Yes, in theory, you can get rich by trading in the FX market. However, it is harder than you think. In 2014 Bloomberg estimated that about 68% of traders have losses every year. Only one out of three traders didn’t lose money. But it gets even worse. Not losing is not the same as getting rich.

So, out of that 32% of traders, you need to pick the few that made enough money to call themself successful. So, it’s not common, but it is possible to get rich in FX trading. And it’s not a matter of luck. We know why so many traders fail and what they have to do to profit consistently.

So, if you want to be one of the successful trading stories, keep reading to learn the key steps you need to follow to be a profitable trader and, hopefully, get rich.

Tip 1. Forex trading is not for everybody

Or at least not for every situation. In contrast to other markets, the best time to start trading is not now. FX is a risky world where you will probably lose money, especially at the beginning. You have to be comfortable losing the money you are trading. The only way of doing that is by setting your finances straight before you start trading.

Why does it happen?

Forex trading can make you rich, but it won’t get you out of poverty. If you struggle to get to the end of the month or even pay the rent, you are in no position to risk money in the FX market. That means that you should have your finances in order before you think about opening a trading account.

On the other hand, if you are not comfortable losing money because you need it to pay your rent, this will probably lead you to make the worst calls driven by necessity, and you’ll end up in a worse situation than when you started trading.

How to avoid the mistake?

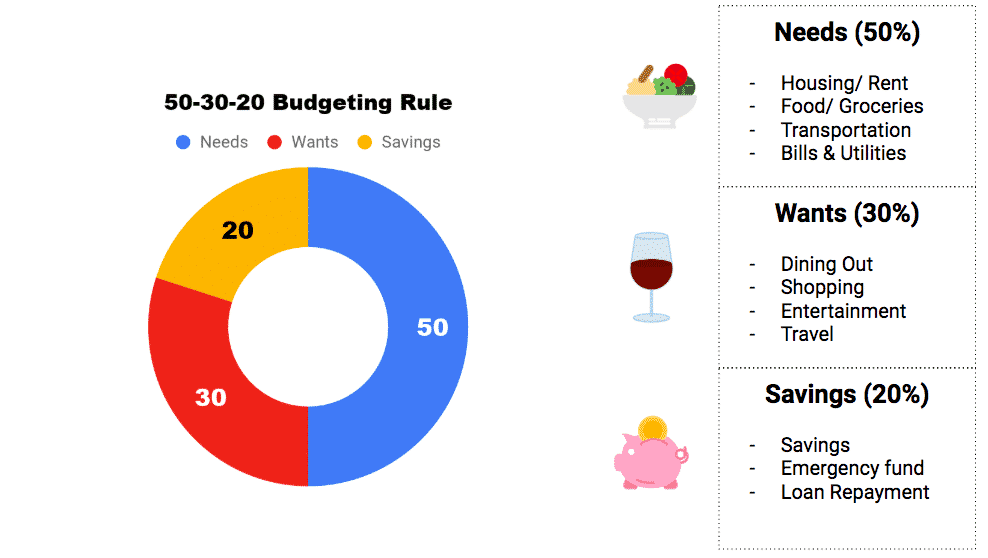

Experts recommend to begin trading with at least $10,000 and only once you have all your expenses up to date. Two rules of thumb can help you to get to this scenario. The first one is the 50-30-20 rule. So your daily expenses will be 50%, your savings 30%, and your investments 20%.

The other rule is the level of saving rule. This rule states that you need to save enough money so you can live without income for at least six months before you start trading.

Tip 2. You won’t get rich overnight

This is probably one of the most common mistakes when trading, and publicity is to blame here. Forex is not only hard, but it takes a lot of dedication and time to grow a healthy account. It is not true that traders get rich immediately. Even the best trading plans take time.

Why does it happen?

