Position trading is popular among traders with significant capital. Since these people are typically busy with other commitments, they don’t often have the luxury of time to trade frequently.

While it is true that position traders take fewer trades, it does not mean that they could not generate significant profits from the markets. They can infrequently trade because of their large accounts, but they take positions and hold them for long. As a result, each trade generates many pips, each pip amounting to hundreds of dollars or more.

Position trading allows you to participate in the currency market with less stress than day trading or scalping. You are not worried about market noise, and you do not stress about short-term price movements against your position.

To get the most out of position trading, you must understand some rules. Here we share five such practices, along with five tips to avoid common mistakes. Read through this post and emerge as a better position trader.

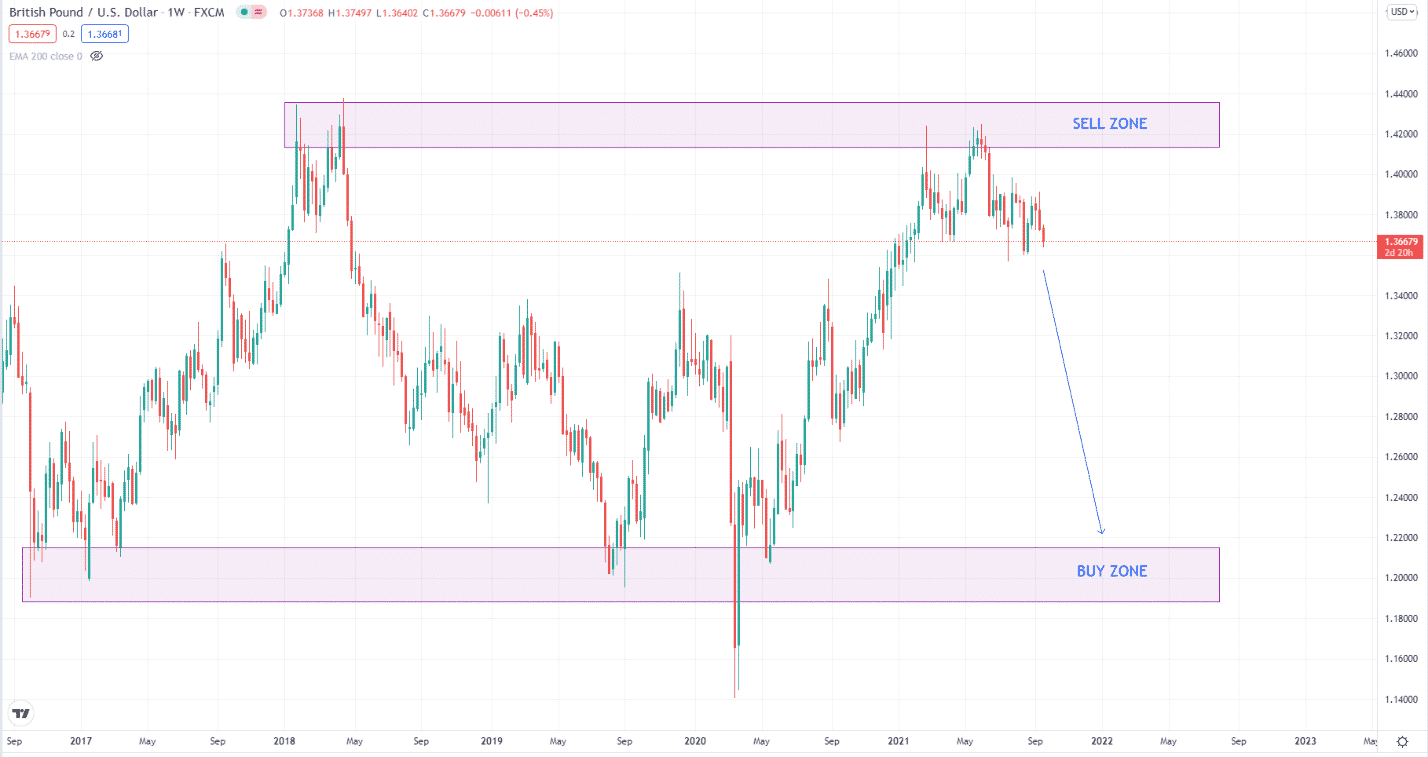

Tip 1: Not using historical support and resistance

Support and resistance is a common theme in forex trading. You know that price plays around these levels or zones. When looking for direction, you can use these levels, especially the historical ones, to begin your position trades. On the flip side, you can target the opposing levels as your exit points.

Why does it happen?

Perhaps you have heard that once a strong trend is in place, it could break down barriers in its path. In addition, maybe you learned that you should choose continuation over reversal when given a choice. There are long-term levels on the chart that price tends to respect over and over again. Possibly, many speculators like banks, big institutions, and even the central banks closely monitor these levels.

How to avoid the mistake?

As a position trader, you should know the roadblocks that price must get through to continue moving in that direction. If the obstacle is far too substantial based on historical evidence, this could be your exit point. Therefore, you have to label these historical levels on your chart and put your take profits there.

Tip 2: Trade after confirmation of a new trend

Picking tops and bottoms have the advantage of entering the trend near the inflection point with a promise of great returns. However, it has the downside of prematurely entering the trade. If you enter trades this way, you will incur frequent losses while waiting for the market to reverse.

Why does it happen?

