FX pairs are combinations of currencies where investors buy one currency against another. There are hundreds of currency pairs in this market, and among them, finding the most profitable pair is challenging.

Some traders argue that major currency pairs are most profitable, while others say expanding the portfolio in cross and exotics is essential. Therefore, new traders often find trading confusing because they don’t know which pair they should trade.

The following section is for you if you plan to build a profitable trading portfolio in trading. Today, we will see the list of the top ten profitable forex pairs that may help you make a strong position in financial market trading.

In currency market trading, investors should closely monitor profitable pairs. It is a decentralized market with leverage. Therefore, losing all investments in a single trading day is very common. Moreover, statistics say that most of the retail traders are losers in this market.

Do you know why?

Because big financial institutes and banks drive the FX market, they trade with billions of dollars where retail trading sentiment is nothing. As a result, even if you have a good trading method, you might end up losing your capital.

You need to maintain a systematic approach in trading to achieve the ultimate success where profitable currency pair is the first requirement.

Let’s see the list of the top ten profitable pairs based on liquidity and profitability.

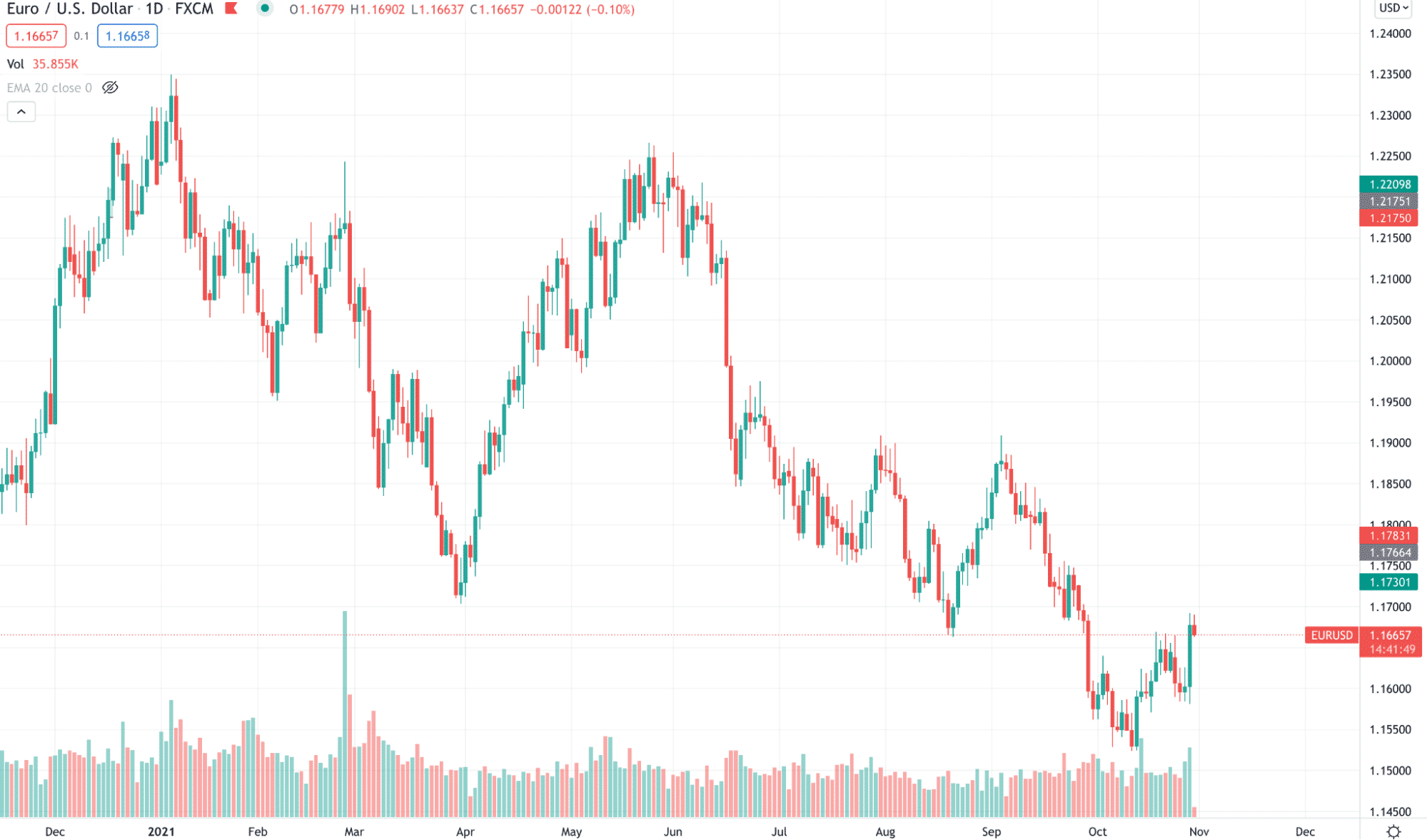

1. EUR/USD

When we talk about FX trading, the first currency pair that everyone should trade is the EUR/USD. It represents the world’s two giant economies: the US and the Eurozone, which holds the global FX markets 24% market share.

The USD is the reserve currency of most countries. They usually use the US dollar in any international transaction. Therefore, holding the USD in the central bank allows the country to remain stable in the international market. Therefore, any currency paired with the presence of the US Dollar has higher market participants. Moreover, the Eurozone is the biggest hub in international business, making the EUR/USD pair the most active pair.

Therefore, if you are interested in trading FX pairs, EUR/USD should be your first choice.

2. GBP/USD

As the same said, GBP is the native currency of the UK, which is the most active trading country in the world. Most of the trading liquidity comes from this country. Therefore, the London open and the price action at the London session greatly impact financial markets. Bank of England is the reserve bank of the UK that has a strong influence on this pair.

Other market influencers are:

- BoE and FED interest rate decision

- Non-farm payroll

- CPI and retail sales

Moreover, the UK is now separated from the Eurozone through Brexit that makes the Pound more profitable.

3. USD/JPY

We have already seen why the US Dollar has the biggest influence in trading. Now come to the Asian giant export-oriented country.

Yes, we are talking about Japan. The Japanese economy mostly depends on exports. Therefore, the Bank of Japan always tries to devalue its currency to make it stable. On the other hand, Japan is a technologically advanced country that often influences businesses to transact with the Japanese yen.

