Forex trading got more popular or available for individual traders after 1990. Before that, the currency exchange business was only meant to be a business for banks and financial institutes.

However, as the industry became popular, it’s a very natural invention that forex signal services came up. FX calls are informative recommendations or profitable trading ideas provided by professional traders or software, based on technical calculations, fundamental data, or both for currency pairs.

Providers may send calls in several ways, such as web, desktop, mobile platforms, apps, etc. Traders have to identify the reliable and profitable signal provider that is somehow profitable and meet the return requirements before starting service. This article will discuss the forex trading calls and how to be an FX signal provider.

Benefits of FX calls

FX involves trading currencies where investors buy and sell currency pairs. Every pair moves with the strength or weakness of the particular currency. Anyway, trading is not so simple or easy because being a good trader involves many complex things like:

- Punctuality

- Consistency

- Money management

- Trade management

- Profitability

- Technical analysis

- Fundamental facts about related currencies, etc.

Moreover, being a profitable trader requires skill and experience. Therefore, it might be challenging to trade in the market for beginners. They may feel confused by the market information. In that case, signal services might provide a handy situation. Simply the traders who may want to trade at the FX but don’t have enough time to devote to market study and develop profitable trading study can use signal services to make money besides gathering knowledge. Also, skilled traders can use forex signal service to minimize their loss and for more profitability.

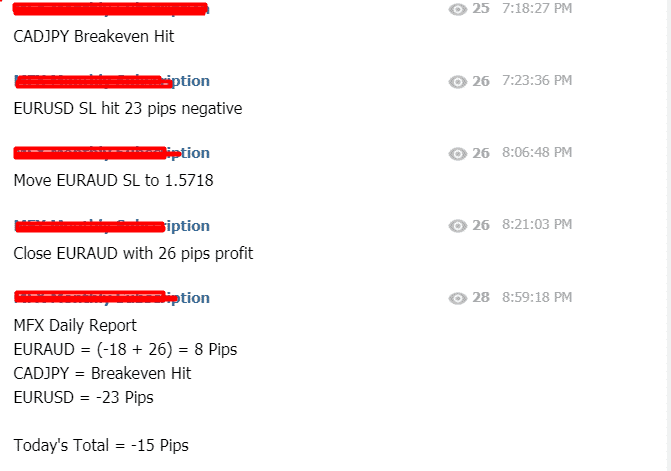

The FX calls include every step that a trader usually takes after opening a position, as shown in the image below.

Forex call subscribers can make a lot of money monthly and even be a millionaire if they follow a satisfactory signal service. So it is essential to select carefully. Another fact of using FX calls is that traders who use signal services don’t need to analyze the market. Someone else is doing that for a declared amount of money. In the meantime, they can utilize their time for some better things like developing skills.

Finally, it is a win-win approach for both call providers and takers. If you have enough knowledge about the forex market, you can provide profits to other people and become a signal provider. In addition, it will help traders to trade with a responsibility that might increase the trading effectiveness.

Beginner guide to be a forex signal provider

FX signal services are becoming more popular daily as signal service has many advantages such as making a profit, saving time, learning from professionals, etc. If any trader finds a trustworthy signal provider, then the sky’s the limit. If you can select signal service correctly, you can quickly grab 100 to 500 extra pips per month.

What if you provide calls and earn money besides regular trading?

In the following section, we will see what you should do to be a forex signal provider:

Create a reliable trading strategy

In the first place, when you want to be a forex signal provider, you must have a reliable and stable strategy. A trader with a suitable trading strategy and proper money management is a profitable forex trader anyway. So it is mandatory to have a reliable and proven trading strategy to be an FX call service provider. A reliable system is a must-needed item for a profitable forex trader, not just for being a signal service provider. So it isn’t easy to create a reliable forex trading strategy first.

Let’s see a list of qualities that a good trading strategy should have:

- Ability to read the market like a book

- The capability of finding exact buying and selling levels

- Allows trade management techniques to minimize trading risks

- Includes conditions when traders should trade or should not trade

Find profitable instruments

After having a reliable trading strategy in the next step:

- Choose the instruments carefully

- Find out which instruments are suitable for your trading strategy

- Check and test your trading strategy so match the reading to find out the reliable instruments to invest in by applying that precious strategy

Knowing this information is a strength in your trading skill. You can’t trade blindly at any FX pair with the same no matter how much reliable strategy you have. In most cases, these pairs’ movement is different, so profitability will differ if someone trades all pairs with the same strategy.

