When trading in the forex market, tools are considered essential. The FX signals are used by several traders daily, which allows them to realize when to buy or sell in the market.

Trading while using this indicator can be used by market participants to receive more reliable trading signals. It reduces the noise that causes moving averages to fluctuate. Eliminating small fluctuations allows one to observe the trend in an asset price.

By reducing the lag between a MA and the price, the ALMA smooths the line. In place of calculating an SMA for a period, it applies a MA twice — from right to left as well as left to right. To master this trading style, you must consider some tips. This article will discuss the ALMA indicator, the best ways to trade, and the top tips to master.

What is ALMA?

This algorithm is a technical analysis tool designed to mitigate minor price fluctuations and enhance market trends. Zero-phase digital filtering reduces the amount of noise in the signals produced and makes them more reliable than conventional averaging.

The movement is enhanced by applying 1-2 average activities twice, once left to right and once right to left, using this trick. As the signaling process continues, the price lag typically associated with other techniques gets reduced.

Top five tips for trading with ALMA

You can use these top tricks you can apply while using this specific metric.

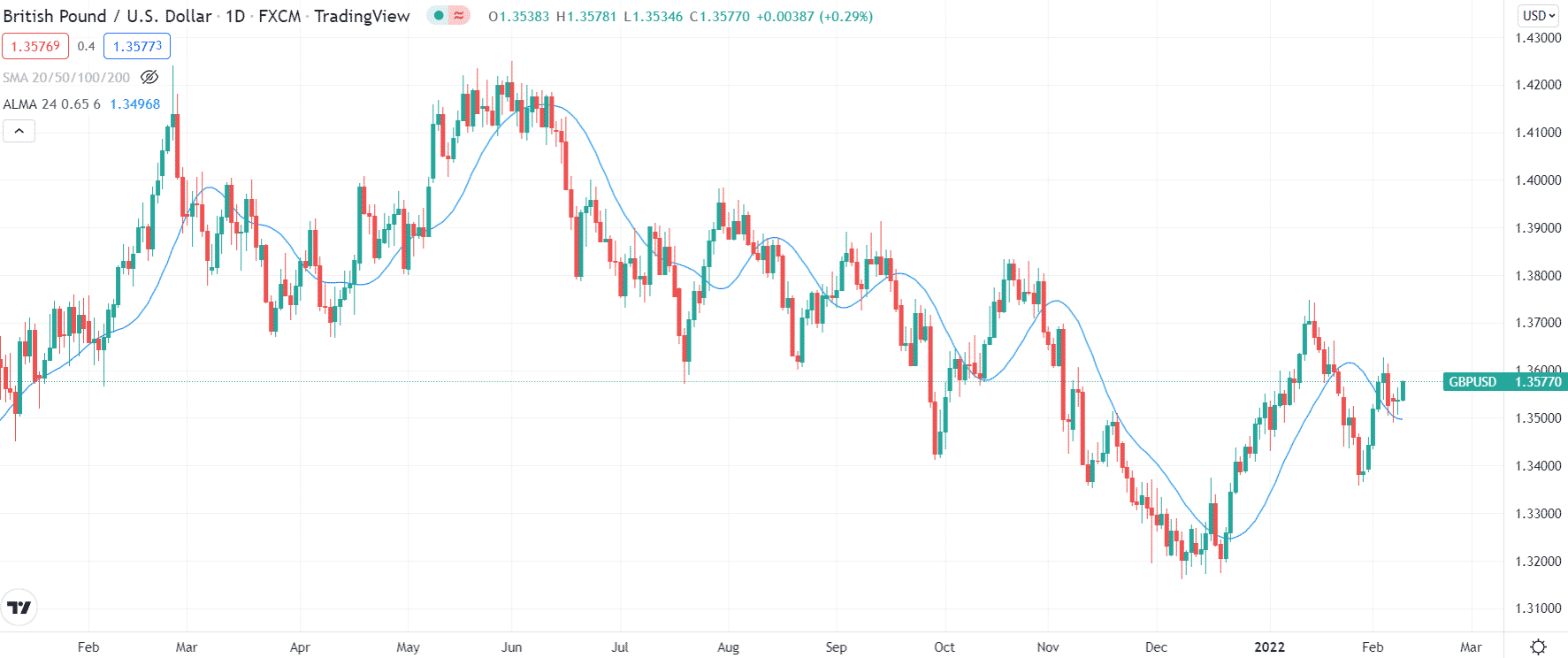

Tip 1. Trade according to the trend

ALMA can serve as the benchmark to use according to the trend. So, it would be best if you considered trading it with trend movement.

