Carry trading is one of the most straightforward strategies in existence. It happens anytime you purchase a high interest-rate currency and sell a low interest-rate currency.

Every time two currencies vary in interest rates, you will find a carry trading opportunity. For instance, when GBP has an interest rate of, say, three percent and USD has, say, one percent, buying GBP/USD will allow you to make profits in the form of interest. You will get an interest credit for each day that your GBP/USD trade is open.

A carry trade takes time to play out. As such, it is best carried out with sentiment and fundamental analysis. A successful carry trade allows you to make two types of profit in one trade: interest and exchange-rate movement.

If you want to know how to use this simple method, keep reading through to the end. Now let us gain some more background about carry trading in the next section.

What is a carry trading strategy?

Most traders engaging in carry trading look to enter positions in the positive swap direction. You will gain interest when you buy a high interest-rate currency and sell a low interest-rate currency. This is possible even if you long or short a currency pair.

When you carry trade, you will use a leveraged account. It means that you can command a prominent position in the market using relatively more minor collateral. Just be aware that leverage can work both ways. It can amplify profits or augment losses. Therefore, a proper risk management method is necessary to trade safely.

How does the carry trading strategy work?

When you trade foreign exchange, you buy and sell two currencies at the same time. Anytime the interest rate varies between two currencies forming a pair, you may gain or pay interest.

To carry out carry trading successfully, the variance in interest rates must work hand in hand with price movement. That is why you must look up the values of interest rates from any reputable online resource. Also, you must check the long swap and short swap of each currency pair in your trading platform. Apart from this, it would help if you studied fundamentals to gauge the future outlook of different pairs.

Your broker carries out interest deductions or payments at the close of the trading day. Then your open positions (floating profit plus commissions) roll over to the next trading day. Note that carry trading requires time to play out, so it is usually a long-term trading method. That is how you are going to accumulate profits from interest.

How to apply the carry trading strategy?

Here is how to implement the carry-trading strategy. Make sure that you follow the three steps below in the correct order to succeed in this trading style.

Step 1: Pick a currency pair

The first step is to select a currency pair. Base your decision on the value of the long or short swap. If you are a new trader, you should stick to the USD pairs, namely:

- EUR/USD

- GBP/USD

- NZD/USD

- AUD/USD

- USD/JPY

- USD/CAD

- USD/CHF

When selecting a pair, choose one with the highest positive swap in any direction. This will give you the chance to score a lucrative deal. Take note that the interest you earn rests on four factors:

- Interest-rate difference between the base and quote currencies

- Position size

- Number of days you hold the position

- Broker factor; some offer better swap rates than others

Step 2: Consider the technical aspect

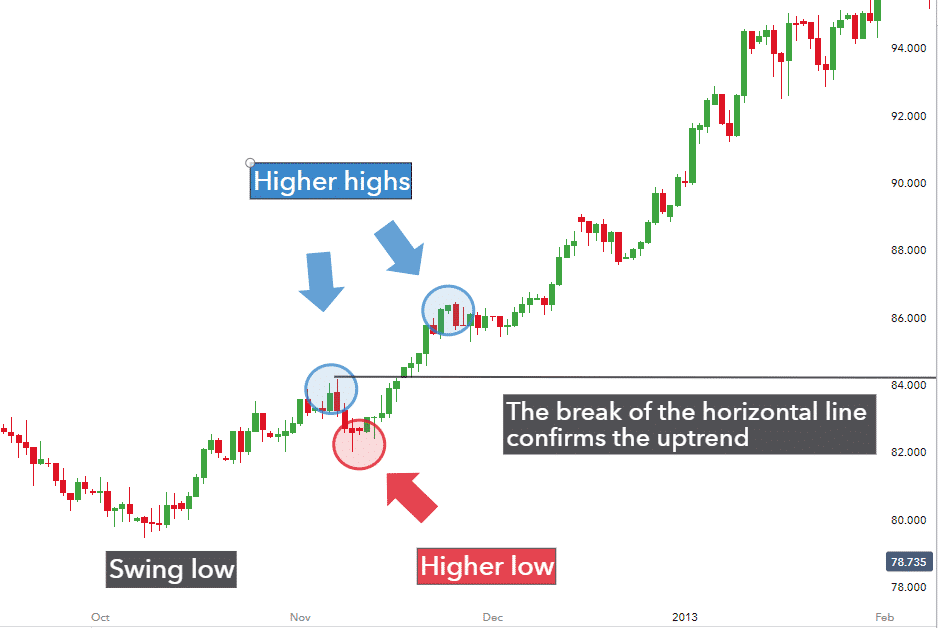

The technical aspect of the contemplated carry trade entry should align with the direction of a positive swap. A carry trade transaction will become more rewarding if the exchange rate and positive swap are in the same direction.

For example, if the long swap of GBP/USD is positive, you would like to open long trade. When the exchange rate goes up, you stand to gain interest and the pip difference between entry and exit prices. The most straightforward tool you can use to gauge the trend is a 200 EMA.

