Trading is a fun win-win game until the market participants know the best hours of entering the market. It ensures maximum profit and less effort. We will discuss some of the essential shortfalls of trading with the reasons for their occurrence and the tricks to avoid them. However, before discussing the tips, let’s calculate the trading days per year.

Out of 365 days in a non-leap year and 366 days in a leap year, the traders get approximately 252 trading days, as reported from the 2021’s data. It makes 21 trading days for a month on average. Now is the time to discuss the five foremost tips to make the most of these trading days.

Tip 1. Don’t fall into greed or overtrade

Most traders believe that the trading market is a solution to becoming financially stable. However, even if it is the case, the trading market is volatile. It means that it requires a comprehensive knowledge of the market movements and careful diligence to avoid drowning in its volatility.

Why does it happen?

It happens when the traders make large bets in the hope of gaining large profits or do trading daily. It is an overconfident step that may lead to losing or gaining an amount fast. Similarly, most traders trade daily, playing with several assets together that isn’t favorable.

For instance

1. If the trader gains $300 profit per three trades, he will gain $1000 profit for ten trades a day. So 300$ for ten trades is not favorable.

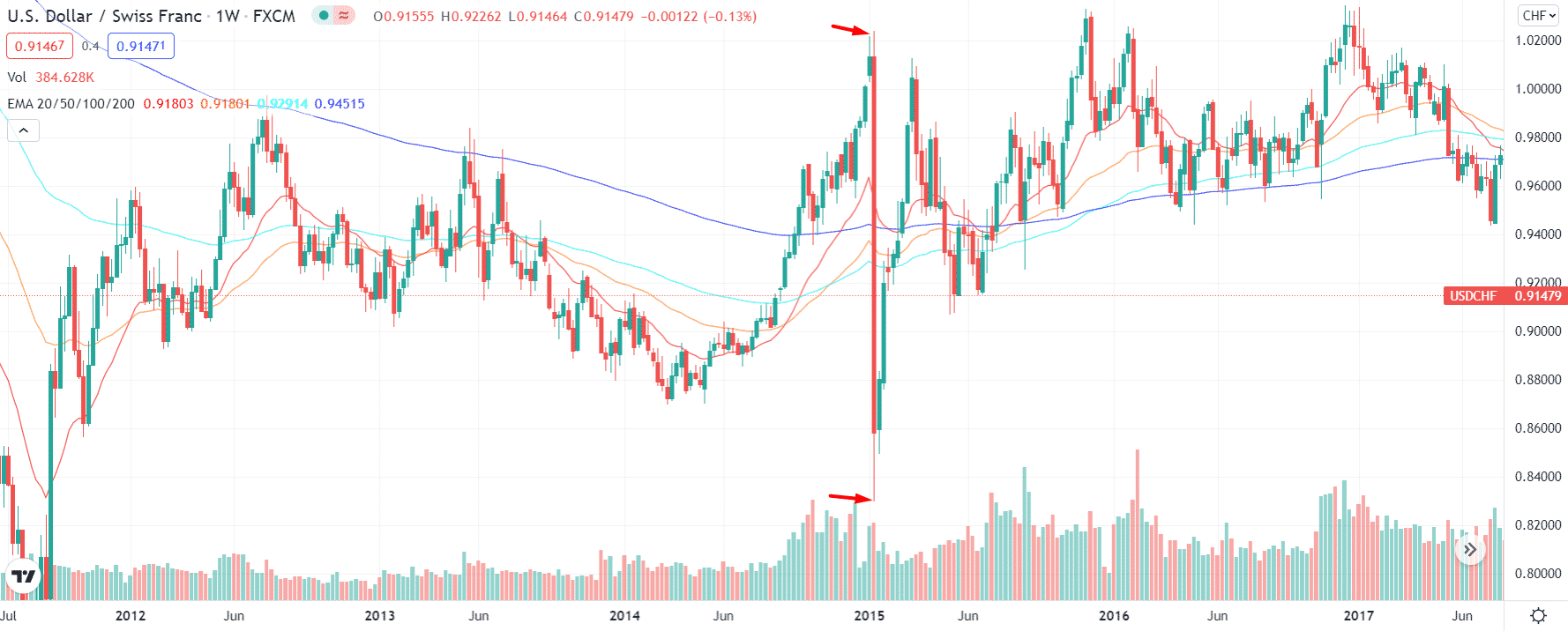

2. In 2015, as represented in the following chart, Swiss F. faced overtrading when it decreased to 0.8860 from 1.0210 in only half an hour.