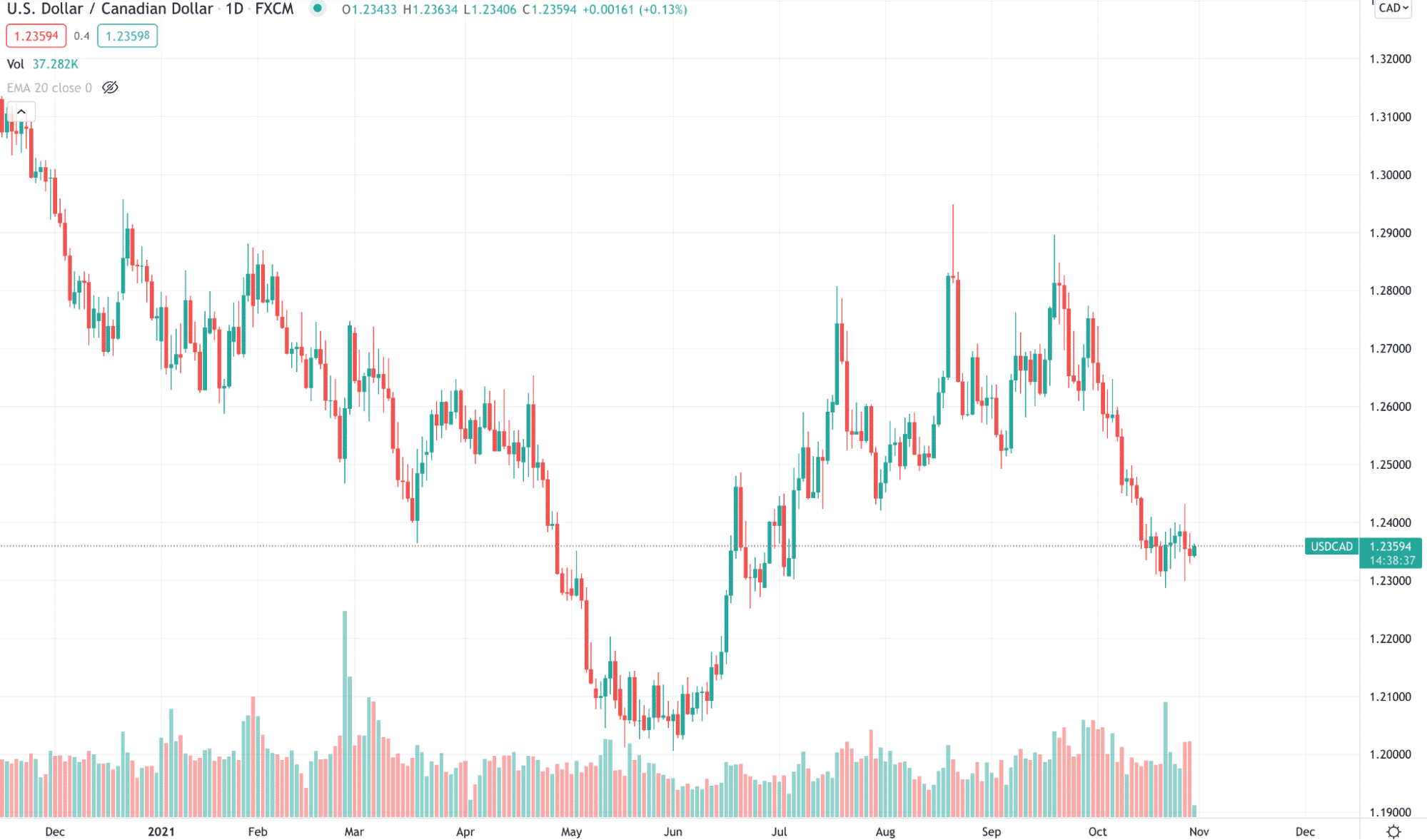

4. USD/CAD

The Canadian economy mainly depends on oil, copper, nickel, etc., manufacturing. Therefore, there is a positive correlation between CAD and crude oil. Therefore, any news or fundamental events that impact crude oil should affect the USD/CAD price.

Besides, the first currency of this pair is the USD, which is also essential in the global economy. Canada is the world’s second-largest oil exporter, where most of its oil exports happen through the USD. As a result, this pair is profitable for those who are experts in the commodity industry.