Step 3: Manage the trade

Carry trading follows the concept of investing.

- If the short swap is positive, you can sell and hold the trade for a long while.

- If the long swap is positive, you can buy and hold the trade for weeks or months.

When you have made significant profits from a carry trade, secure the trade at some point. You know that trending markets do reverse. Look for market signals when the trend is about to reverse. Use stop trailing to lock in profits.

Bullish trade setup

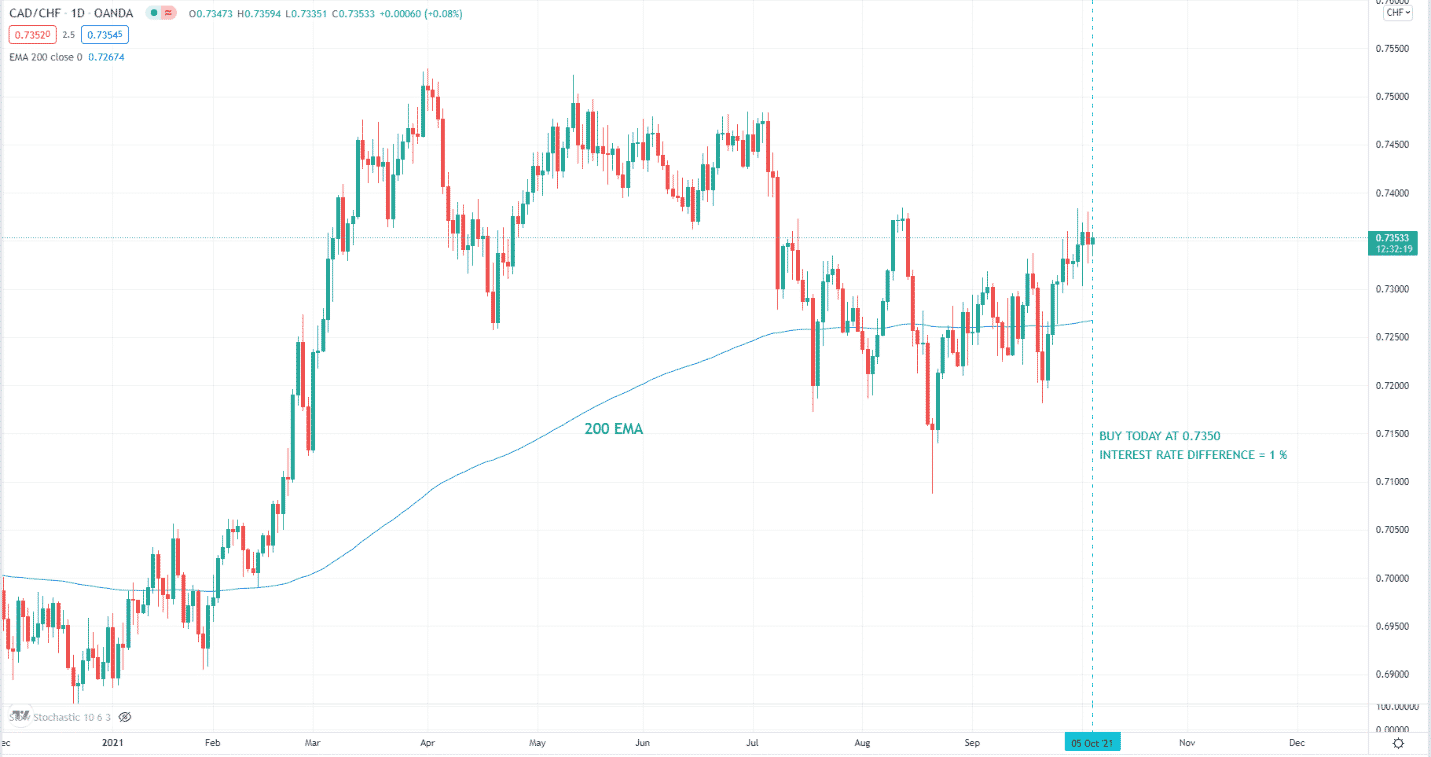

Let us take a real scenario to illustrate the carry trade. At the time of this writing, the Bank of Canada has an interest rate of 0.25 percent, while the Swiss National Bank has -0.75 percent. The difference is one percent. The daily interest for one lot of CAD/CHF is:

Daily interest = {[0.0025 – (-0.0075)]/365} * 100,000 = $2.74

The daily interest is not much as you see. However, if you hold the trade for a long time, that is how you can amass big profits. Even if the exchange rate of CAD/CHF moves to your entry point after one year, the interest you earn would be substantial.

You can open a long position at any point since the long swap for CAD/CHF is positive. Once you execute the trade, take note of the price entry, and monitor the price against the 200 EMA.

You expect the price to rally from this point onward. As long as it stays above the 200 EMA, you stand to make money as the interest accumulates over time. When the price goes below the 200 EMA, and your long entry has become profitable, you can close the trade.