Early entering can help you limit the loss per trade. It will allow you to put the stop loss close to your entry. If the trade fails, you will lose a small amount. The profit potential is several times greater than the amount you are bound to lose if you win. While the concept is excellent, you should find a way to reduce losses before finding the proper entry.

How to avoid the mistake?

To reduce losses, you must enter a trade after confirmation of a trend reversal. You can use a simple tool to achieve this goal. If you intend to go long, wait for a higher low to form before you enter. When looking to go short, wait for a lower high to occur before you trade. Traders call this setup the 1-2-3 pattern. The entry trigger is the break of the 2-point, either up or down.

Tip 3: Choose trending markets

To realize that, you have to trade trending markets. As a position trader, you want to gain as many pips as possible out of each trade. Ranging markets will only waste your time as you will not generate enough profits to compensate for the time investment. Plus, the swap will eat into your profits over time.

Why does it happen?

You might not be aware that some markets tend to range more than they trend. This is in addition to the market propensity to range about 70 percent of the time. Therefore, you should be selective of which markets you place position trades on.

How to avoid the mistake?

It is best to stick with the 28 major pairs in the currency market. For example, GBP/USD or EUR/USD. This is a good starting point for your search. If you look deeper, a small number of these pairs range most of the time. Therefore, you must avoid these pairs when position trading. Examples of ranging pairs include GBP/CAD, AUD/NZD, USD/JPY, and EUR/CHF. Be aware that these pairs also trend once in a while. More often, they play around a defined trading range.

Tip 4: Set trailing stops

One efficient way to manage your position trades is through stop trailing. With this method, you can lock in profits while the market goes in your favor. If the market turns around, your position will ensure profits and not turn into a losing trade.

Why does it happen?

You might be having difficulty monitoring your trades because of your busy schedules. As a result, you miss chances to secure profits while you are not looking at your charts.

How to avoid the mistake?

There are many ways to implement stop trailing. Examples include:

- Using a fixed number of pips or points.

- Putting the stop on the recent swing point.

- Using a mandatory number of candles.

The easiest method among the examples given is the first option. You can apply the first option by determining the average daily range and then using this figure as the trailing stop. You will need an expert advisor to apply the other two options.