The basic idea is to follow major currency pairs as a trading instrument as they have enough liquidity. Let’s see the list of significant pairs in the FX:

- EUR/USD

- GBP/USD

- AUD/USD

- USDJ/PY

- USD/CHF

- USD/CAD

Day trading vs. swing trading

You have to choose what type of trading signals you will provide. Simply the profit-taking, stop loss levels can’t remain the same in every case, like day trading and swing trading. The day traders generally trade and find setups on the intraday market movements when the swing traders wait before making any entry until the price gets to a certain level or the market creates a particular structure.

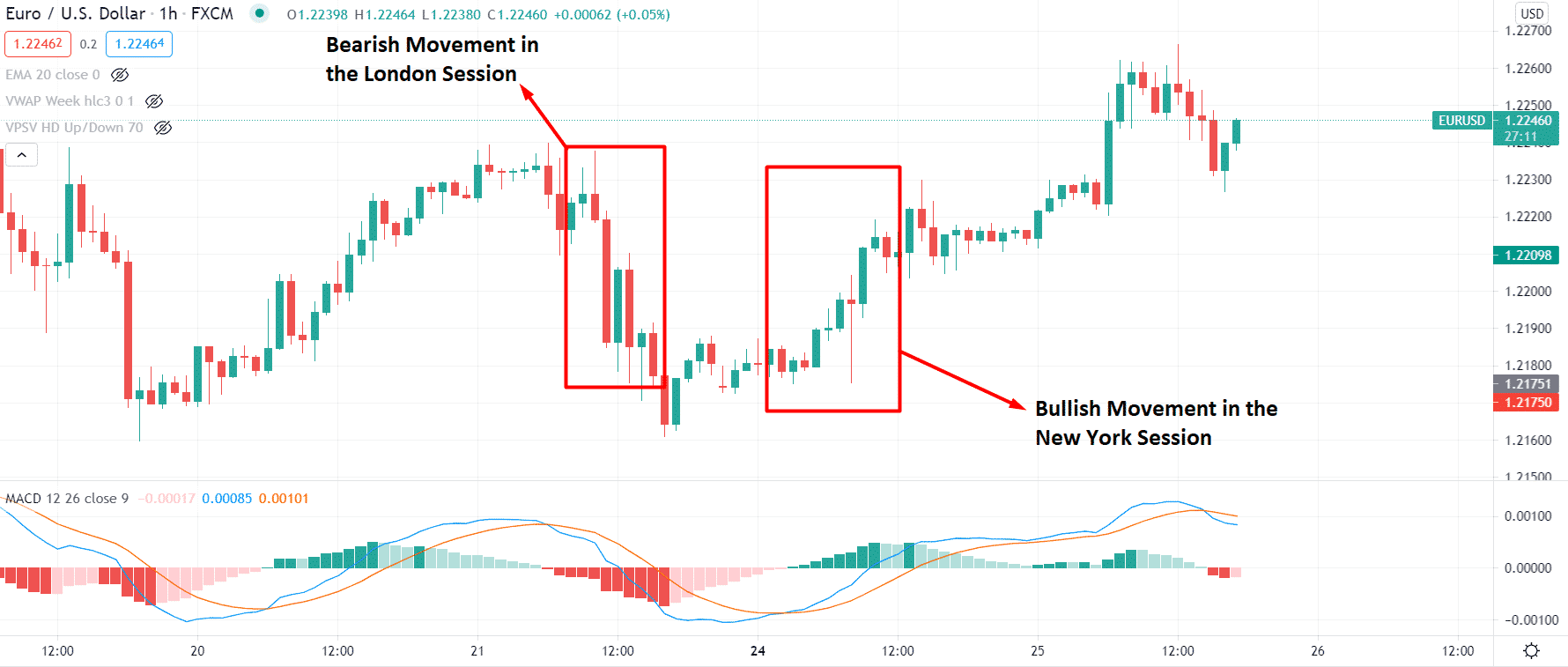

For day trading, the London and New York sessions are best due to prominent market participants, as shown in the image below.

Control mental stress

Finally, an essential part of trading is to control mental stress. Mental health is significant to be a profitable trader. However, you can’t make every trade in the direction of price movement. So some orders might cause you to lose. Whatever, it’s okay to get your stop loss hit. It’s part of the business, but if you are drive-by emotion or can’t control yourself from taking revenge trades, that will harm your balance for sure.

Moreover, if you can’t control your mental stress, then you’ll end up losing your money like most of the newcomers, as a signal provider, that would be a matter of shame.

Summary

In the end, nothing is absolute at the FX as it is a decentralized marketplace and pairs move with the strength and weakness of both currencies. Therefore, it’s better to gather knowledge and skills as much as possible and remain updated as much as possible.

Moreover, be careful before making entries during volatile fundamental economic events like GDP, interest rate decisions, central bank press releases, policy meetings, etc. Finally, always use proper money and trade management for any order because you must deliver complete order suggestions to your clients as a signal provider.