How to avoid the mistake?

Successful trading depends on trade quality instead of quantity. For a safe game, do not risk more than 2% capitals in a go. Give yourself a break for a few days, and do not overtrade.

Tip 2. Make a budget plan to avoid the risk

If you want to avoid the uncalculated risk, you have to plan well on it. Taking a blind risk without planning and allocating a certain amount of money may hurt your investment.

Why does it happen?

The risk of loss occurs when the traders don’t have an idea of their investments. Therefore, a proper understanding of the indicators and market movement is important. Besides, money management is also necessary to identify the ideal entry and exit positions.

For example, Etoro’s trading platform has noticed 80% of day traders lose their money in the long run because of unclear management and identification of trading points or hours.

How to avoid the mistake?

Trading calls for several risks, and to avoid this, a calculated to-do list or the budget plan is important to make decisions and ensure profit. Tracking your daily activities, evaluating your investments, and assets management are some of the notable steps of successful traders.

Tip 3. Using the right indicators

There are several methods to analyze the market. So, it is important to use the specific one to gain maximum profit value. Otherwise, the trader may fall prey to the losses.

Why does it happen?

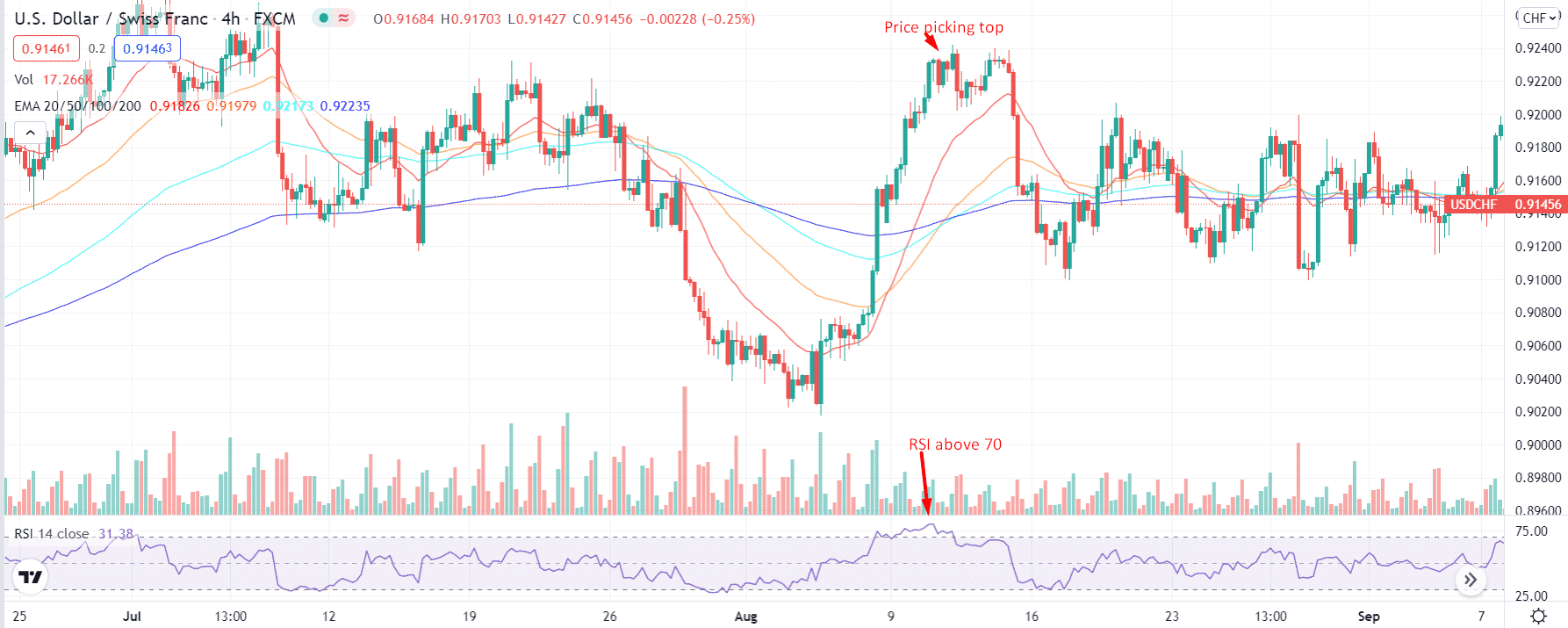

A technical indicator RSI compares the average asset losses with the average gains and calculates a numeric value ranging from 0 to 100 to indicate if the asset is overbought or oversold. Here, this technical indicator will work wonders because a calculated magnitude is significant to understand price action. Otherwise, the trader would lose much buying momentum.

