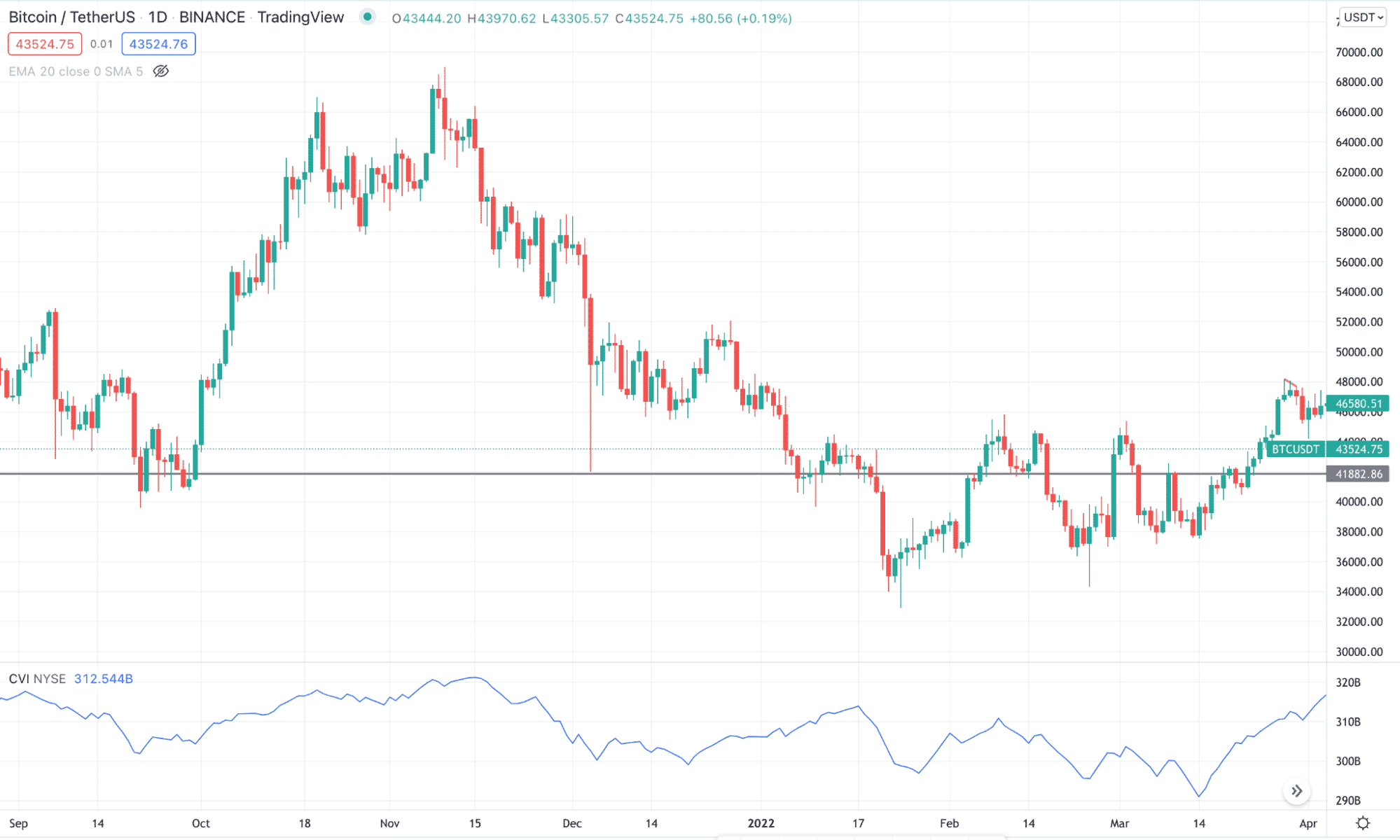

Momentum trading is a process to gain profits when the price remains within an intense form of a trend. Any trend strategy will work well when its strength is strong. However, finding a stable trend is crucial for momentum, where the CVI or Cumulative Volume Index works as a key momentum finder.