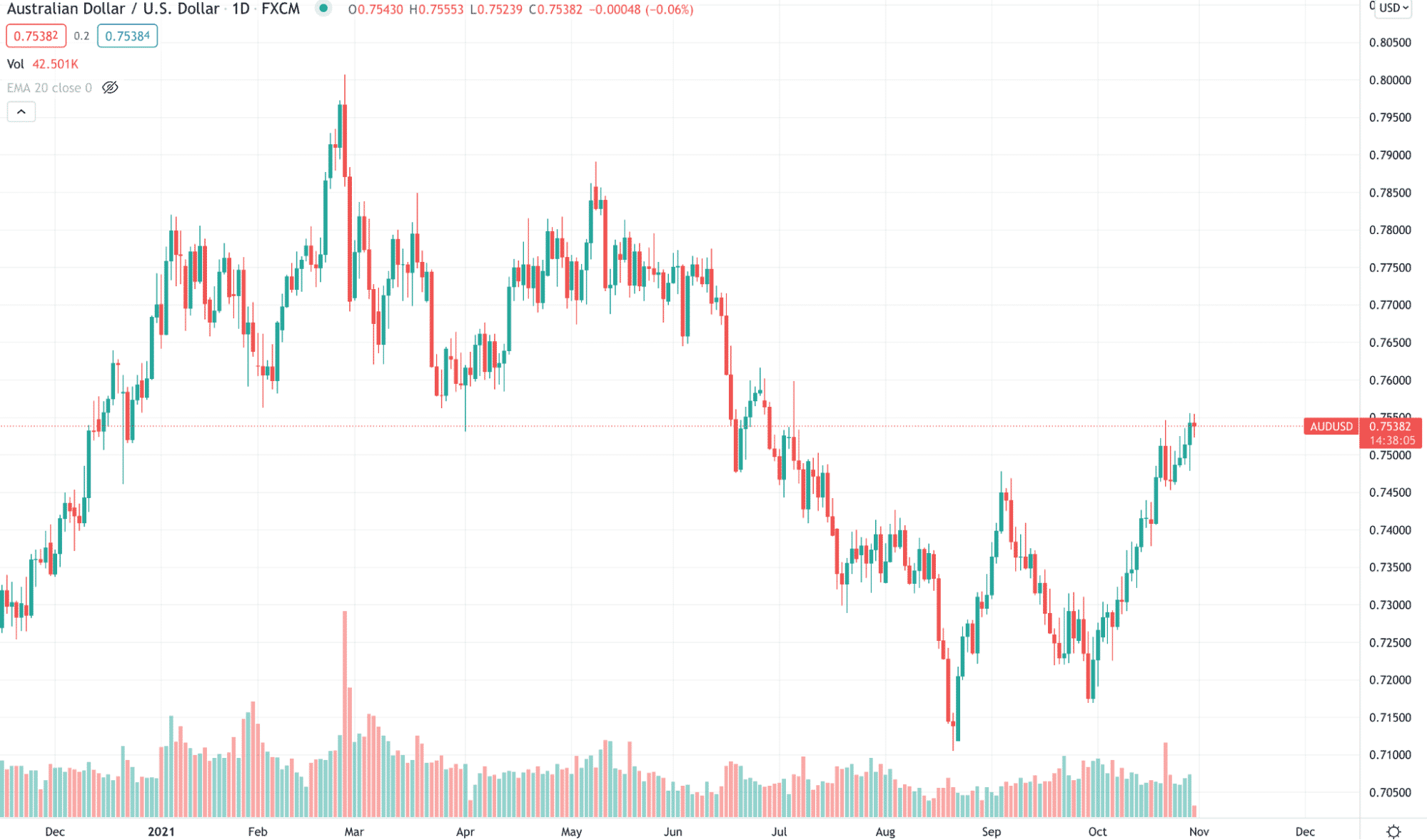

5. AUD/USD

This pair is known as commodity currency pair as the Australian economy depends on commodity mining and exporting. Therefore, the Australian dollar has a positive correlation with gold. Any positive news for gold also positively affects the AUD. Therefore, if you are interested in correlation trading with gold, AUD/USD should be your first choice.