How to avoid the mistake?

To avoid this loss, the traders have to wait for the RSI to analyze the market until it gives accurate asset data. Following the above example, in the trading chart below, the trader trading the USD/CHF currency pair would have maximized profit if he waited for the RSI reading to drop up to 70.

Tip 4. Calculated management of positions

Managing profitable trading positions and losing positions is both difficult and the most vital step in the trading market.

Why does it happen?

It happens when the traders sell either of the positions early or late without any calculations. If the trader has sold his winning position, he may be able to gain more profit. However, if the trader holds his profitable positions for too long, it also causes the same risk of nullifying the gain profit.

How to avoid the mistake?

The traders can resolve this problem by planning about their buying and selling beforehand. For example, you can sell all of your winning positions together at the same time or by dividing them in half to maximize profit. Again, focusing on the reward is important. But, again, do not even hold losing positions for long.

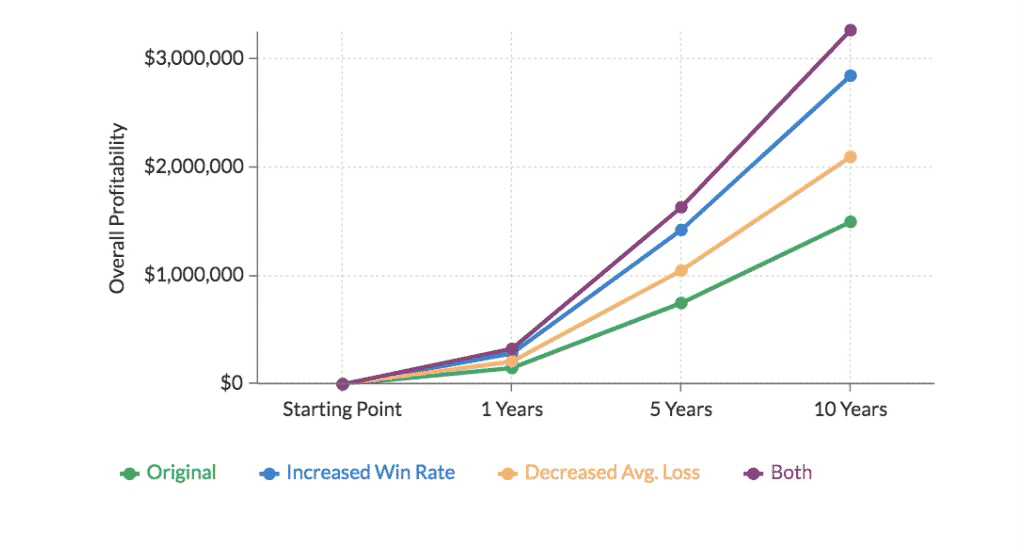

If you win 50% gaining $1000 profit on average, and only lose $500, your anticipated profit is $250 per trade. Thus, at 50 trades in a month, the trader can double its winning positions in a few years by ideally selling his winning positions and increasing his winning value.

Tip 5. Don’t make large bets

Trading large amounts all at the same time is riskier. It is like betting on a red or black flag simultaneously. So, it is better to make smaller bets to have less risk.

Why does it happen?

As discussed in tip 1, usually, the traders make large bets that fall under gambling. It causes a 50 50 situation. Either you will lose all, or you will gain all. There is no in-between.

How to avoid the mistake?

The traders can avoid it by only risking the amount that they can afford to lose. Ideally, you should only 1% of your total capital to avoid losing more trading balance because if the value faces a downfall, the market also changes.

Final thoughts

The trading market becomes risky when the volatility rate becomes high because it drives prices to move in downtrend or uptrend. Thus, the market structure also fluctuates. Therefore, comprehensive knowledge about the trading market and tips and tricks is important to learn before trading. In addition, these tips may help you in locking enough profit at the end of the day.