Determining correlation enables opportunities to diversify investors’ portfolios efficiently. Many financial assets are co-related, so investors use this data to generate trade ideas as you can make investment decisions on any asset by tracking other assets’ price movements. No wonder the crypto industry also has correlations, and many crypto assets reflect the price movements of other cryptos or financial instruments.

However, the correlation fact works depending on different parameters, and there are positive and negative correlations. So it is mandatory to have a clear concept and understanding when using correlation data to execute trades. This article discusses correlation and the top five crypto trading tips.

What is the correlation in crypto?

Cryptos are digital assets that usually use peer-to-peer transactions. These assets allow making direct transactions without involving any third party. The correlation refers to the positive and negative impacts on any particular asset depending on the price movements of other assets.

For example, there is an expected correlation between the Australian Dollar (AUD) and the precious metal gold.

Both are positively correlated, so the price of XAU goes up triggers the AUD price, AUD also surges upside and vice versa. Many crypto assets also have this type of correlation, either positive or negative. When two assets are negatively correlated, one goes up, and the other declines.

Top five crypto correlation strategy

There are some specific guidelines that you can follow to use the correlation concept effectively in crypto trading. This part lists the top five professional crypto investors’ tips to make profits from the crypto market utilizing the correlation info.

Tip 1. Follow the Bitcoin price

First, when you seek to invest in crypto assets, you must know the name of the king crypto in the industry, Bitcoin. BTC is the very first and most valuable cryptocurrency that made a peak above $65k last year, and BTC is the most successful crypto in history. When you follow this coin’s price, many Altcoin prices will reflect the price movements of many crypto coins and blockchain products have positive or negative correlations with this crypto.

Why does this happen?

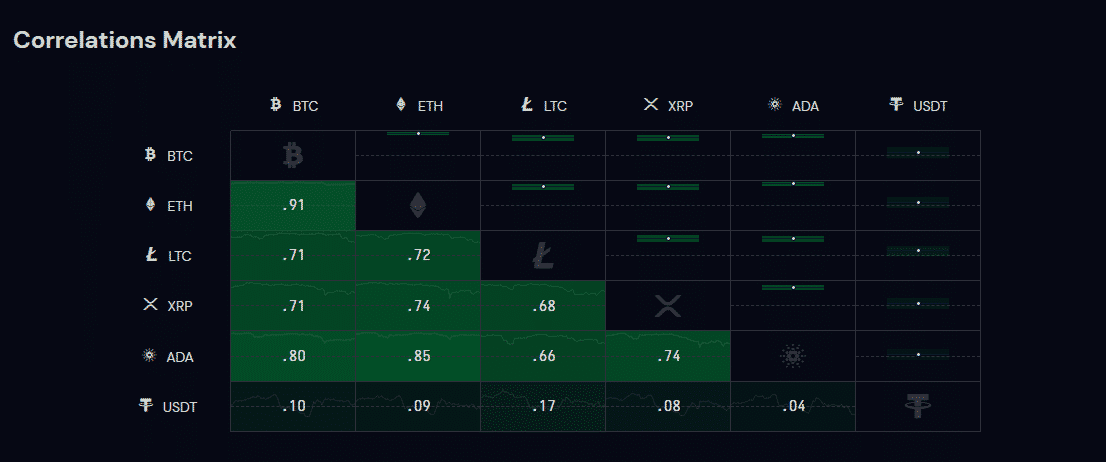

The BTC has a market share of over 40%, so any rapid movement or action in this asset indicates participants’ interest in the marketplace. Check the correlation chart below to understand the matrix.

How to avoid mistakes?

Using this correlation concept requires a sustainable trading approach to make profits from crypto assets. This concept usually suits long-term investments rather than frequent trades in maybe a five min chart. We do not suggest entering any trades immediately by looking at the chart.

