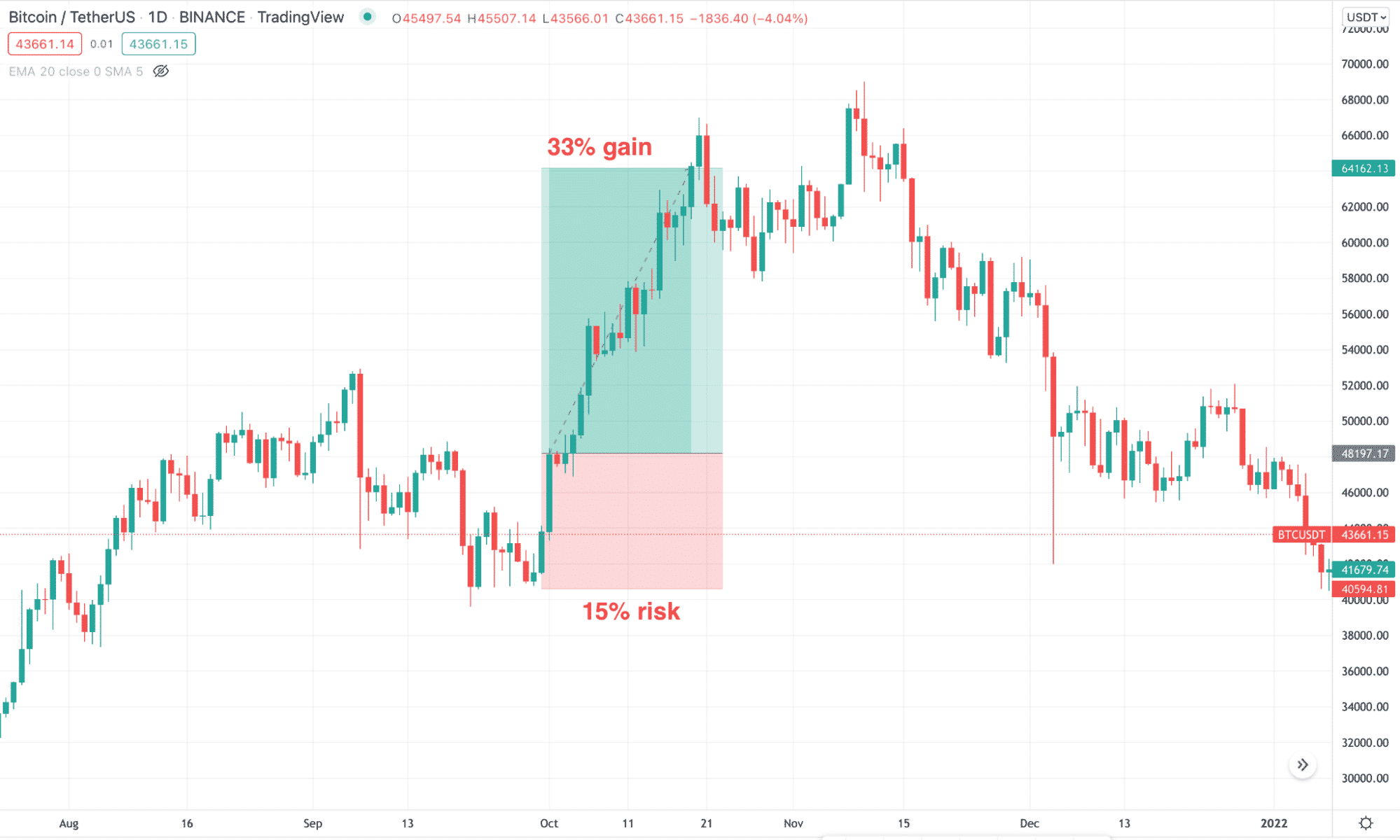

Tip 3. Try not to forget the risk management

The crypto market is expanding at a crazy speed. The starting of 2021 smashingly shows it. This market’s total capitalization surpassed $1.36 trillion on 9th June 2021. In contrast to 2021, the market capitalization was evaluated only at 160 billion in March 2020. Still, numerous people take no notice that trading crypto is not only about profits but also about risks since the market keeps on expanding at high speed.

Why does it happen?

Let’s have a look at a short instance. Suppose you are willing to invest in cryptocurrencies and buy a comparatively stable and robust crypto project for your whole deposit. But something unexpected happened when you had not expected them totally, and the price of your project collapsed by 50%. That means you are losing 50% of your deposit only due to a solitary deal.

How to avoid the mistake?

