Forex trading has exploded at the height of the Covid-19 pandemic. This is because many people stay at home and have nothing much to do. Thanks to electronic trading, just about everyone, regardless of financial status, can trade forex.

In 2021, the number of online forex traders has reached 13.9 million. This statistic indicates that one person in every 561 population is a trader.

Trading can be a time-demanding career, depending on your style. If you are a day trader, you will spend a lot of time finding entries and monitoring trades on your desk. For busy professionals, day trading is not suitable. The good thing is that there is one trading method that is not as demanding. That is end-of-day trading (EOD trading).

If you hold a day job, you can trade FX even with limited time through EOD trading. Just open your trading platform at the opening of a new trading day. This coincides with the close of the previous trading day. Then scan your favorite pairs, focusing on higher time frames such as the daily chart.

There is more to EOD trading than this, and you will learn more as you read through this article.

What is an end-of-day trading strategy?

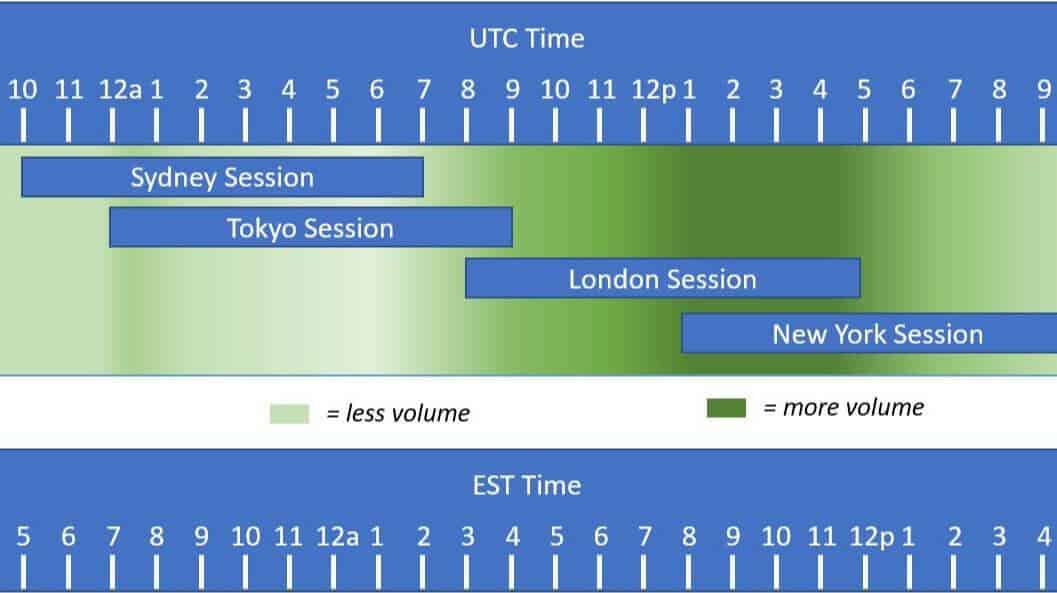

It is not a strategy per se by the definition of the term itself. It is simply a trading routine. With this routine, you look at your charts and find entries when the market is about to close. It happens at the close of the New York session. This type of routine has a lot of advantages to the trader. It is generally less stressful than day trading. Also, as traders claim, they get more quality entries when they trade this way. This is because they tend to focus on higher time frames, specifically the daily chart.

You will not worry about news items, exchange rate fluctuations, or life pressures when you do EOD trading. EOD setups tend to give you a clear picture of the trend and high-quality candlestick patterns. Others think this type of trading is less profitable, but this is not true.

EOD trading naturally makes you a swing or position trader. It allows you to capture a massive amount of pips by trading less often and keeping your trades open for quite a long. If you work a day job, this trading routine suits you well.

How to trade end-of-day trading strategy?

With EOD trading, you do not need to find or develop a new trading strategy. The existing strategy that you apply on lower time frames applies to EOD trading. You move from a lower time frame to a higher time frame. If you have a trading plan, which you should, use the same plan.

A typical trading plan includes:

- Specific instruments to trade. Will you trade the 28 major pairs or just a few of them?

- Market condition. Will you trade a trending market? What about ranging markets?

- Set of indicators to use. Here you will list down the indicators and their specific settings.

- Entry rules. What events must transpire before you open a trade? Here you will use your favorite indicators if you are a technical trader.

- Exit rules. What scenario must happen before you close a trade? Will you use stop loss and take profits?

- Money management. What percentage of your account are you going to risk in each trade?

- Risk management. What reward-risk ratio will you accept or aim for in each trade?

- Performance evaluation. You need to decide how frequently you will do a performance evaluation to understand the effectiveness of your strategy. This is how you will continually improve your trade plan. You can do this, for example, every time you have opened and closed ten trades.

