When it comes to crypto, many people throw caution to the wind in the hopes of striking it rich. Whether it’s the surge of DogeCoin or the drop of BTC, many want to hop on the bandwagon.

However, there are risks involved with following the trend blindly. But what if you can trade the crypto market by trading the bottom. If you hear about crypto bottoms for the first time, then in this guide, we’ll explain everything about them.

Also, we’ll tell you the top five tips to master and profit.

What is the crypto bottom strategy?

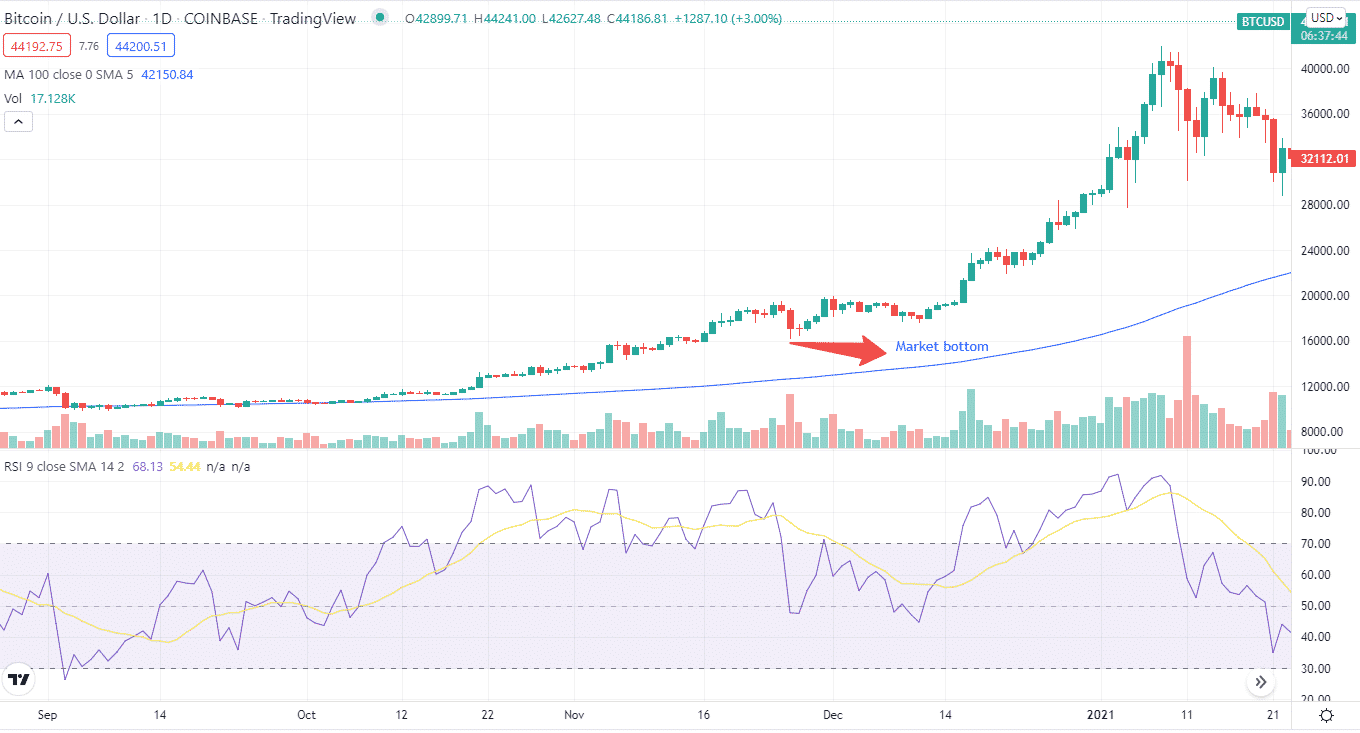

A crypto bottom occurs when the price of a cryptocurrency drops and then rises due to the volume of sellers against buyers. The “bottom price” is the lowest price at which a cryptocurrency can be purchased on the day the bottom forms.