What is it about?

During periods of solid asset price increases, it will remain above the asset price. Conversely, during periods of downturns, the price stays below the average.

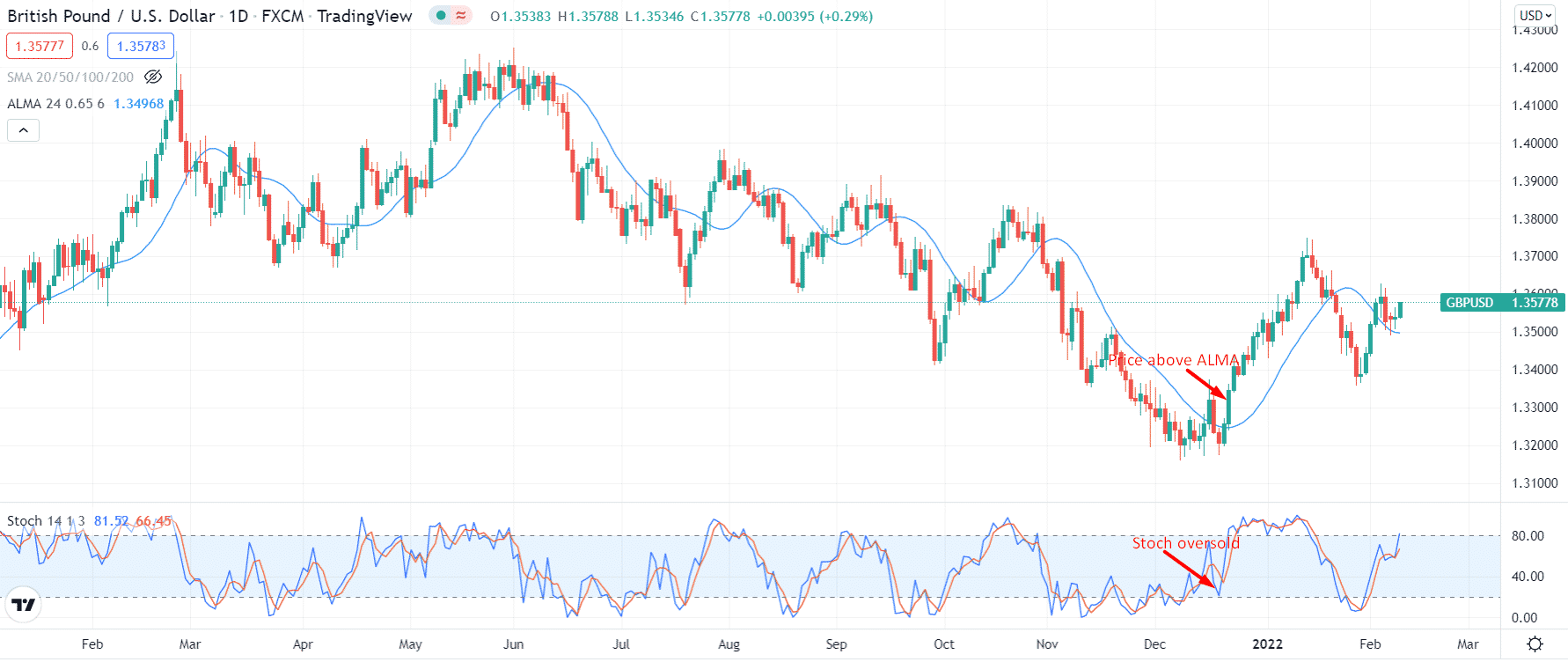

As a result, retracements and breakouts can be traded like any other support and resistance indicator. Stochastic can also indicate overbought and oversold positions in a trading system. It is common for two hands to appear simultaneously when congruent signals.

How to avoid the mistake?

Altogether, these signals can be used as a trend line indicator since it’s more efficient than the regular moving averages, and it’s nothing but a trend indicator. As the price takes a position above the point, you will see an uptrend, and a downtrend will occur as it decreases below it.

Furthermore, to identify oversold and overbought levels within a trend, we also employ a stochastic oscillator with a setting of 14, 3, 3. You can check the high momentum at approximately 20-30 and 70- 80, respectively.