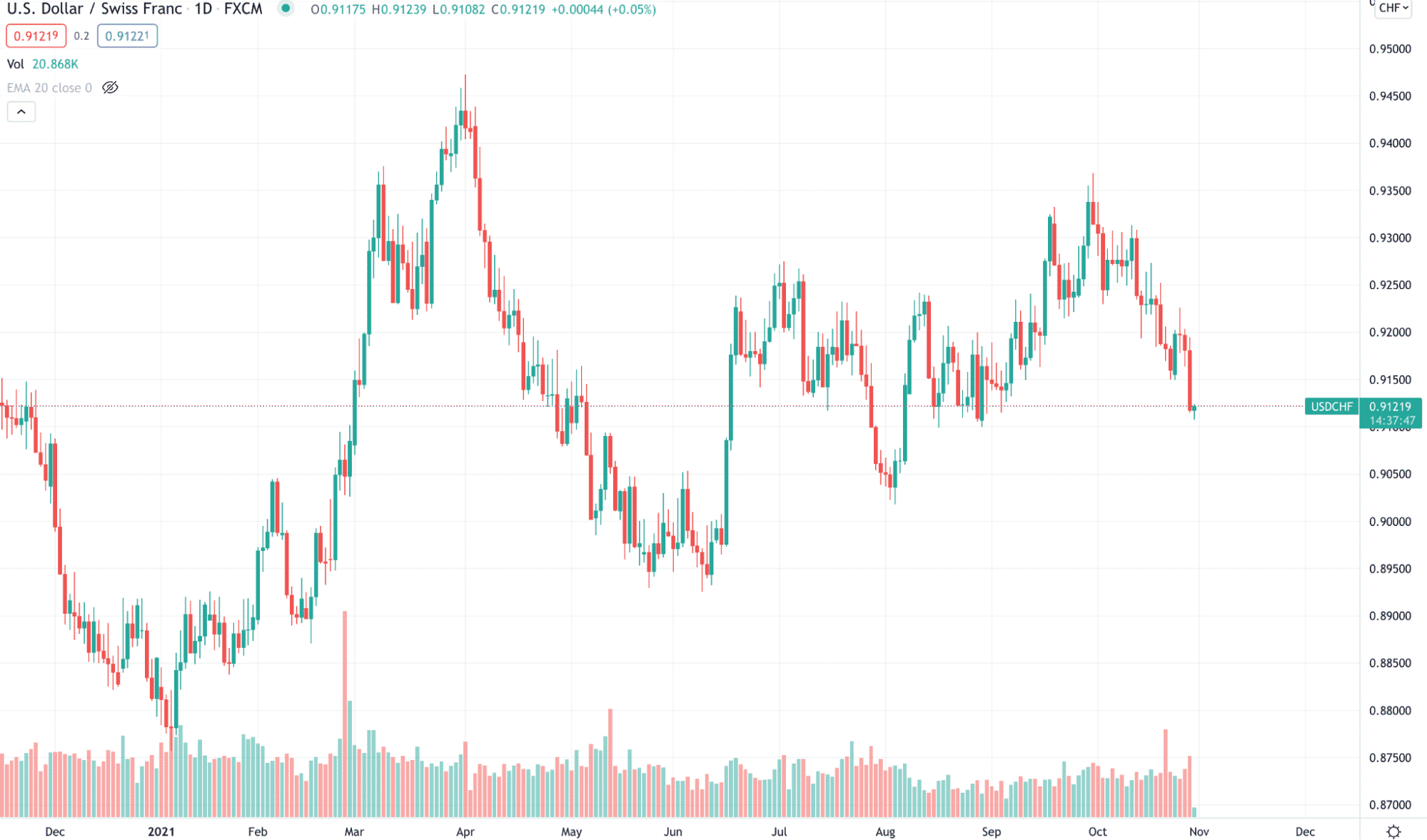

6. USD/CHF

USD/CHF is the sixth-largest currency pair in the FX market, where the CFF means the native currency of Switzerland. The Swiss banking system made this pair important among investors. Many individuals and businesses use Swiss banks to operate hassle-free international operations.

Therefore, the CHF is often known as a haven currency. Any uncertain global economic crisis, CHF rises. This currency pair holds a 3% market volume of the overall trading.

7. EUR/GBP

This currency pair is the combination of two major European countries — the Eurozone and the UK. This pair holds the 2% market share of the FX market. Its major influencer is decisions from BoE and ECB. Moreover, the recent Brexit made this pair volatile, where traders need additional attention in trading.