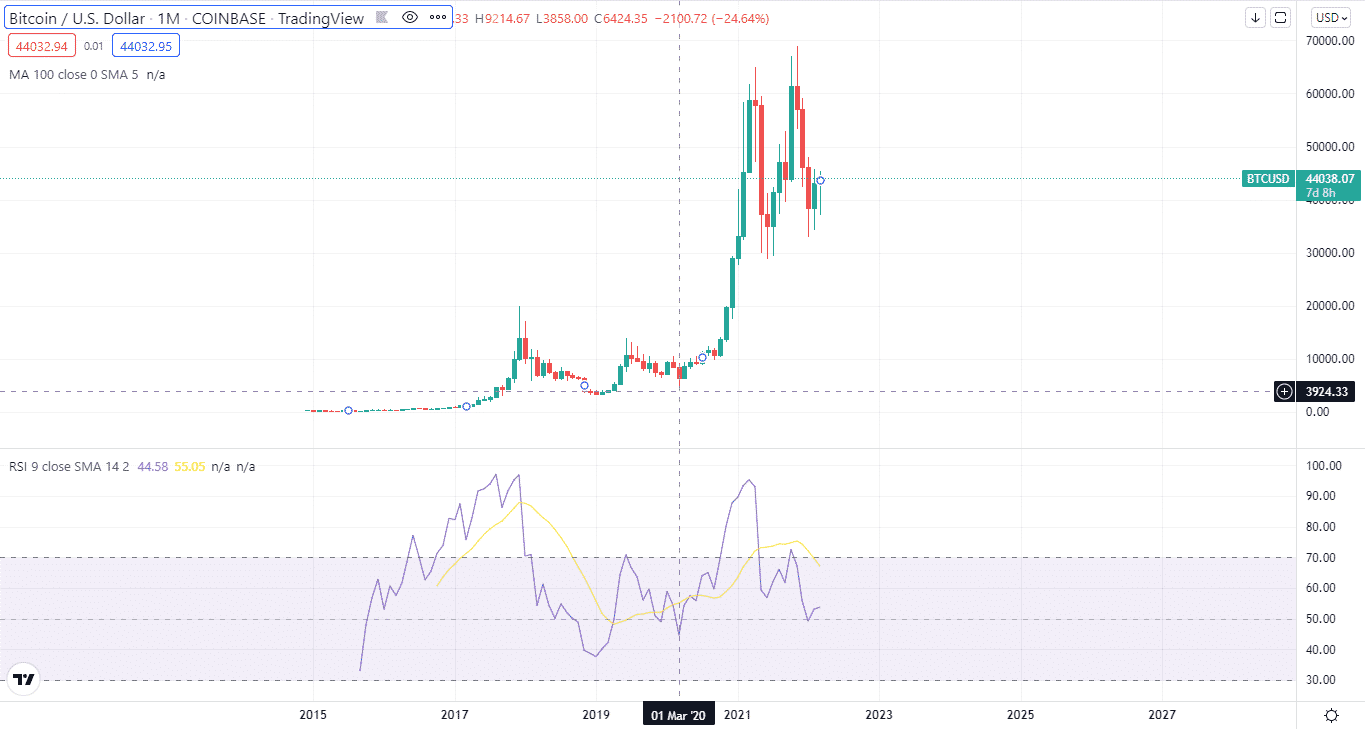

On a chart, a bottom formation resembles a bowl pattern, in which the crypto’s price drops and then rises. After an unparalleled boom-and-bust cycle dubbed as the Great Crypto Crash, crypto found its bottom in 2018.

One of the most difficult challenges for cryptocurrency investors is determining when the market is at its bottom. A stock bottom is more than just the lowest traded price or dropping prices.

Just because prices have stopped falling doesn’t indicate the market has reached a bottom. However, the reversal of a negative trend is a bottom, influenced by supply and demand. Moreover, it examines the relationship between buyers and sellers in particular.

The bottom formation is completed by an infusion of new buyers who help to the cryptocurrency’s price comeback. The price rises in tandem with the demand for cryptocurrency.

Top five tips for trading with crypto bottom strategy

Now that you know what crypto market bottoms are, let’s move to the top five tips for trading them like a pro.

Tip 1. Look for volatility

First, traders trying to catch a market bottom should search for market volatility indicators.

Why does it happen?

Using a VIX-like volatility index for Bitcoin is a direct way to assess the volatility of crypto-asset price swings. The BitVol index is a market mood indicator that updates in real-time. To put it another way, this is the Bitcoin equivalent of the Fear and Greed index.

Higher VIX levels, on average, indicate a higher level of anxiety. However, when the VIX index reaches its peak, it suggests that the fear is dissipating. As a result, market sentiment is pessimistic.

The BitVol index reached a high of 190.28 on March 16, 2020, during the Covid-19 pandemic. It was the bottom of the cryptocurrency market and the end of the negative market of 2018.

How avoid the mistake?

Daily variations in the VIX tell us what’s happening in the past, not what’s going to happen in the future. As a result, day-to-day VIX changes have virtually little forecasting power.