If you are keen to build a strong crypto trading portfolio, using the indicator would increase the success rate. The following section will uncover everything a trader should know about the tool with the top five mistakes to avoid.

What is the CVI or Cumulative Volume Index crypto strategy?

The tool defines a crypto’s momentum that helps traders know whether the money flows in or out of the market. It is generally introduced for the stock market, where the primary aim is to subtract declining stock volumes from advancing stocks.

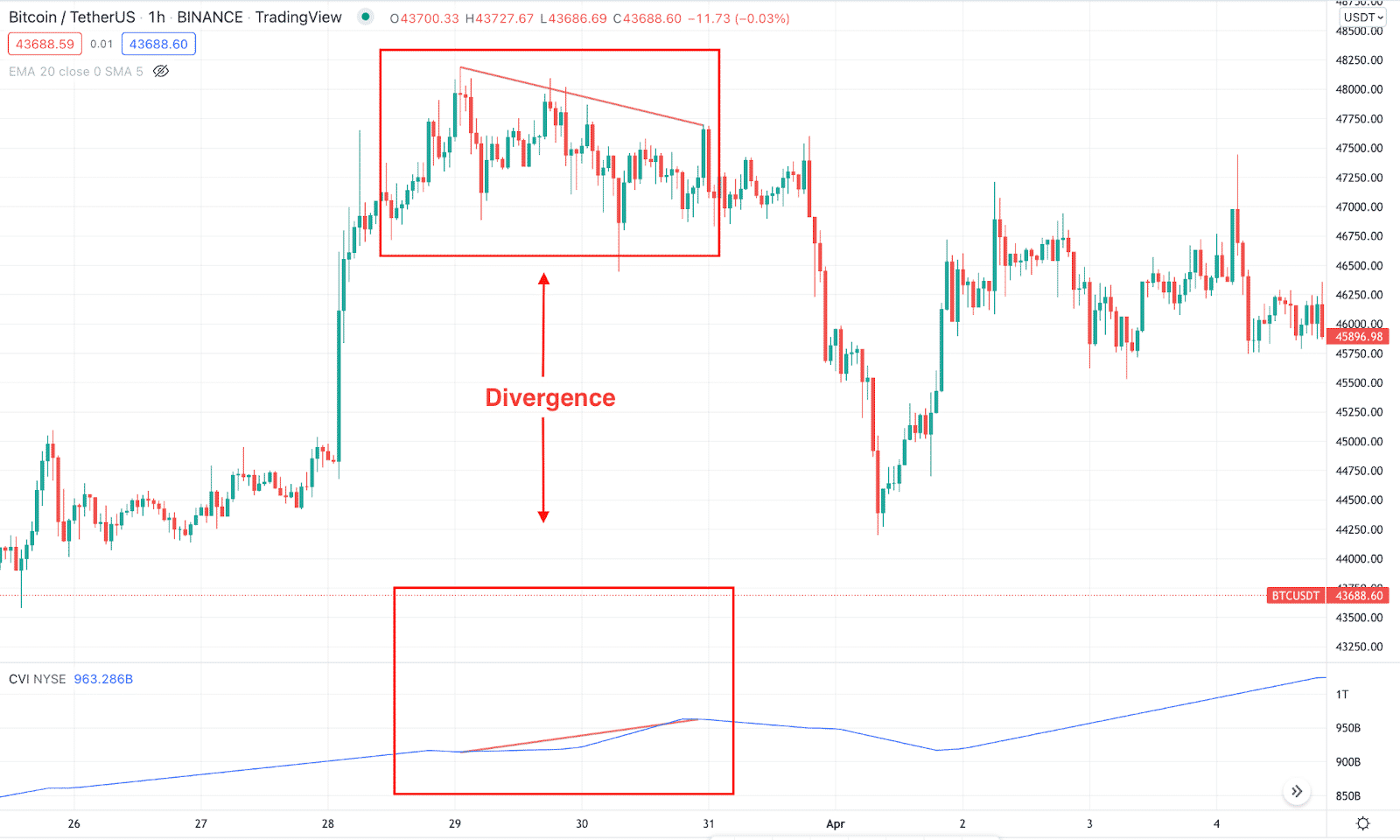

It is almost similar to the traditional on-balance-volume indicator, allowing some computer programs to call by their name incorrectly. However, the helpful fact of the CVI is that it shows the overall trend of the instrument. The up volume and down volume is shown in this tool, where traders can see how long a trend has formed. Moreover, any divergence in this indicator often shows the reversal sign.

For example, if the price moves up by making new higher highs, but the CVI fails to follow it, it would form a divergence that may work as a key price reversal indication.

Top five tips for trading with CVI

Although the tool is made for the stock market, this tool works well with crypto. The money inflow or outflow in the global financial market indicates traders’ activity, and investors can combine it with other technical indicators to predict a crypto’s price trend.