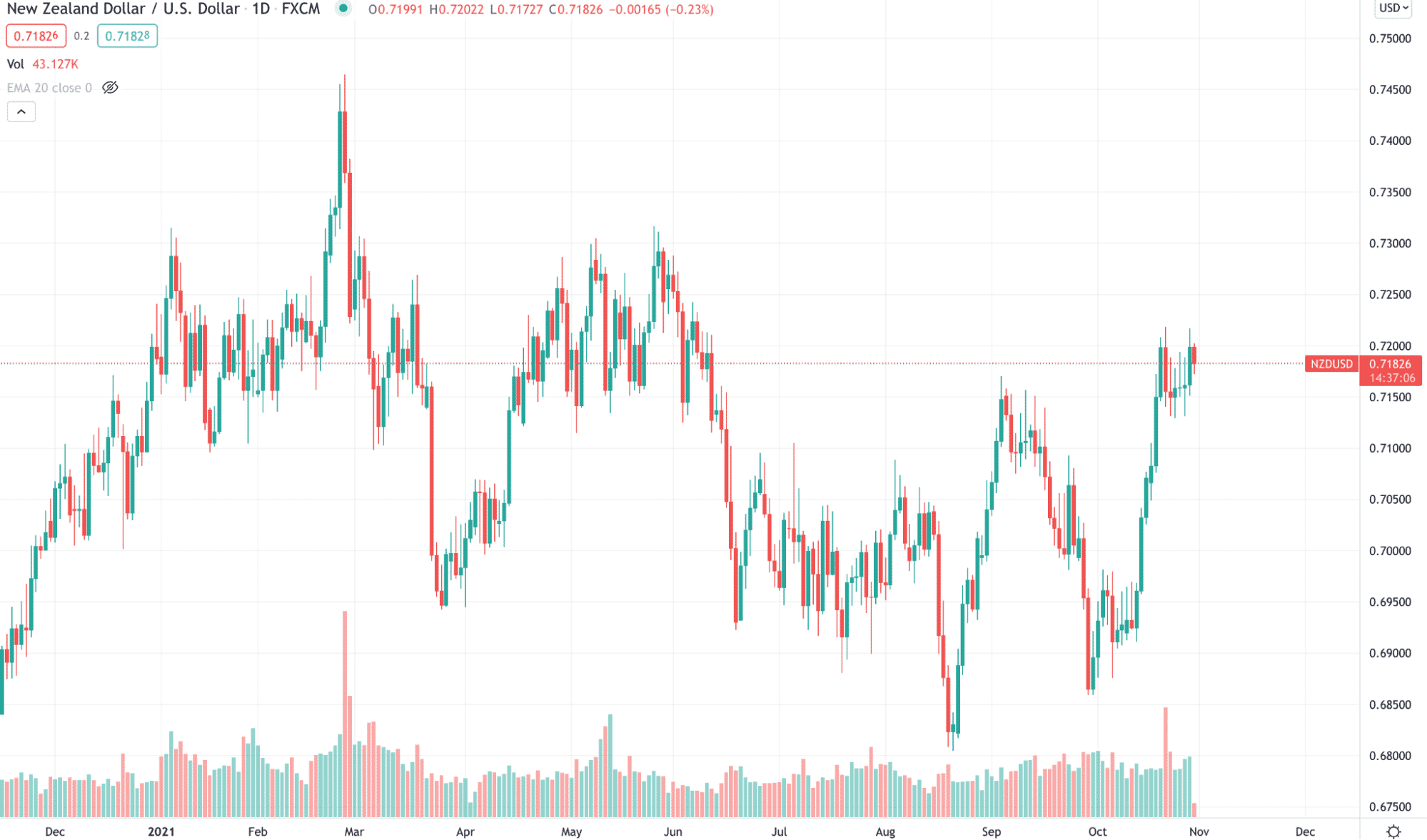

8. NZD/USD

If you are interested in trading low volatile currency pairs, you should choose the NZD/USD. New Zealand is the world’s largest dairy producer, making this currency pair correlated with the dairy industry.

Any positive sign in dairy or dairy-related prices increases bullish pressure in this pair. Moreover, it has a strong trading partnership with Australia that positively correlates with the AUD/USD.

