In addition to fundamental and technical strategies, one area of market analysis is equally effective in major financial markets. That is convertible or exchangeable arbitrage.

The concept of exchangeable arbitrage is easy to comprehend but not readily available. It is like buying one dollar for $0.95. The difference is yours as profit. While it may sound counterintuitive, that scenario can happen. The problem is that such an opportunity has a tiny window of availability.

Since investing involves risks, diversification is critical. Adding assets capitalizing on convertible arbitrage could significantly improve your portfolio’s risk tolerance. Deep-pocket investors employ this method to generate profits while assuming limited risk.

If you look to implement exchangeable arbitrage, you need to dig much more profound than what has been covered thus far. In this article, you will learn this method in more depth, how to implement it in theory and through examples, and what risks to know and manage.

What is convertible arbitrage?

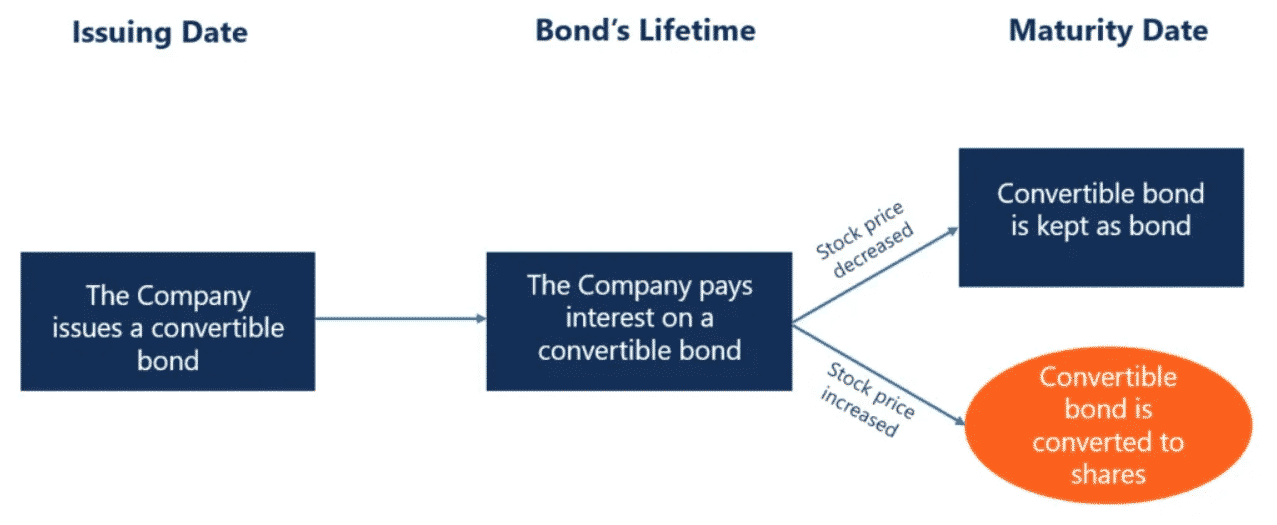

Exchangeable arbitrage seeks to exploit price variances between an exchangeable asset and supporting equity. To implement this strategy, you must buy the exchangeable asset (e.g., bond) and sell the underpinning equity simultaneously. After execution, three things can happen. Let us look into each scenario and comprehend if the arbitrage works in our favor or not.

First scenario. Supporting stock plummets

In this case, your sell position of the supporting stock is profitable. Meanwhile, the value of the exchangeable bond will go down. A bond will not fall too much as a fixed-income asset, so your loss in your long bond position is limited. If you subtract the loss of your long bond entry and the profit of your short stock entry and you get a positive value, it means the arbitrage transaction wins.

Second scenario. Supporting stock soars

In this scenario, your sell position of the supporting stock is losing. Meanwhile, the value of the exchangeable bond will go up, counterbalancing the stock loss. This is where exchangeable arbitrage may not work in your favor. As you know, stocks are more volatile than bonds. Your losses in your short stock entry could overtake your gains in your long bond position.

Third scenario. Supporting stock ranges

When the supporting stock moves sideways, your long bond position will not grow in value, but you will get interest payments periodically. Such gains will offset the costs involved in holding a short stock position. In this scenario, the result of the exchangeable arbitrage could be breakeven.

How to trade with convertible arbitrage?

In exchangeable arbitrage, you hope to generate profit when the bond and stock markets move in a certain way. Otherwise, you will hit breakeven or lose a minimal amount. That is the beauty of this trading method. You can fail, but your losses are limited.

Asset allocation is an essential aspect of exchangeable arbitrage. It means the bond volume and stock you will take for a particular transaction. This volume rests on the hedge ratio, which depends on the variable delta.

Take note that delta is a factor that indicates how sensitive a bond is to fluctuations in stock price. Once you have a ballpark delta value, you can establish the ratio between the bond and the supporting stock in terms of asset allocation. You may need to adjust the asset allocation depending on the change in delta.

Sample convertible arbitrage

Let us take an example to understand how exchangeable arbitrage works. Assume that an exchangeable bond has an initial price of $108. You then decide to use an initial investment of $202,500 plus borrowed capital of $877,500. The total investment is $1,080,000. Therefore, the debt-to-equity ratio (D/E) is 4.33 ($877,500/$202,500).

The supporting stock has a price of $26.625. You sell 26,000 shares, totaling $692,250 of investment. Using a hedge ratio of 75 percent, your bond allocation will be 34,667 (26,000/0.75). You will hold the position for one year.

To compute the total return, let us use the tables below.

| Return source | Return ($) | Notes |

| Bond profit on interest | 50,000 | 5% coupon for every $1,000,000 investment |

| Stock rebate on short entry | 8,653 | 1.25% interest on $692,250 investment based on 75% hedge ratio |

| Leverage fee | -17,550 | 2% interest on borrowed capital ($877,500) |

| Stock dividend | -6,922 | 1% dividend yield on $692,250 |

| [1] Total profit | 34,481 |

| Return source | Return ($) | Notes |

| Bond profit | 120,000 | $108 purchase price and liquidation at $120 for every $1,000 |

| Stock profit | -113,750 | $26.625 short selling price and liquidation at $31 |

| [2] Total arbitrage profit | 6,250 |

Total profit = 34,481 + 6,250 = $40,431

This transaction has netted you a 20 percent return ($40,431/$202,500). Take note that you managed to reap this return in one year. This was made possible by borrowing funds and having a suitable market environment.

How to manage risks?

You will face multiple risks when you attempt to trade this strategy. Two of the major risks are interest risk and currency risk. You must fully understand these and other risks and find a workaround to become successful.

- Interest risk

When you buy any type of bond, your investment is subject to risk caused by varying interest rates. This is especially true if the bond has a long maturity period.

- Currency risk

Exchangeable arbitrage may involve taking positions in assets that go beyond your national border. As such, currency risk comes into the picture. You must utilize either forward contracts or currency futures to mitigate this risk.

Final thoughts

Exchangeable arbitrage has considerably evolved following the recent financial crisis. This is primarily due to three factors: a limited number of arbitrage traders, growing distribution, and lower leverage. Now more than ever, you have far more opportunities as an arbitrage trader. With the recent market volatility and growth in issuance, this front of the asset management sector has found new life.