Tip 1. Don’t forget the trend

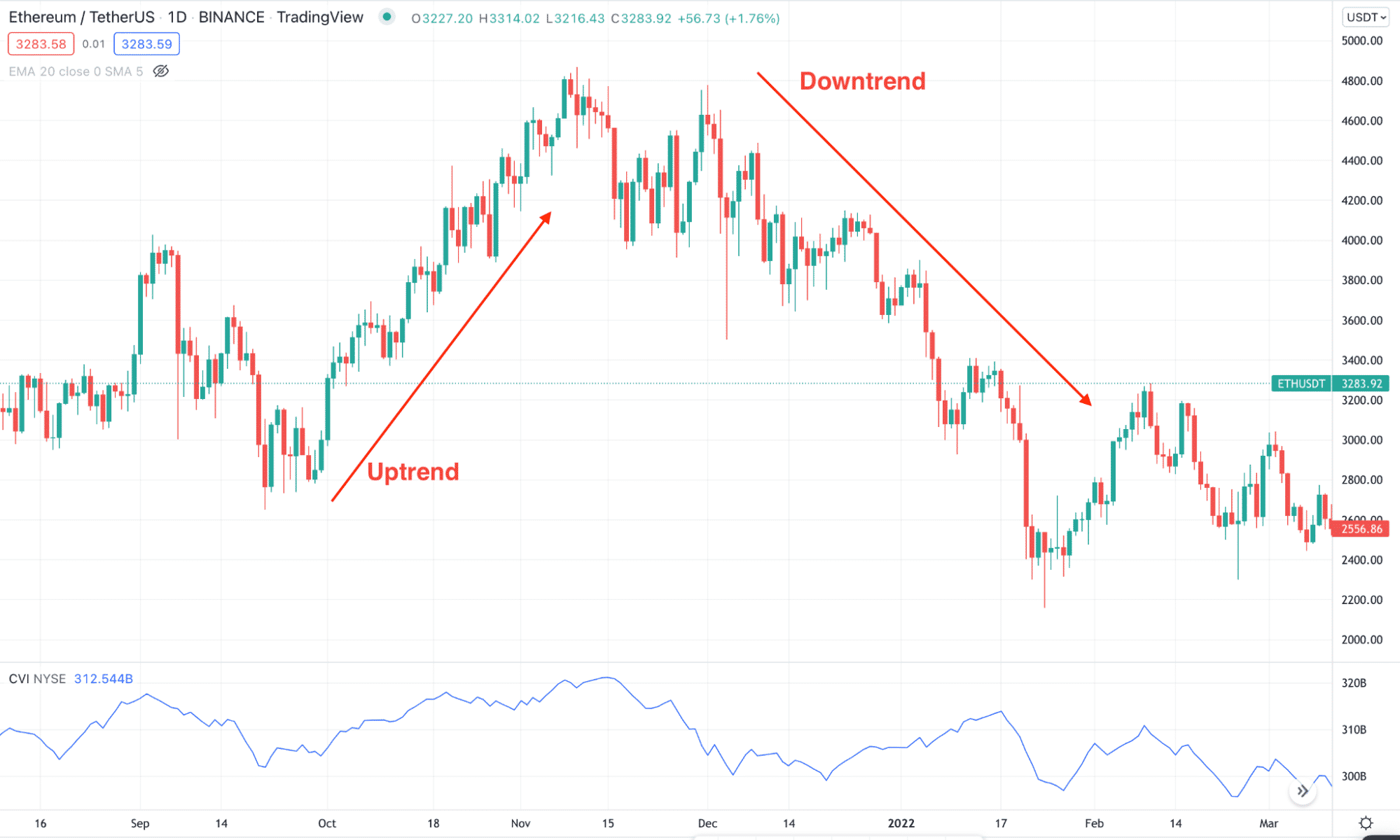

Trend forms when the price of a crypto pair makes consecutive higher highs or lower lows. In momentum trading, traders have to find the trend and identify a strong momentum towards it.

Why does it happen?

Many people consider taking buy/sell trades once they find their trading conditions appear in the chart. Unfortunately, many new traders forget to see where the broader market trend is heading. Even if they follow the trading condition, they end up trading with a loss.

How to avoid the mistake?

Finding the trend is easy by looking at the naked chart in the higher time frame. First, the price should make higher highs or lower lows or breakout from any significant support/resistance level. After that, traders can identify the price direction towards the trend using the CVI or other technical indicators.

