Doji candlesticks patterns are among the most accessible patterns to recognize. Thus, they are one of the most used for traders to identify reversal or continuation of a trend.

Traders who use these patterns correctly can enter successful trades first, which signifies entering the position and yielding more than their pairs. By following simple Doji star strategies, you can be one of those traders who most market movements.

Continue to read to learn how the Doji trading strategy works and how you can get the most out of it.

What are Doji star candles?

We are talking about a type of Japanese candlestick whose main feature is that the closing price is nearly the same as the opening price.

In the chart, you see this as a candlestick whose body is short. Also, the long wicks of the candle are at least two or three times longer than the body.

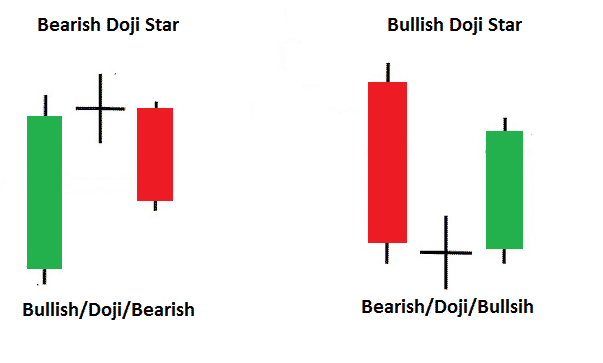

A particular type of Doji candlestick is Doji star candles. These are three-candle patterns consisting of a Doji candlestick between one bearish and one bullish candlestick. Doji star candles can be bullish or bearish. The configuration of each goes as follow:

Bullish Doji star

- A first bearish candlestick.

- A Doji candlestick below the first candlestick.

- A bullish candlestick whose closing price is above the middle of the first candle’s body.

Bearish Doji star

- A first bullish candlestick.

- A Doji candlestick above the first candlestick.

- A Bearish candlestick whose closing price is below the middle of the first bullish candle’s body.

How does the Doji star candle work?

The Doji star candlestick represents uncertainty. Traders consider the Doji star candle as a reversal signal, but the truth is that isolated Doji candles can’t tell us anything about the price. Therefore, it’s not recommended to use Doji candlesticks as a sole indicator of a reversing trend.

One can get the most out of this pattern when combined with other indicators like 20-day or 50-day SMA.

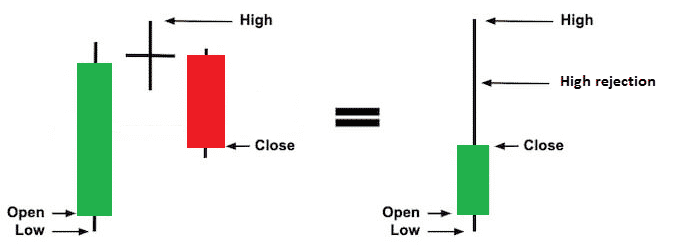

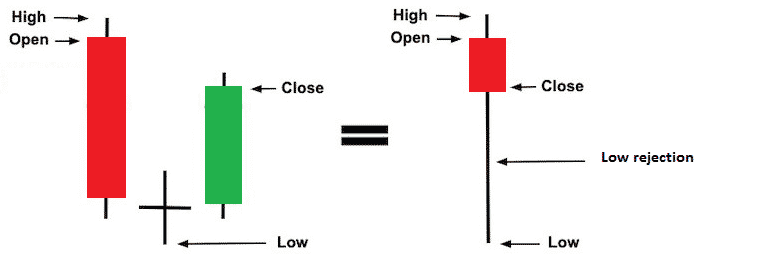

Looking at the Doji star candle carefully, we notice that one can think of it as a pin bar divided into three candles. This pattern represents a strong rejection of the highs or the lows in the market, which is why they trigger price reversal. The image below illustrates the similarities between a bearish Doji star candle and a bearish pin bar.

How to trade with the Doji star candle?

As stated above, Doji star candles shouldn’t be used as a unique indicator of price reversal or continuation. Instead, it should be combined with some other indicator to get some confirmation. Fibonacci retracement, basic resistance/support levels, and SMA are a few basic indicators that traders often use with Doji star candles.

Doji stars can be bullish or bearish. Bullish Doji stars are morning Doji stars, and bearish Doji stars are known as evening Doji stars. Let’s see which trade setup is for each.

Bullish trade setup (morning Doji star)

The morning Doji star pattern consists of a bearish candlestick followed by a Doji candlestick and then a bullish candlestick that closes above the middle of the first candle.

The pattern tells us that the market rejected the lowest lows, and the price is ready to rise. If this rejected low coincides, for example, with a support level or a double bottom, the reversal signal is a lot stronger.

Where to enter?

The trader should place the position right after the third bullish candle confirms the reversal in the trend.