Tip 2. The single-day craze

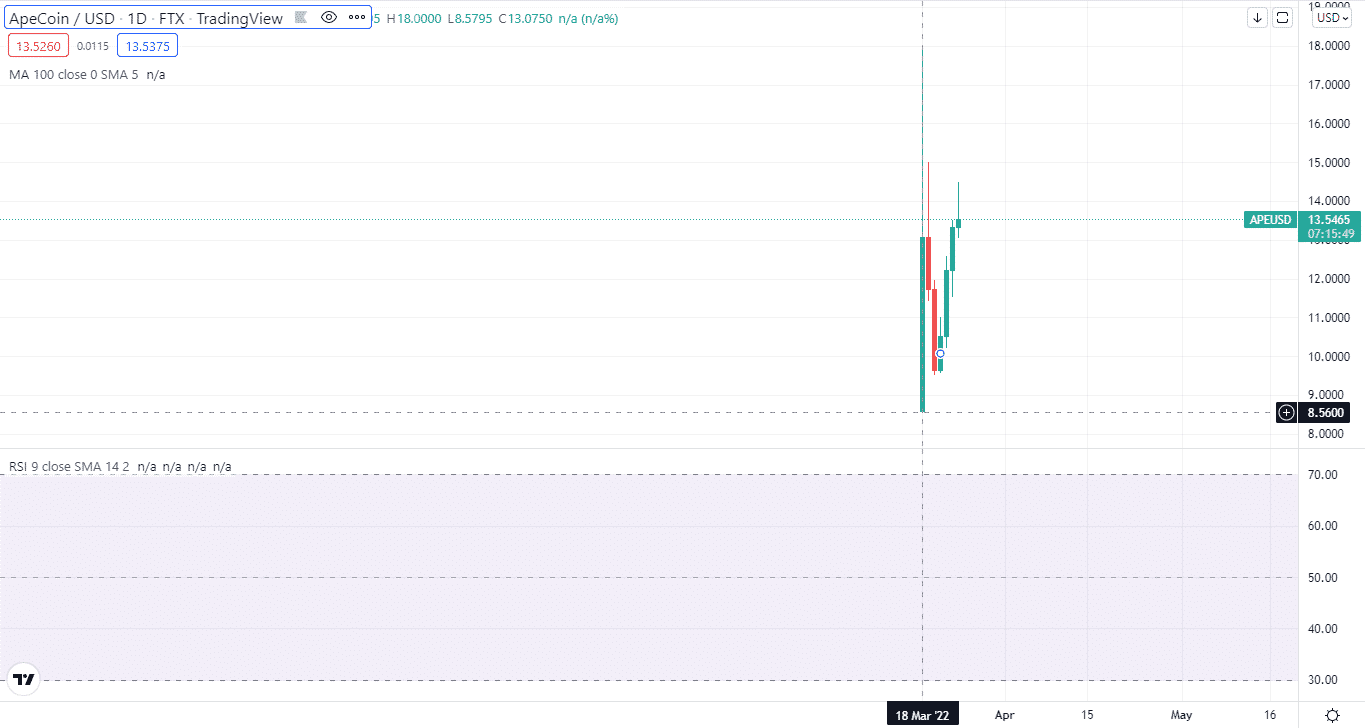

The huge market travel day is a form of volatility pattern in which the price of an asset goes dramatically up and down in a single trading day.

Why does it happen?

These tumultuous trading days indicate that the market is approaching a turning point. But, unfortunately, they don’t say who won the fight between bulls and bears.

The trade signals alert market players to an impending change in trend direction, but they do not specify how the trend will shift. Below you can see that, right after its launch, the ApeCoin went wild.

How avoid the mistake?

Due to market volatility, prices might swing from one level to another without passing through the area. It’s known as gapping, also known as slippage, occurs most frequently during periods of significant market volatility.