Tip 2. Momentum + impulse

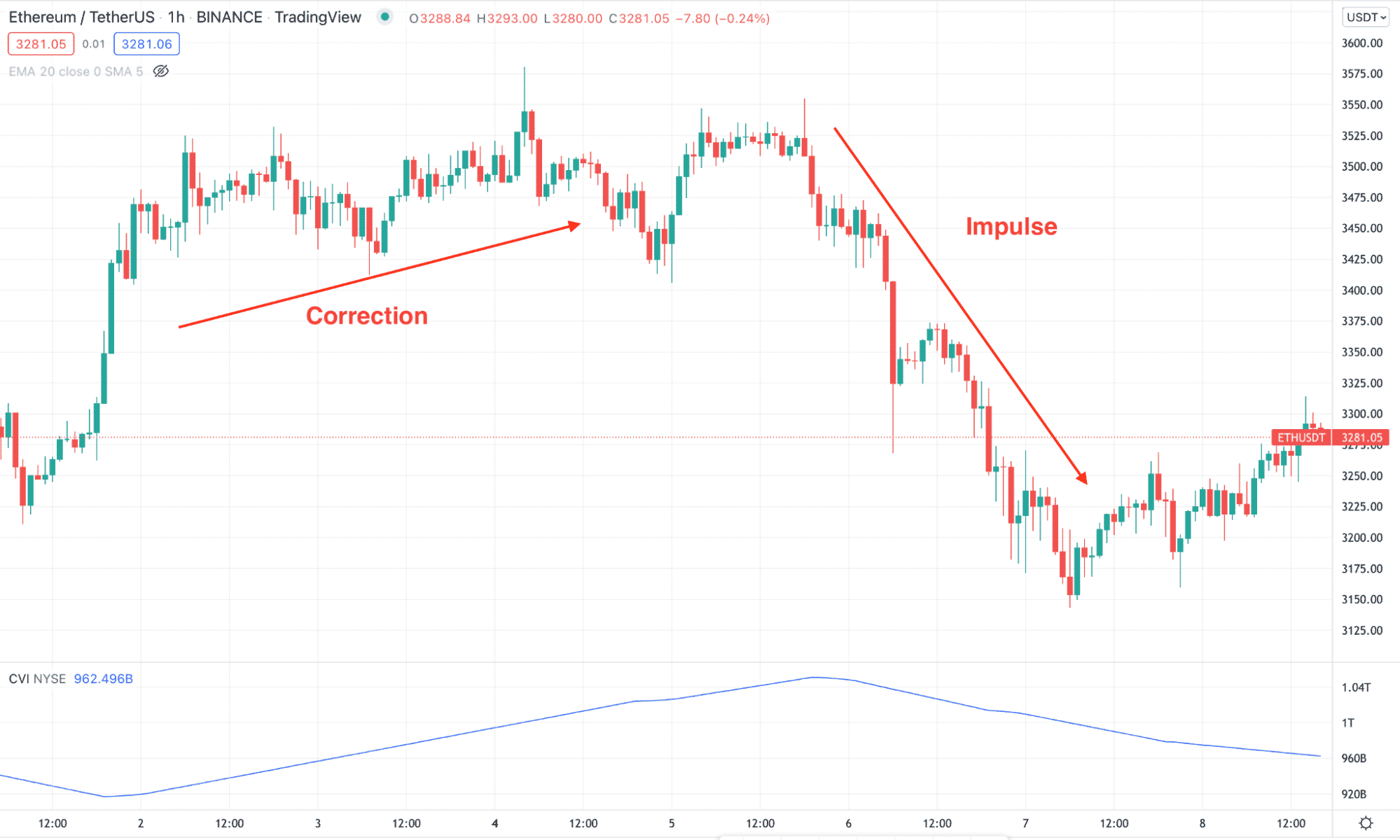

Impulse indicates an aggressive way to make higher highs or lower lows in the price. The forceful momentum is a sign that the price trend is strong and is likely to continue the pressure.

Why does it happen?

Many people ignore the impulse and consider the trend just by looking at its location above or below any critical static level. However, impulse indicates the strength of a trend where the success rate of momentum trading is high.

How to avoid the mistake?

The first thing a trader should do is explicit knowledge of impulse and correction. Then, any trend trading strategy will be fruitful when the price momentum follows the impulse within the trend.

