The ‘Gap and Go’ strategy is one of the best ways to invest while the market is open. You may be able to finish your trading day in 30-60 minutes if the right things happen. It’s called an overnight void if the price of shares changes between the end of the last business day and the start of the next market day.

In today’s pre-market and post-market times, changes in market prices are taken into account in the most common scan logic. Do you want to learn more about the GnG strategy? Then let’s go.

What is the Gap and Go strategy?

In this strategy, you buy when an asset rises above the price it closed the day before. This is called the GnG. Using a pre-market scanner and looking for assets with high pre-market volume is the most common way to manage gaps effectively.

Day traders use this method of trading a lot. The pre-market scanners get a lot of tickers that are going up and down every day. These people are being watched by investors worldwide to see if there is a way to make money.

How to trade with a Gap and Go trading strategy?

Getting a head start on the market means you’ll be ready when trading starts. The key to success in this situation is to plan very well. It’s imperative to keep an eye on the prices when the market begins.

The strategy is a way to ride the price of an asset’s momentum. It is a simple plan.

- When the market opens, look for a significant change in the cost of the thing you’re interested in.

- The pre-market opening session is often an excellent place to get this information, which can help you know which assets will move the most before the market starts.

It’s time to take a long position after figuring out which ones have gone up a lot. Because the asset has dropped in price, you can also go short on it. People set their stops a few ticks below the open. When you trade, you can make money by trailing your stop losses until you get out of the market altogether.

GnG is an excellent way to trade because the market will tell you right away if your plan is wrong. There may be times when the stops are very close together, but the reward can be enormous.

Bearish trade setup

Quantitatively, this can be described as follows. The void is greater than 3%, but less than 18%. The asset is opening below a price it has not traded in two months.

Although the ‘2-month rule’ can easily be changed if the break is perfect, it does take practice to find the ideal interval. However, when you start with very rigid rules and see how significant cracks occur, you can become a little more flexible with numbers and expectations.

As soon as you have found the void, you can play it in many different ways. If you have experience, you might choose from the following options:

- Take the low of the 5-min candle

- The low of the 3-min candle

- The low of the 2-min candle

- The low of the 1-min candle

If you are new to this bearish day trading strategy, you should start with a larger time frame. First, determine how many contracts are short according to your risk level. Act accordingly. Once the trade is set up, you can begin selling.