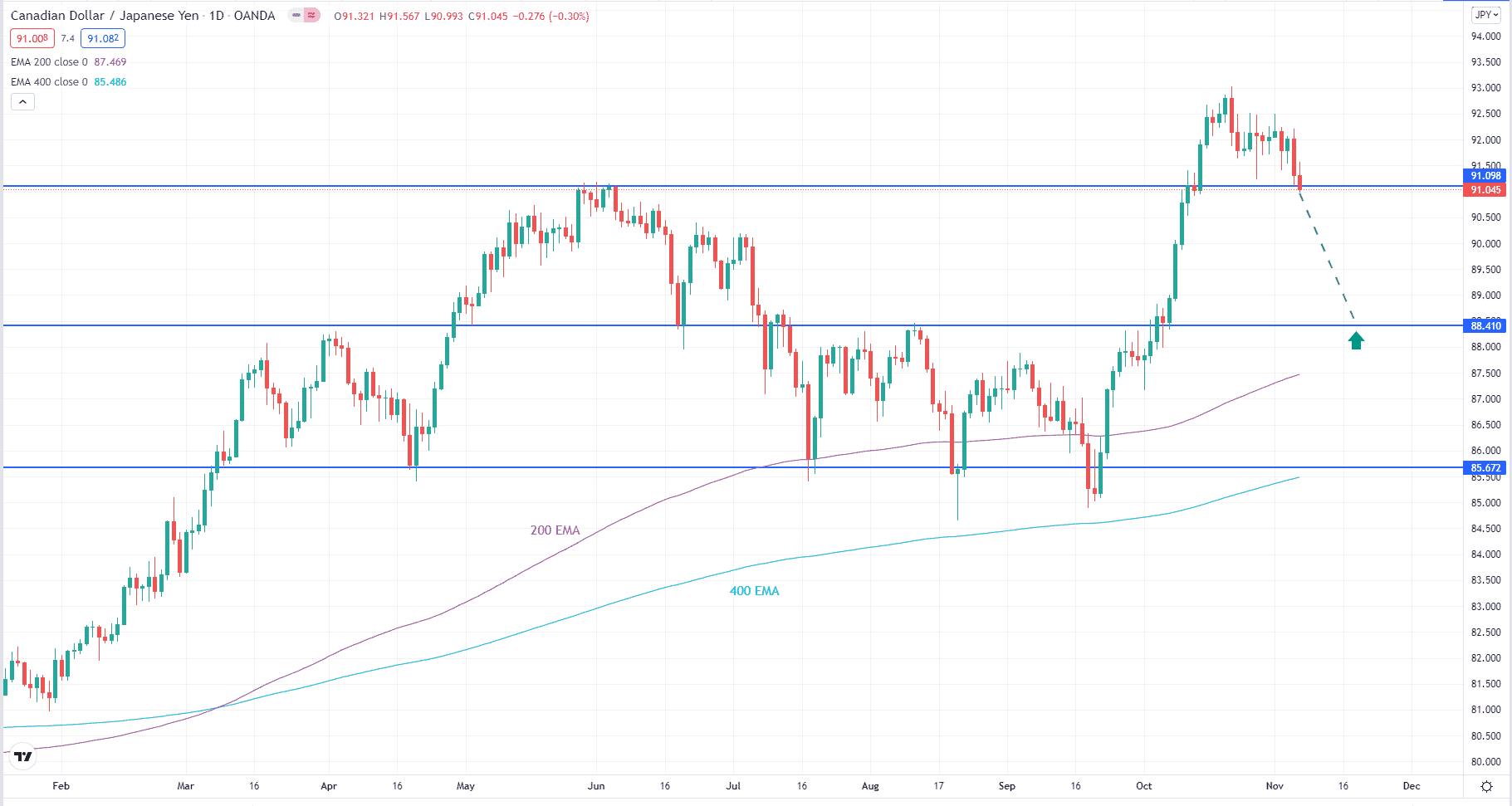

Bullish trade setup

Let us use the above chart to discuss a sample buy entry. As already mentioned, EOD trading focuses on the higher time frame, particularly the daily chart. You can use any trading method you like, but the daily chart is one way to trade.

- First, you identify the trend using long-term moving averages. Here we use 200 EMA and 400 EMA. Since 200 EMA is above 400 EMA, the trend is up. Therefore, you will look for long entries.

- Next, you plot horizontal lines marking support and resistance. When price returns to these lines, be on high alert.

- You might find a trade opportunity. The price is on support on the above chart, but we are not interested in taking long. This is because the price is too close to the previous swing high. We are interested in when the price moves down to the following line as shown with an up arrow.