Where to set the stop-loss?

Place the stop-loss right below the low of the Doji candle.

Where to set the take-profit?

It depends on the indicator you use to confirm the trend. One of the Fibonacci retracement levels, like 38.2 or 50%, is a good option.

Bearish trade setup (evening Doji star)

It is a three-candle pattern consisting of a bullish candlestick followed by a Doji candlestick and then a bearish candlestick that closes above the middle of the first candle. This pattern is a signal that indicates that the market rejected the highs, and a downtrend is coming next.

Where to enter?

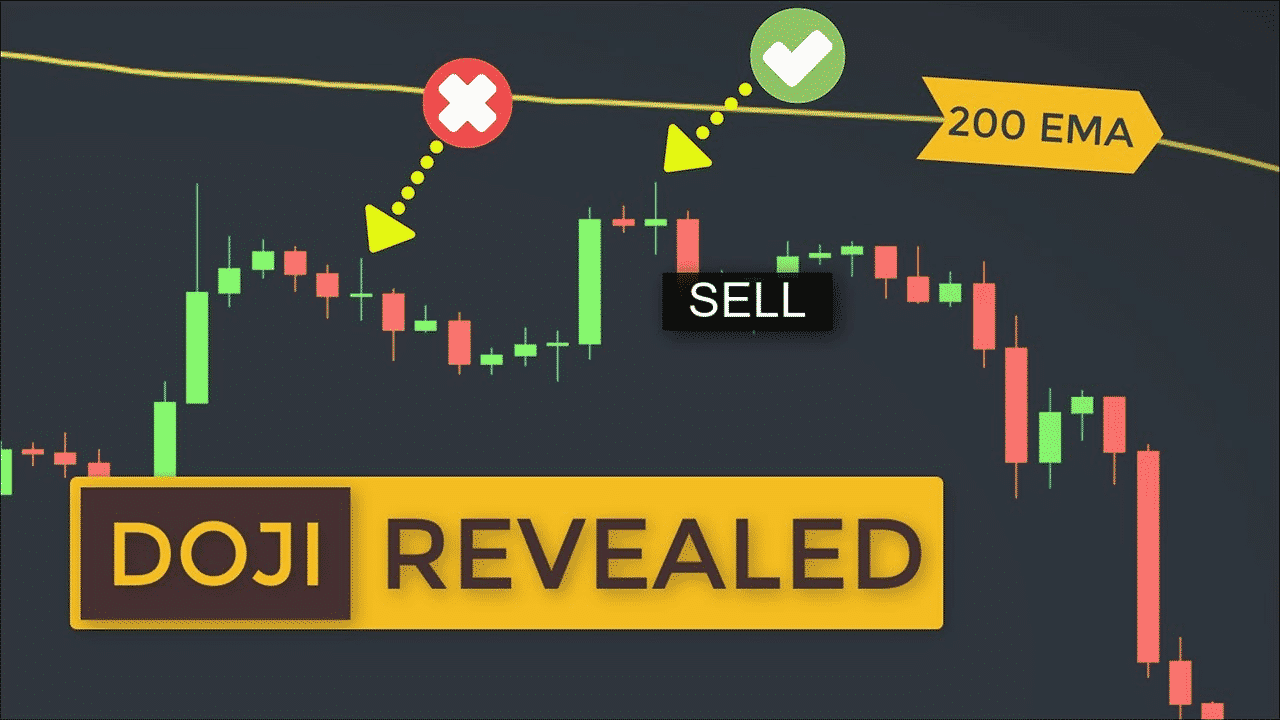

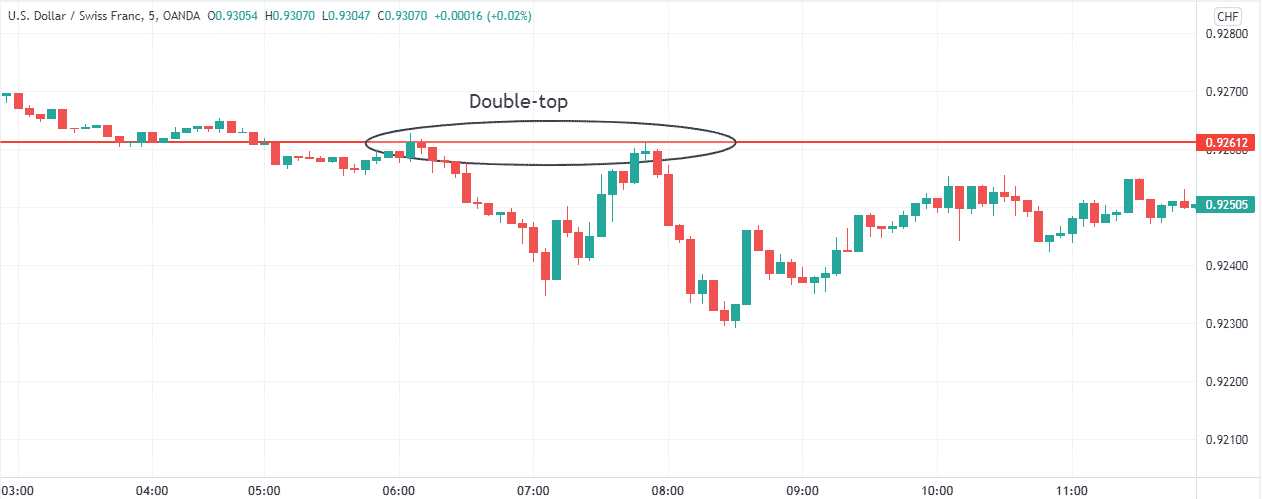

As in the bullish setup, the trader should place the position right after the third candle confirms the reversal in the trend. First, however, it needs confirmation by another indicator like the double top shown in the figure below.

Where to set the stop-loss?

Place the stop-loss right above the high of the Doji candle.

Where to set the take-profit?

It depends again on the indicator you use in combination with the Doji star candle. Besides Fibonacci retracement levels, basic support and resistance levels are good options.

How to manage risk?

The management of your risk is crucial in the trades you make. It is hard to predict how much money we are going to win in every trade. The only thing we can know for sure is how much we are willing to risk.

So, you must set your risk accordingly. A rule of thumb is not to risk more than 1 to 3% of your capital on each trade. Let’s see an example of risk management.