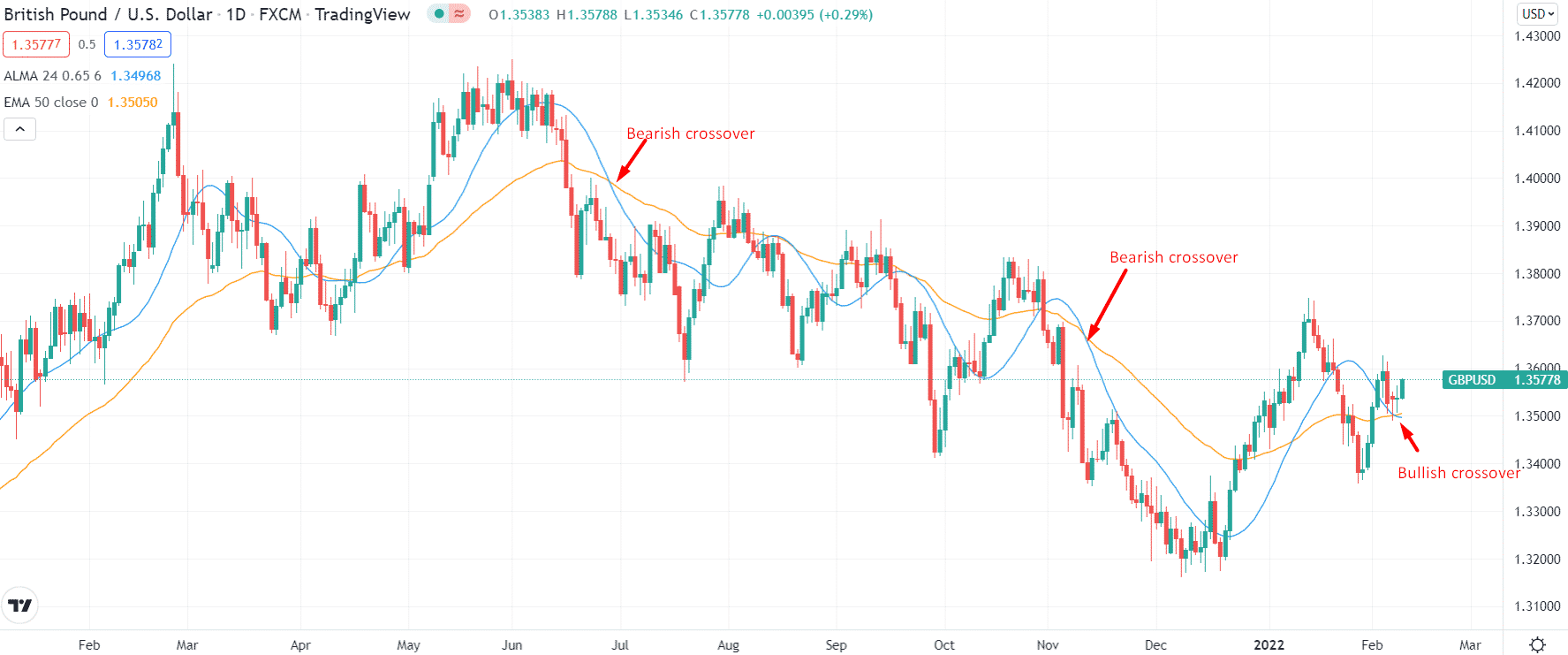

Tip 2. Use ALMA with EMA to trade crossovers

Using two exponential moving averages and the indicator is another easy way to deal with the ALMA.

Why does it happen?

In this case, the (50 periods) defines the primary trend filter, meaning that longs have to be taken above it and shorts have to be taken below it. Five and ten-period exponential moving averages are plotted to provide early direction indications.

How to avoid the mistake?

You can take long signals when the 50 EMA crosses above it, which results in a bullish crossover. In the same way, temporary signs are taken when the 50 EMA crosses below the indicator at the bearish crossover.

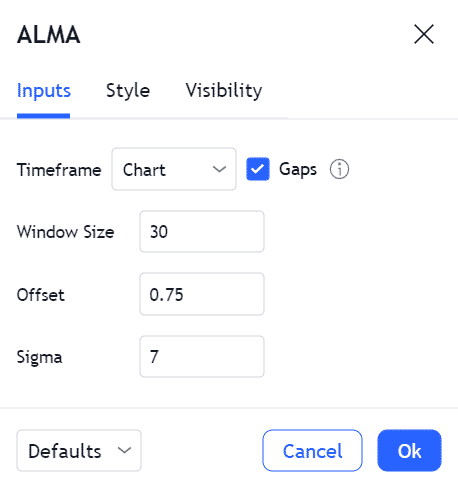

Tip 3. Play around with settings of ALMA

You may alter the settings of indicators based on your trading style.

Why does it happen?