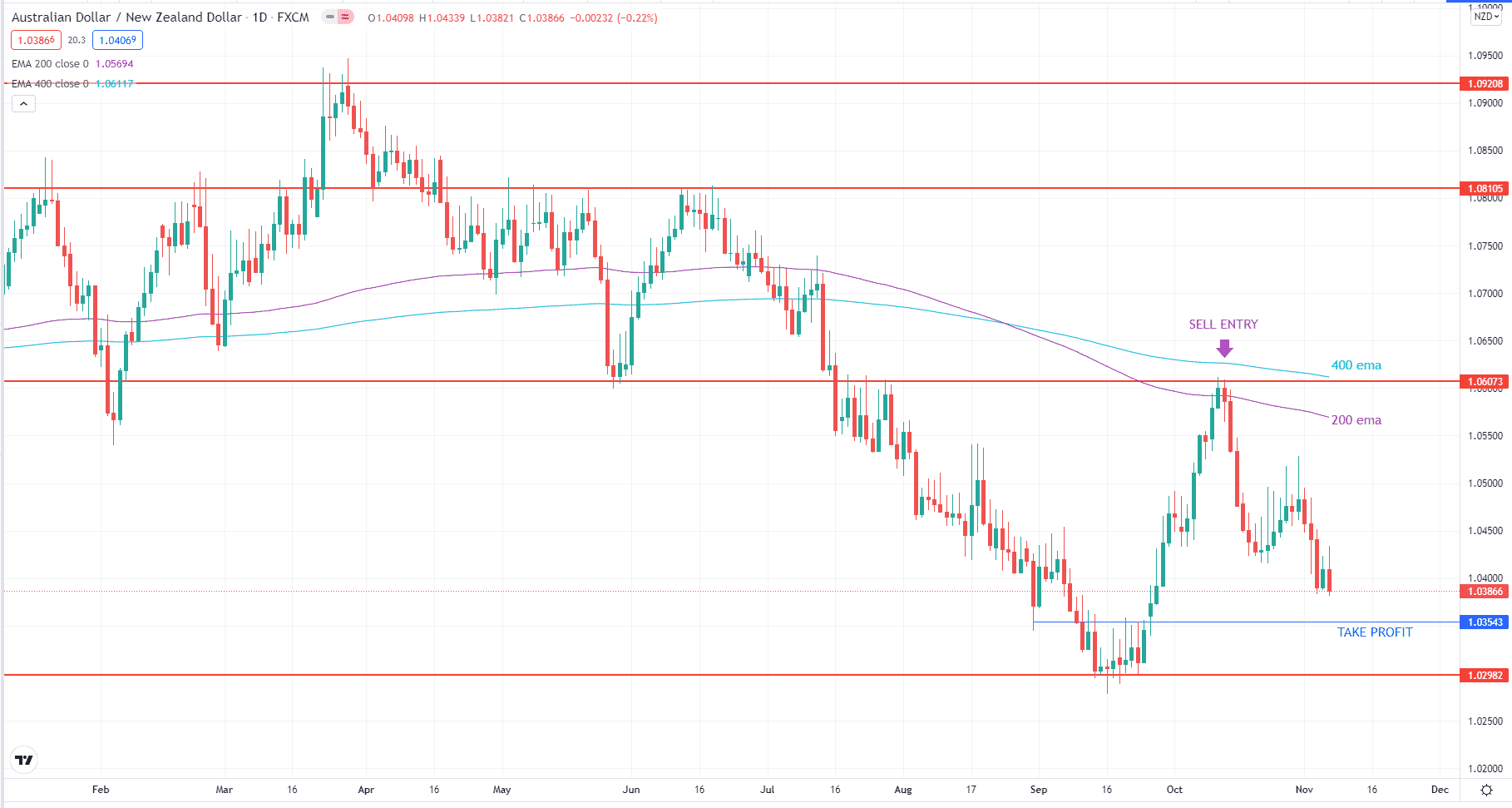

Bearish trade setup

Let us take the above AUD/NZD daily chart to explain a sell entry. The trend here is bearish because 200 EMA is below the 400 EMA. Therefore, we will look for sell entries only. Next, you plot horizontal lines to mark off support and resistance. When the price pulls back to these lines, be ready. A sell trade could be around the corner. On the chart above, the perfect sell entry occurs at the intersection of resistance and 200 EMA.

The entry is challenging because we do not get a clear candlestick pattern. It looks like we have a bearish engulfing formation. This is because the second candle’s body is within the range of the previous candle’s body. This is not the textbook definition, but it is worth considering. Then your sell entry could be the break of the low of the inside candle. You can put your take profit a little higher than the lowest support level to be safe.

How to manage risks?

Whatever trading method you use or the schedule you trade, trading involves risks. Losing is always part of the game. You can win some trades and lose some trades. To become profitable, you have two options.

- First, you should have more winning trades than losing ones.

- Second, you should gain more money in your winning trades and lose less money in your losing trades.

Final thoughts

If you are struggling as a trader, consider using the EOD trading routine. In forex trading, doing more will not always lead to earning more, much less success. The opposite is quite true. Many traders lose money because they try so hard. With EOD trading, you can trade in a more relaxed manner. You execute trades based on your trade plan and let the market do the talking.