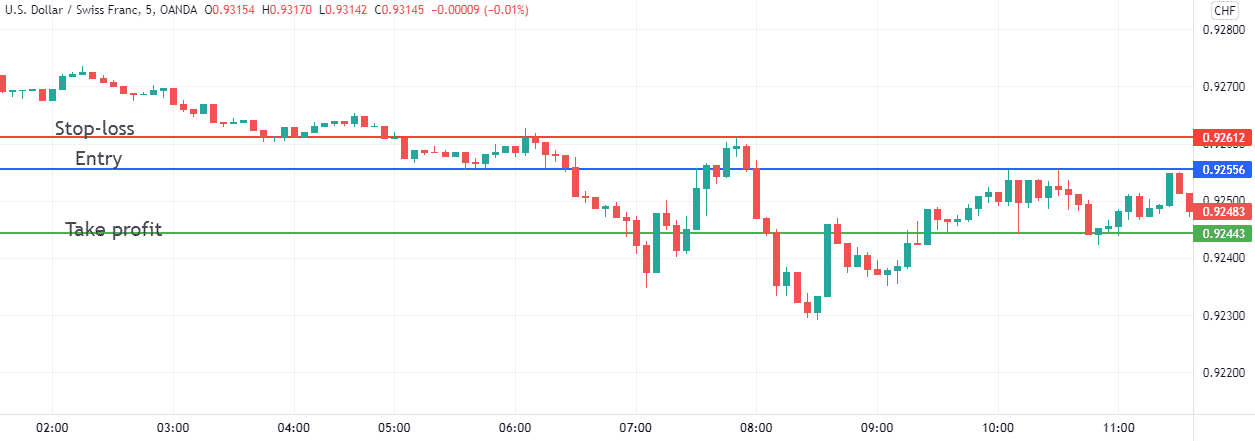

In the example, the entry-level is 0.92556. The stop-loss and take-profit are at 0.92612 and 0.92443, respectively. Your trading account balance is $2000, and your risk limit is 2%.

So we have that:

- The risk is 5,6 pips (the difference between entry and stop-loss)

- The reward is 11,3 pips (the difference between entry and take-profit)

- Risk to reward ratio 1 to 2,017

With an approximate pip value of $10.80 the risk in USD is $10.80 x 5,6= $60.48

If your trading account balance is $2,000, the 2% of your account is $40

$60.48 is above $40, so the total risk of the trade exceeds the established risk. The trader needs to adjust the risk by selling mini lots instead of 1 lot.

A mini lot is one-tenth of a lot, so one mini lot costs $1.08. To fit the established risk, the trader should sell six mini lots: 6 x $1.08 = $6.48

Total investment = $6.48 x 5.6 pips = $36.28 which is less than $40

This way, the trader gets to manage the risk effectively.

Final thoughts

Doji star candles are an easy pattern to recognize that can help us to enter profitable trade. However, we must avoid the temptation of getting into the trade relying solely on Doji stars. Instead, it would help if you always used Doji stars combined with other indicators. In contrast to other indicators, Doji stars provide clear stop-loss points.

Finally, no matter how good a trade looks or how strong the signal is, no single trade will make you rich. Instead, discipline and managing your risk will make you profitable in the long run.