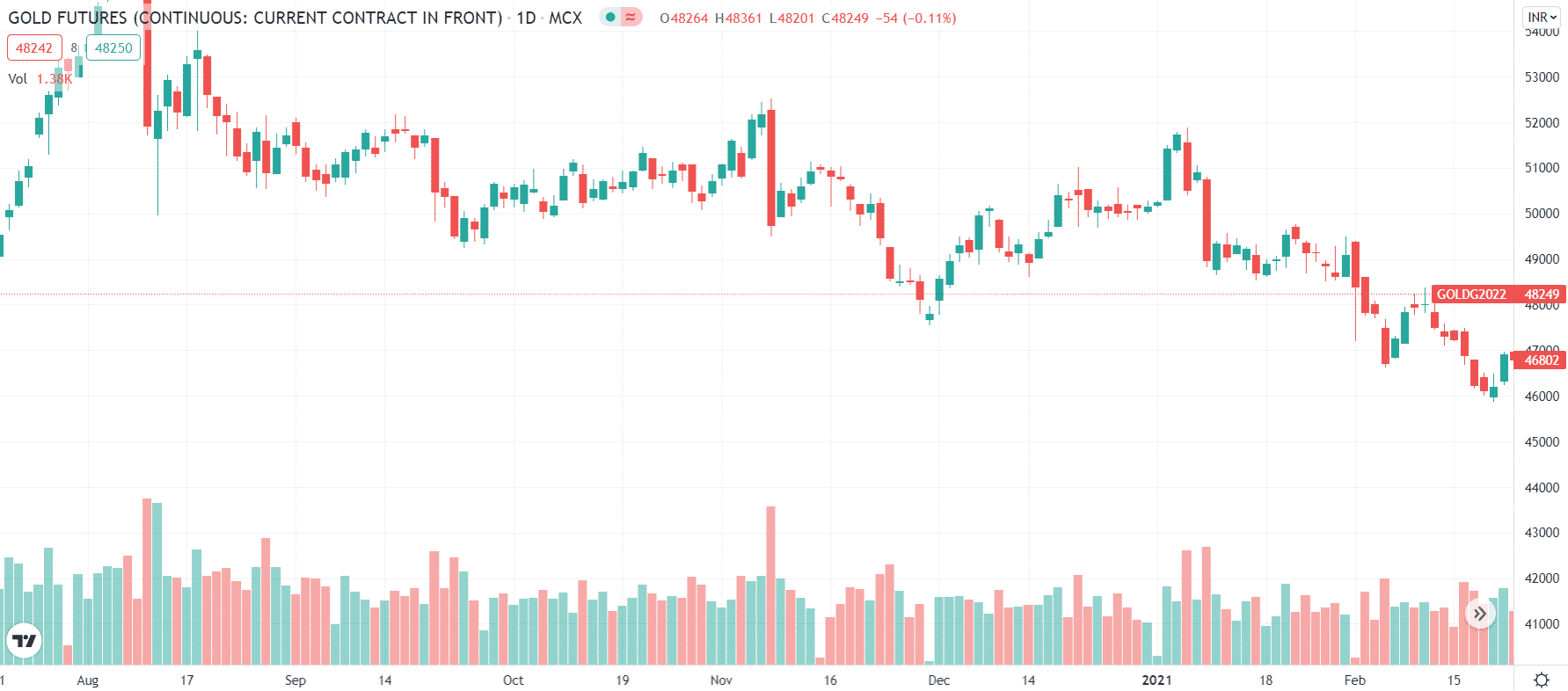

Let’s explore an example related to it. Gold futures are facing high resistance at 200 day EMA at roundabout 47600. The figure given below shows a breakdown clearly.

Entry

The entry would be at 47150, and it should be a short entry as the price has significantly gapped down and is likely to exacerbate the selling action.

Stop loss

Place the SL at 47750, which is the beginning of the gap.

Take profit

US RSI oversold conditions to exit the trade or use the immediate support level as a means to close your trade in profit.

