Forex leverage enables market participants to trade at a much larger volume than a trader’s limited capital allows. Such trading employs a small amount of capital to obtain exposure to high-volume positions. It applies to practically all financial markets, including FX, indices, stocks, commodities, government bonds, and ETFs.

Let’s check leverage trading in detail, including its calculation, benefits, application, and examples.

What is leverage in forex trading?

It is the number of trading funds the broker is willing to lend to your investments, based on the ratio of your capital to the amount of credit support.

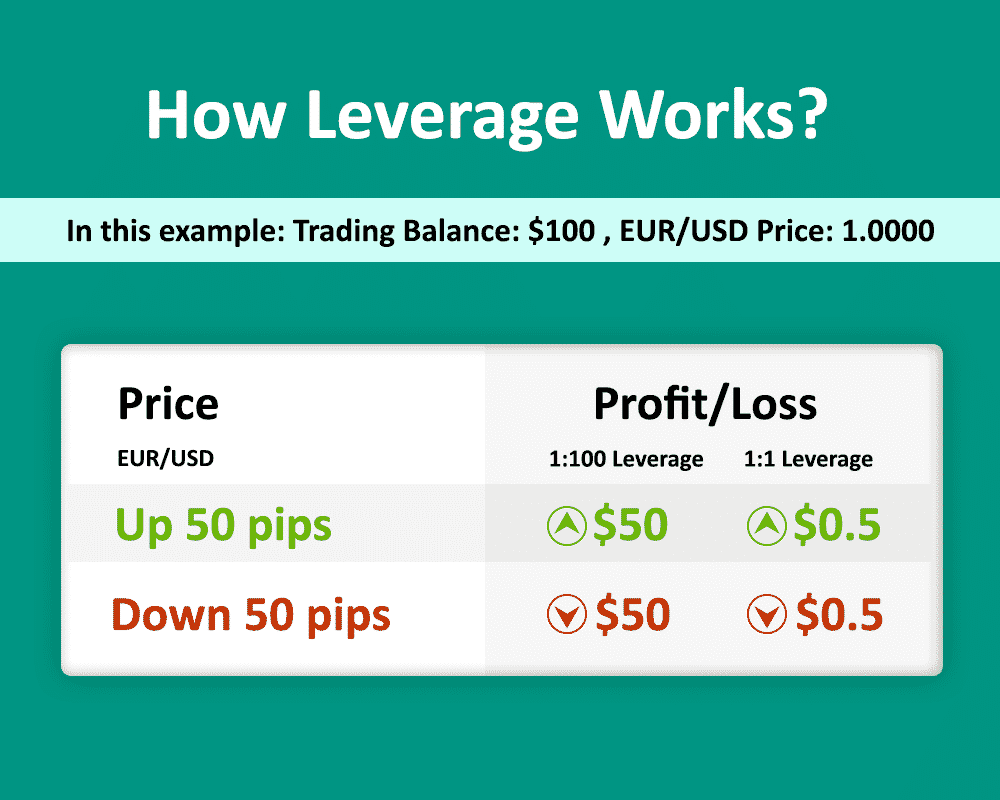

The total amount of leverage provided by an exchange intermediary is not constant. Brokers set their rates for such support, which in some cases can reach 1:100 or even 1:1000. It is most often expressed in this ratio format. A 1:100 leverage means that with a $1 equity balance, you will be able to open positions worth $100.

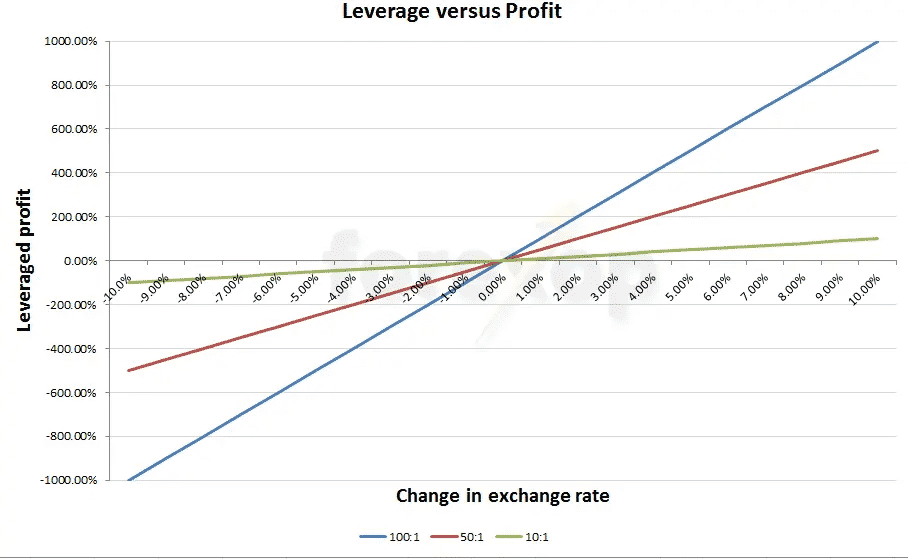

However, leverage is a two-edged sword, which means, if the market moves against the trader’s forecast, he can suffer magnified losses.