Tip 2. Stablecoins correlation

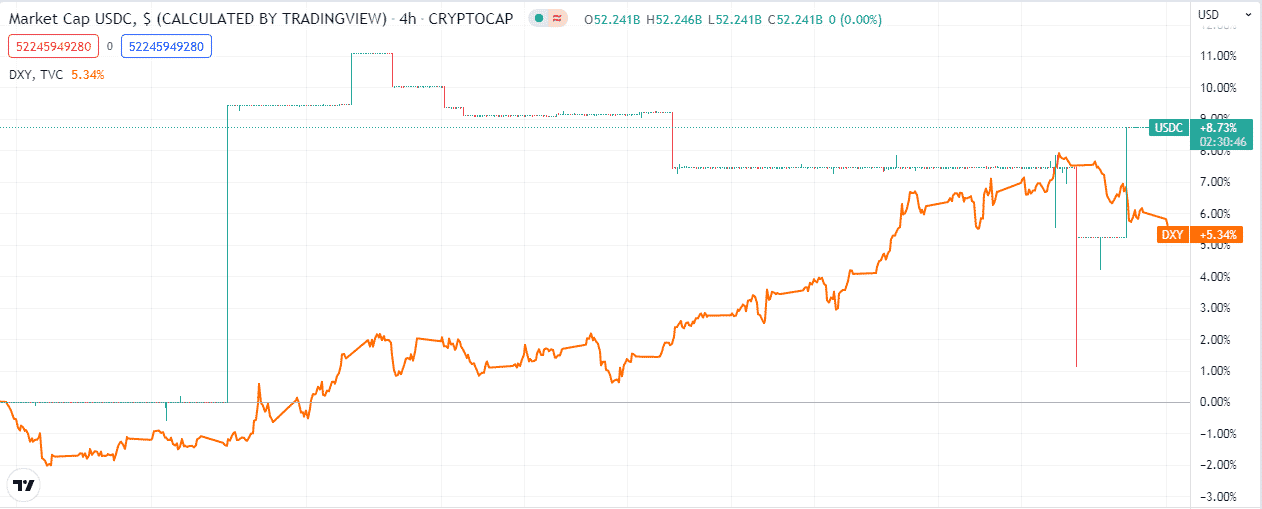

When you participate in the crypto market, you may know about stablecoins. There is a peg relation between the fiat-based stable coin and the US dollar. So no wonder that when the US dollar keeps growing or becomes more demandable, stablecoins also show positive movements. There are several types of stablecoins in the crypto industry, including crypto-baked, fiat-baked, gold-baked, etc.

Why does this happen?

When blockchain users feel comfortable doing transactions using any specific financial asset or currency that is globally acceptable, any blockchain product related to that asset will also be attractive for this accessibility feature.

When there is a peg relation between two or more financial assets, the base asset rises, triggering the growth of another asset. Moreover, most crypto industry transactions still occur in US dollars. So the demand or value of the US dollar rises indicates any USD pegged crypto will also be an attractive investment to crypto investors.

How to avoid mistakes?

Dollar pegged stablecoins are suitable investments, but the price does not move much like many other crypto assets. Investors usually invest in these assets for other utilities these assets offer.