Tip 3. Crypto market sectors

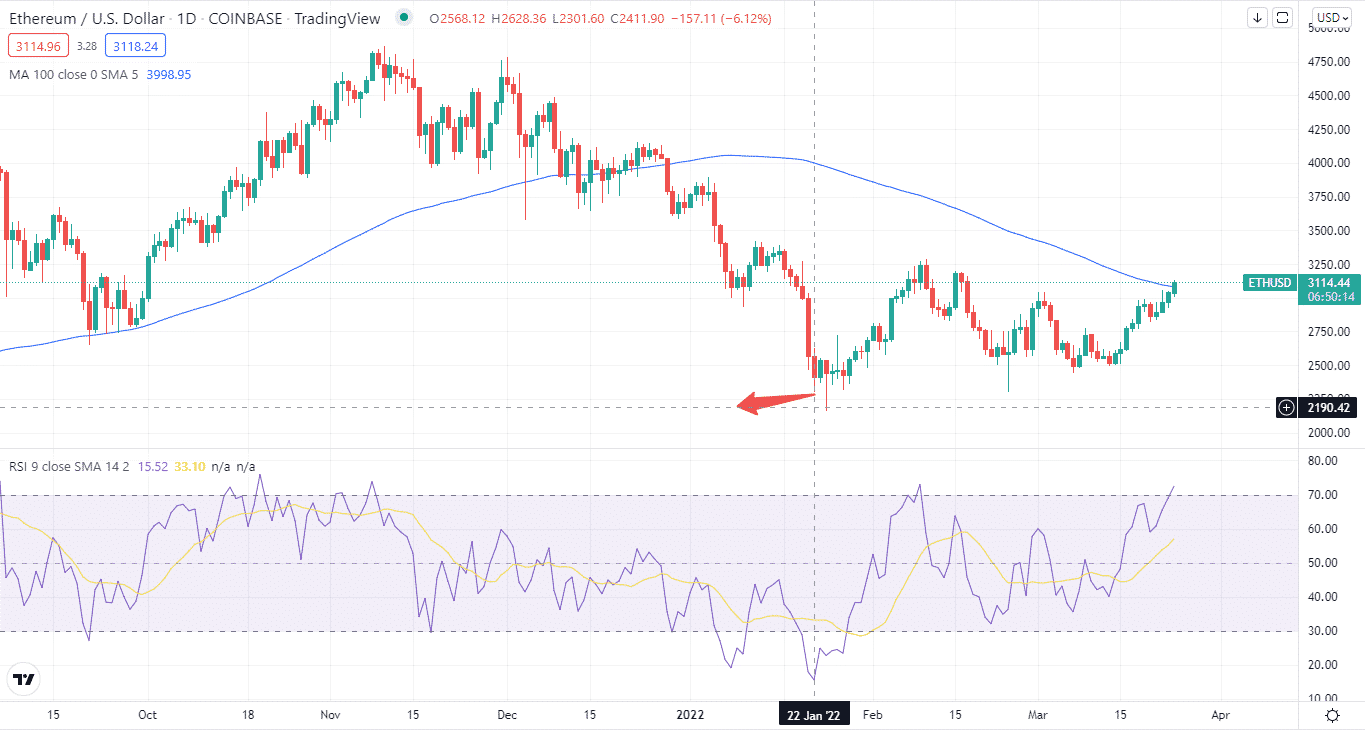

Paying attention to the many crypto market sectors is another technique to spot market bottoms. Similar to how the stock market is divided into sectors, cryptocurrencies can be classified into several categories.

Why does it happen?

A crypto market sector is a collection of cryptocurrencies. It shares many characteristics and provides similar services. For example, the app crypto sector includes Ethereum and Cardano.

Typically, cryptocurrencies in the same industry will move in lockstep. However, individual crypto sectors and the cryptocurrency market will not constantly develop on the same path.

Knowing which sector your cryptocurrency belongs to can allow you to predict when the market will bottom. For example, below, you can see that ETH and ADA bottomed out on January 22.

How avoid the mistake?

The link between two cryptos is fluid and might alter at any time. The correlation may change, particularly during periods of increased volatility.

Tip 4. Following the herd

Keep an ear out for what the crowd is doing to determine when the market is bottoming.

Why does it happen?

Retail investors tend to acquire comparable cryptocurrencies purely because other investors buy them, owing to the herd instinct. In addition, retailers tend to believe what they see on TV or social media.

It can be quite beneficial to cut through the noise. However, to do so, you must pay attention to the street and utilize it as a contrarian indication to predict market bottoms.

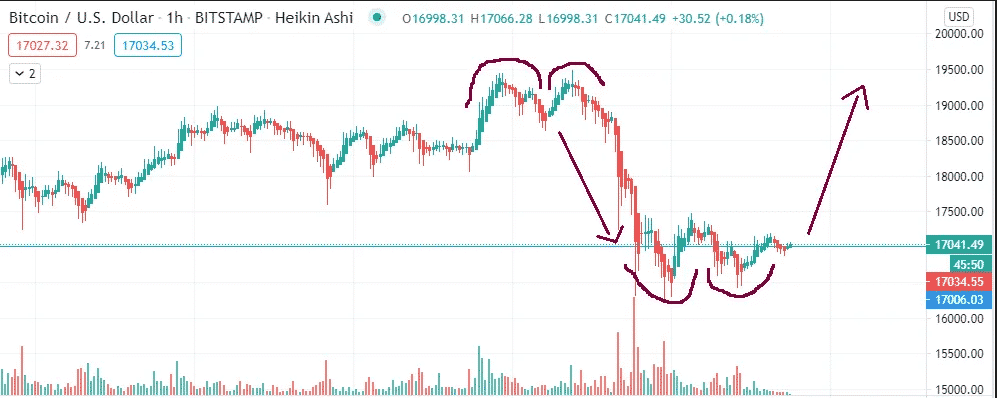

For example, when Bitcoin was between $15 and $19k, human emotion likely made users feel safe about trading because everyone was doing it and making a huge profit.