All traders must understand the risk associated with leverage. In-experienced participants see their margin wiped out incredibly quickly. For newcomers, it is recommended to choose lower leverage to control the risk involved. It means traders are less likely to wipe out all of the capital if the trade goes wrong.

Forex leverage calculation

The below-mentioned formula is used to calculate it.

Leverage = 1/margin = 100/ margin percentage

For instance, if the margin is 0.02, then the percentage is 2% and the leverage is =1/0.02 =100/2 = 50. The leverage ratio for a 2% margin will be 50:1. Similarly, the leverage ratio for a 0.25% margin percentage will be 400:1, and the leverage ratio for a 0.50% margin percentage will be 200:1.

Meanwhile, the real leverage being used by a trader can also be calculated by using the below formula:

Real leverage = total value of transactions/ total trading capital

How to use leverage in trading?

There are several strategies and methods to use the right leverage level while trading FX. For instance, scalpers and breakout traders opt for high leverage because they usually look for quick traders. On the other hand, positional traders tend to trade with lower one.

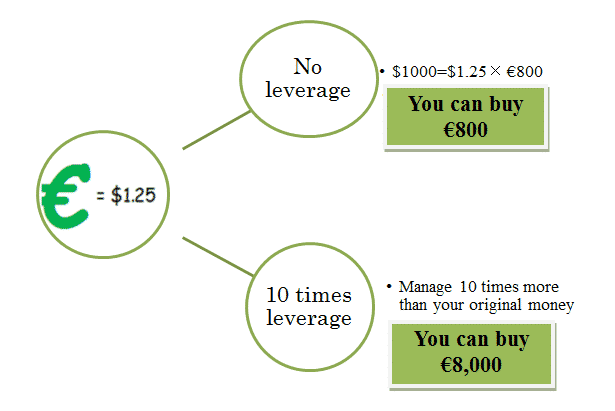

Leveraged trading enables market participants to trade with higher volumes. Forex traders can get offers from brokers for leverage ratios ranging from 1:1 to 1:400. The most commonly used ratio in the FX is 1:100. A trader can take a position worth $100,000 in the FX while using a leverage ratio of 1:400 if he has a minimum of $1,000 in his account. In the given example, the other $99,000 would come from the broker.

Many small-capital investors prefer leverage trading as their deposit is usually not enough to open sufficient trading positions. In the FX, since the margin buying power increases significantly, there are chances that traders will put themselves at tremendous risk.

To demonstrate, consider a typical USD/CAD trade. Without leverage, the trader would need to deposit $100,000 in account money, the whole value of the position, to purchase or sell 100,000 USD/CAD. However, with 50:1 (or a 2% margin requirement), the trader would need only $2,000 of their funds to establish and maintain that $100,000/CAD bet.

How to trade safely?

What should novice traders do with a recommended leverage of up to 1 to 10 if there is no free $10,000, and they want to trade successfully and make money right now?

- Decide on your trading style. Are you going to trade intraday or catch medium-term trends actively? The longer the horizon of trade transactions, the more the size of the deposit is needed.

- It is necessary to acquire basic knowledge in technical analysis, to understand the specifics of the market — published news, reports, multipliers, indicators, and other factors that affect the price of your instrument.

- If you understand that you cannot be actively involved in trading on the market, but you want to invest, then use social trading, which requires copying transactions of experienced traders.

- You shouldn’t use the entire margin for one trade — better 100 different positions with a minimum lot of 0.01 than one with one lot size of 1 lot.

- Be sure to use stop loss and not allow the loss on one position to exceed 2% of the deposit.

- Don’t stop honing your risk management system. Determine the maximum allowable risk for the number of open positions — monitor compliance with the risks for each position. Keep track of the “level” of the account. Do not liquidate with a stop-out.

- Do not open a position without a pre-written trading plan. Determine for yourself the entry-level, profit, and loss fixation level, the signal to build up the position, and the signal to exit the market.

- Keep a trader’s diary. Write down the parameters of the trade. Keeping a journal will make trading more conscious and provide a basis for introspection and learning from your own mistakes.

Final thoughts

The best leverage in trading depends on the capital the trader has at his disposal. The most optimal is 1:100, which compromises sufficient purchasing power and the risks of automatic liquidation of positions by stop out. Most often, this leverage ratio is chosen by both beginners and experts. But don’t forget about the risks of using high leverage.