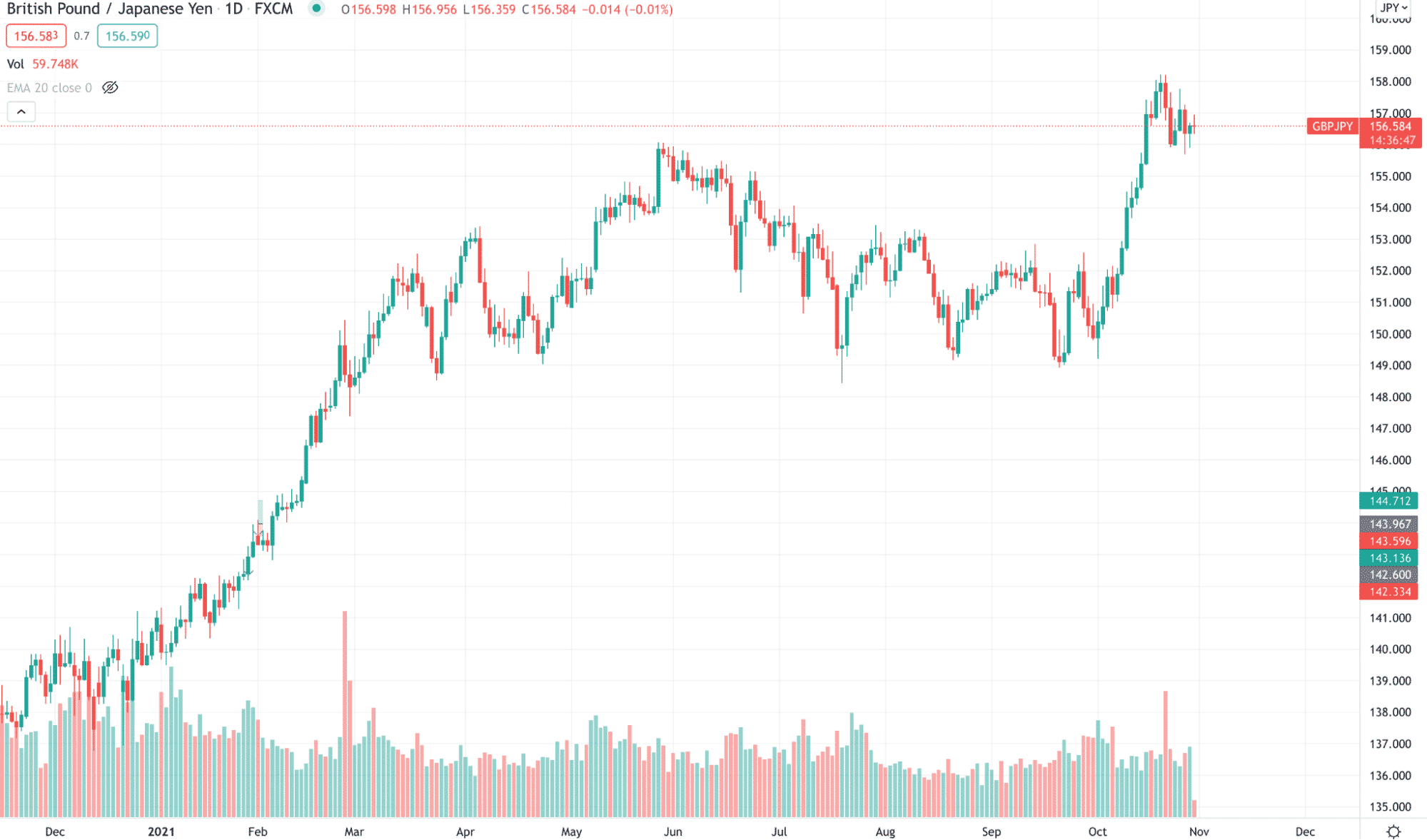

9. GBP/JPY

It is the most volatile pair among cross and majors where the average daily movement is higher than other pairs. Moreover, after Brexit, this pair has become important to traders. The main reason is that the UK is a separate country now and transactions with the JPY and GBP happen without any involvement of the Eurozone.