Tip 3. Crypto fundamentals

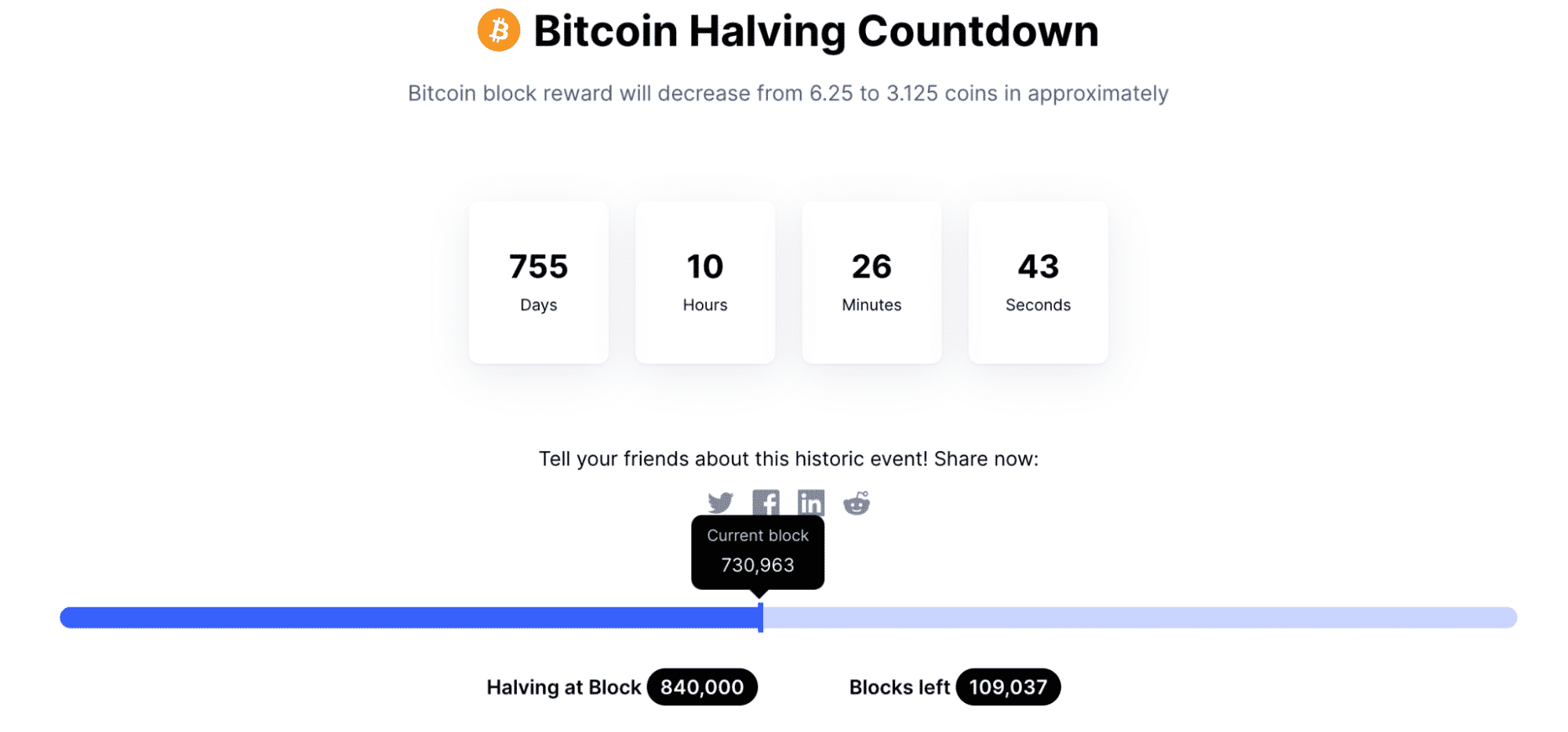

The fundamental analysis is a process to anticipate the price movement of a trading asset using the fundamental event or calendar. The crypto market is volatile, where any fundamental events like fork or halving might change the price trend.

Why does it happen?

Many new traders like to focus on the chart, forgetting what is happening in the broader market. Therefore, they ignore events like fork, halving, etc. They will incur a huge loss when they see a sharp price movement against their desired direction.

How to avoid the mistake?

Bitcoin halving is the most significant fundamental event for the cryptocurrency market. Moreover, forks and geopolitical events like war play an essential role in the crypto market. In that case, regularly focusing on cryptocurrency blogs or articles would keep you up to date.

Tip 4. Understand the volatility

CVI is made for the stock market, where the current CVI value is shown for the New York Stock market on all platforms. Therefore, using this tool is often challenging for investors in the crypto context.

Why does it happen?

The crypto market is a decentralized market where all activities happen without any centralized platform. Therefore, technical indicators often provide wrong signals leading to a loss for traders.

How to avoid the mistake?

In crypto trading, strong trade management rules are applicable to avoid loss. Keep the risk tolerance level low, as it can eat all of your investment in a single swing.

Tip 5. Choose the right time frame

Traders can move from one minute to one-month charts for crypto trading, but the excessive volatility and uncertain market conditions often make intraday trading hard.

Why does it happen?

If we compare the crypto market with the FX, we can easily define crypto as a volatile asset. Therefore, if you try to trade on the intraday chart, the excessive volatility would make your trade challenging.

How to avoid the mistake?

If you are not a master in your trading strategy, stick to higher time frames. The higher time frame trade would provide you a relief from the intraday volatility, which is usually a 5% to 50% price change.

Final thought

Overall the CVI might provide you with a clear idea about the market context. Therefore, you can add it as an essential trading tool and use other technical indicators to make your trading meaningful. However, the tool has some drawbacks that you should consider while trading, like other trading indicators.