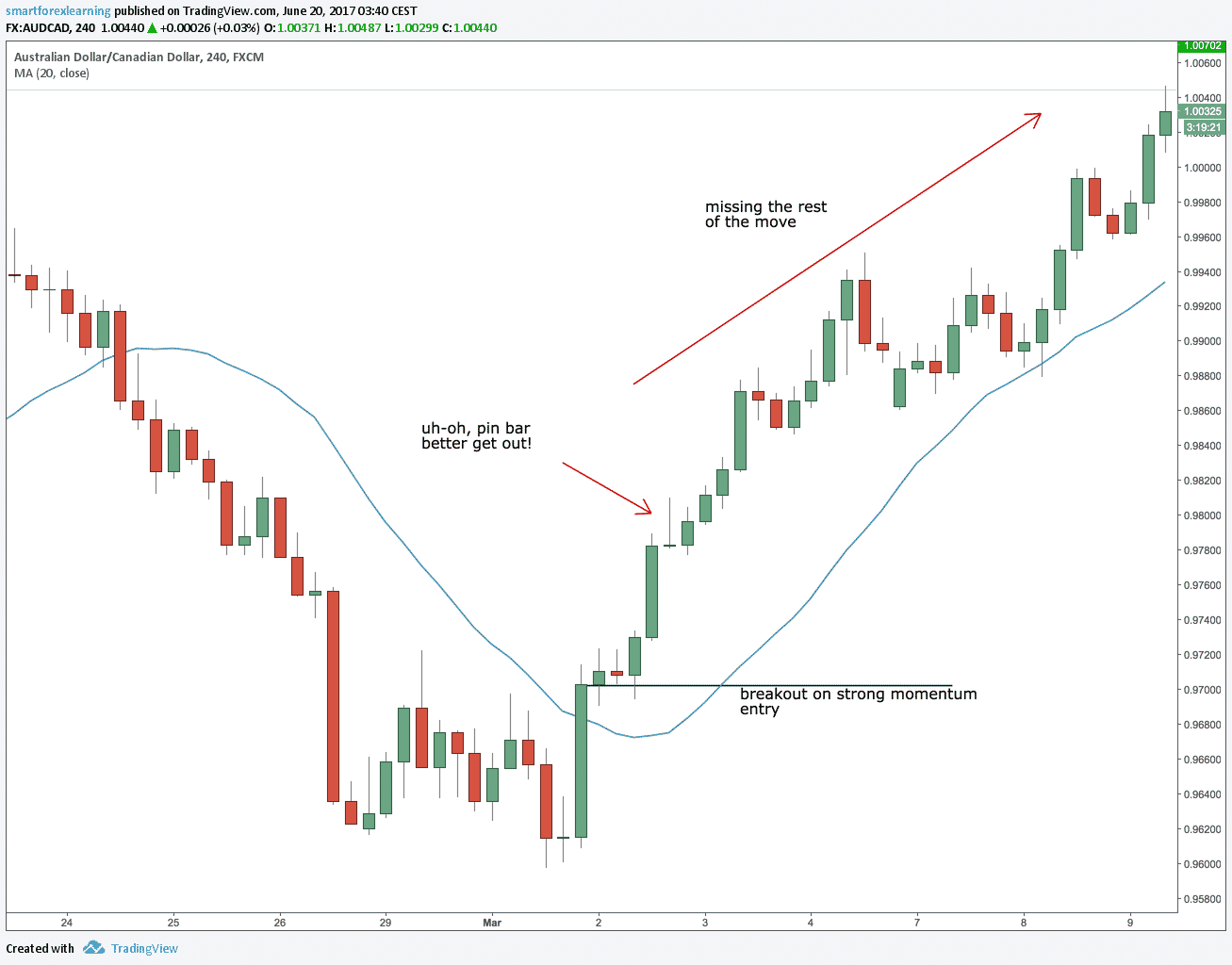

To profit in trading, you need to get consistent earnings, not a few big trades. Also, it is more important to reduce your losses than have great rewards. This all leads us to an important conclusion, forex trading requires dedication and making small, consistent earnings over long periods to be profitable in the long term.

How to avoid the mistake?

Stick to the “Cut Your Losses and Let Your Profits Run” Adage. This is an old saying that works for every trader in the world. But again, the important part is the “Cut your losses part,” if you don’t, you’ll be betting on failed trades that will only ruin your account in no time.

Tip 3. Comercial plan

Trading is like investing in a business, and like with any business, there is no investing without a plan. For example, let’s say you want to buy a house to rent it. It doesn’t make sense if you don’t know how much you can spend or how much money you will get for rent. The same goes with trading.

Why does it happen?

A plan will help you decide how much you’re willing to invest, how much you want to take out of the trade, and how much you’re willing to lose if things go wrong. When you don’t know any of these things, your losses can skyrocket before you even notice, and that is the worst thing you can do when trading. Of course, not having a plan will also affect your profits by cutting them earlier, but again, the thing that makes you go bankrupt is not poor profits but large losses.

How to avoid the mistake?

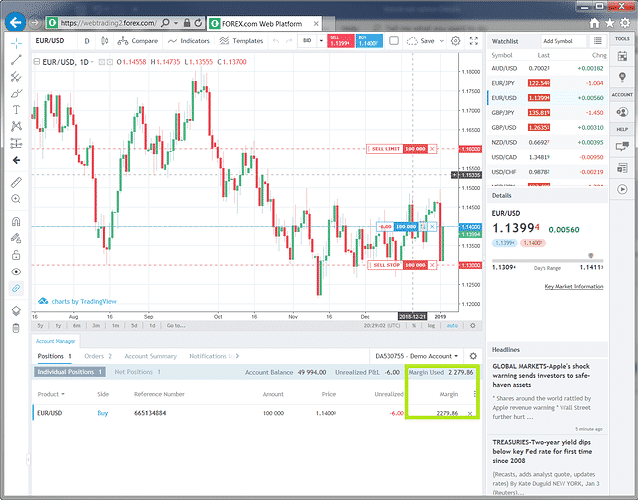

With time, education and experience, you will make a trading plan adjusted to your trading style. Meanwhile, using the common rules for traders is very helpful. For example, never invest more than 2 or 3% of your account in one trade, set clear stop-loss and take-profit points, and limit your leverage.

Let’s say you have $10,000 in your trading account. The 3% of that is $300, so no trade should compromise more than $300. And establish your stop-loss, so you have a maximum loss of $100.

Tip 4. Demo account

Nobody knows if their strategy is the right strategy. If there were one right way of trading, everybody would use it. The strategy your mentor taught you maybe worked during a time, or maybe it was another pair. You don’t know how it will work out now, and testing it with real money is too expensive.

Why does it happen?

The market is hard to read. But, since it involves people, it changes itself when most traders learn to read the market. You need to test out your strategy without risking your own money.

Remember, no matter how good your technique is, you will need to adjust it from time to time, and if you are wrong, you can lose your account quickly.

How to avoid the mistake?

Before trading based on a new strategy, please test it out in a demo account. Almost all brokers offer this option, so you can see how suitable your trading is and improve without losing any money.

Tip 5. Brokers

Not every broker offers a demo account. Also, they have different options for you to prepare before trading. As important as any other step, it is to make sure you find the right broker for you.

Why does it happen?

Every broker has its way of doing things. Those ways can be appropriate for you or not. Even the user interface it’s important. You need to be comfortable while trading.

How to avoid the mistake?

Take enough time to research the best traders available. Then, check if a regulatory institution recognizes the broker.

Forex is not a centralized market. Therefore, the possibility of being scammed by a fraudulent broker exists.