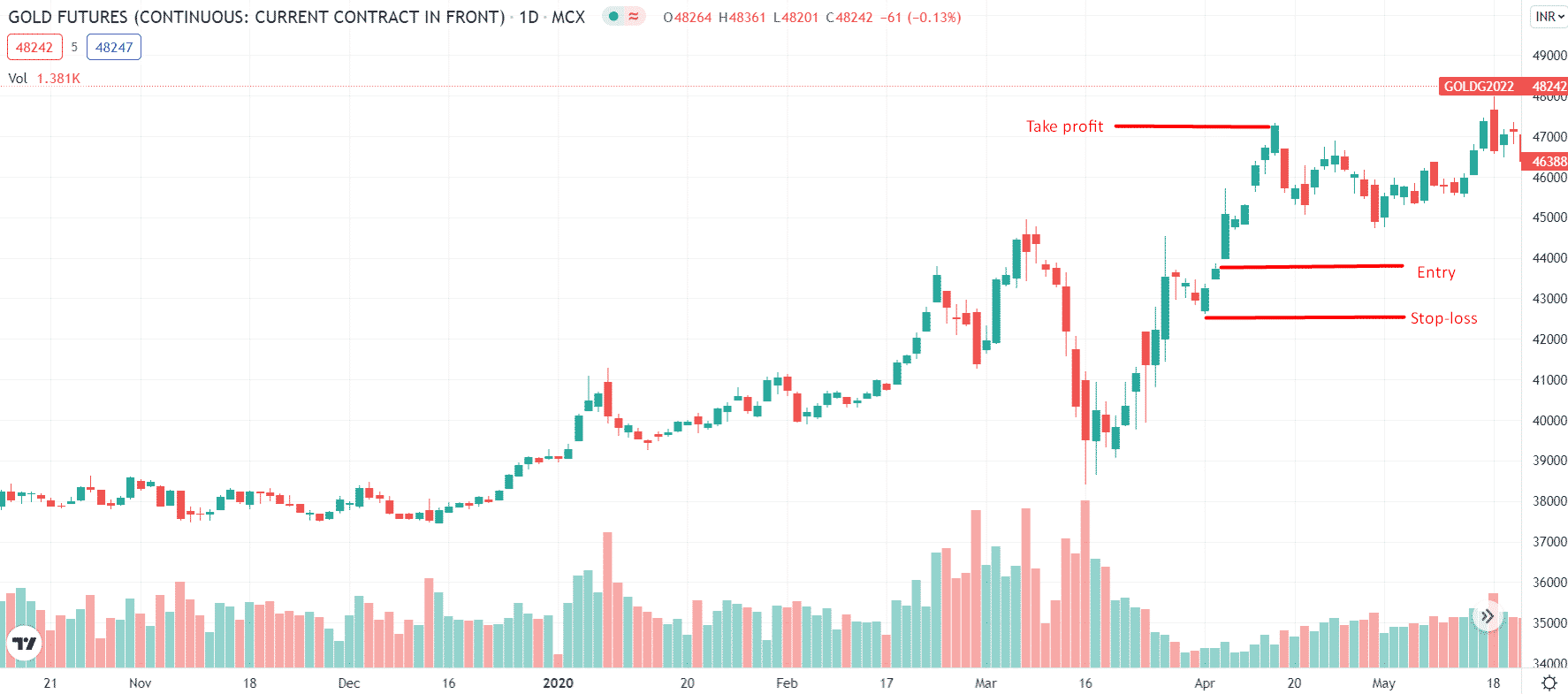

Bullish trade setup

The act of opening up indicates that the current open price is much higher than the previous day’s closing price. On the other hand, a down gap is created when today’s open price is lower than yesterday’s closing price. Up movements are also known as bullish breaks.

Down voids are bearish signals, as you might expect. The spread between support and resistance is critical to watch in the markets because it can signal a change in support or resistance. Traders can either get it right or wrong because of the different confusing aspects of the needs. Unfortunately, many traders tend to miss the market context.

Entry

The trade opened up as a long entry at 43900 when the market gave an upside gap.

Stop loss

The SL should be placed just below the local lows of 43200.

Take profit

US RSI overbought conditions to exit the trade or use the immediate resistance level as a means to close your trade in profit.

How to manage the risks?

Investors might use hedging strategies to lessen the risk of price fluctuations. For example, investors might buy put options, inverse ETFs, or short sell a highly linked investment to reduce the risk of a hole.

Cut back on the size of investment

Deflation risk should be considered when setting a position size for transactions that last more than one day. It doesn’t matter how much money a trader decides to risk on each deal. A hefty price difference could still cost them a lot. To avoid this, investors might cut back on the size of their investments before they start making them.

Use the risk-reward ratios

There are also risk-reward ratios that can limit the risk of a gap. For example, a risk/reward ratio of 5:1. A hole doubles the risk, making the risk-to-reward balance 2.5:1, which is good if the trading strategy has more than a 29% success rate. Risk management requires market evaluation.

Be on the alert

You need to know why the price is moving to determine whether the news has the potential to sustain it. Always keep in mind that the law of supply and demand applies. When a stock opens higher than the previous day’s closing, this is known as a GnG strategy.

The most frequent approach for effectively time-gap selling shares is utilizing a pre-market scanner and hunting for equities with pre-market volume. Day investors love this investment approach since it’s simple and effective.

Every morning, pre-market scanners pick up lots of new unlisted stocks. Many day traders rely on a simple breakout or breakdown to make money on the market. To manage risks in the GnG strategy, you should do a comprehensive market analysis.

Final thoughts

Before the market opens, pre-market scanning is the most typical strategy for finding lucrative trading opportunities. You should seek companies trading at a high volume before the market starts. It is necessary to use the GnG strategy when the stock price rises considerably from the previous day’s closing. Day analysts often use this approach to create a profit.