To avoid these types of conditions, evaluate the trade size. In most cases, traders get carried away by emotions instead of calculating by being rational or logical. It is called fear of missing out ‘FOMO’. Try to think rationally.

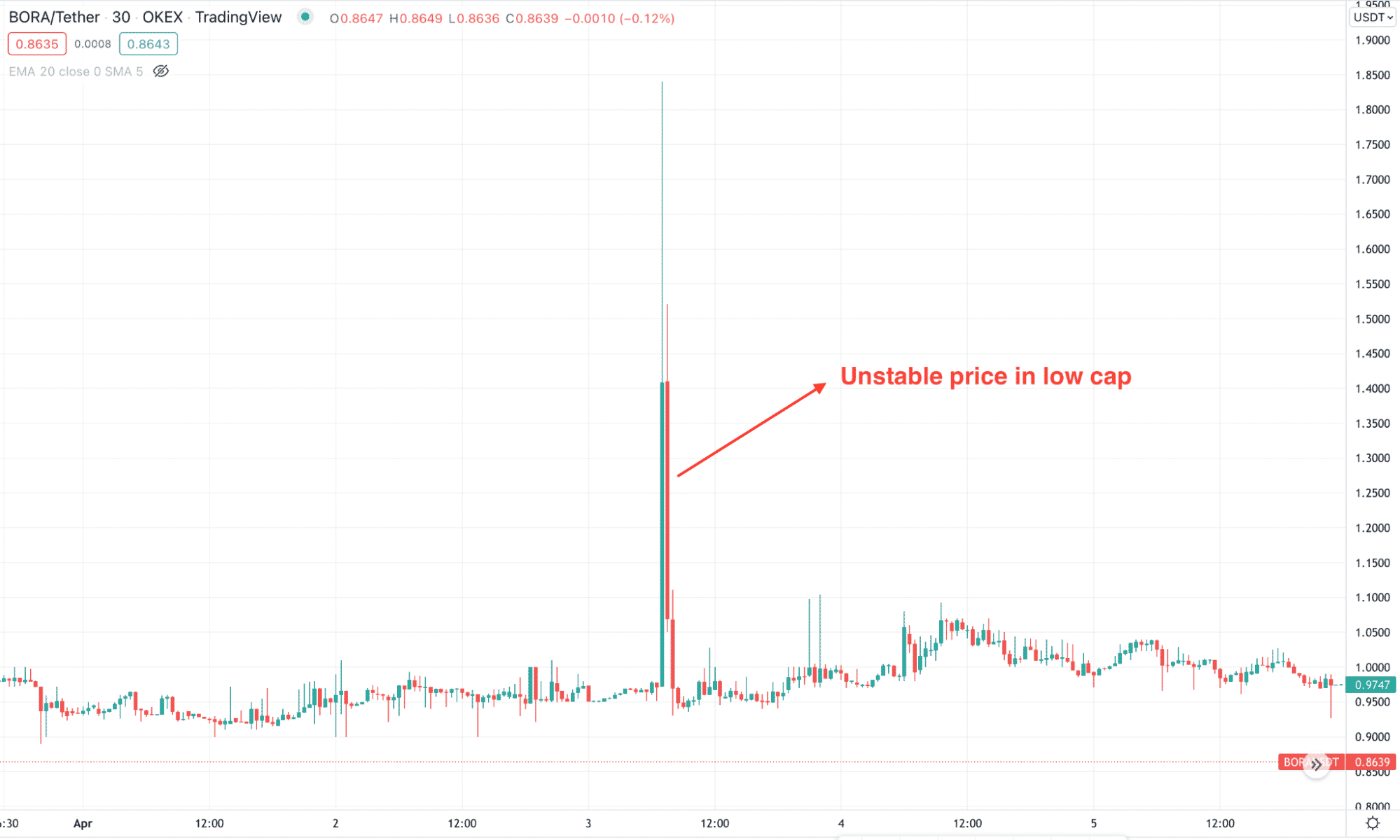

Tip 4. Stick on large-cap cryptos

Market cap is standard to measure the market value of particular crypto. Hence, it is utilized as a benchmark of the supremacy and fame of cryptos. Since the notion is still widely used before you make any trading choices, gathering more data on the market cap is suggested.

Why does it happen?

The idea behind the market cap is frequently encountered criticism even if it is broadly used. The crypto market cap reveals the long-term fame of the coin to some extent.

How to avoid the mistake?

It is always suggested to run detailed research in the first place afterward and pay heed to all the factors that may essentially impact the cryptocurrencies you are willing to invest in.