How avoid the mistake?

The crowd isn’t always right when it comes to predicting market movements. Because the crypto market environment does not reflect the crowd’s market expectations, the crowd loses money.

Tip 5. Reversals

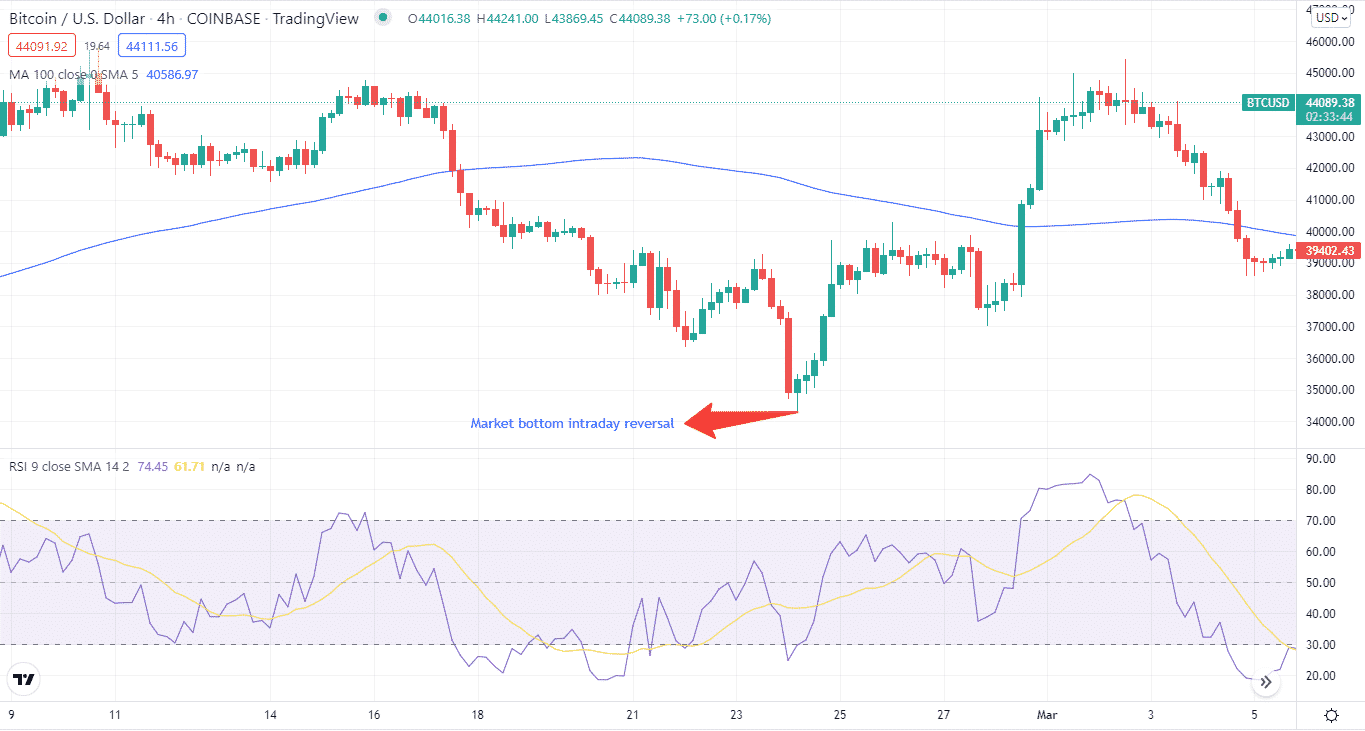

Intraday reversals are another trading signal that your coin is about to reach the bottom. Again, these happen swiftly and are easily recognized.

Why does it happen?

Intraday reversals occur on the price chart when the market declines and buyers suddenly control it, allowing them to transform a significant losing day into a positive day, even if it’s a slight gain.

The intraday chart will show the first reversal hints when the market begins to bottom. It will then expand to the longer time ranges.

How avoid the mistake?

The intraday trading reversal isn’t particularly significant on its own. It can, however, be more trustworthy when combined with technical indicators.

Final thoughts

When it comes to a specific cryptocurrency, being able to spot a price bottom might help you measure the trading range. Having the ability to buy around the bottom of a year’s market can significantly boost returns.