The default settings of the indicator generate a very narrow line sticking to the candlesticks. Such a thing does not allow traders to interpret the market.

How to avoid the mistake?

You may change the window size or offset as per your trading style. For example, increasing the window size and decreasing the offset value may filter plenty of noise associated with the indicator.

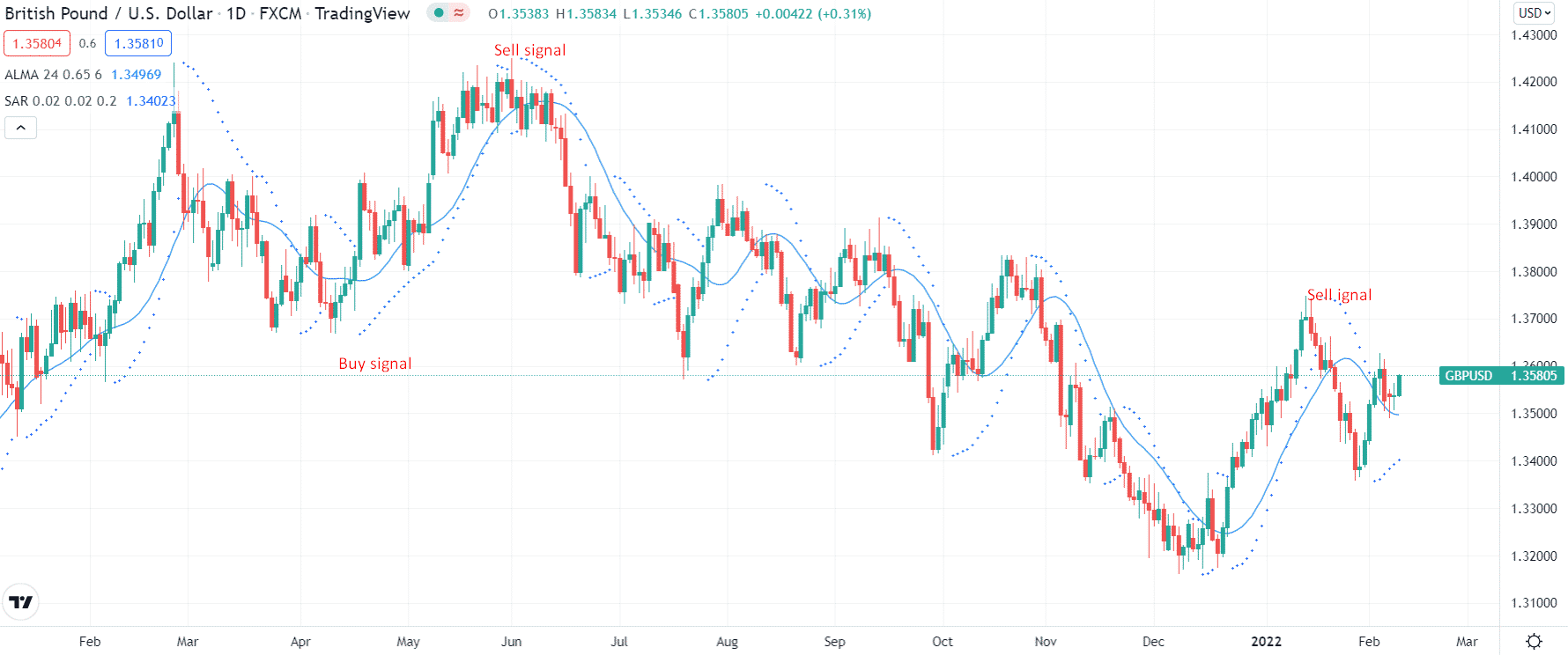

Tip 4. Combine ALMA and Parabolic SAR

Another way to trade this indicator effectively is to link it with Parabolic SAR.

Why does it happen?

Traders typically open a sell position when the asset closing price falls below ALMA and the Parabolic SAR plots above the high cost when using this combination.

How to avoid the mistake?

Traders consider opening a buy position when the asset closing price crosses the ALMA and the PAR plots below the high cost. Nevertheless, no system can guarantee 100% accuracy.