Bearish trade setup

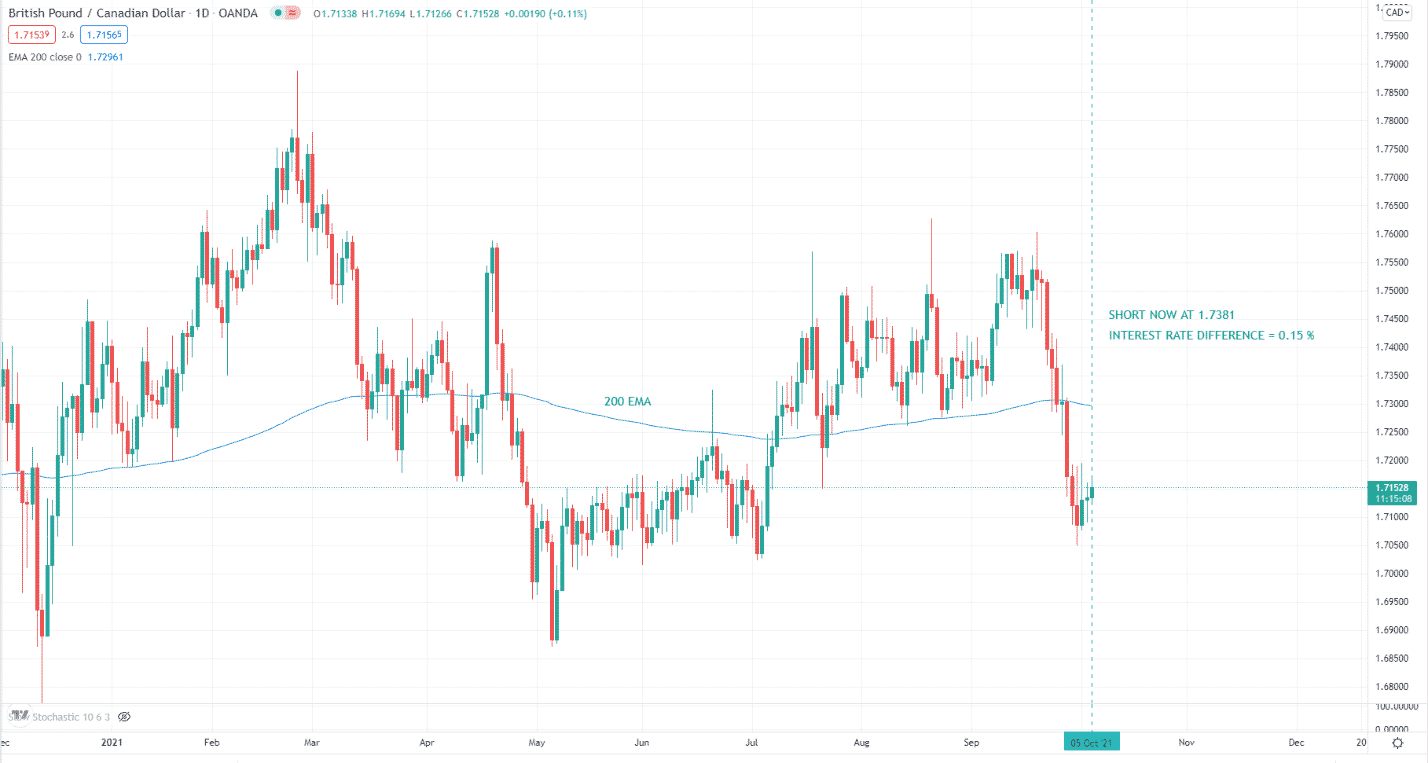

Let us take an example to illustrate how a positive swap on the sell-side is generated. At the time of this writing, the Bank of Canada has a rate of 0.25 percent, and the Bank of England has 0.10 percent. To earn interest, you must buy the high interest-rate currency (i.e., CAD) and sell the low interest-rate currency (i.e., GBP). To do this, you must short GBP/CAD.

You can open a short position at any point since the short swap for GBP/CAD is positive. Once you execute the trade, take note of the price entry, and monitor the price against the 200 EMA. You expect the price to sell off from this point onward.

As long as it stays below the 200 EMA, you stand to make money as the interest accumulates over time. When the price goes above the 200 EMA, and your short entry has become profitable, you can close the trade.

How to manage risks?

Typically, a carry trade has no stop loss. You will hold the trade long enough until you accumulate substantial interest. This is possible even if the market moves against your position. However, you can only hold the position for as long as the drawdown is tolerable.

If the dollar amount corresponding to the number of pips lost significantly outweighs the interest gained, consider letting go of the trade at a loss. The trade size should not take too much of your capital to exit the trade without harming your account. Therefore, the trade volume is critical to the success of the carry trade.

Final thoughts

Carry trading is relatively easy compared to other trading strategies. Plus, you can make money in two ways: interest and pips gained. However, it does come with a risk. When you use this strategy, do not risk too much of your capital in any one trade. This will allow you to exit a trade in a loss without gravely affecting your account. Then you can trade another day.