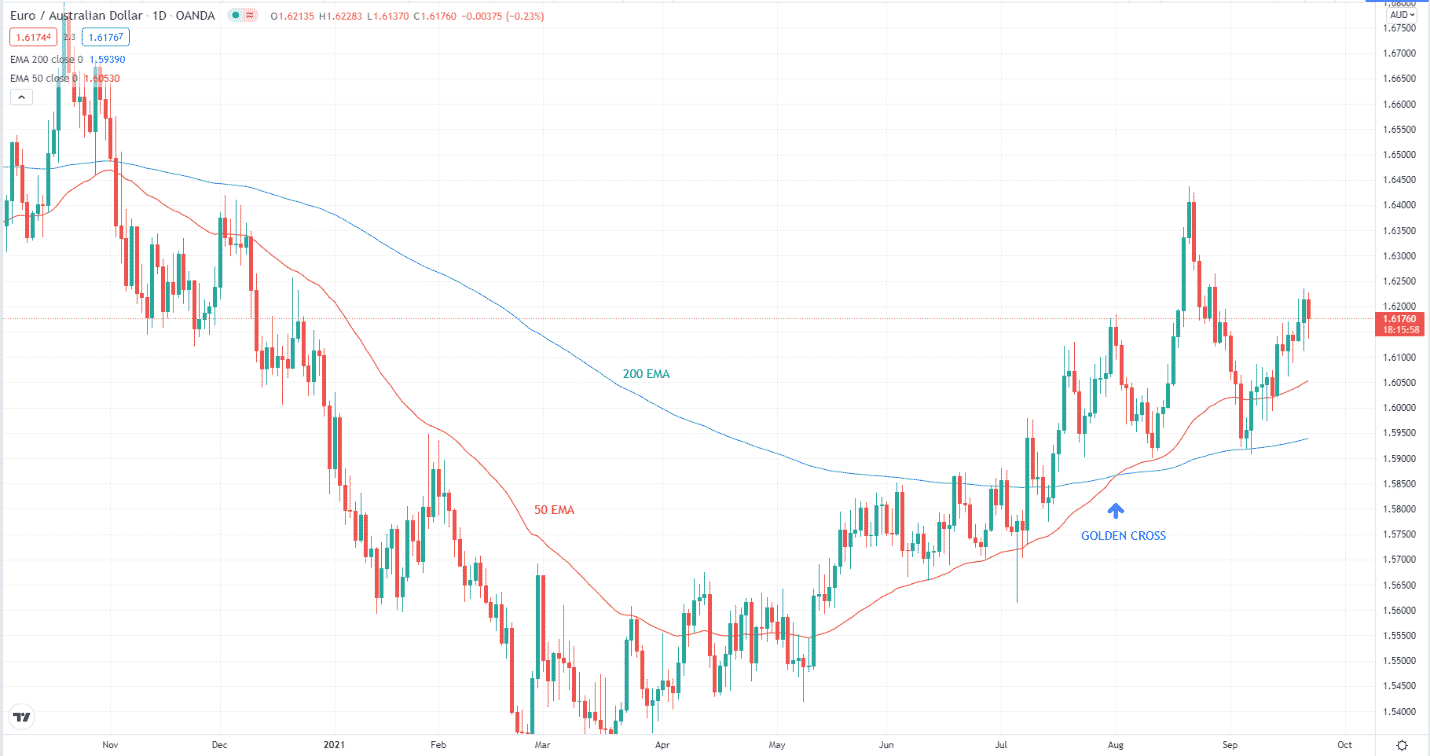

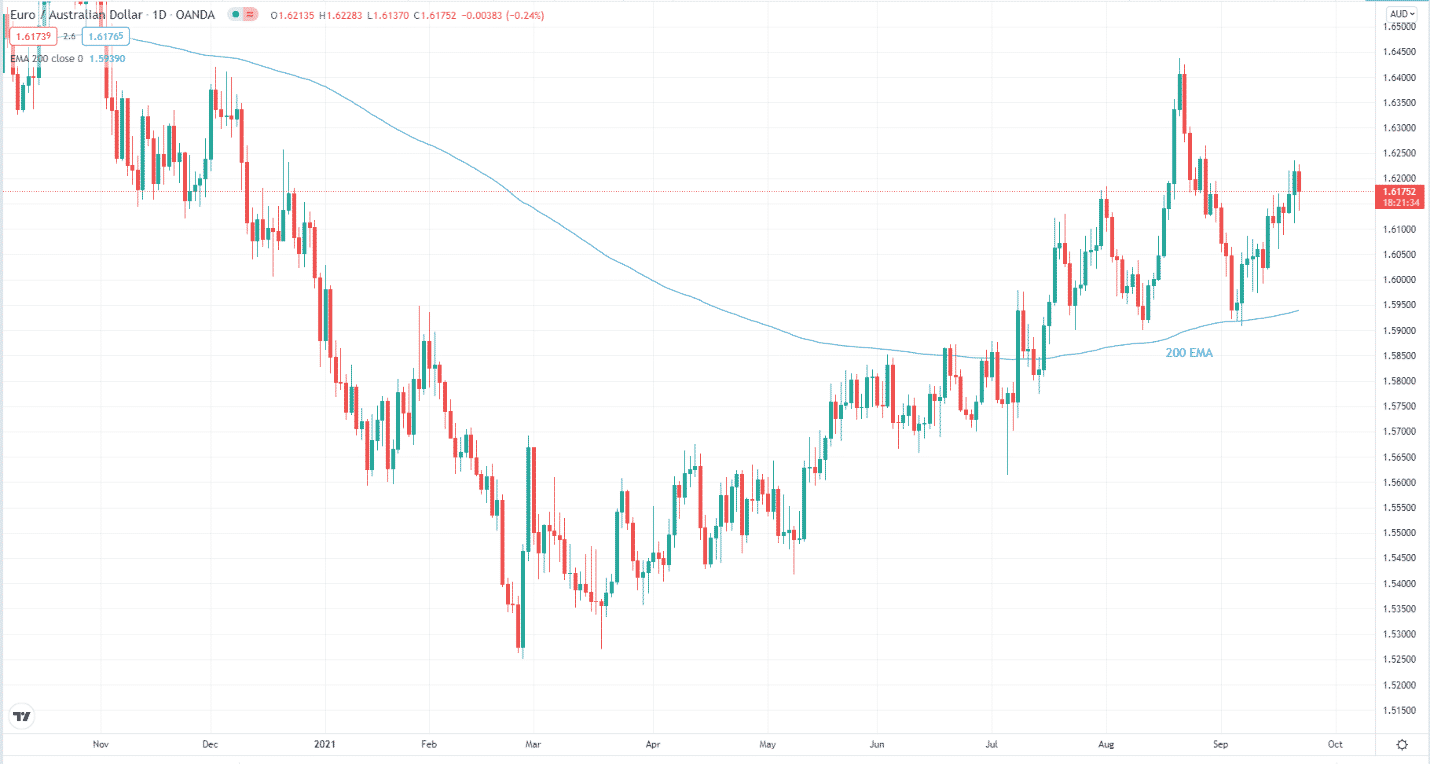

Tip 5: Use the golden cross strategy

There are many types of position trading strategies you can use. You might have chosen the position trading style due to your limited chart time. If that is your case, you better use a simple strategy such as the golden cross. You could learn it here.

Why does it happen?

Position trading is close to investing as you will need to hold your trade for weeks or months. The difference is that position trading allows you to take short positions. If you are a busy person and do not have ample time to check your charts, you might miss opportunities to enter or exit your trades.

How to avoid the mistake?

To avoid missing good opportunities and exiting your trades late, you should use a simple entry and exit strategy. The golden cross is one such strategy. It defines the entry and exit of your trades. With this strategy, you can quickly tell if there is a trade opportunity or time to exit at first glance on your charts. This is indeed a valuable strategy for busy forex traders.