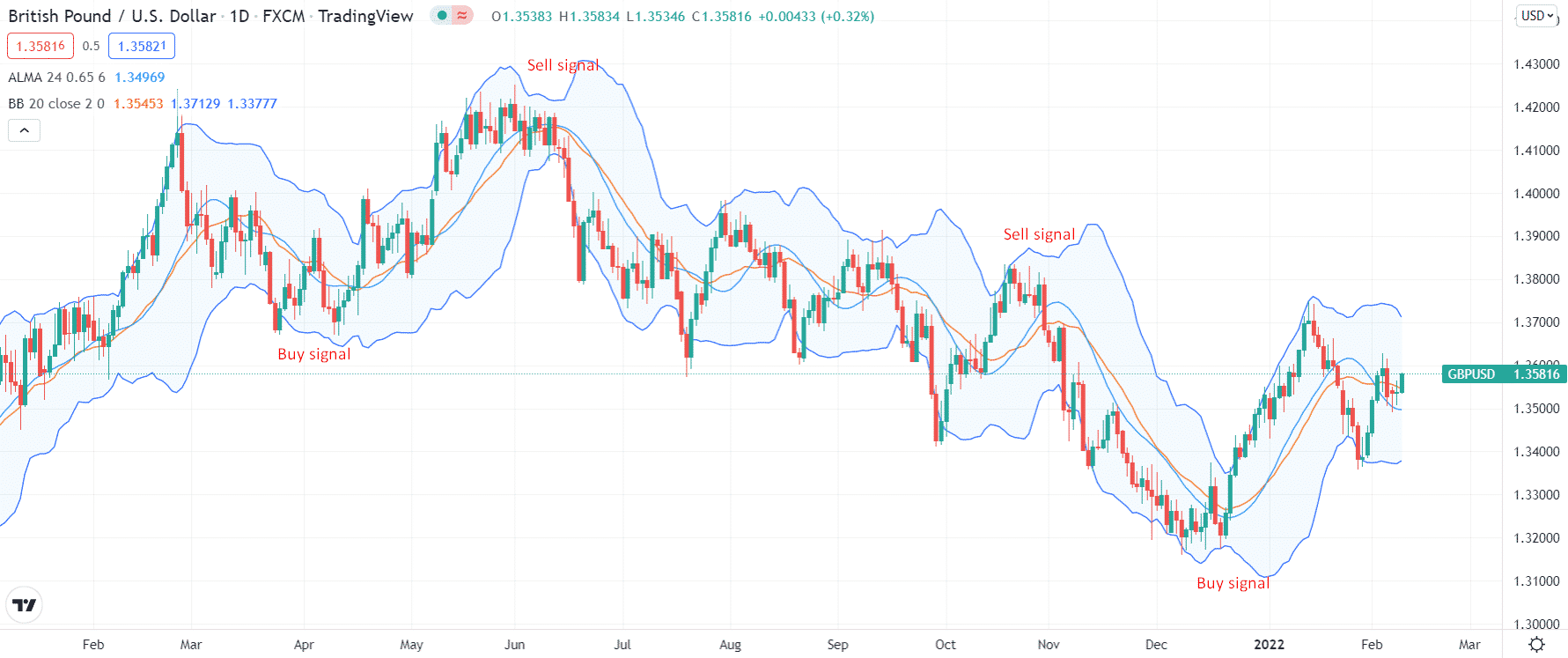

Tip 5. Pair ALMA with Bollinger Bands

To trade the market using his analysis with Bollinger Bands, you can pair them together.

Why does it happen?

The BB is one of the tools that consists of two bands above and below the cost value. Moreover, it has a moving average for the centerline. The market volatility controls the expansion and contraction of these bands. The default settings of both parameters are used in this setting to find out the sell or buy signal.

How to avoid the mistake?

It is straightforward to apply this tip. First, look at the ALMA signal when the price touches the lower band in the chart, whether it goes below the price or not. If yes, you should buy the stock instantly. Similarly, if the price touches the upper band, you must consider it a sell signal.

Below is a chart of GBP/USD, and the market is on an uptrend. You can see that the prices are hitting the lower band, and the index is below the price. It is a genuine buy signal. You can use the support resistance or recent high trick to leave the trade.

Final thoughts

ALMA can be customized to provide different hands to create your trading system. Before you start trading on a real account, test the design on a demo account.

The above tips are some ways by which you can utilize Arnaud Legoux moving averages as a central theme. Algorithms like the ALMA can bring a balance between an indicator’s responsiveness to price while also being smooth. These features are impossible to achieve by other moving average hands.

In the world of trend following, MAs are one of the most valuable indicators. The Arnaud Legoux moving average with improved smoothness and responsiveness offers an enhanced market trade.

You can apply it to a range of trend or counter-trend following trading strategies in addition to simple or exponential MAs, and it can even replace existing trading strategies. Furthermore, the ALMA can be configured to tailor to each market’s volatility, allowing for a more effective way to trade the market trends by changing only three parameters.