Tip 3. Crypto and stock market correlation

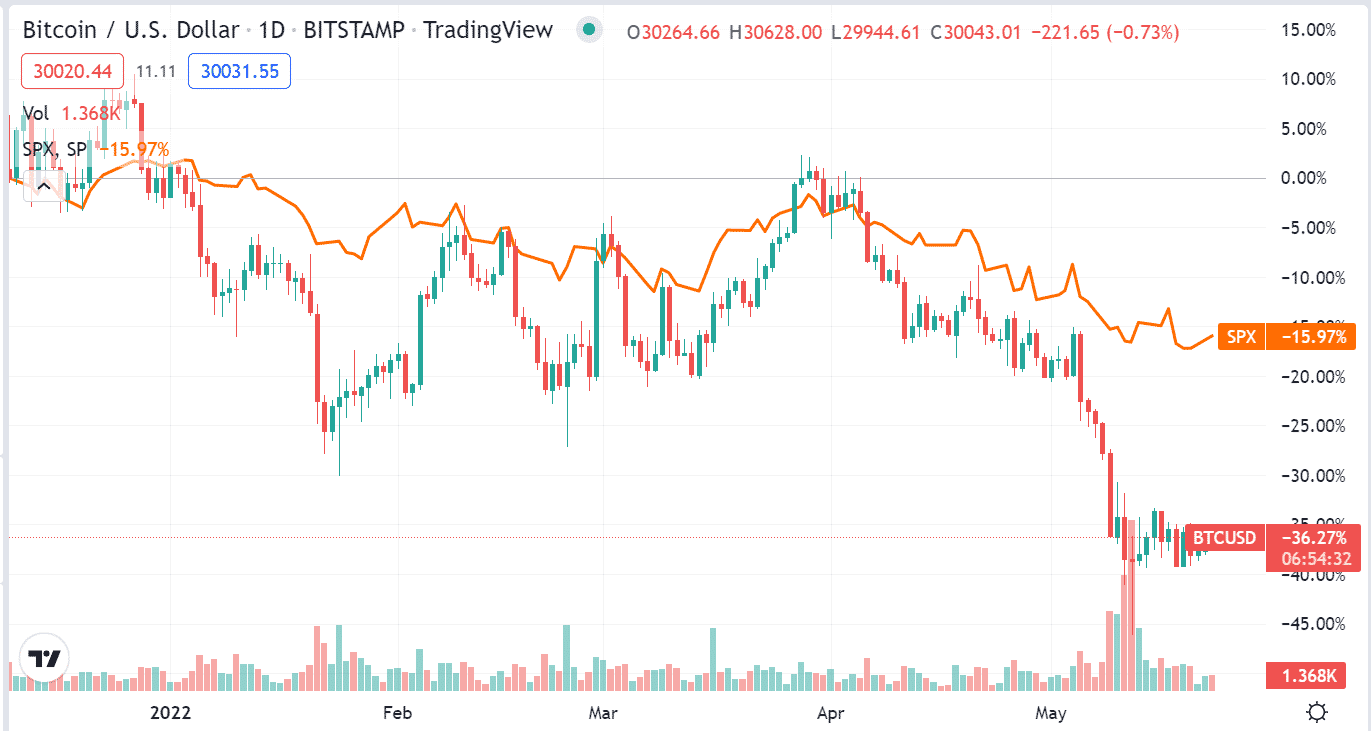

The crypto industry and the equity market are correlated. The S&P 500 index and BTC price correlation recently rose to 0.49, the highest since Q4 2020. When comparing the price movement of both assets in the previous 90 days, BTC price follows the price movement of S&P 500 stocks.

Why does this happen?

As long as the crypto-verse remains an exciting topic, speculative investors seek to make money. People have been investing in stocks for hundreds of years, and the crypto industry is emerging, containing various digital products. Several fundamental factors affect the stock market, so it moves according to participants’ actions. So no wonder there may be some correlation between both assets.

How to avoid mistakes?

Keep track of both assets and understand the correlation types, as it can be positive or negative depending on participants’ actions.

Tip 4. ETH and blockchain products correlation

Many cryptos and dApps keep booming for attractive features. When the usability increases of these apps and more investors keep adopting them, the demand for the base platform will also increase. So the native token of the Ethereum platform price will also surge upside.

Why does this happen?

When the demand or usability of any dependable product of any blockchain platform increases, the native token also is demandable.

How to avoid mistakes?

Blockchain technology remains in the implementation phase. So it is better to conduct sufficient research before choosing any investment asset.

Tip 5. Diversify your portfolio

You can use the correlation info to diversify your portfolio. For example, you can choose two or three potential positively correlated assets and may invest different portions of your capital in particular assets. So you can make considerable profits from different assets.

Why does this happen?

When you invest in different assets of the same group that may correlate with each other enables opportunities to make money.

How to avoid mistakes?

Match the correlation data and type correctly before investing. Moreover, don’t forget to conduct additional research before investing to determine the actual potential. This investment type supports the old textbook: “don’t put all your eggs in the same basket.”

Final thought

Finally, using correlation data to understand the actual potential of any financial asset is a common practice among financial investors. Crypto investors can also use this concept to generate successful investment ideas. We suggest checking several fundamental facts when choosing any crypto-asset alongside the correlation data, such as project offerings, future projections, utilities, etc.