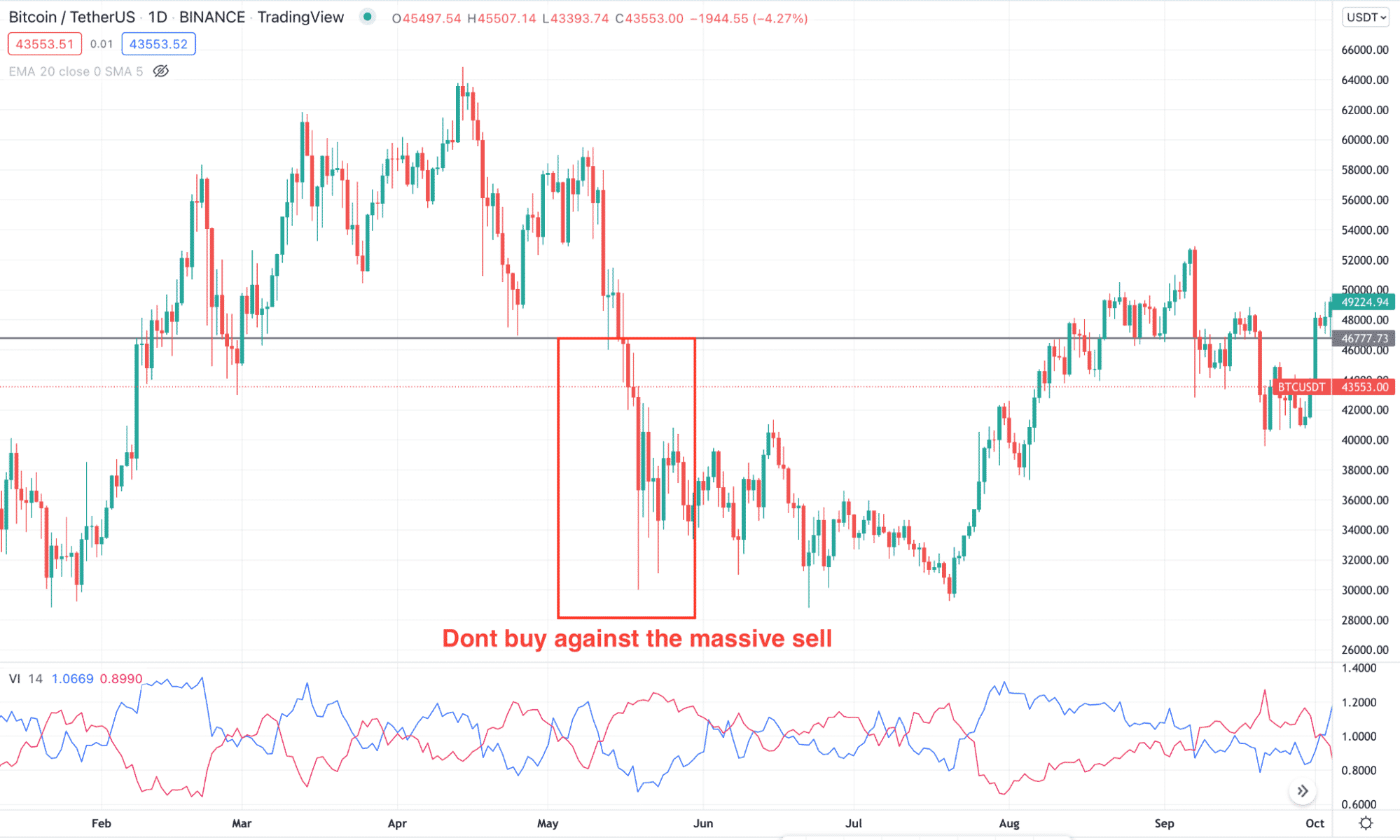

Tip 5. Choose when not to trade

No existing mechanism is 100% automatic that may obtain outstanding outcomes. Hence, you have to constantly make decisions, such as deciding when not to trade. You must understand that the market is in the control of the market giants, the market is immensely volatile, and here someone wins while someone loses. It is significant to get a transparent understanding aforehand taking entry into crypto trading.

Why does it happen?

Lack of data, knowledge and perception is the most significant drawback amidst the many obstacles related to cryptos.

How to avoid the mistake?

In most cases, novice traders do not understand the entry points and exit points before starting any trade. It leads them to chase the top prices all the time since they trade, relying on their optimism. Therefore, it is mandatory to know about both entry points and exit points before starting.

Final thought

The Vortex tool is a unique indicator in terms of direction. It gives clear indications and specifies the overall trend. Also, the indicator applies to a range of cryptos across various time frames. Hence, always consider the tips mentioned above while using the tool to grab more profitable trades.