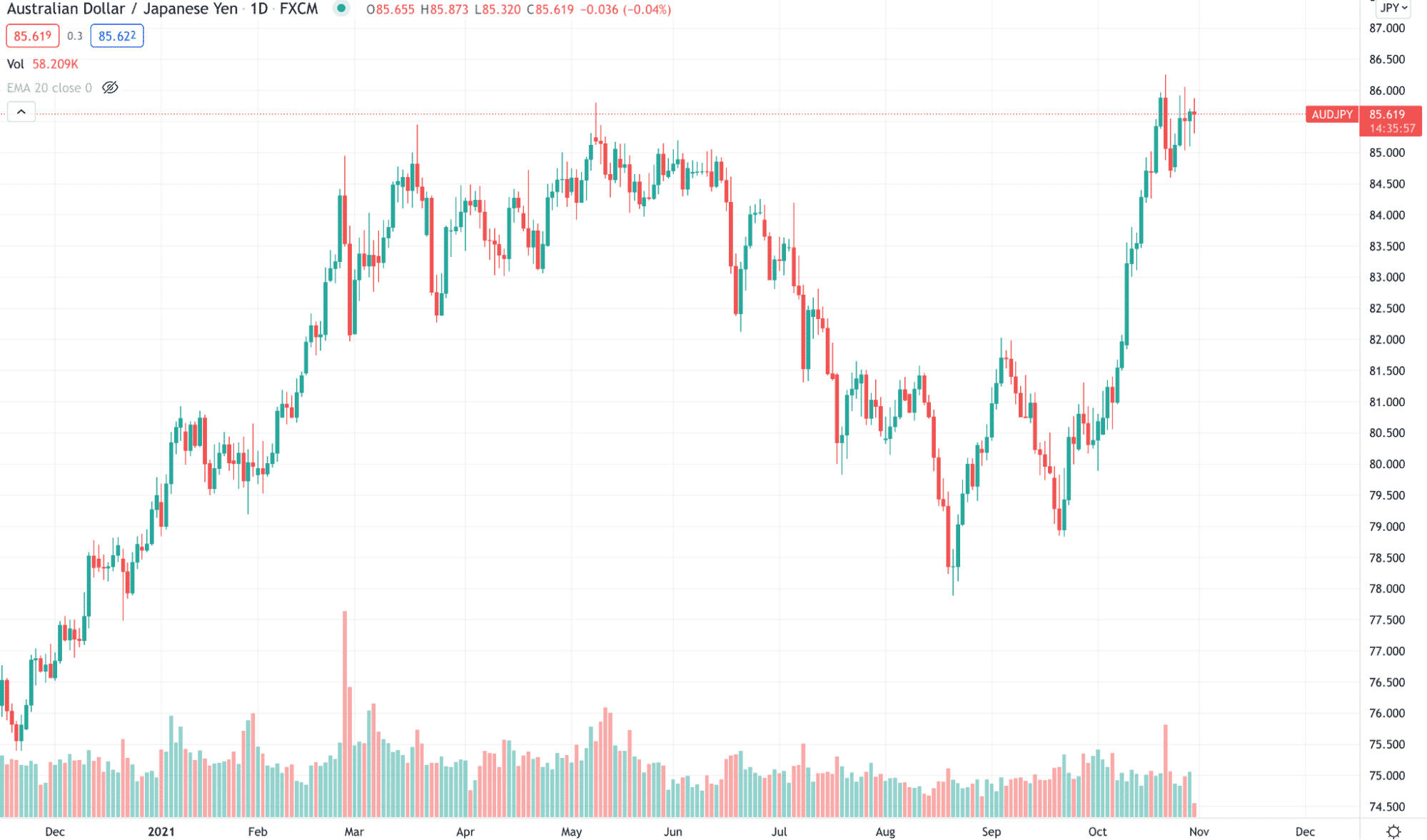

10. AUD/JPY

This currency pair combines two Asian giant economies where the Australian major economic influencer is a commodity, and for Japan, it is export. The Bank of Japan and Reserve Bank of Australia are central banks with the most strong influence in this currency pair.

Final thought

Trading in the financial market needs some attention, where finding profitable currency pairs is the primary requirement. Besides, you need to build up a trading method with a proper risk management system.